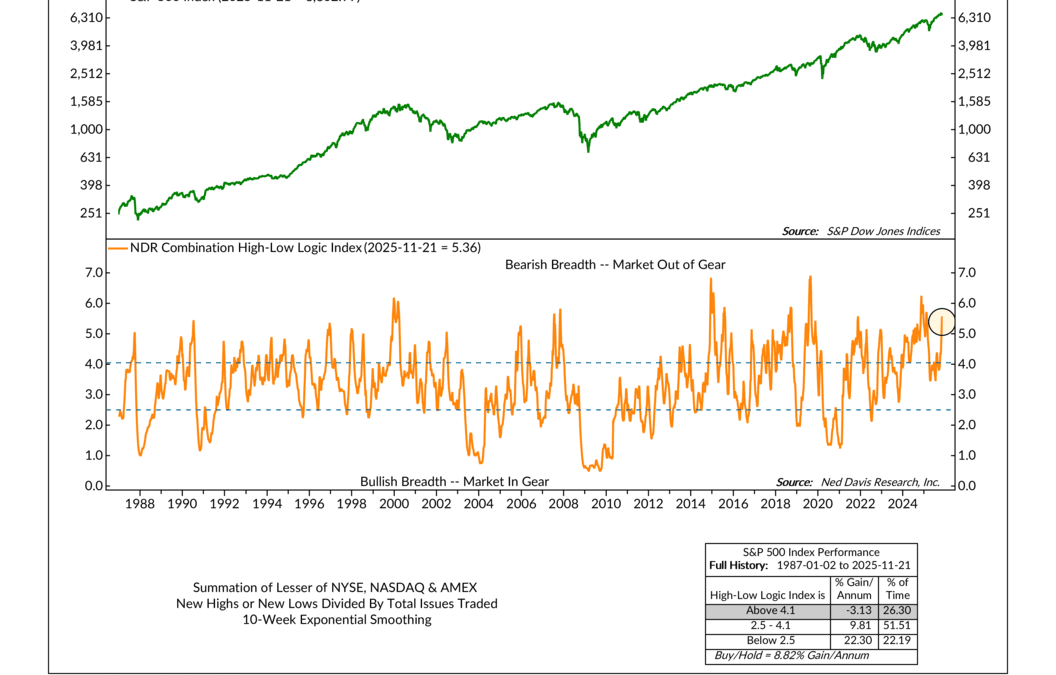

Gearbox

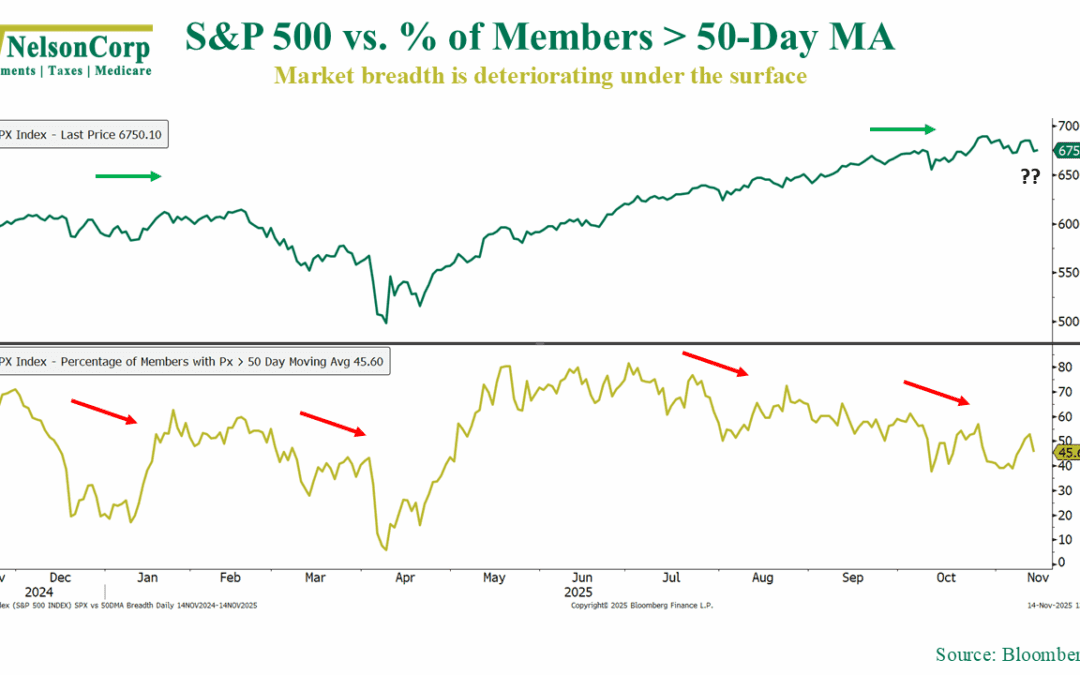

At first glance, the stock market seems pretty straightforward. If plenty of stocks are hitting new highs, that’s bullish. If plenty are hitting new lows, that’s bearish. But what happens when a lot of stocks are making new highs and new lows at the same time?...

Financial Focus – November 26th, 2025

This week’s Financial Focus dives into the fast-approaching end of Medicare