Don’t Fight the Tape or the Fed

This week I'd like to highlight a fun little indicator called “Don’t Fight the Tape or the Fed.” Technically, it’s a model, because it combines two separate indicators. And while we don’t use it directly in our broader modeling process, it still captures an important...

Financial Focus – October 15th, 2025

In this week’s program, Nate and Andy talk about a busy mid-October week filled with tax deadlines and Medicare open enrollment. They also break down the latest tax bracket changes, the shift toward online IRS accounts, and why paper checks are officially a thing of the past.

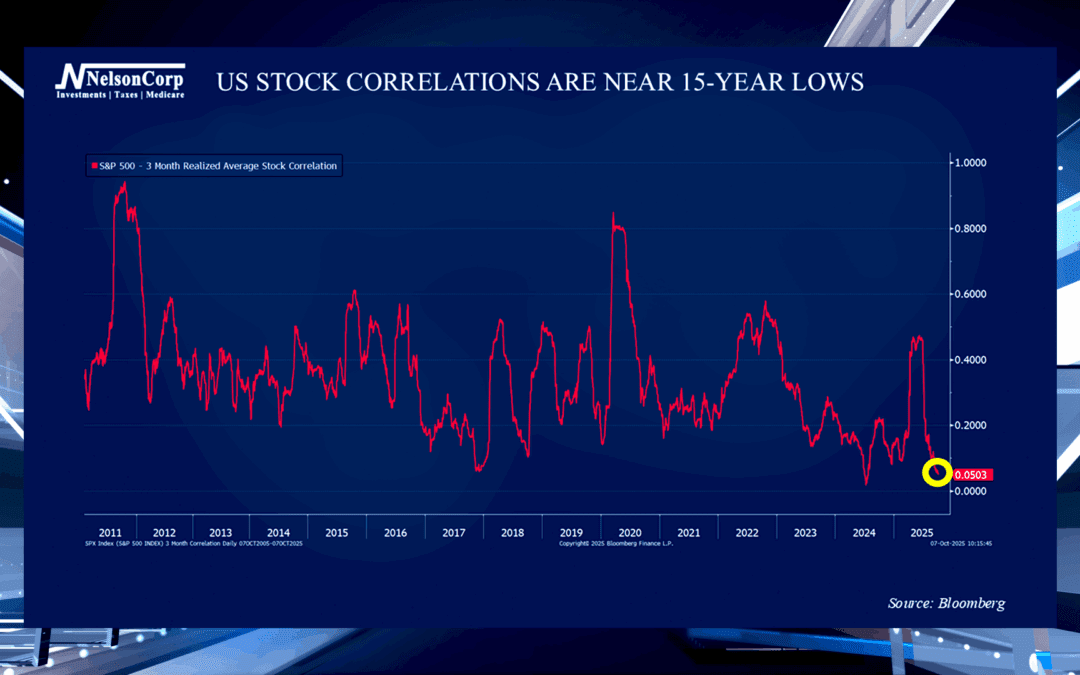

Micro Matters

David Nelson is here to explain stock market correlations and why the lack of correlations in the current S&P 500 data is a positive sign for investors.

