by NelsonCorp | Feb 13, 2026 | Chart of the Week

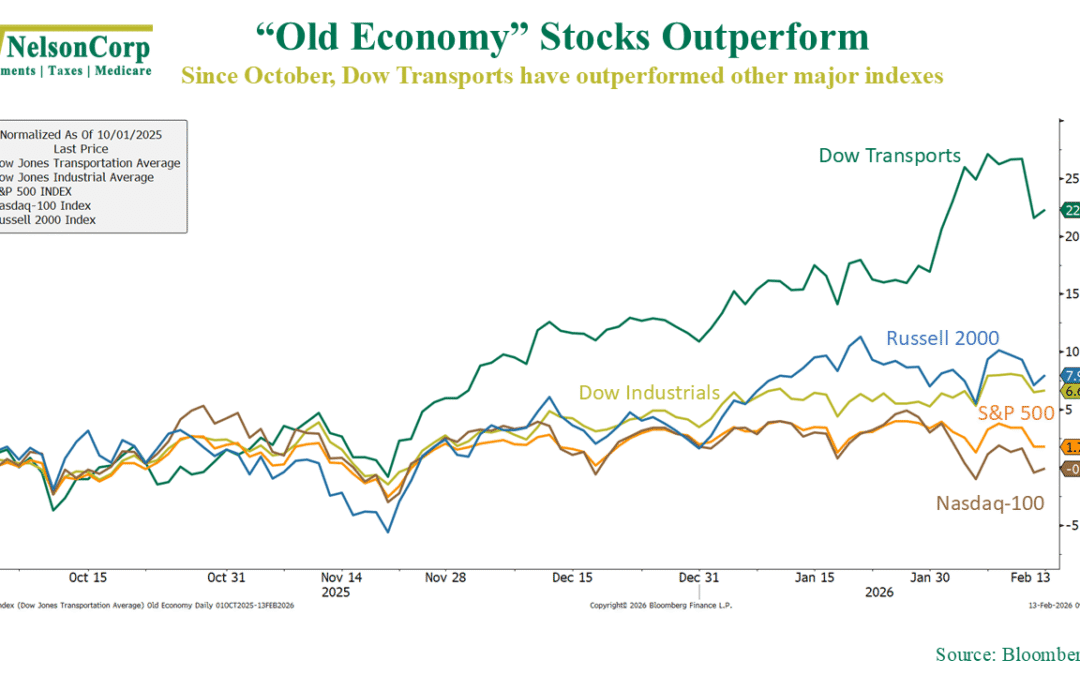

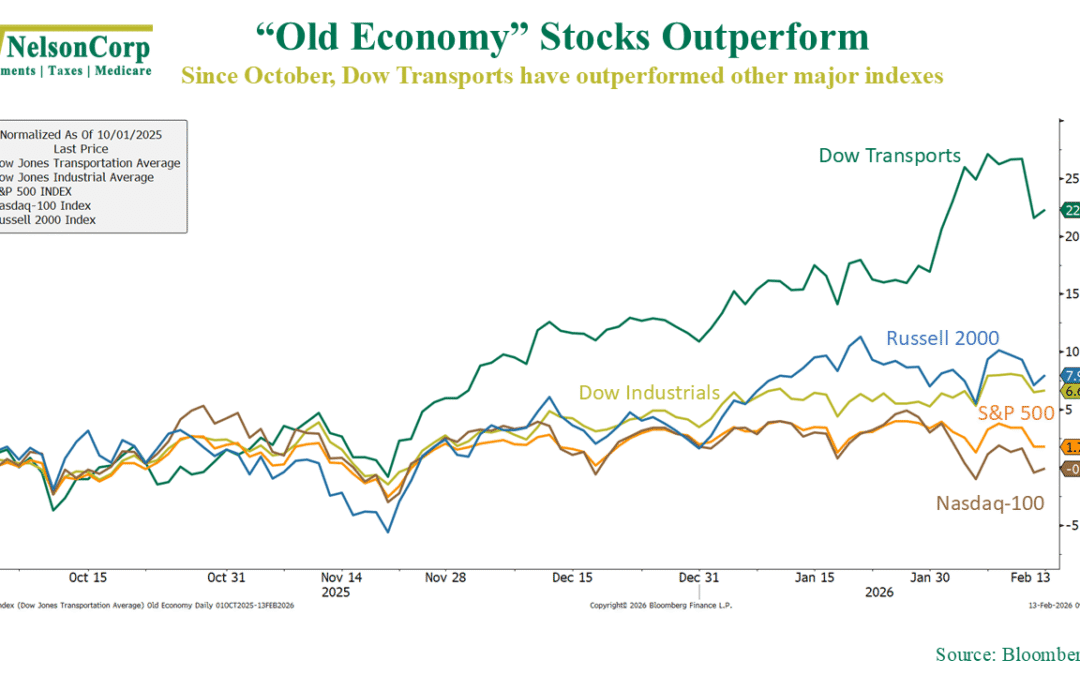

Over the past few months, we’ve seen an interesting shift happening in markets. As this week’s chart shows, the so-called “old economy” stocks have taken the lead. Since early October, the Dow Jones Transportation Average has surged more than 20%, decisively...

