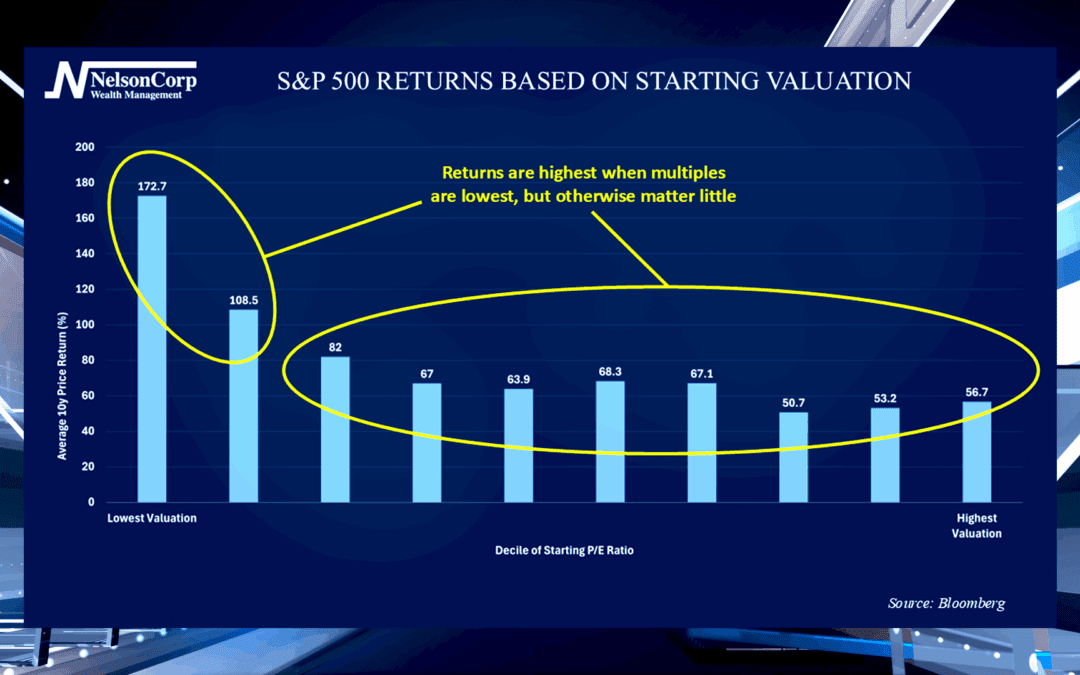

Value Isn’t Everything

Stock prices are very expensive right now. Nate Kreinbrink joins us to explain how these high valuations don’t necessarily mean low returns.

Stock prices are very expensive right now. Nate Kreinbrink joins us to explain how these high valuations don’t necessarily mean low returns.