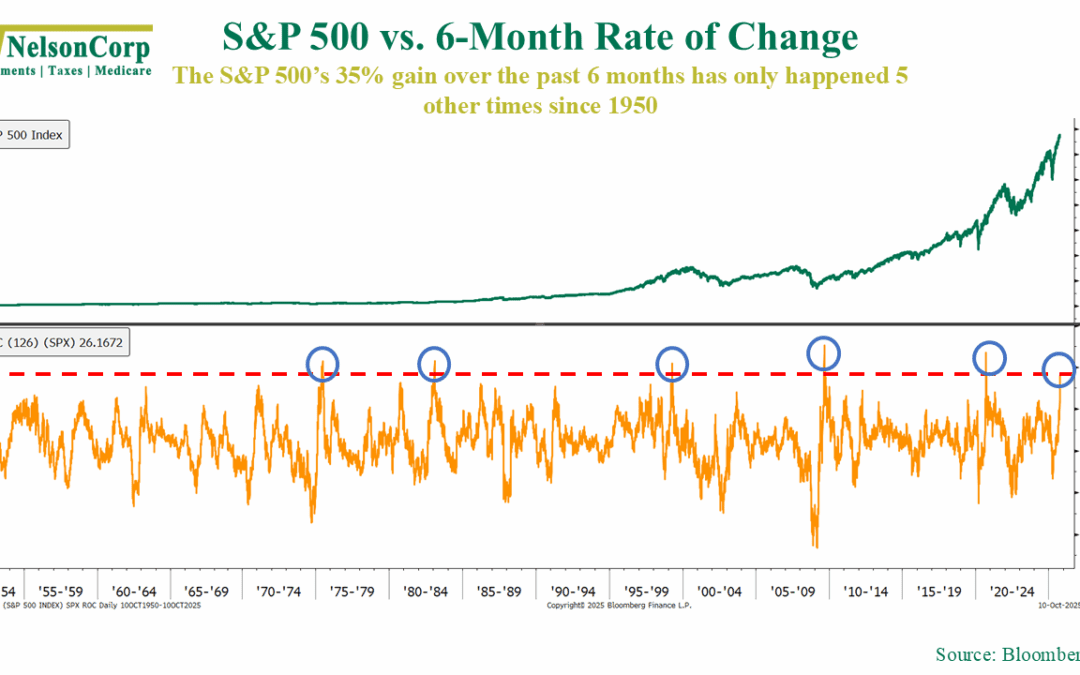

Running Hot

OVERVIEW Markets stumbled last week, as selling pressure hit nearly every corner of the equity landscape. The S&P 500 dropped 2.43%, while the Dow Jones Industrial Average fell 2.73%. The NASDAQ slid 2.53%, extending a broad pullback that also saw the...