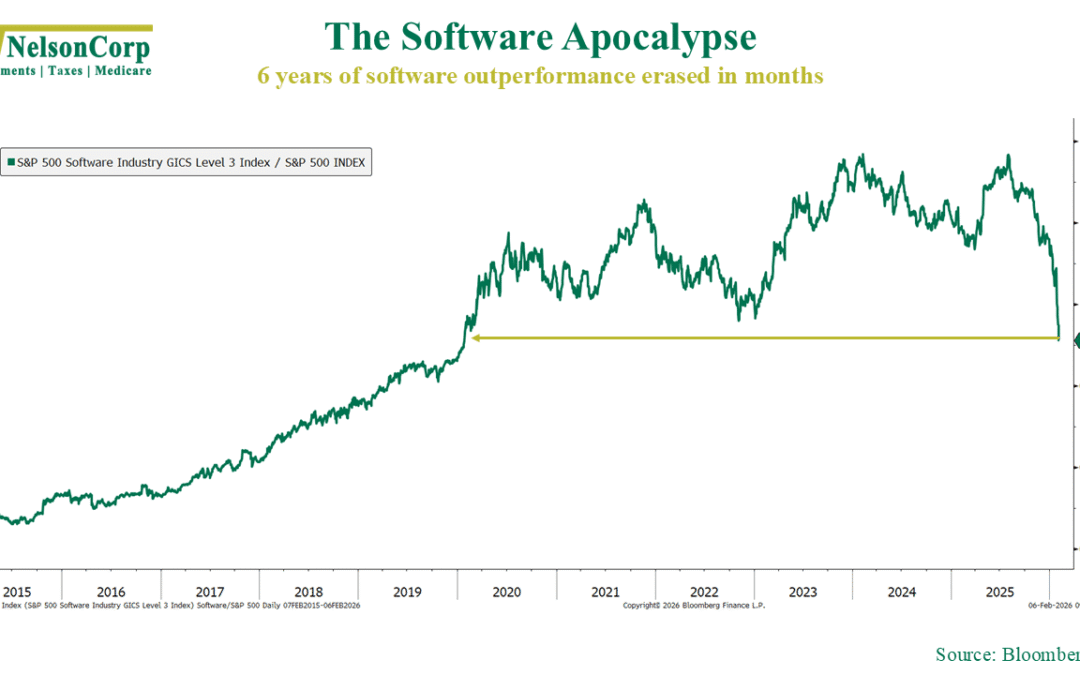

by NelsonCorp | Feb 6, 2026 | Chart of the Week

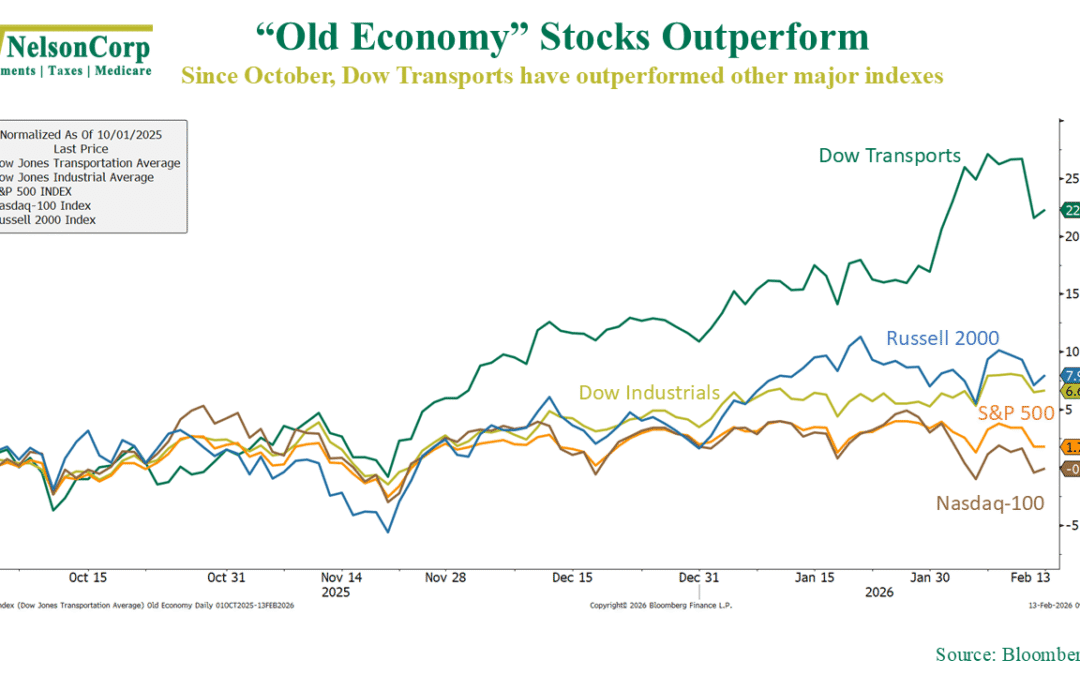

It was a rough week on Wall Street for technology stocks, and software took the brunt of it. This week’s chart shows the relative performance of the S&P 500 Software sector compared to the broader S&P 500. It’s a brutal picture. Nearly six years of...

