Leading The Way

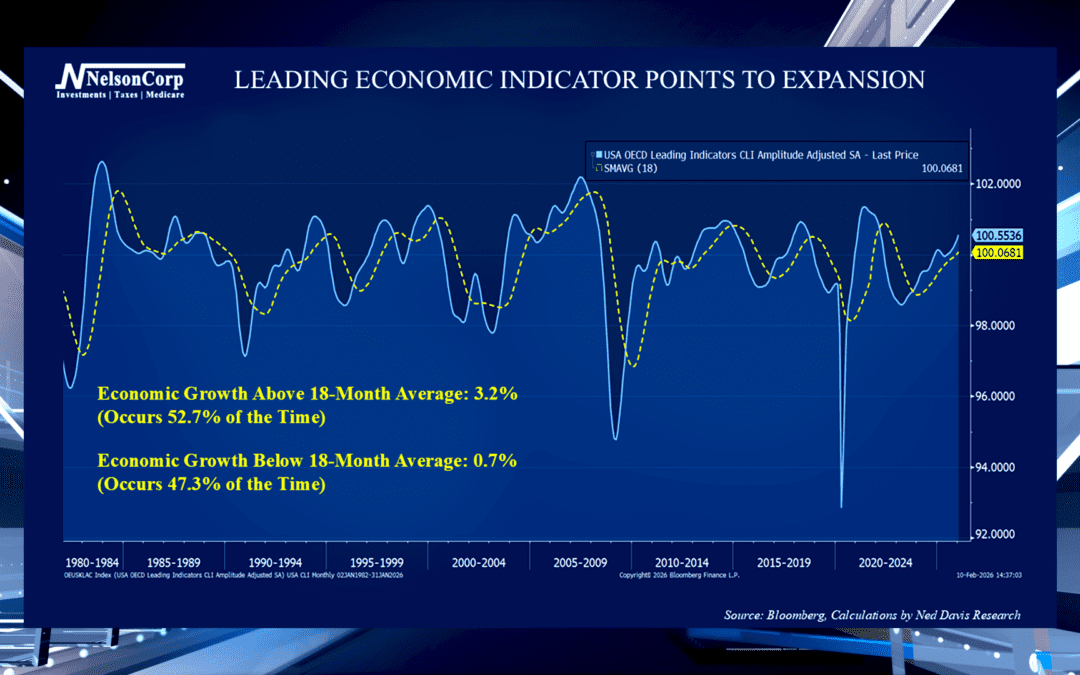

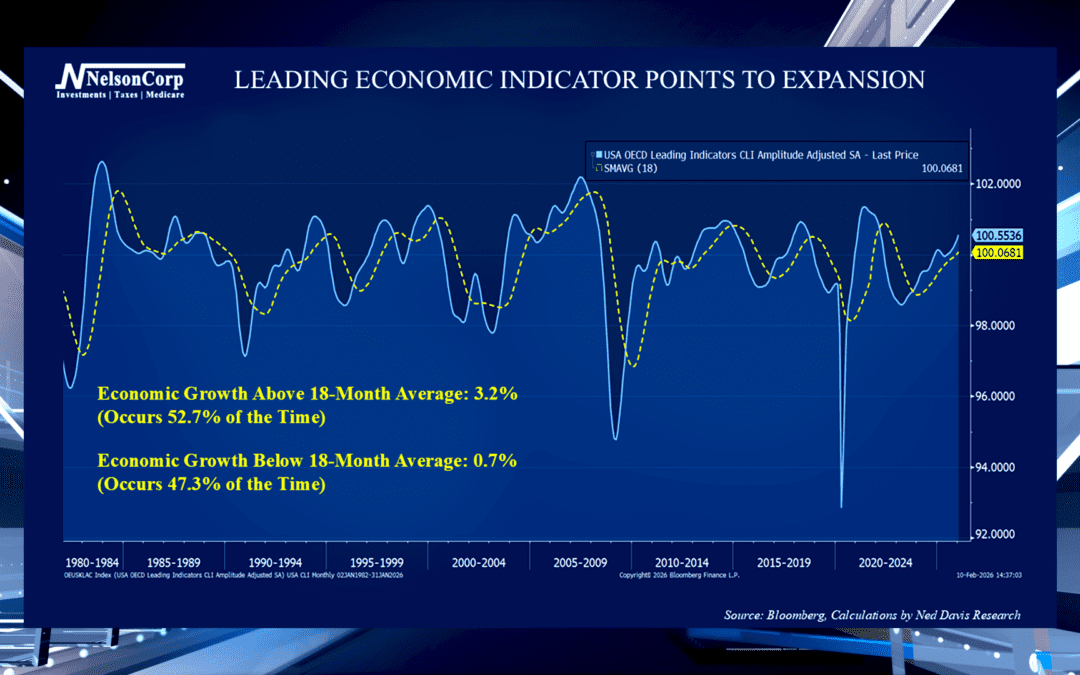

When evaluating the overall economy, it is important investors focus on the future instead of past or current conditions. David Nelson explains the Leading Economic Indicator and how the data suggests good news for risk assets.