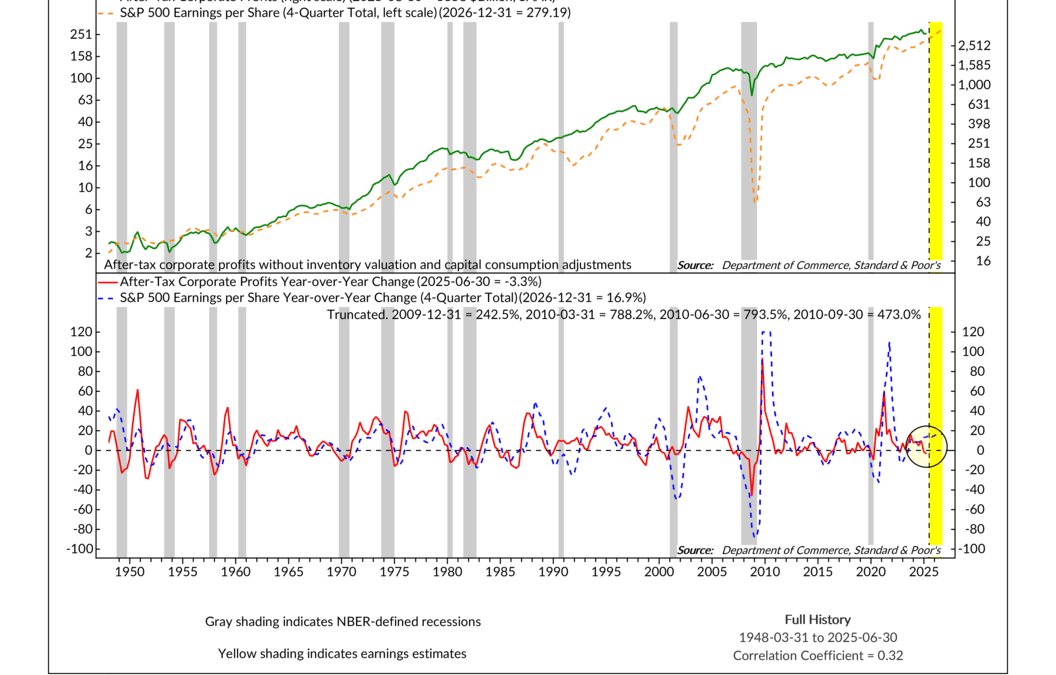

A Tale of Two Profits

This week’s chart compares S&P 500 reported earnings (orange line, top panel) with after-tax corporate profits from the National Income and Product Accounts, or NIPA (green line, top panel). NIPA profits track economy-wide corporate earnings,...

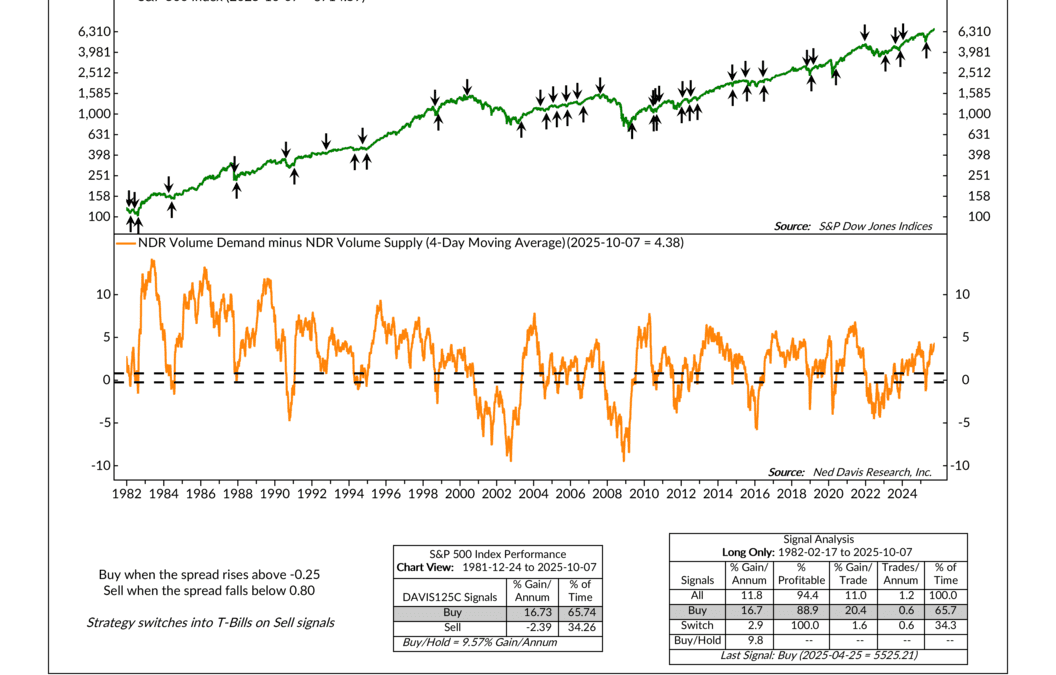

Conviction Speaks Volumes

This week’s featured indicator blends two important ideas: volume and conviction. The volume part is fairly straightforward. We measure how much trading activity happens in stocks that are going up—what we call Volume Demand—and compare it to the activity in...

Financial Focus – October 8th, 2025

Check out this week’s Financial Focus where Nate Kreinbrink talks about the upcoming Medicare open enrollment period and what retirees should review before making changes. He also dives into one of the most common retirement questions—how much you really need to save—and why managing debt is just as important as building your nest egg.