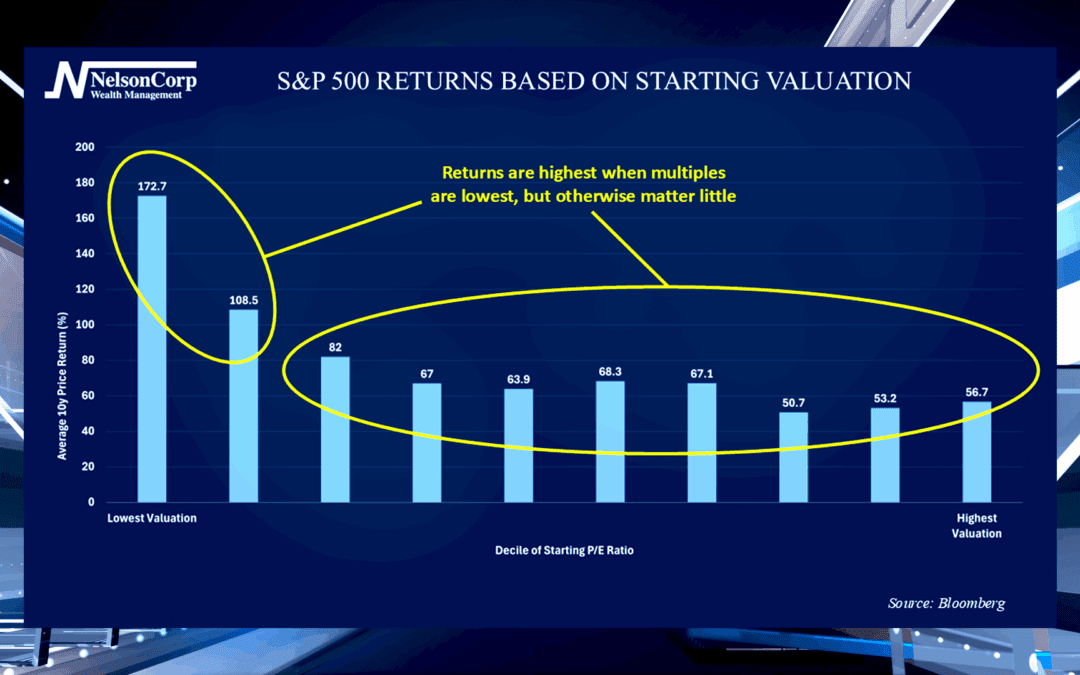

Consumer spending and confidence has been a big question mark lately. David Nelson explains how real time data on bar/restaurant spending is a good gauge for how consumers are feeling about the economy.

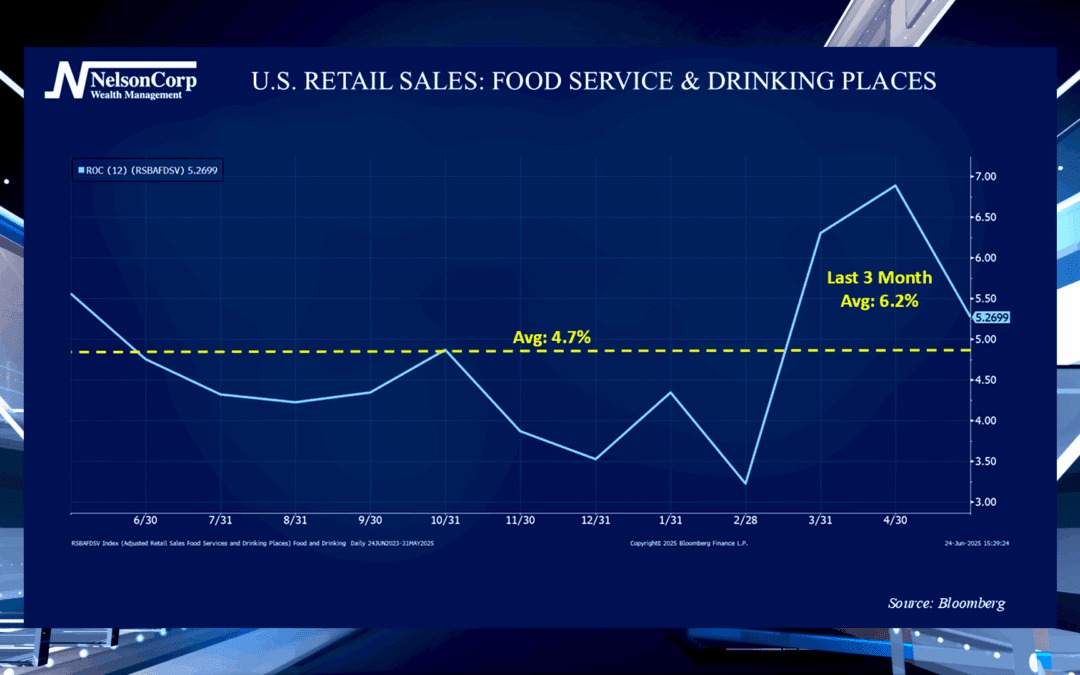

The price of a stock fluctuates based on demand and other market impacts, and that price may not be reflective of its true value. David Nelson shows how comparing the S&P 500 stock index to the Bloomberg Gold Index is a good gauge for stock valuations.