When evaluating the overall economy, it is important investors focus on the future instead of past or current conditions. David Nelson explains the Leading Economic Indicator and how the data suggests good news for risk assets.

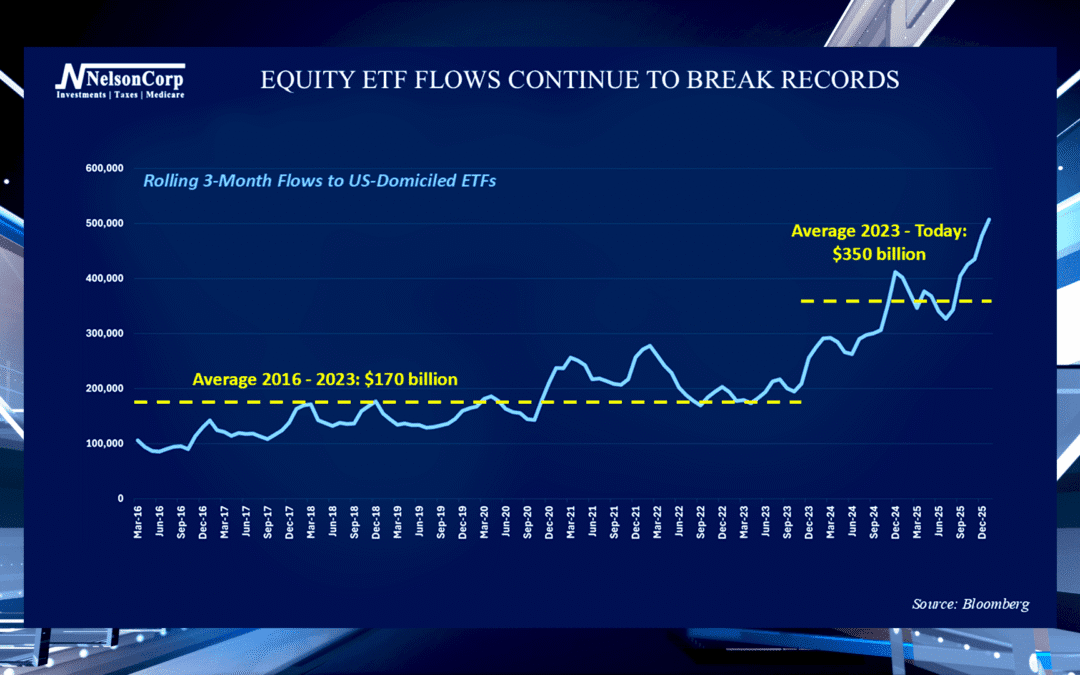

An ETF (Exchange-Traded Fund) is a “basket” investment that holds many different assets, such as stocks, bonds, or commodities, commonly with a similar theme or strategy. David Nelson shares how ETF’s continue to grow in popularity primarily because it provides investors instant diversification.