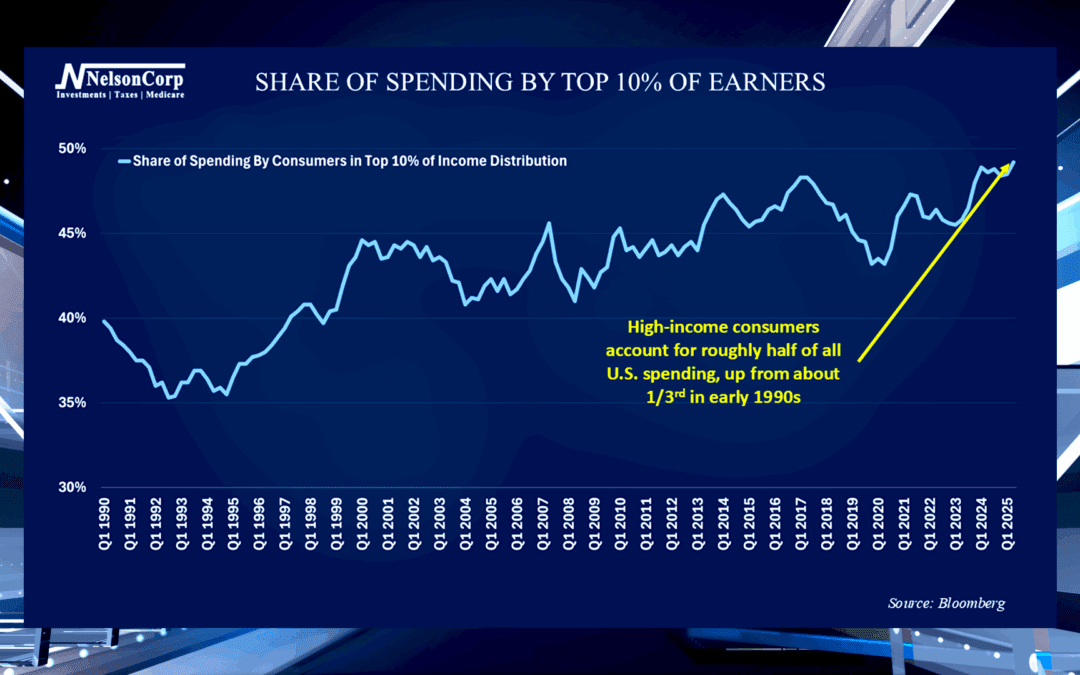

Spending Skew

Consumer spending is always important to watch since it makes up two thirds of the U.S. economy. James Nelson joins us to share the main takeaway that investors should know from recent data.