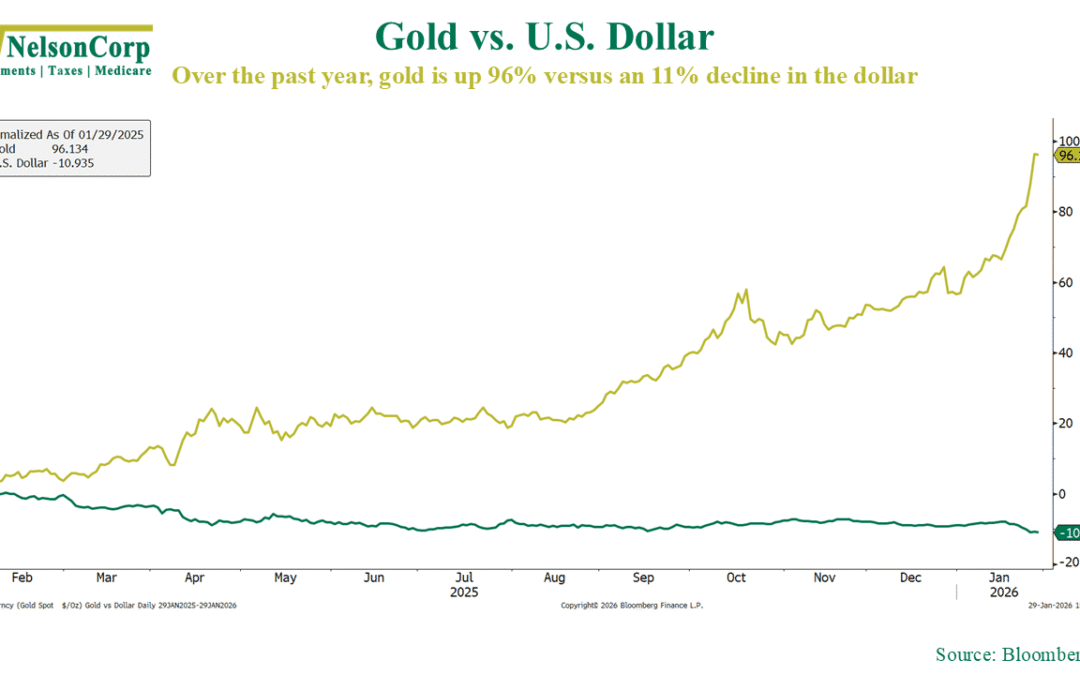

by NelsonCorp | Jan 30, 2026 | Chart of the Week

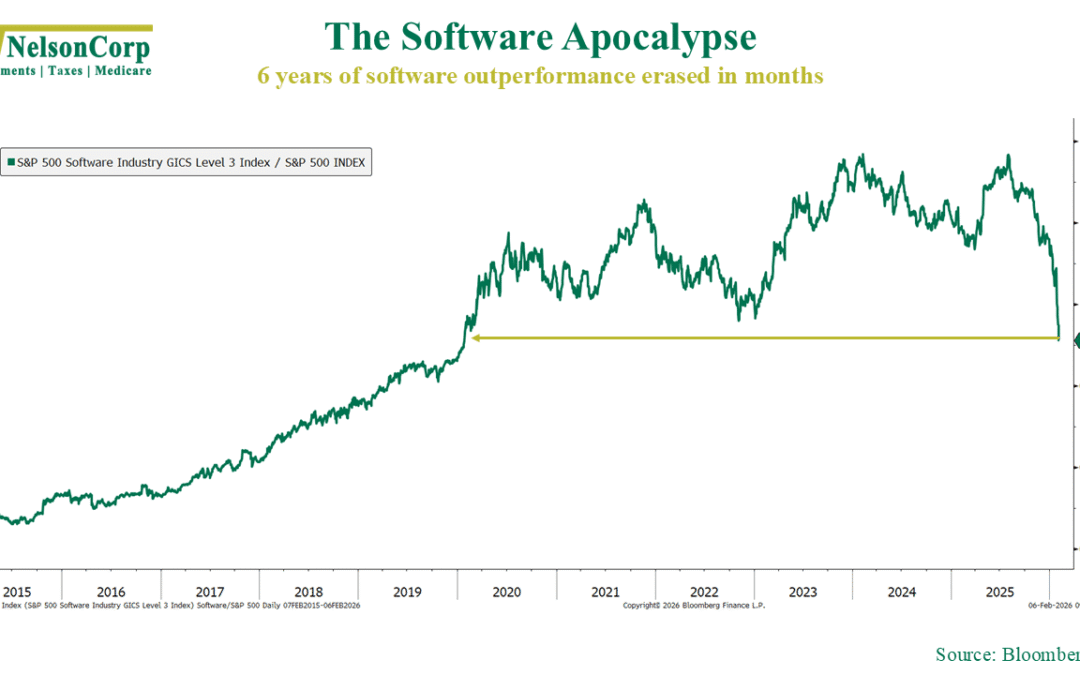

Gold has been on an absolute heater lately. The dollar? Not so much. That’s the message from this week’s chart, shown above, which compares the cumulative return of gold to the U.S. dollar over the past year. As you can see, gold is up more than 90% over the...