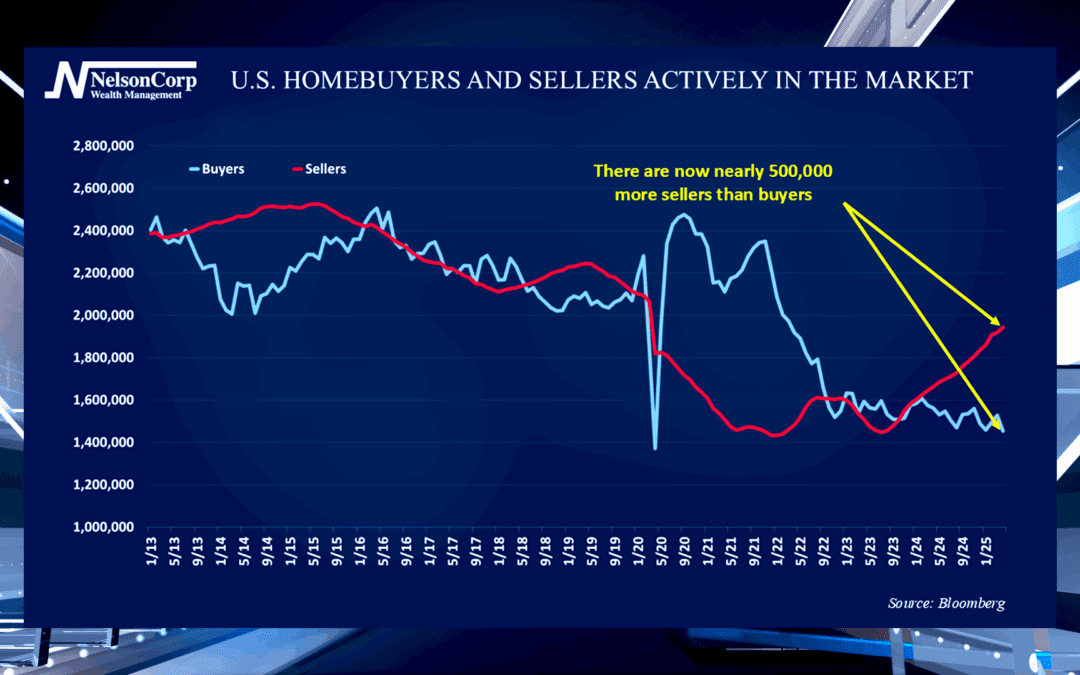

The housing market continues to cool this year. James Nelson explains the record-setting conditions that have given buyers an advantage.

