by NelsonCorp | Jan 13, 2026 | 4 Your Money

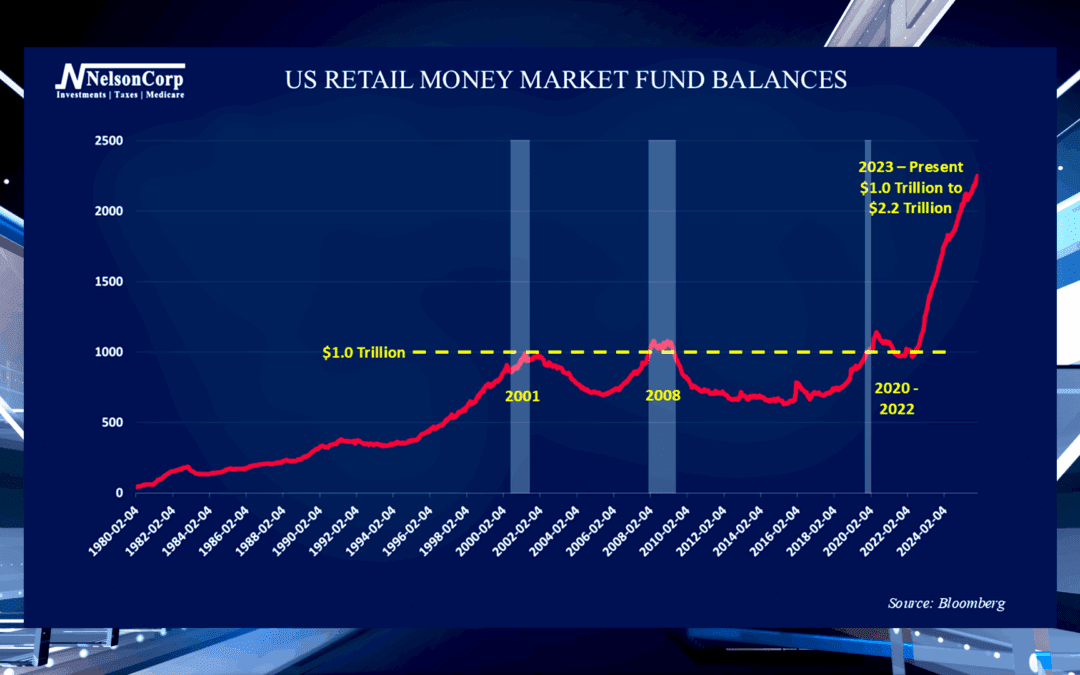

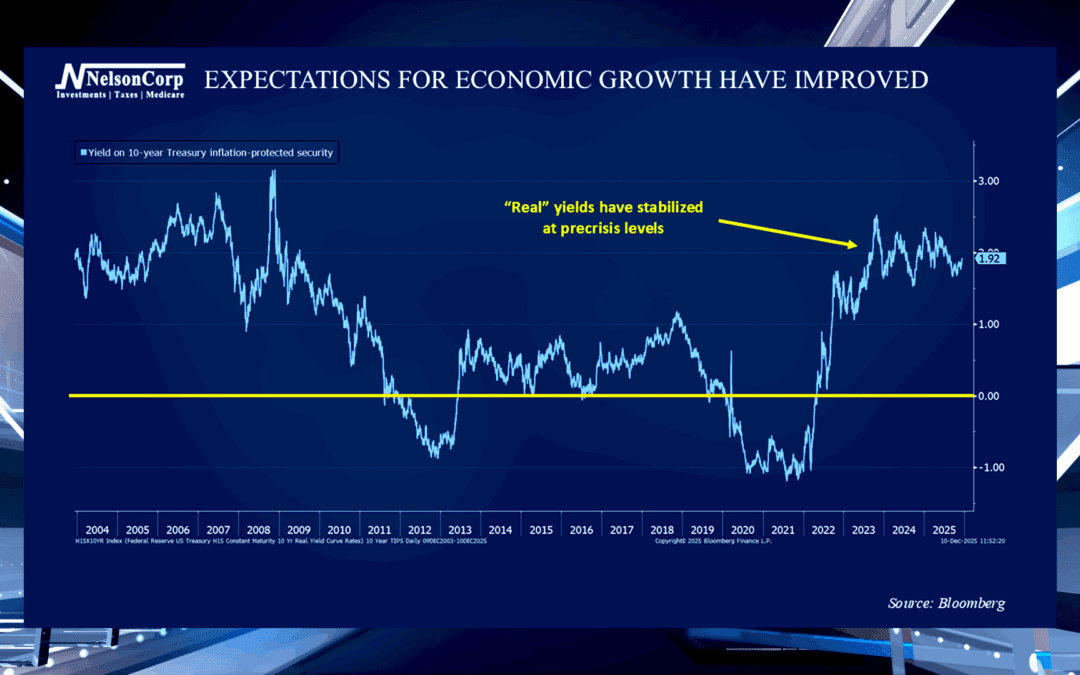

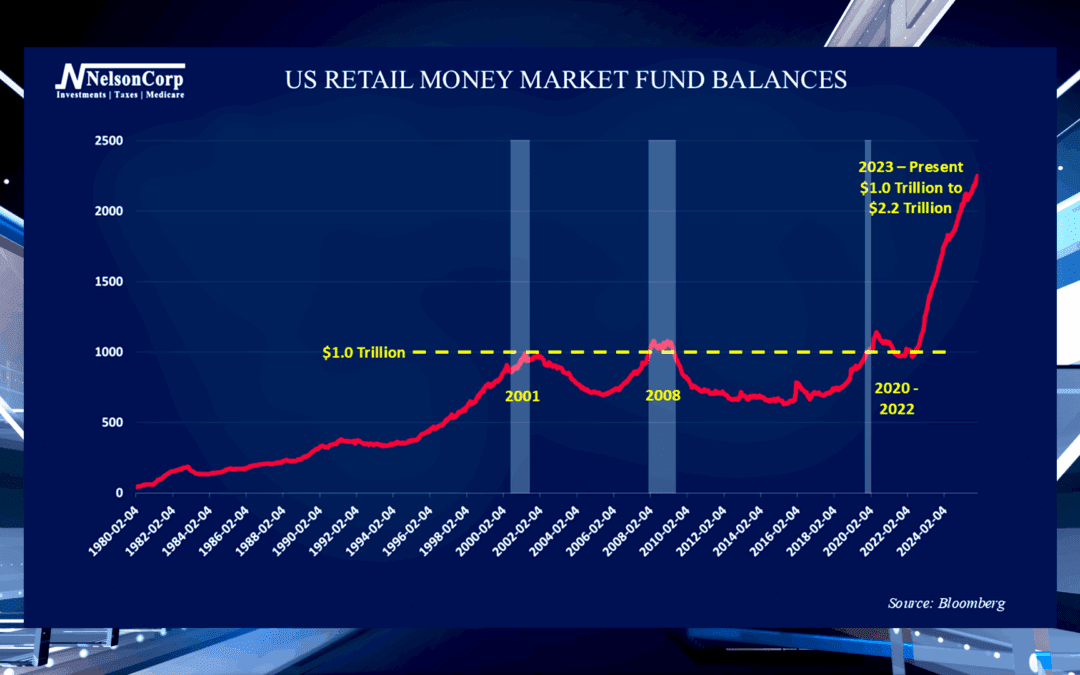

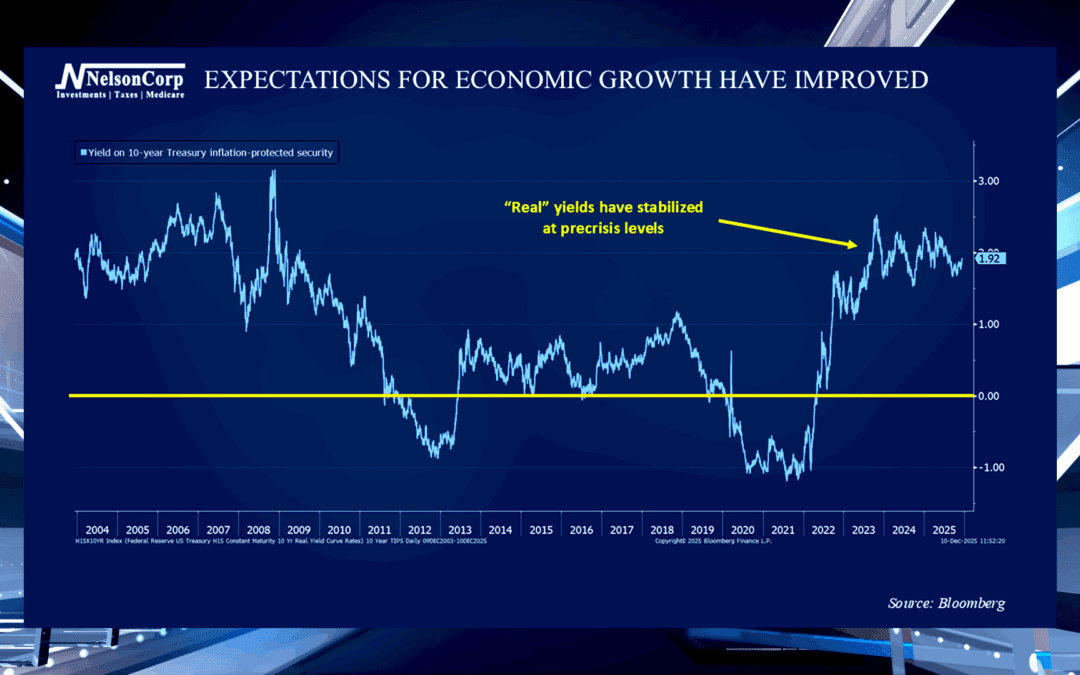

Last week we discussed money market funds and why cash tools have been so popular lately. David Nelson elaborates more on real cash yields and explains why cash tools provide short-term stability but are not ideal for long-term investing.

by NelsonCorp | Jan 6, 2026 | 4 Your Money

In the last couple years, money market funds have been very popular. David Nelson shares the numbers behind this trend and explains why more investors are using this tool for short-term goals.

by NelsonCorp | Dec 30, 2025 | 4 Your Money

Unfortunately, the data continues to show struggles for small businesses. John Nelson shares the numbers on Subchapter 5 bankruptcy filings and how they could become a warning for the broader economy.

by NelsonCorp | Dec 23, 2025 | 4 Your Money

There is plenty of talk about where the economy is currently heading. David Nelson names what he believes to be the most important indicator for investors to keep an eye on right now.