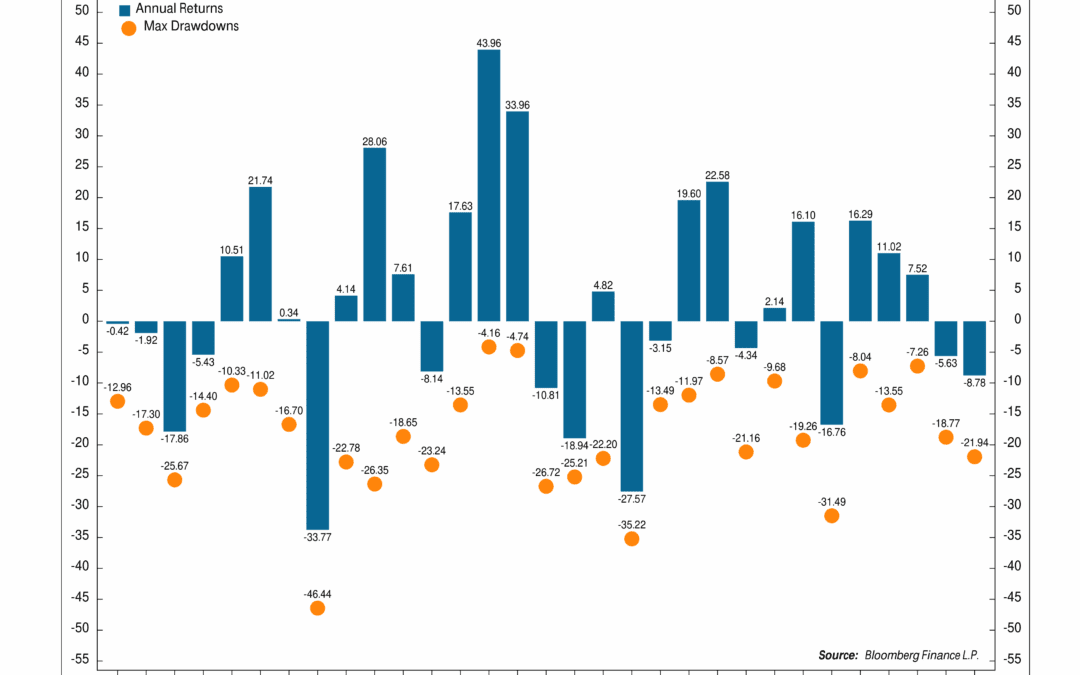

by NelsonCorp | Jan 23, 2026 | Chart of the Week

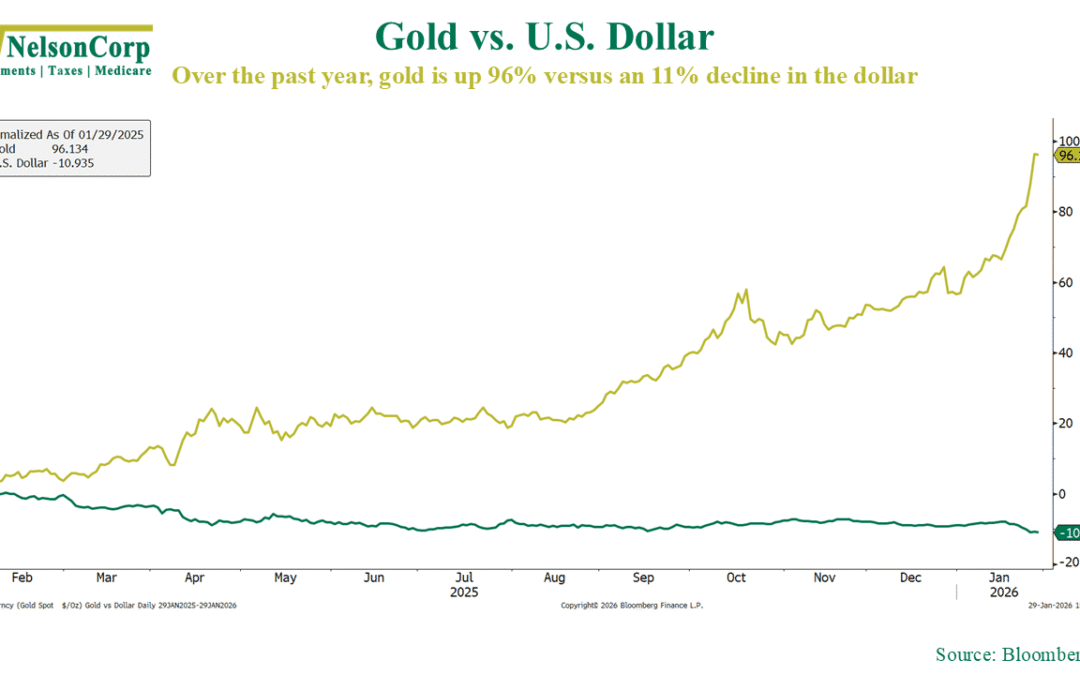

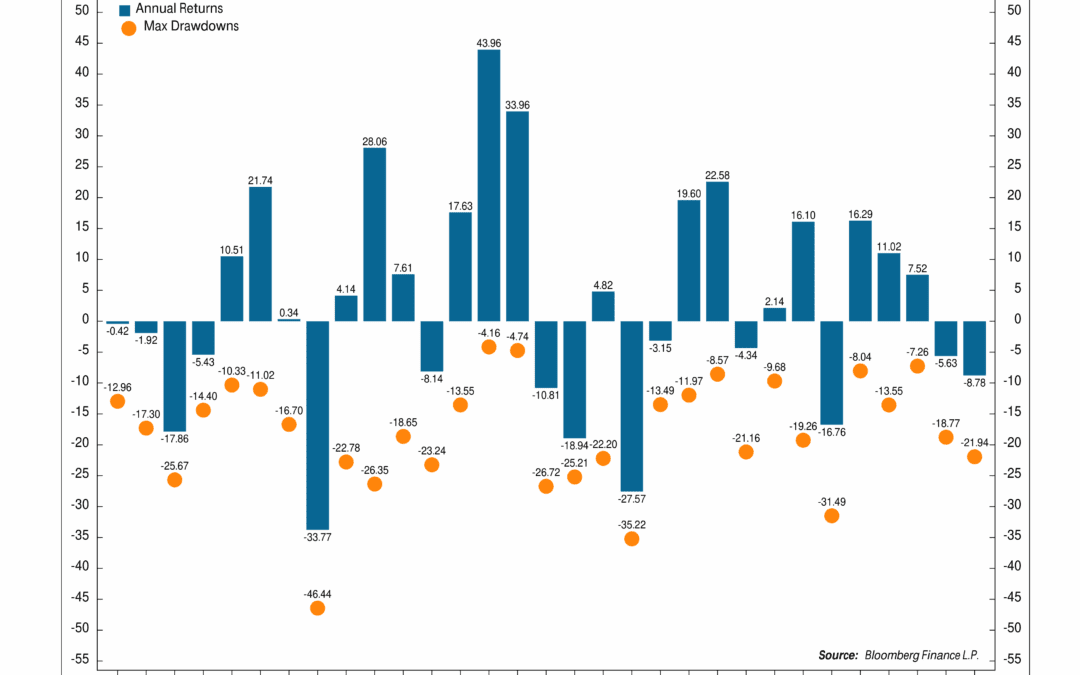

This week’s chart looks at how the Dow Jones Industrial Average has typically behaved during midterm election years. There have been 31 midterm elections since 1902. Each blue bar on the chart represents the annual return for that midterm year, while the orange...