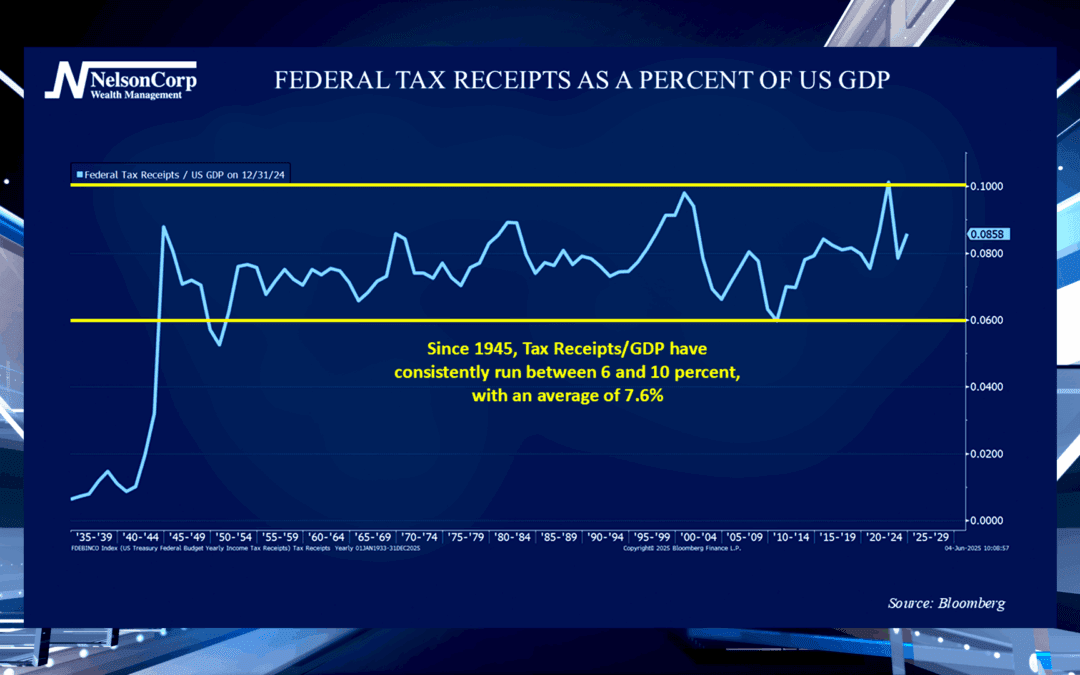

With all the recent tax debates, people are wondering how much money the government typically collects year to year. David Nelson answers that question and shares what has a greater impact compared to tax policy.

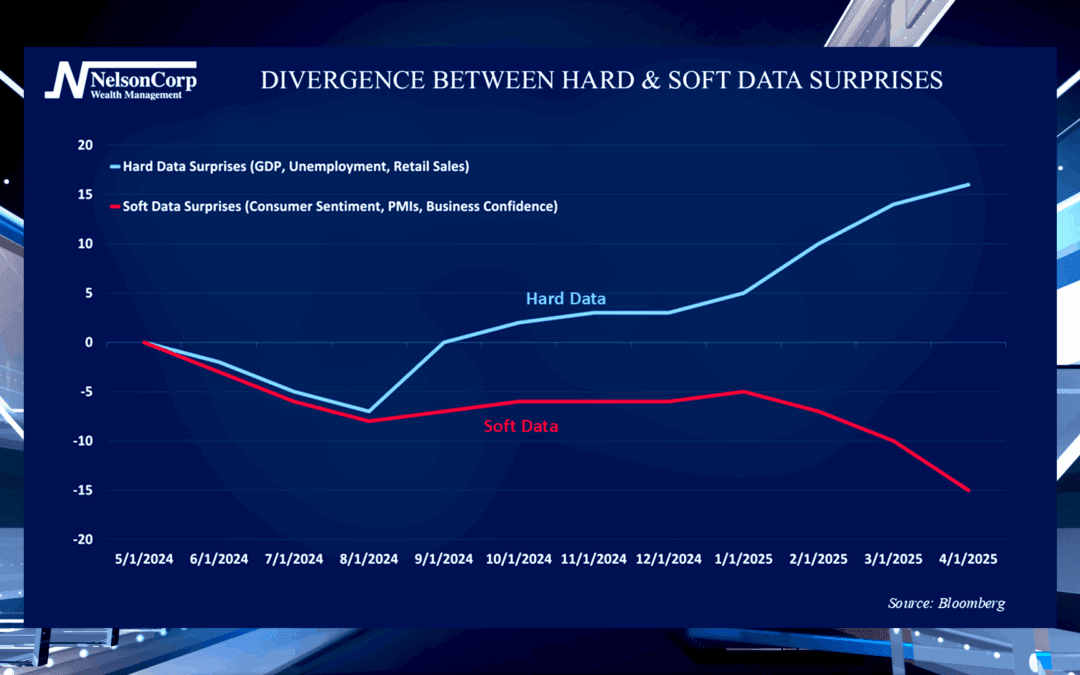

The economy has been sending mixed messages lately. David Nelson is here to explain one reason why by showing the growing divide between hard data and soft data.