by NelsonCorp Wealth Management | Dec 22, 2023 | Chart of the Week

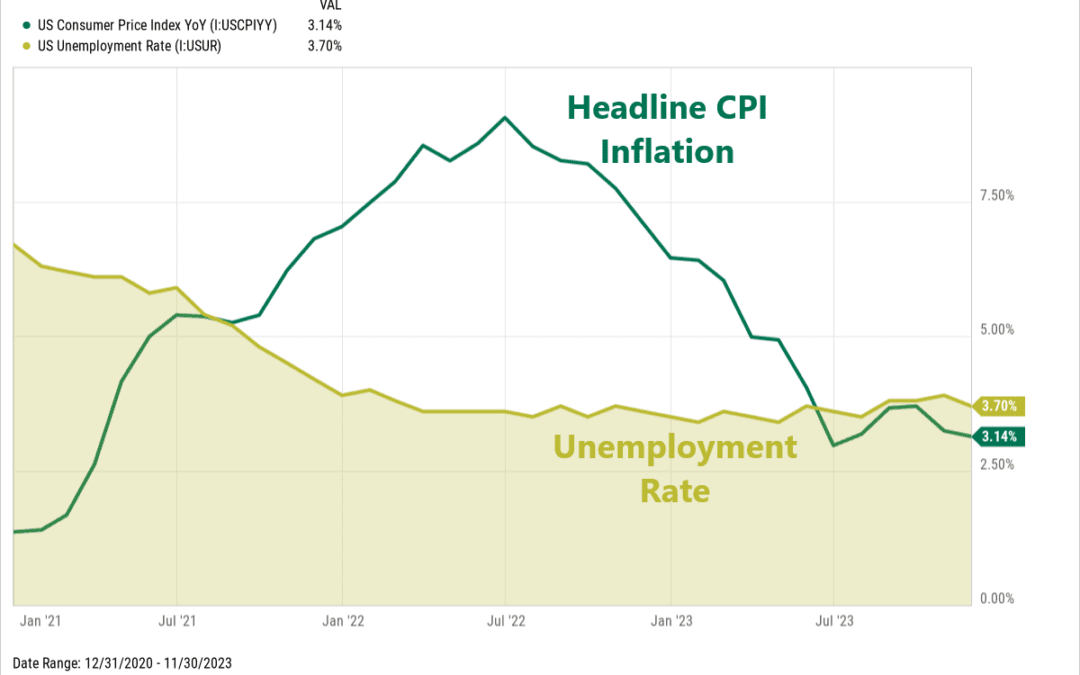

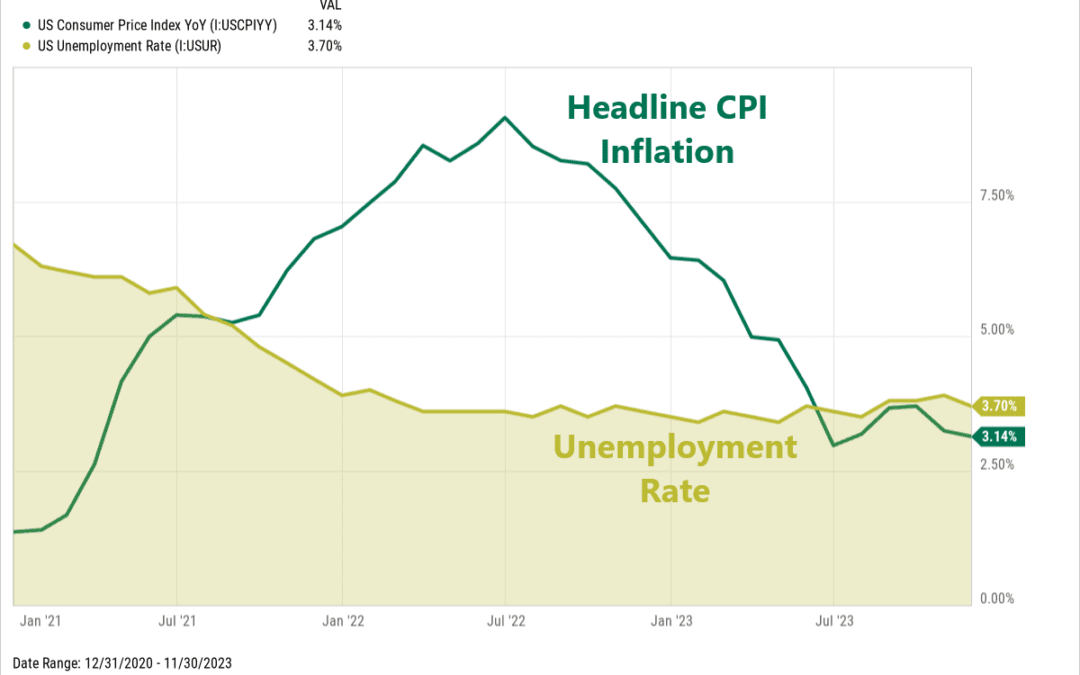

When the Federal Reserve began increasing interest rates in 2022, the big worry was that it would put a lot of people out of work. Initially, the Fed predicted that the unemployment rate would need to rise from 3.7% to 4.4% in 2023, equivalent to 1.2 million...