by NelsonCorp | Dec 16, 2025 | 4 Your Money

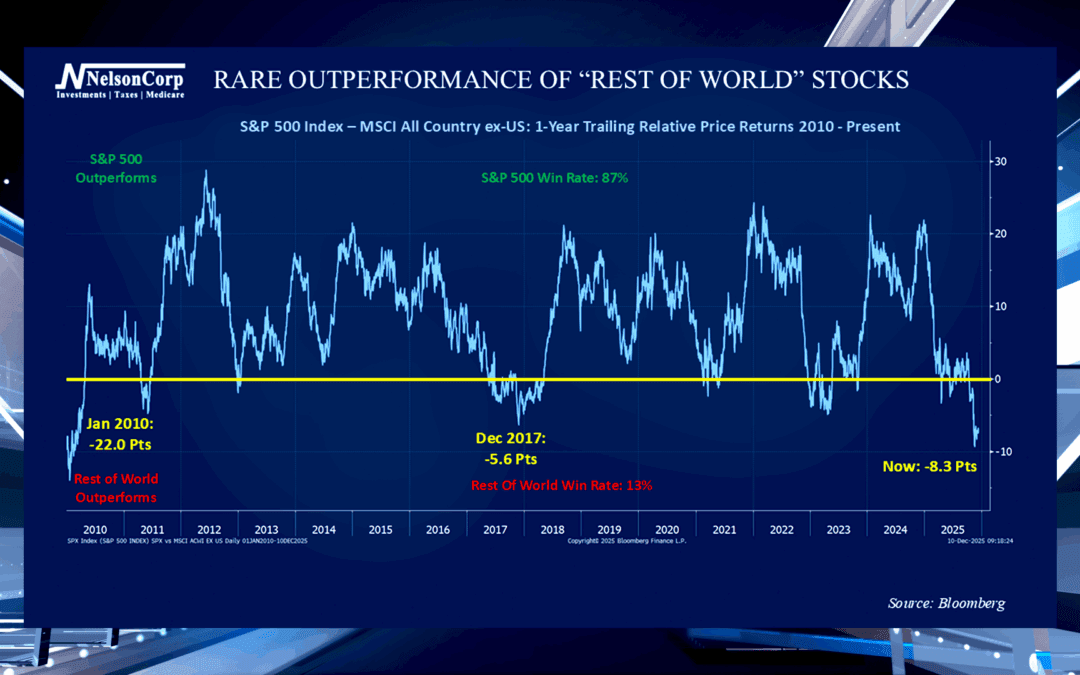

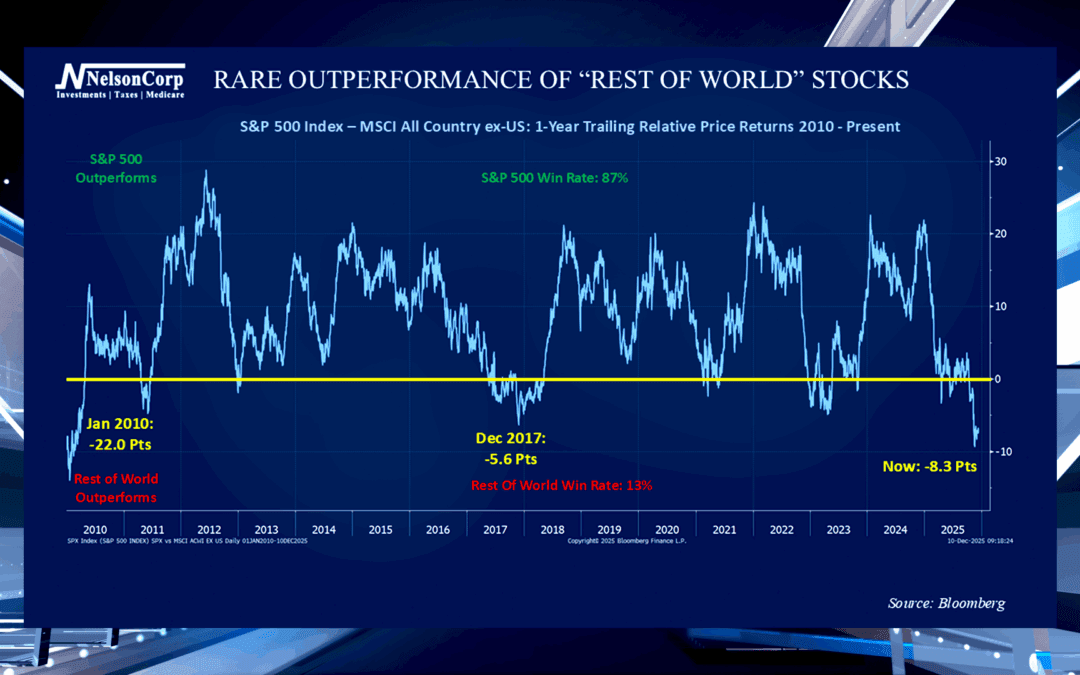

Many investors have questions concerning how much they should own internationally versus keeping their money invested in U.S. stocks. David Nelson shares data showing how the U.S. markets typically outperform international markets by a significant margin.

