by NelsonCorp Wealth Management | May 26, 2023 | Chart of the Week

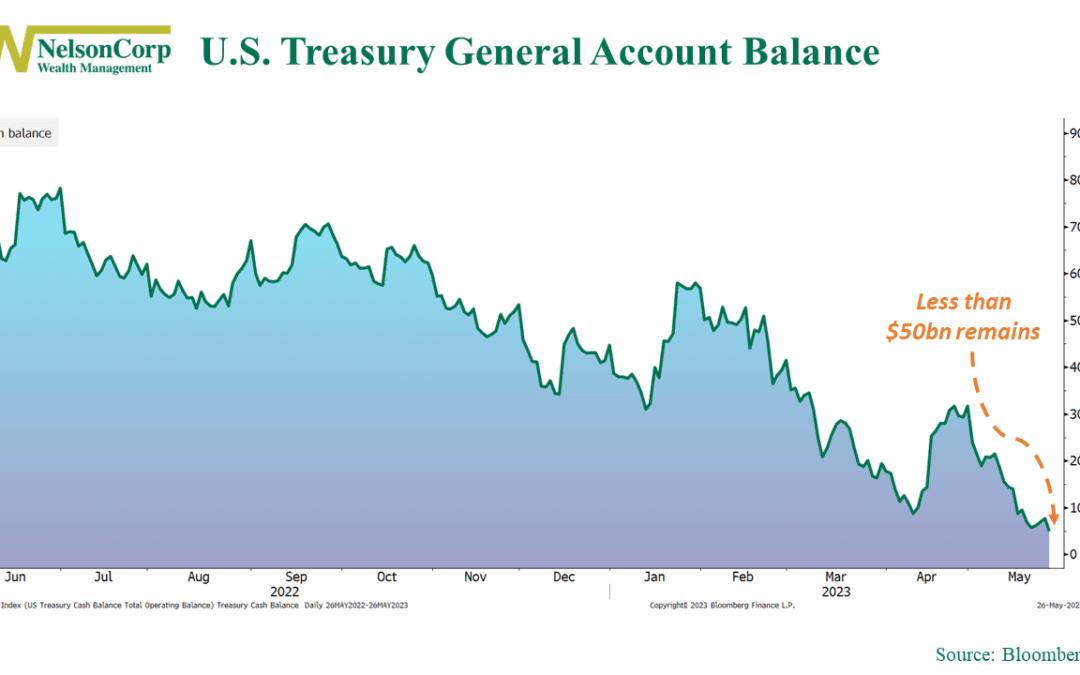

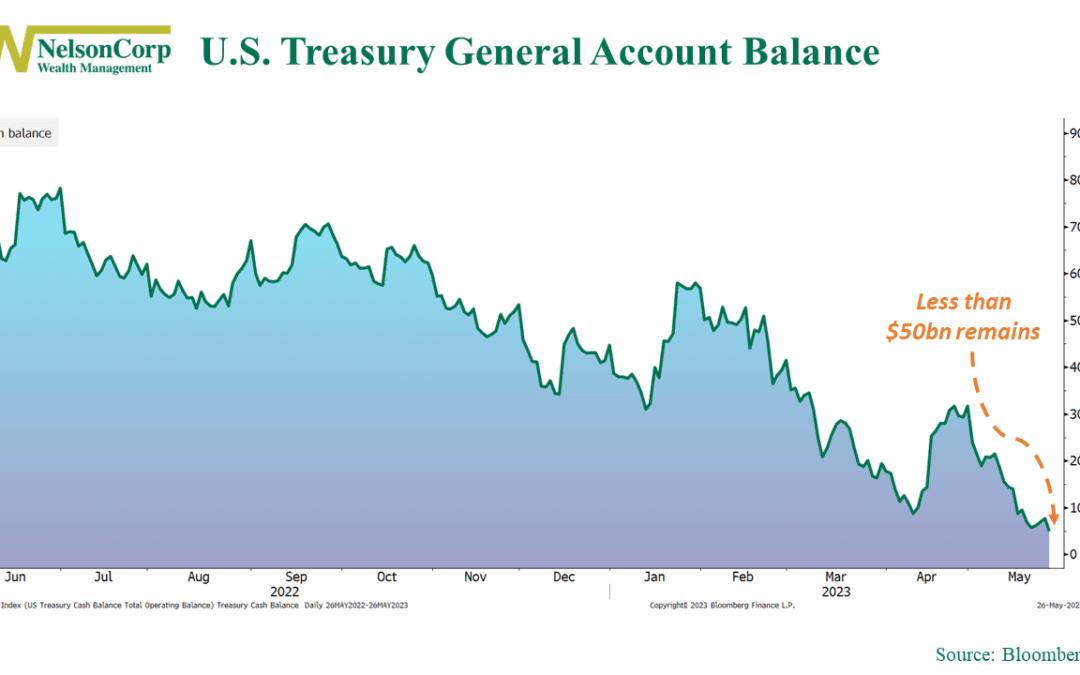

The clock is ticking for the U.S. government’s finances. As our featured chart above shows, Uncle Sam’s checking account—something known as the Treasury General Account—is quickly shrinking. This week’s latest update showed the balance dropping to less than $50...