open enrollment and the important changes coming for drug plans in 2026. We explain why reviewing your coverage now can help you avoid surprises when premiums and formularies shift next year.

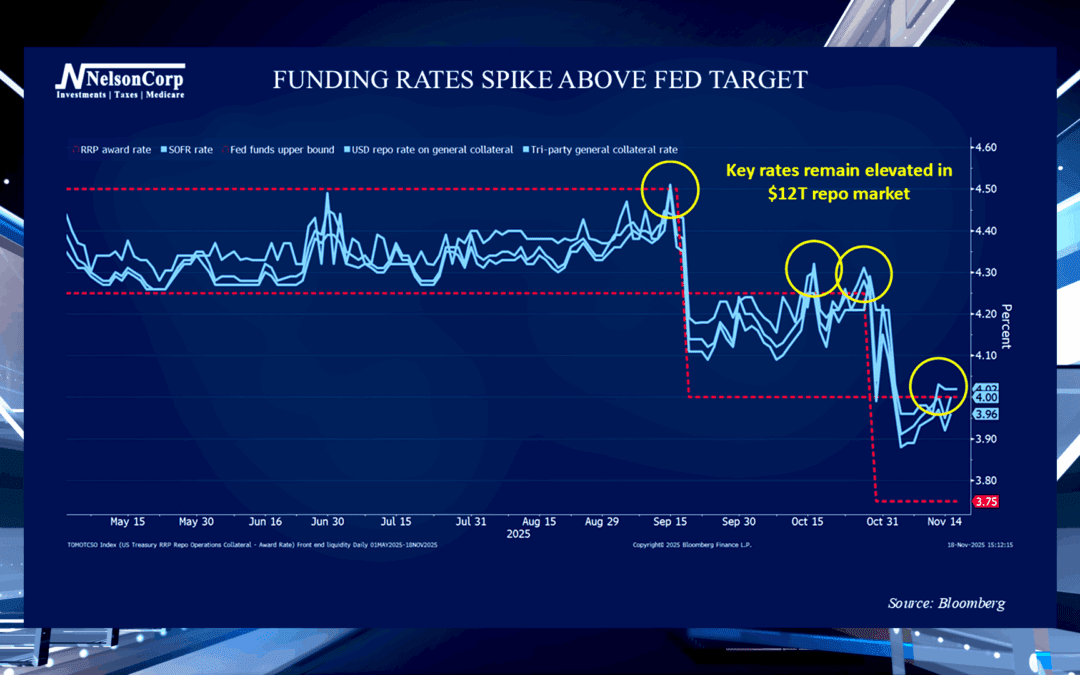

Funding Market Stress

Short-term interest rates aren’t behaving the way they normally do, and that’s creating some extra volatility. In this week’s segment, David Nelson walks through what’s happening and what it means for investors.