by NelsonCorp Wealth Management | Dec 15, 2023 | Chart of the Week

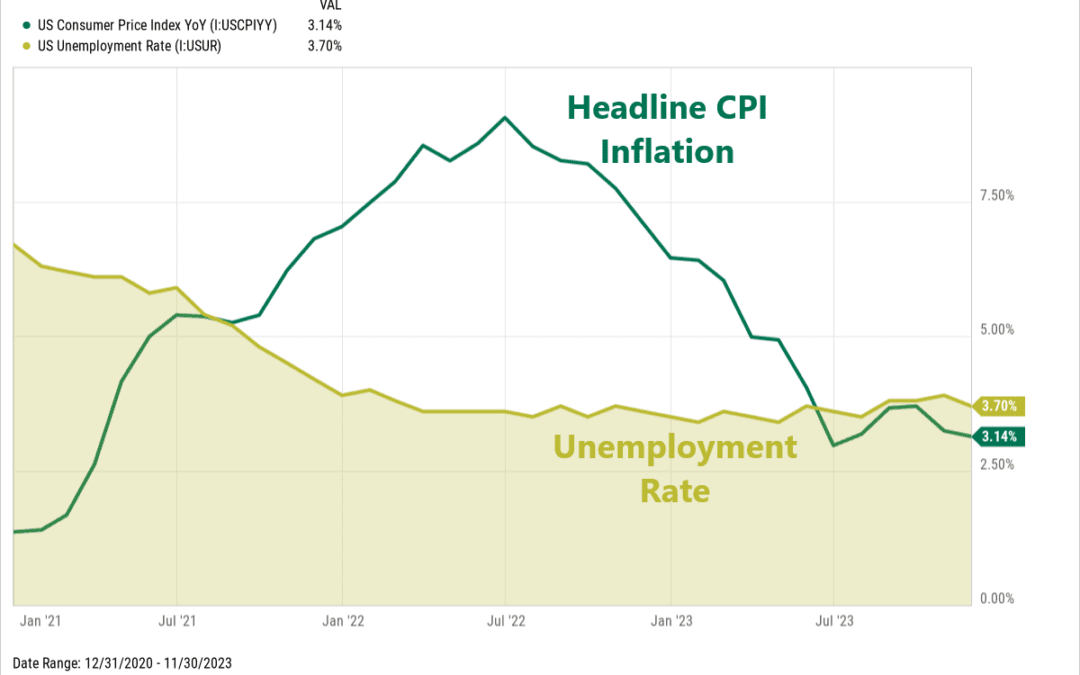

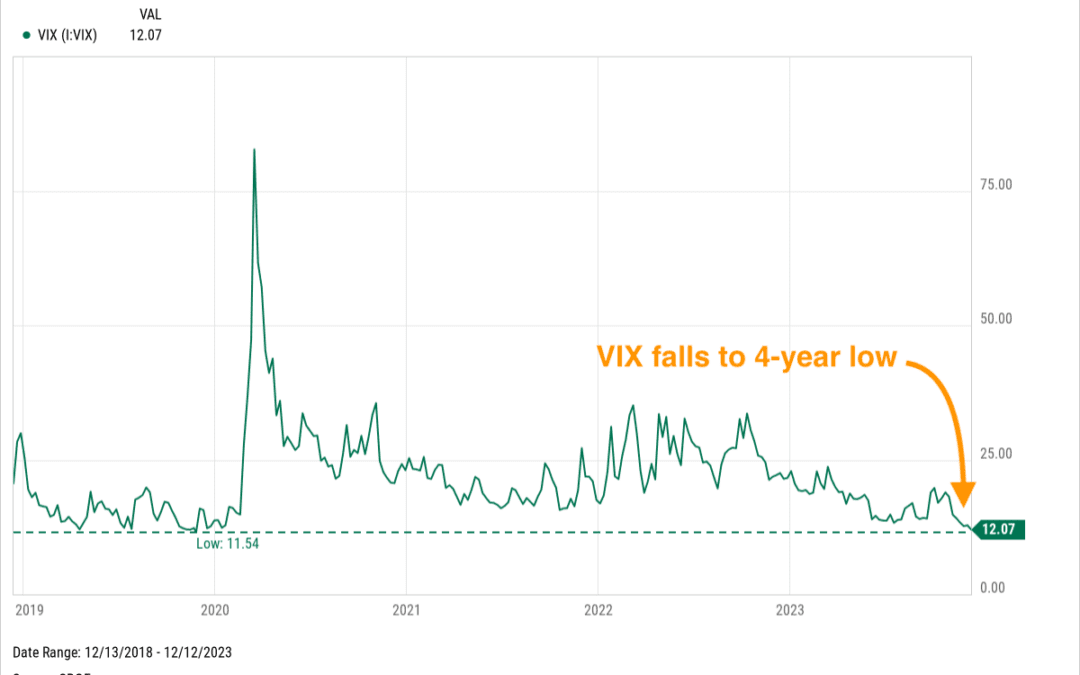

For this week’s chart, we highlight the VIX. No… not that ointment your mom rubbed on your chest when you were sick as a kid. But rather the VIX Index, a measure of market expectations for future stock market volatility. When the VIX is high, it means traders...