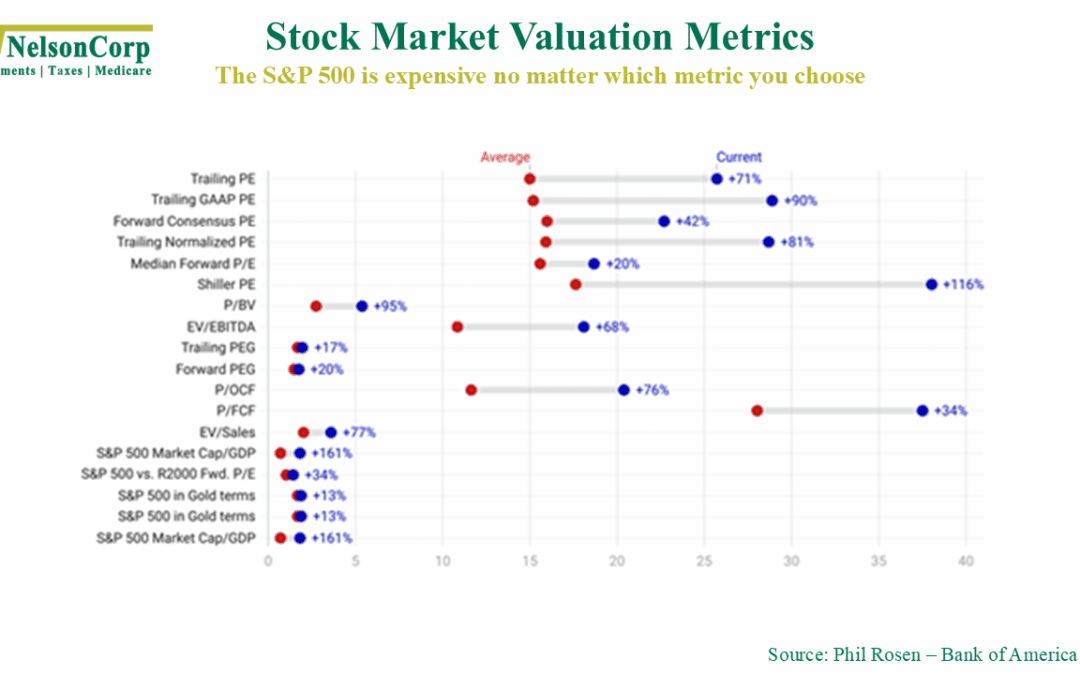

In the Eye of the Beholder

OVERVIEW Markets advanced last week, with solid gains across major equity benchmarks. The S&P 500 rose 1.09%, while the Dow added 1.10%. The NASDAQ led the pack with a 1.32% gain. Broad measures were similarly strong, as the Russell 3000 climbed 1.09%....

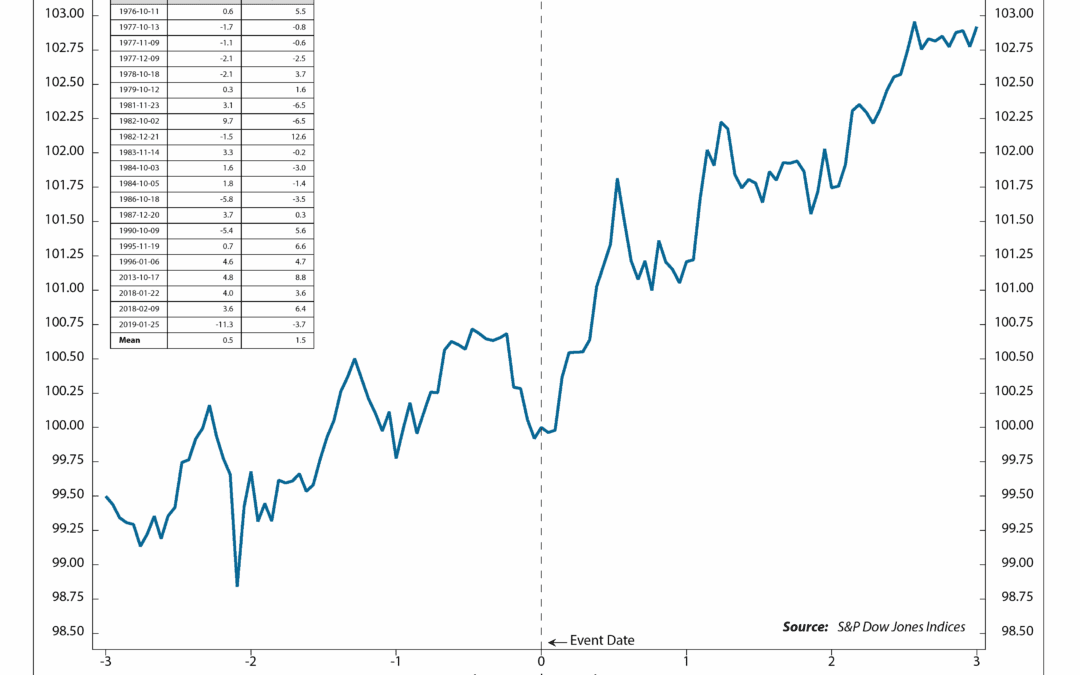

Shutdown—but Not Shutout

Well, it happened again. The U.S. government went into “shutdown” this week after Congress couldn’t agree on a stopgap funding bill. We’ve seen this before, and while it makes for plenty of high drama in Washington, for the stock market it tends to be more of a...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.