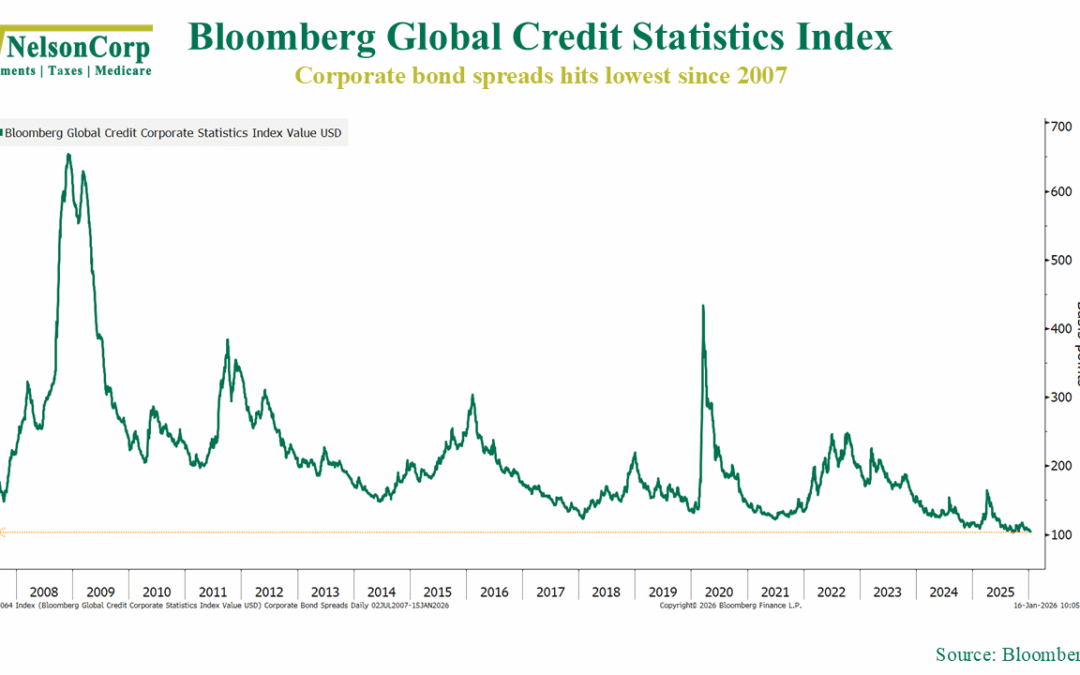

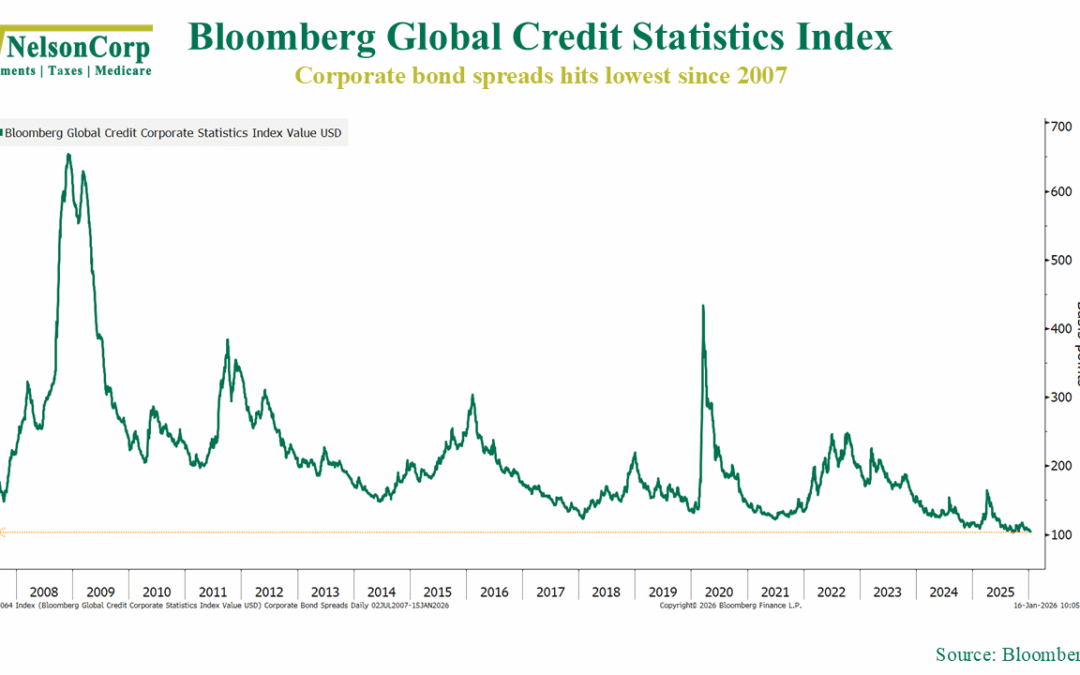

by NelsonCorp | Jan 16, 2026 | Chart of the Week

How do we know when investors are gearing up to embrace risk? We look at credit spreads, the featured metric in this week’s chart shown above. What are credit spreads? Simply put, they are the extra interest investors earn for lending money to companies instead...