by NelsonCorp | Dec 9, 2025 | 4 Your Money

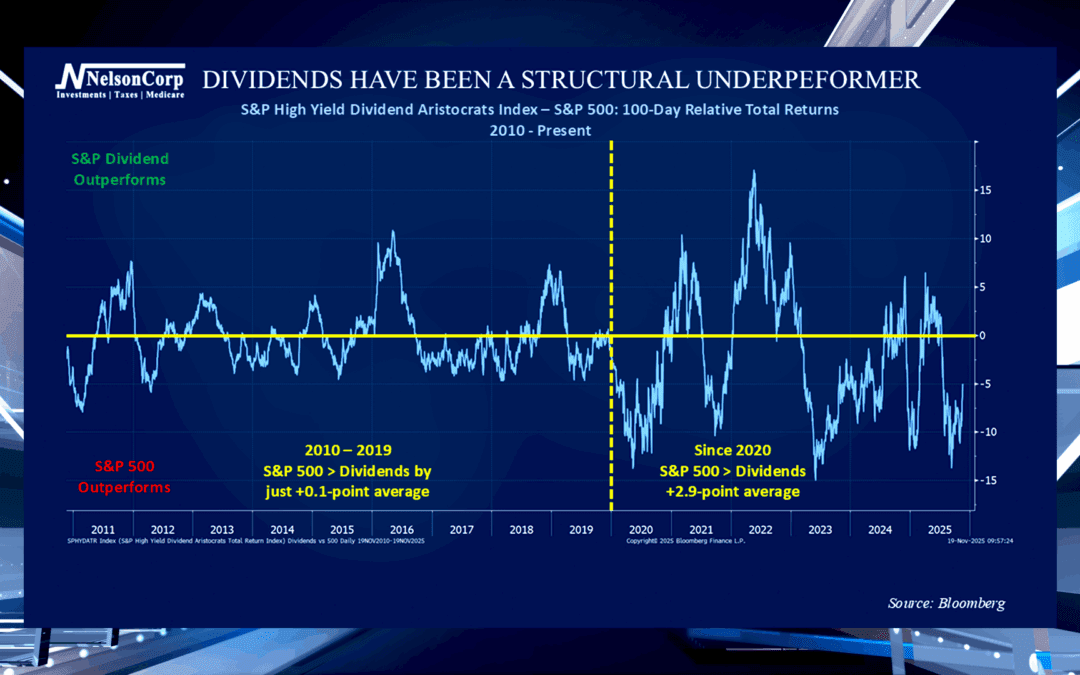

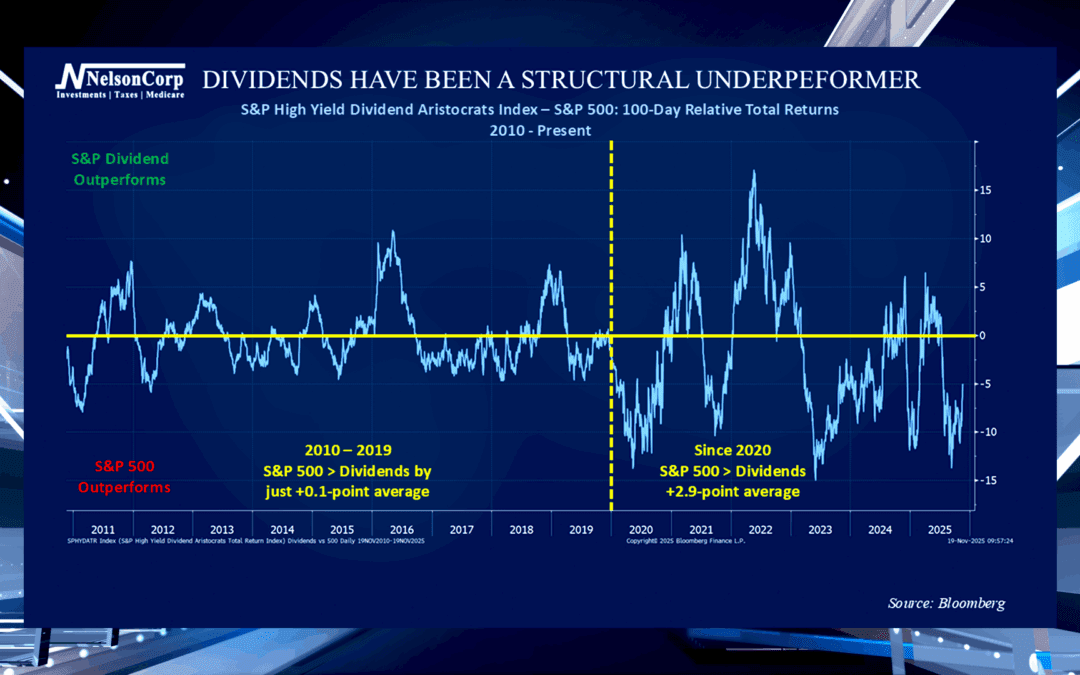

Dividend investing is traditionally thought of as a safer, steady approach. James Nelson joins us to explain why dividend investing is no longer the value strategy it was in the past.