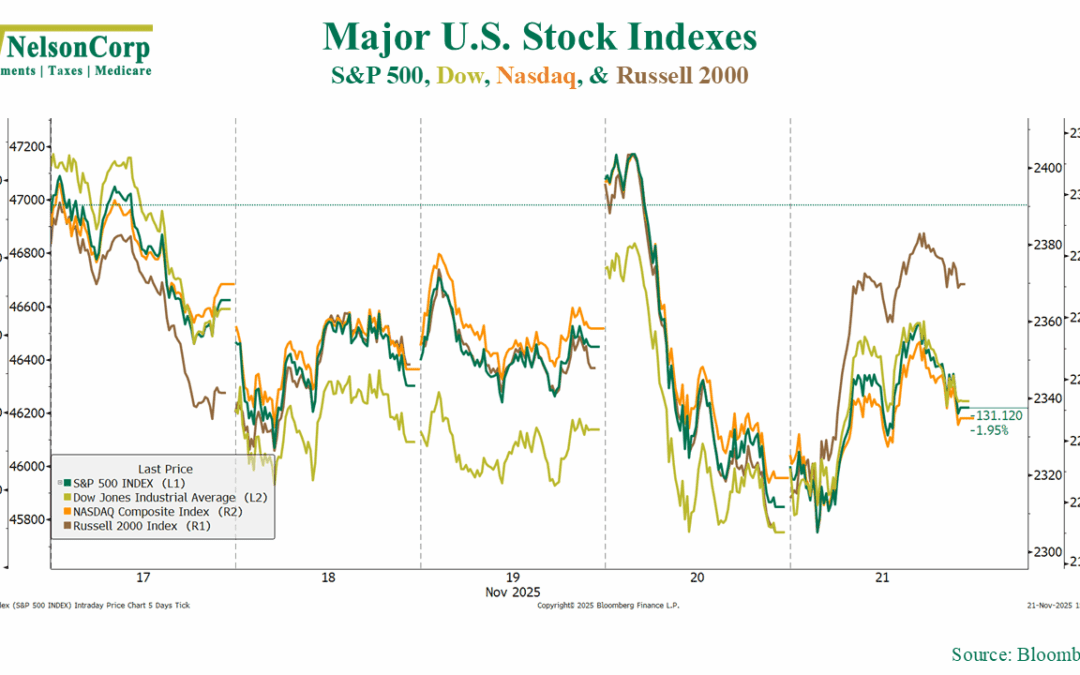

The Crowd is Fickle

OVERVIEW Markets finished broadly lower last week, with most major equity indexes declining. The S&P 500 fell 1.95%, the Dow slipped 1.91%, and the NASDAQ dropped 2.74%. Across the broader market, the Russell 3000 lost 1.85%, driven by a 2.74% pullback in...

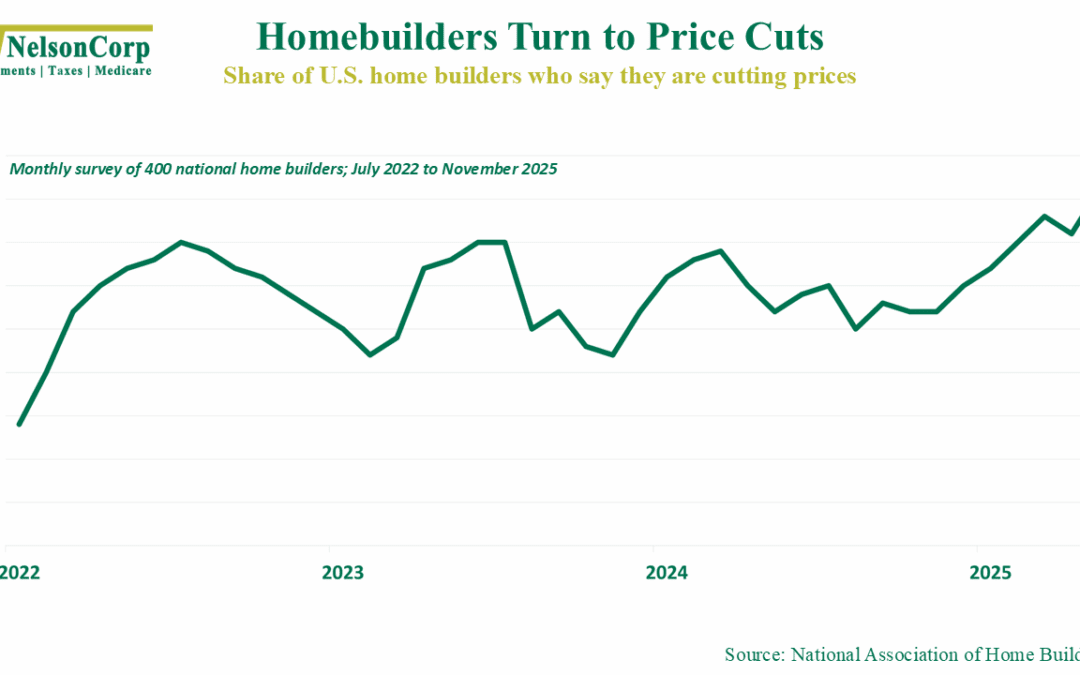

Builder Cuts

Let's check in on the housing market this week. A new report from the National Association of Home Builders shows that a record 41 percent of builders are now cutting prices to bring buyers back into the market. That’s well above the roughly 30 percent average...