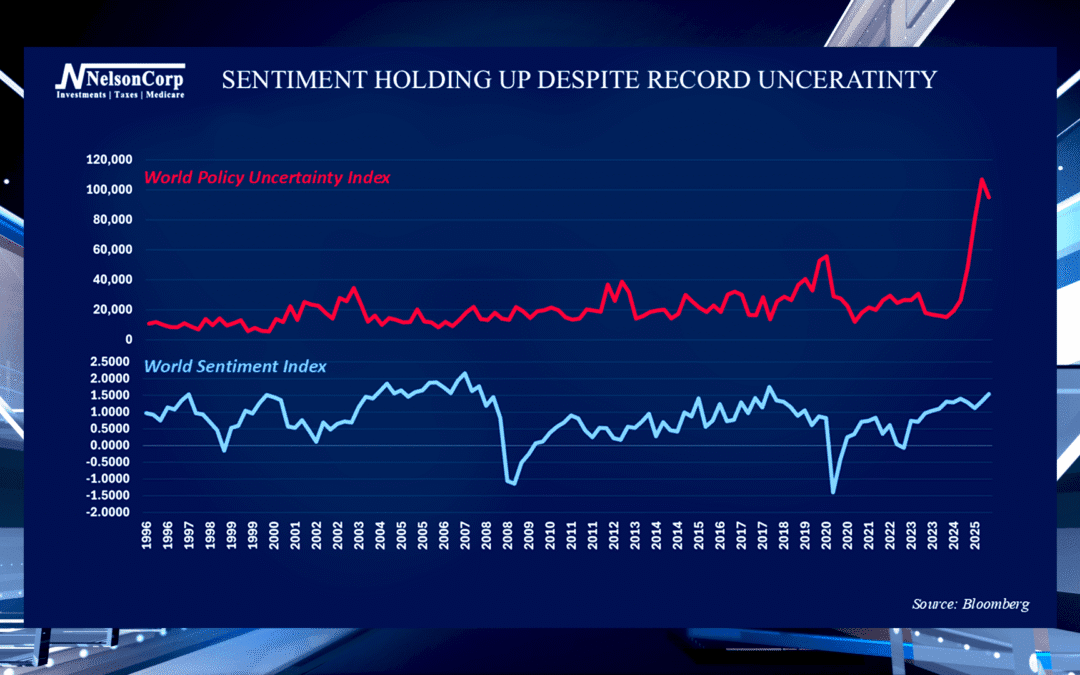

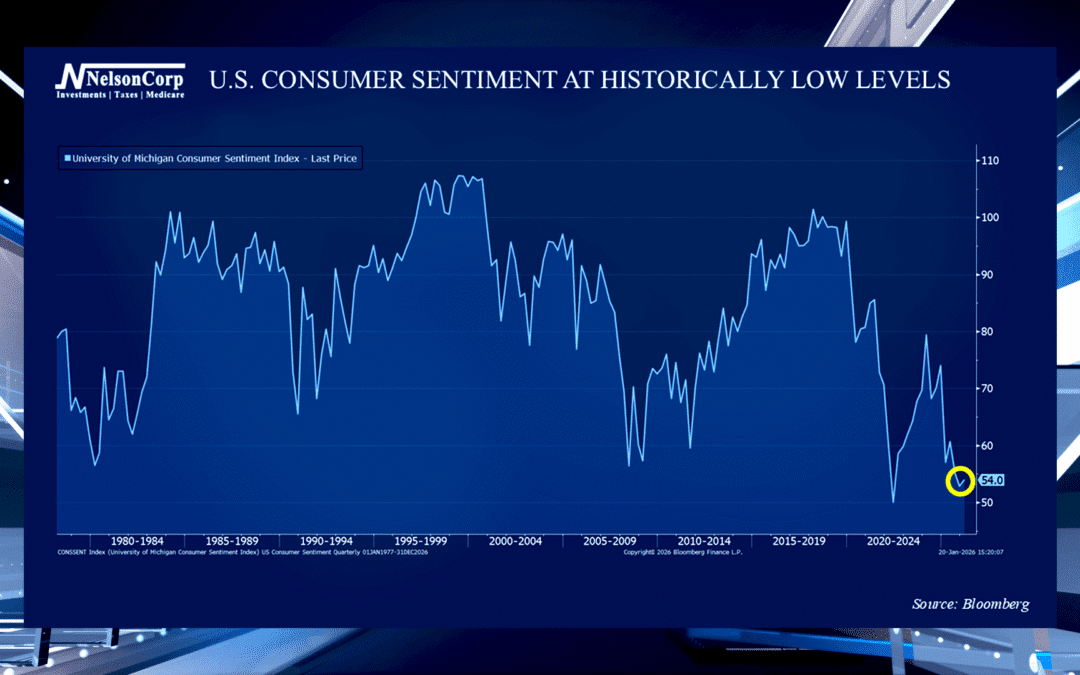

While there is significant uncertainty in the world right now, political and economic, it does not always translate to the markets. James Nelson compares sentiment data and reminds us that headlines should not drive investment decisions.