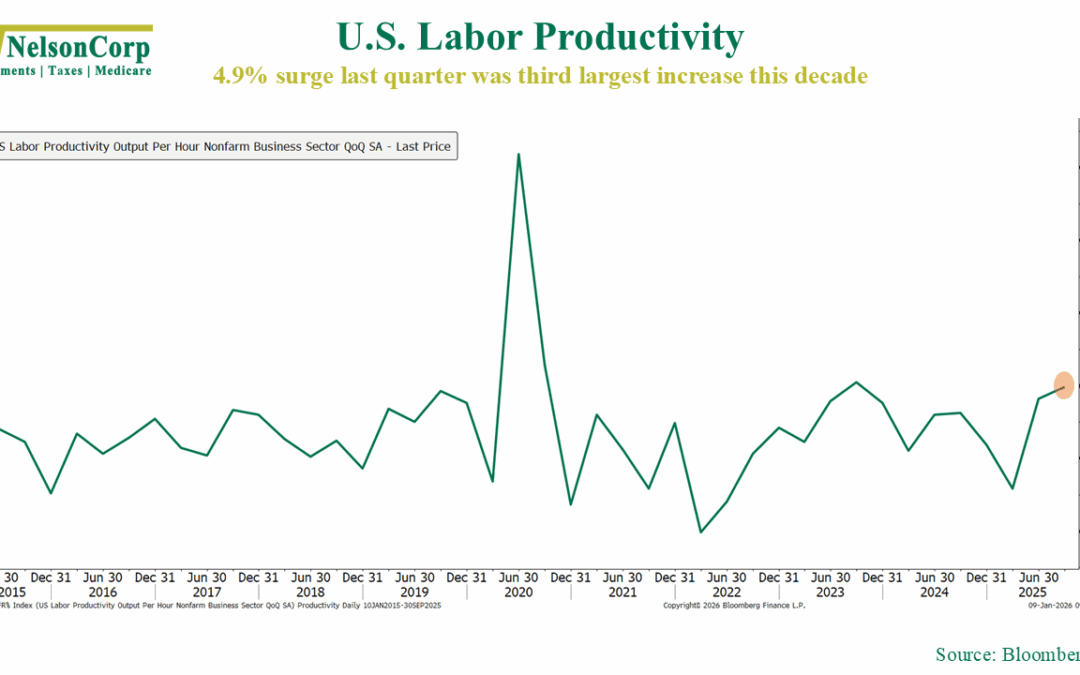

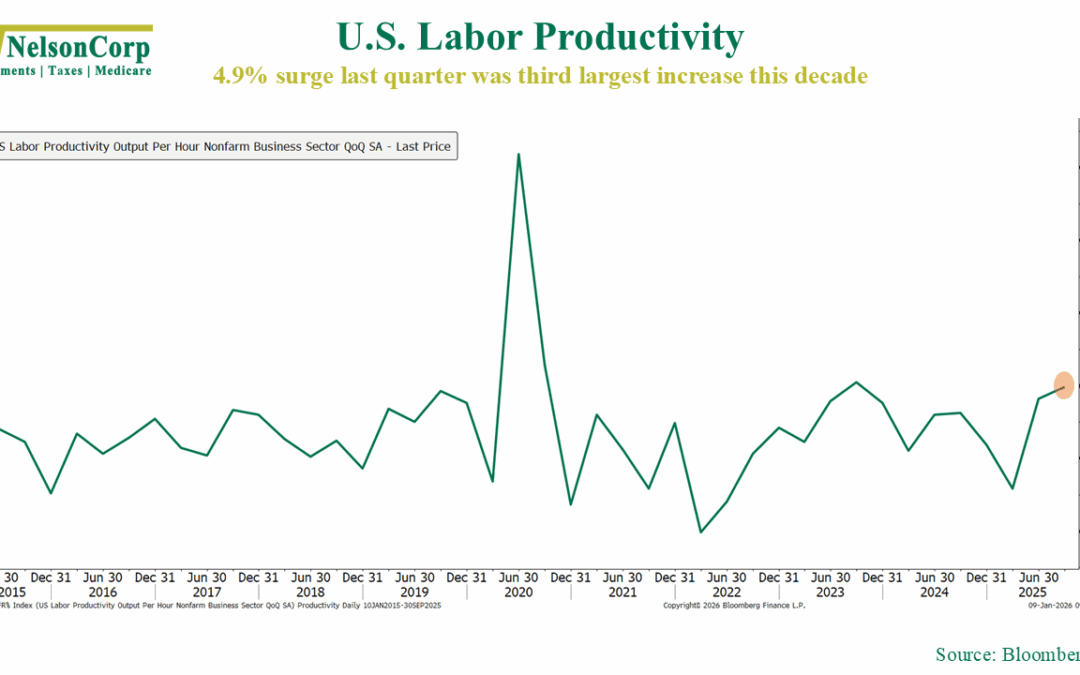

by NelsonCorp | Jan 9, 2026 | Chart of the Week

Sometimes we get an economic report that really jumps off the page. That was the case with this week’s productivity data. According to the BLS, labor productivity surged at a 4.9% annualized pace in the third quarter, the fastest increase in two years....