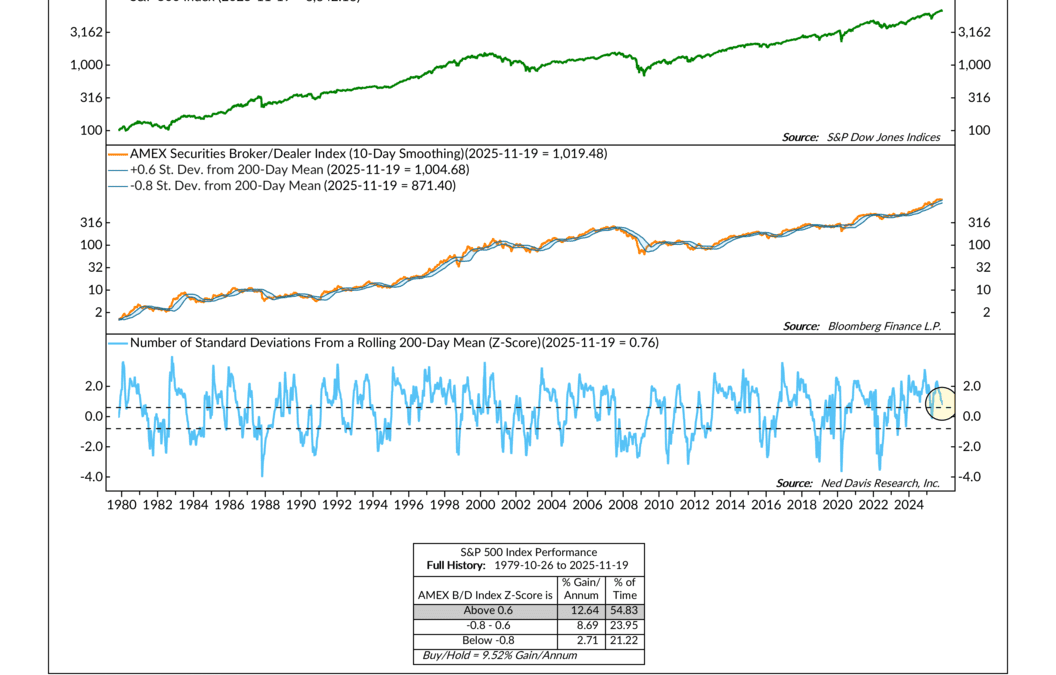

Murmurs From the Middlemen

This week’s indicator focuses on the AMEX Securities Broker/Dealer Index. If you’re not familiar with it, this index tracks companies in the securities brokerage business and related areas. It works like a barometer for activity inside the investment services...

Financial Focus – November 19th, 2025

A wave of tax changes is rolling in for 2025, and many of them are being misunderstood. Nate and Andy walk through the biggest updates, so listeners know what to expect before filing.