by NelsonCorp Wealth Management | Dec 8, 2023 | Chart of the Week

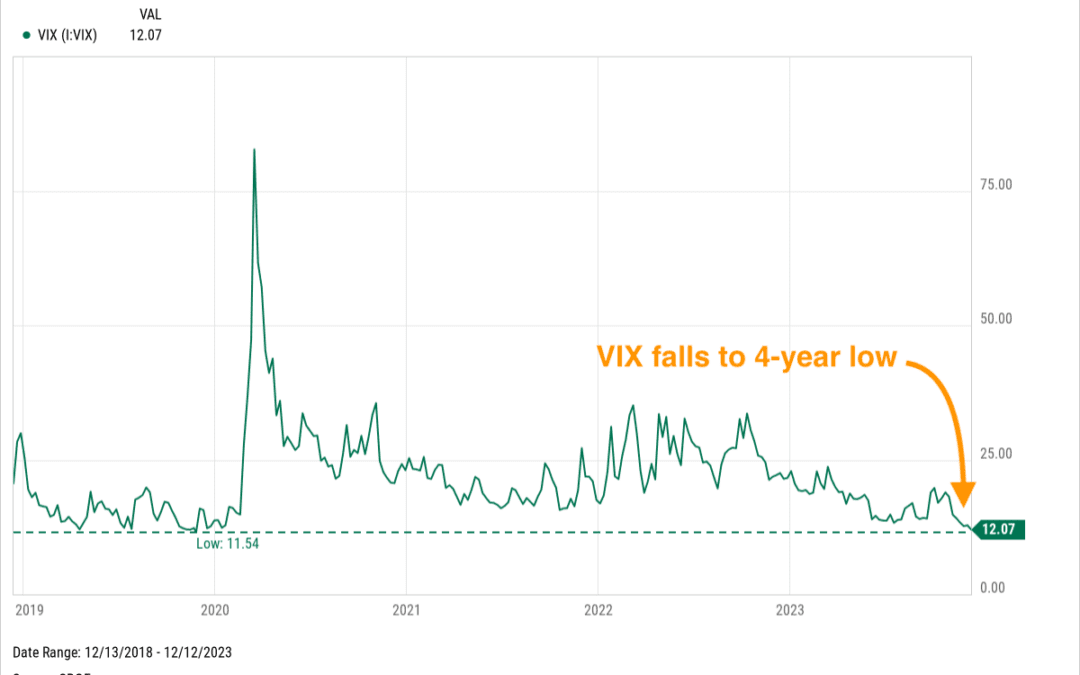

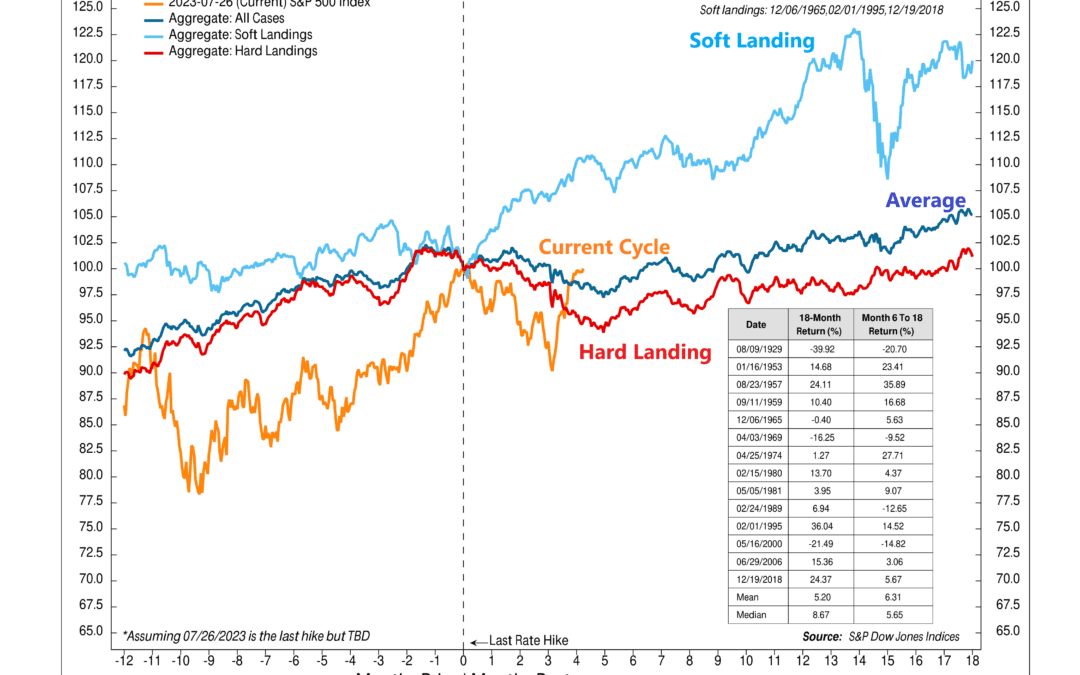

Has the Fed reached the summit of its rate-hiking adventure? If so, our featured chart this week might shed some light on where the stock market could be headed next. The chart illustrates the historical performance of the S&P 500 stock index after the...