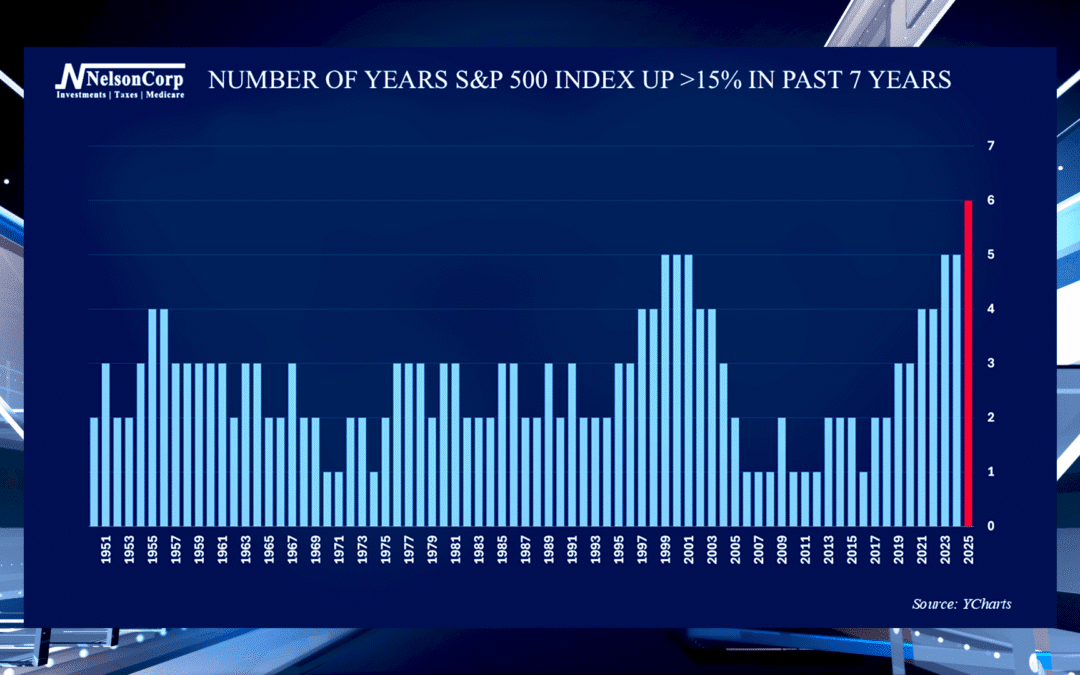

The stock market has continued a successful run the past several years. David Nelson shares the bigger picture by looking at historical patterns and what this current run means for investors.

The U.S. Consumer Sentiment Index tracks consumers’ confidence in the economy, reflecting their financial outlook and spending intentions. David Nelson explains how the current data shows consumer confidence at historic lows but reminds us that the markets are focused on the future, not today.

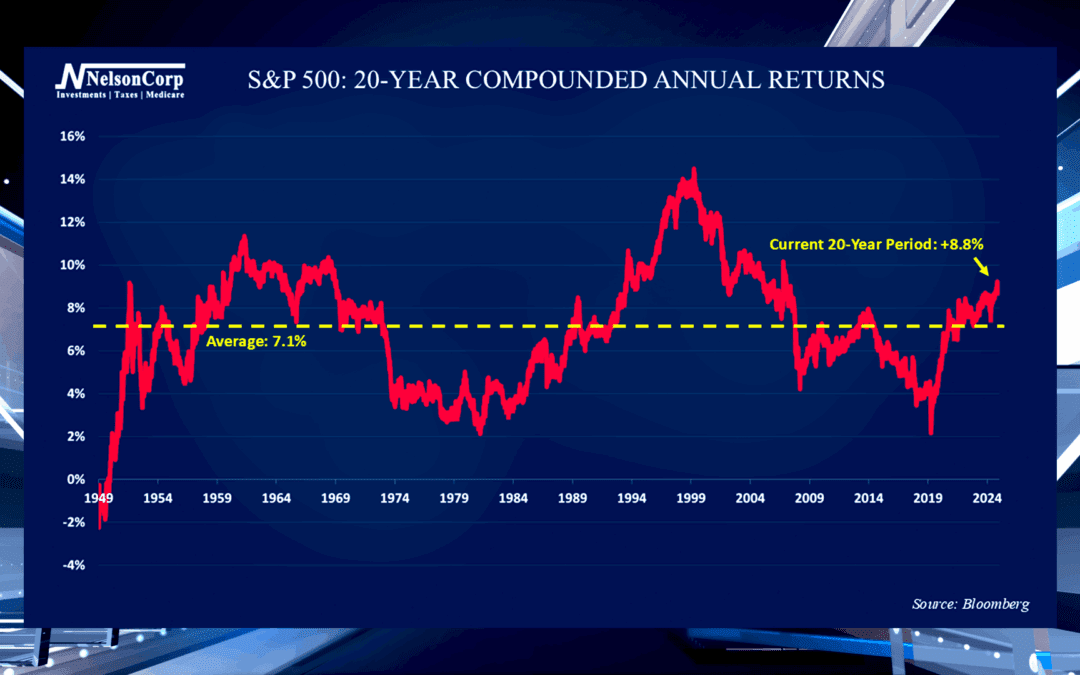

When investors evaluate long-term stock market returns, it is helpful to look through the lens of rolling 20-year periods. Nate Kreinbrink shares the history of S&P 500’s returns and where the index stands now.