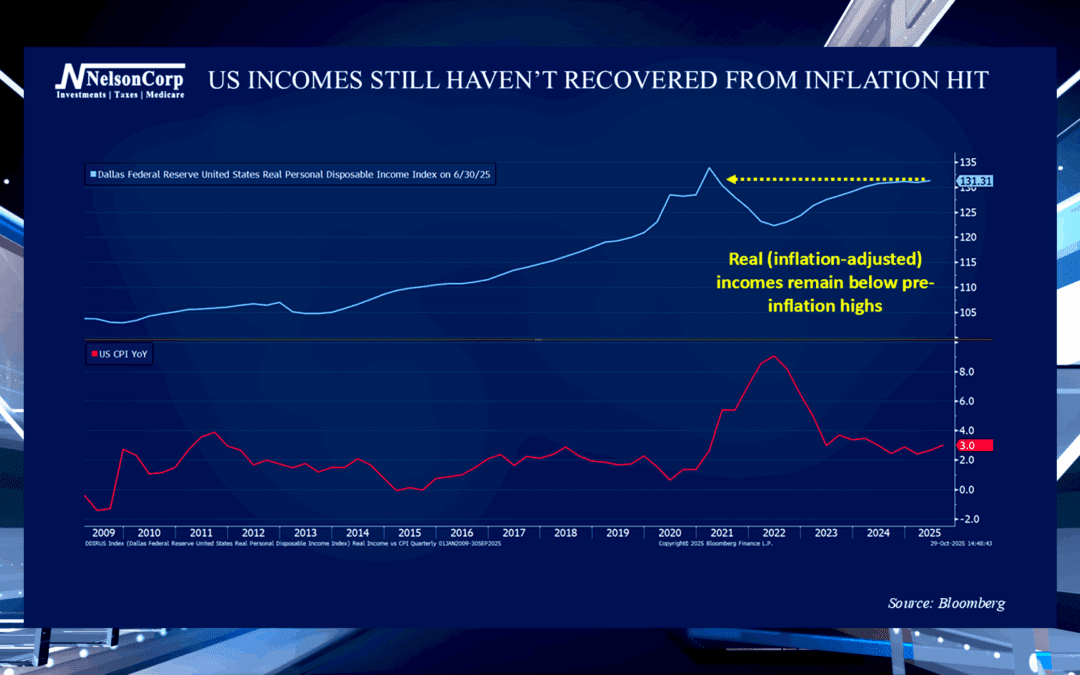

Keepin’ It Real

Inflation has cooled quite a bit from the highs we saw a few years ago, but many people still feel like they are falling behind. Nate Kreinbrink explains how “real” incomes remaining below pre-inflation levels are one cause for this hangover.

Hitting a Wall

OVERVIEW Markets were mixed last week. The S&P 500 inched up 0.08%, the Dow gained 0.34%, and the S&P 100 (large-cap) rose 0.32%. The NASDAQ slipped 0.45% as technology shares struggled to keep pace. Broadly, the Russell 3000 dipped 0.07%, as growth...

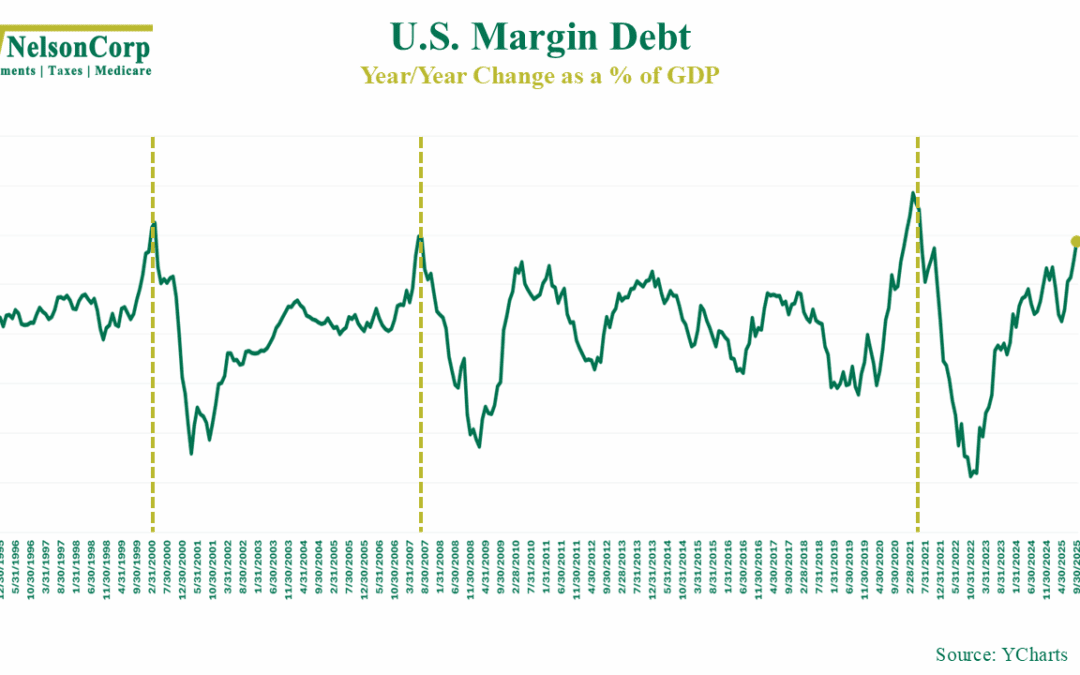

Borrowed Money

This week’s chart looks at margin debt, or how much money investors are borrowing to buy stock. In good times, it’s good. It’s a sign that investors are feeling confident and willing to lever up to buy stock. But, like anything, it can get out of hand—and when...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.