by NelsonCorp Wealth Management | Dec 1, 2023 | Chart of the Week

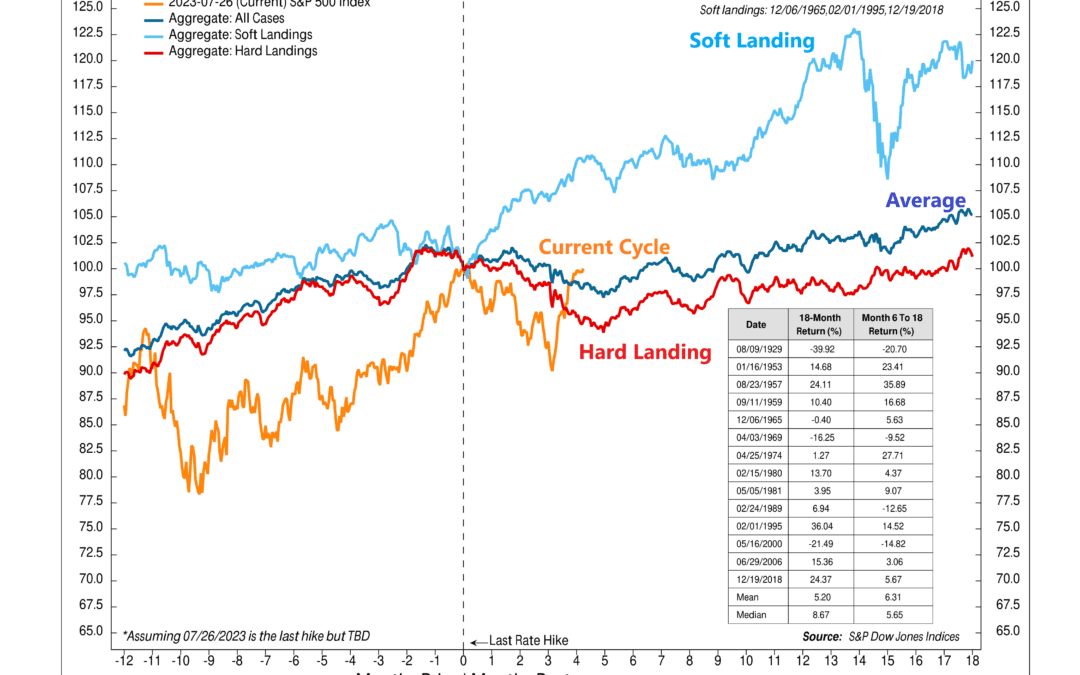

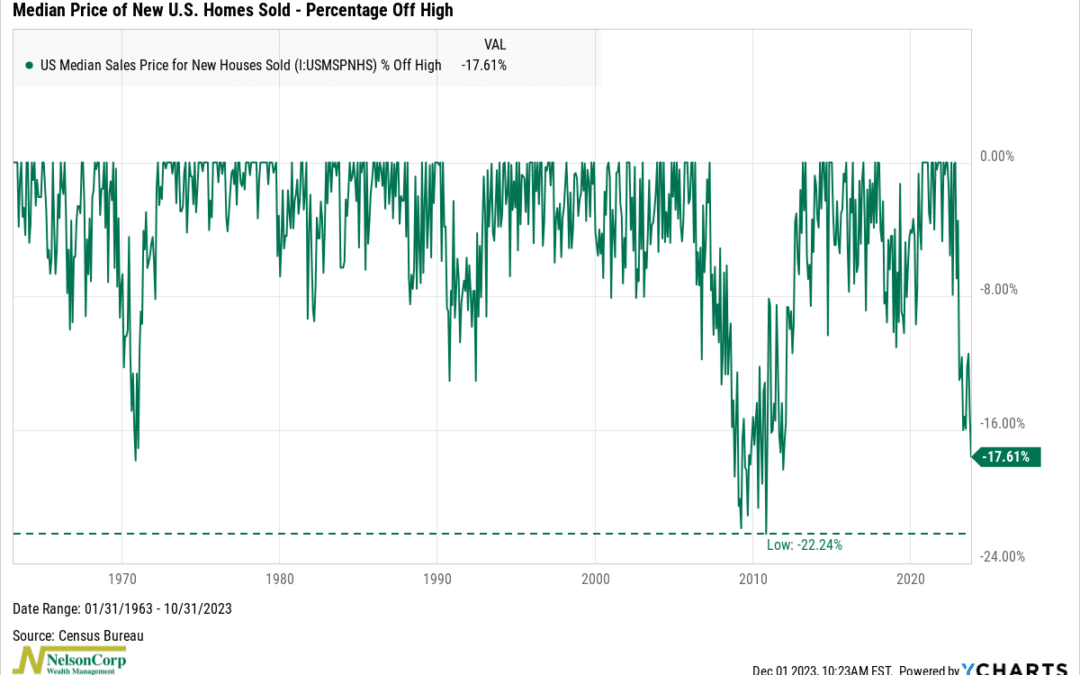

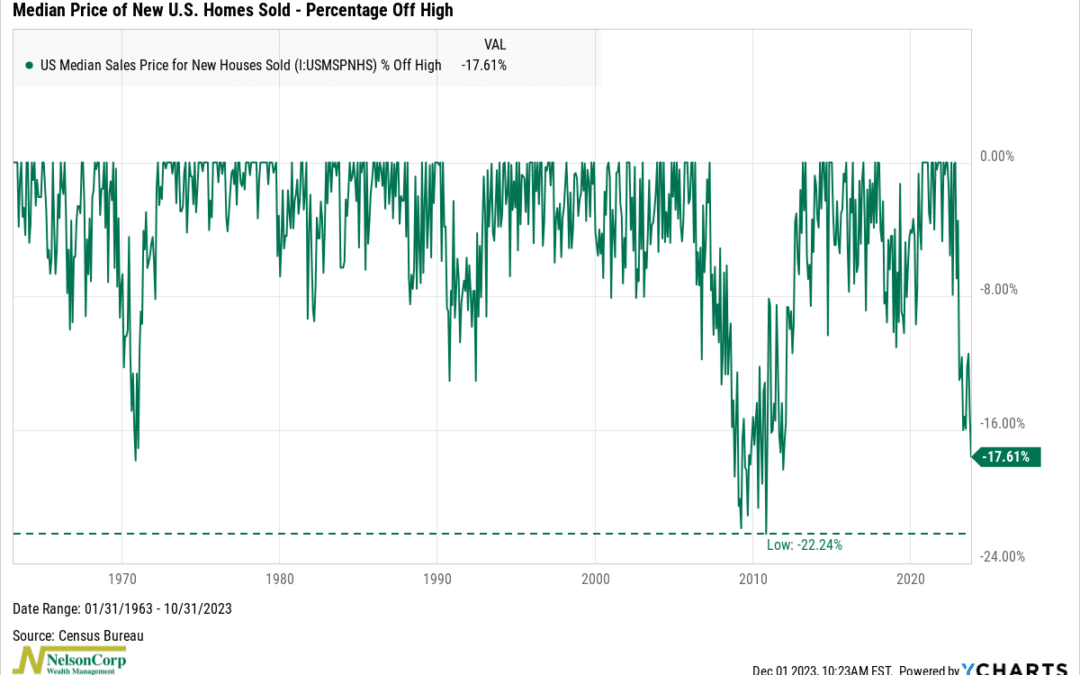

Last year, the Federal Reserve geared up in its battle against inflation by swiftly increasing interest rates. They threw a powerful right hook at inflation, delivered in the form of 8% mortgage rates. The impact? A direct hit on the housing market, leaving it...

by NelsonCorp Wealth Management | Nov 24, 2023 | Chart of the Week

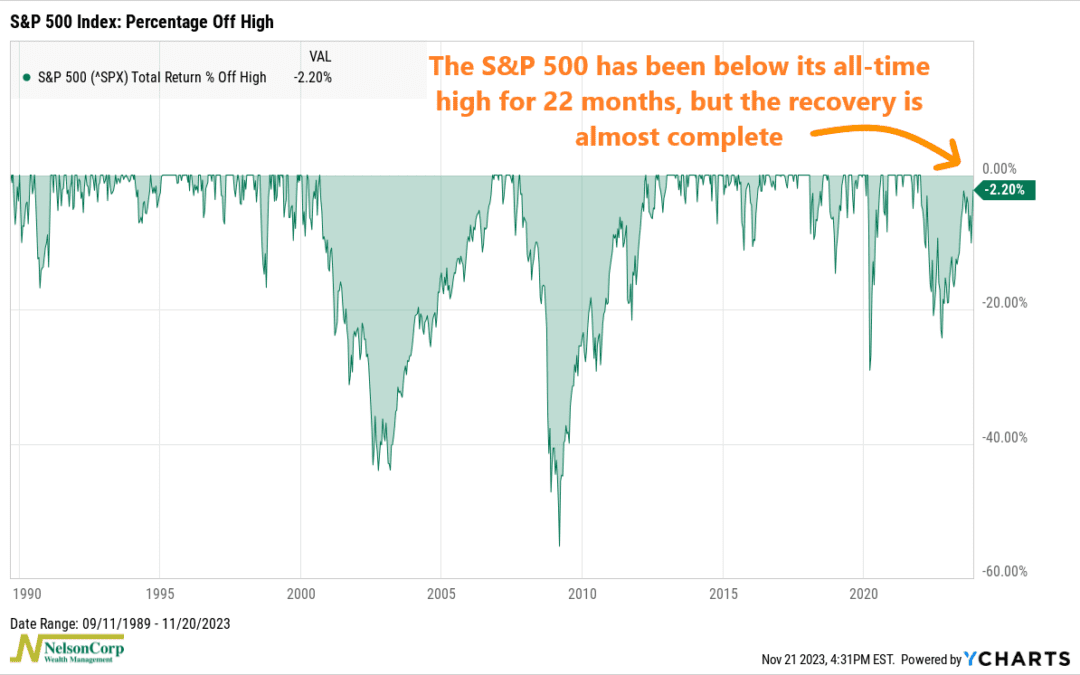

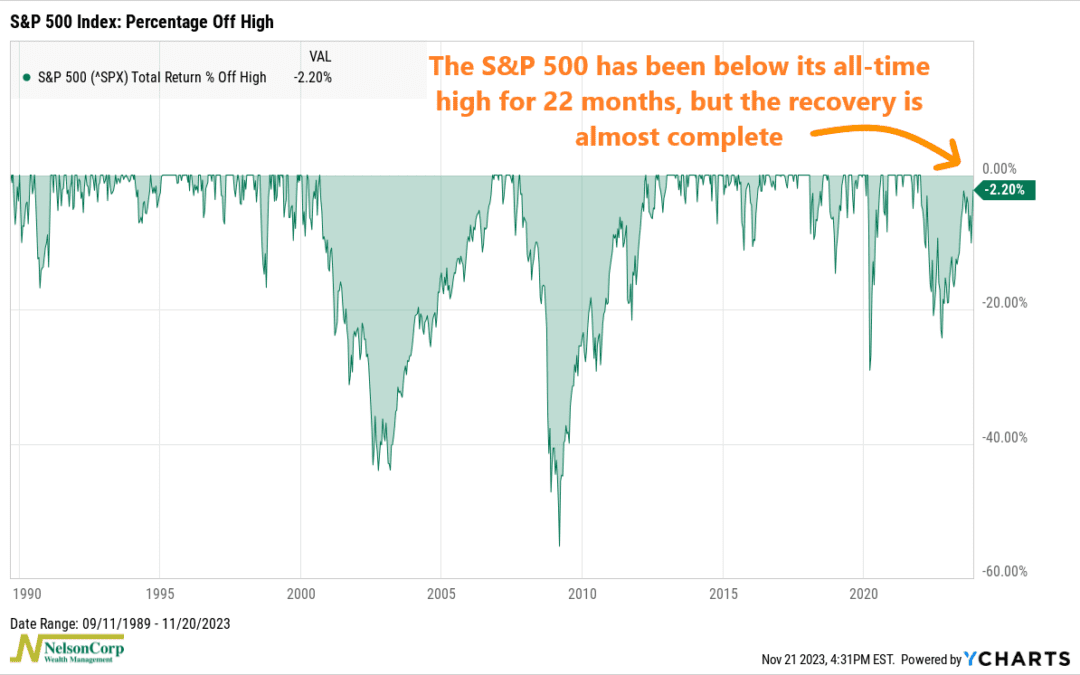

This week’s chart is called a percentage drawdown or percentage off high chart. It’s a visual representation of the decline in the value of the stock market from its peak to its lowest point, expressed as a percentage. For example, the last time the S&P 500...

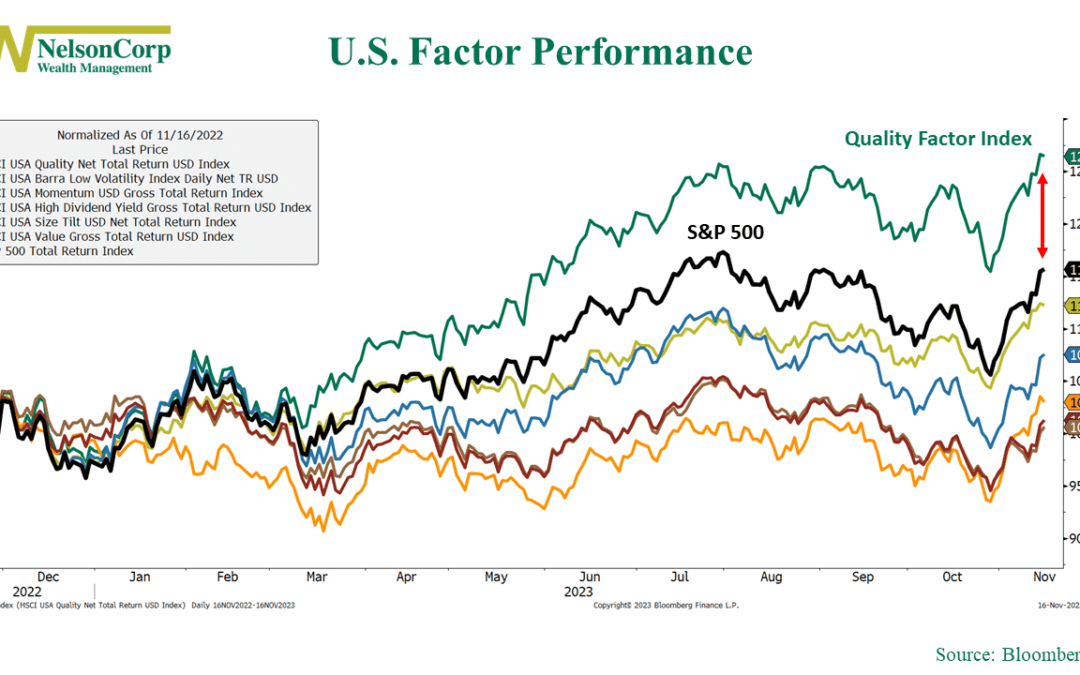

by NelsonCorp Wealth Management | Nov 17, 2023 | Chart of the Week

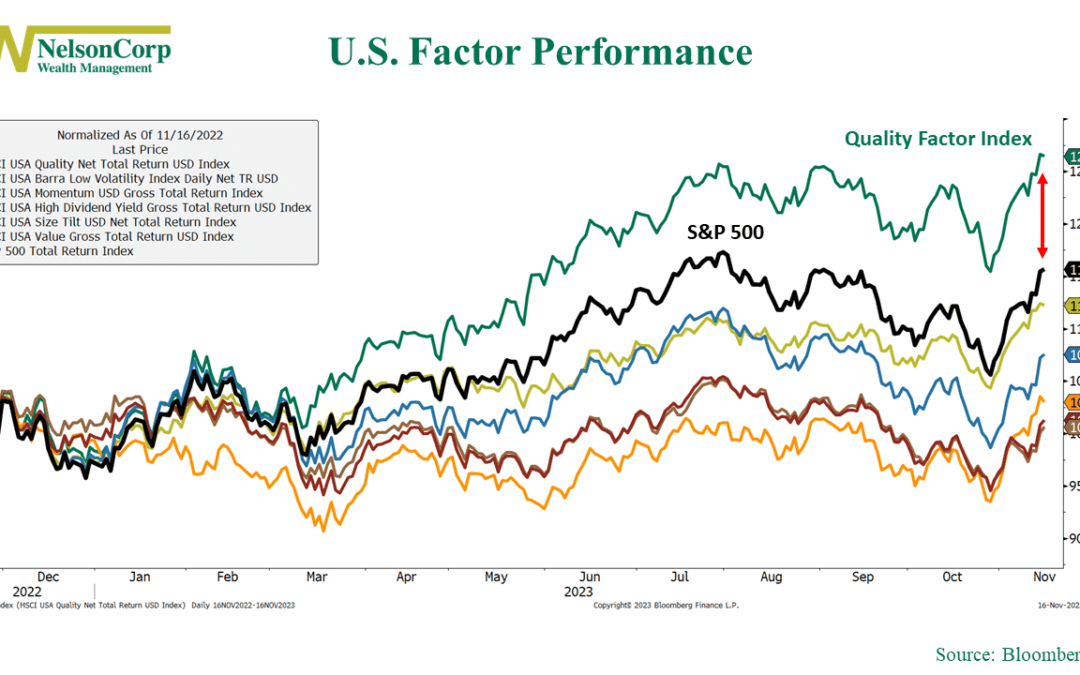

In the past year, the U.S. stock market has generally been trending upward. However, what’s interesting is that most of the gains have come from a particular kind of factor: quality. The Quality Factor Index, shown as the green line on the chart above,...