by NelsonCorp Wealth Management | May 19, 2023 | Chart of the Week

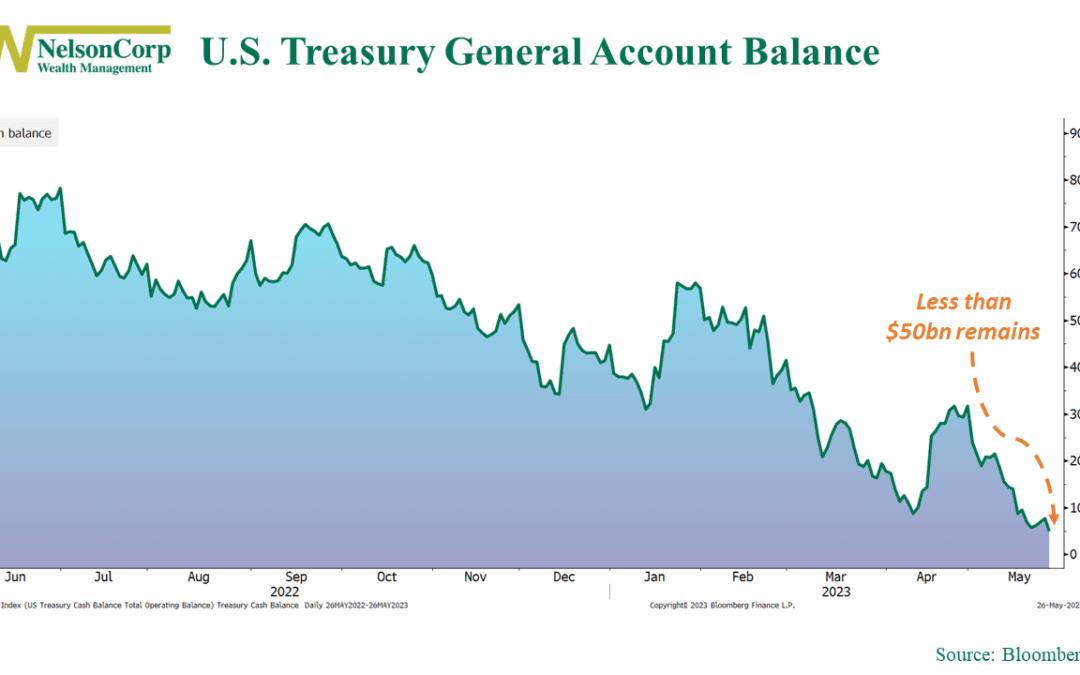

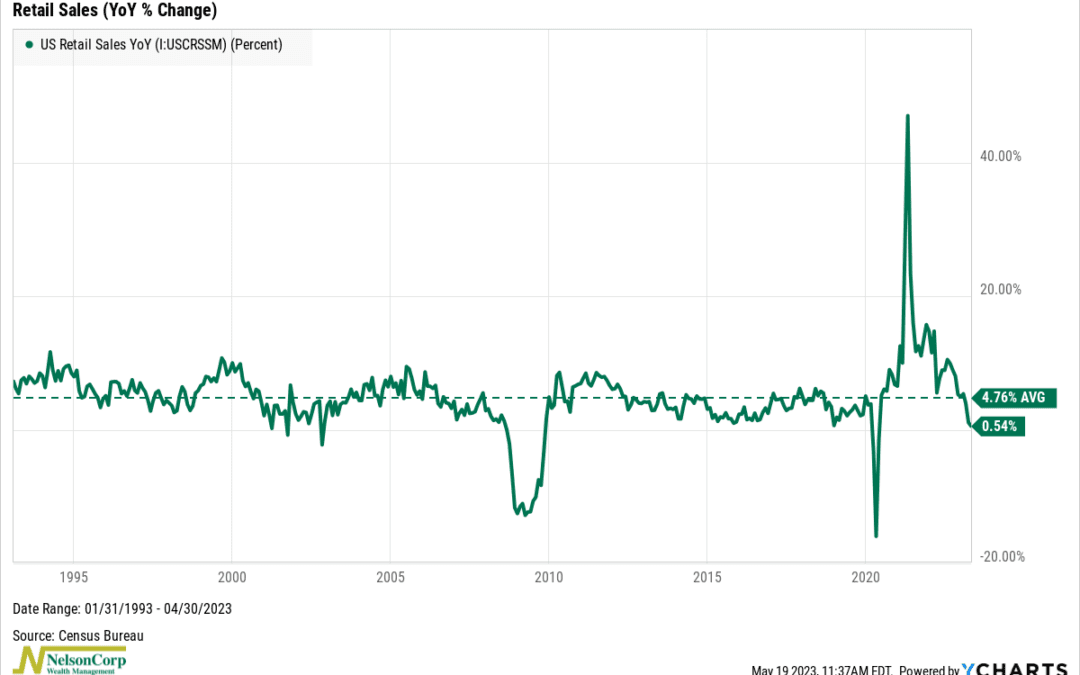

Sluggish growth continues to plague the U.S. economy. Retail sales and industrial production, both of which are strongly correlated with economic growth, came in unusually weak last month. The year-over-year change in retail sales, shown below, rose just 0.5% in...

by NelsonCorp Wealth Management | May 12, 2023 | Chart of the Week

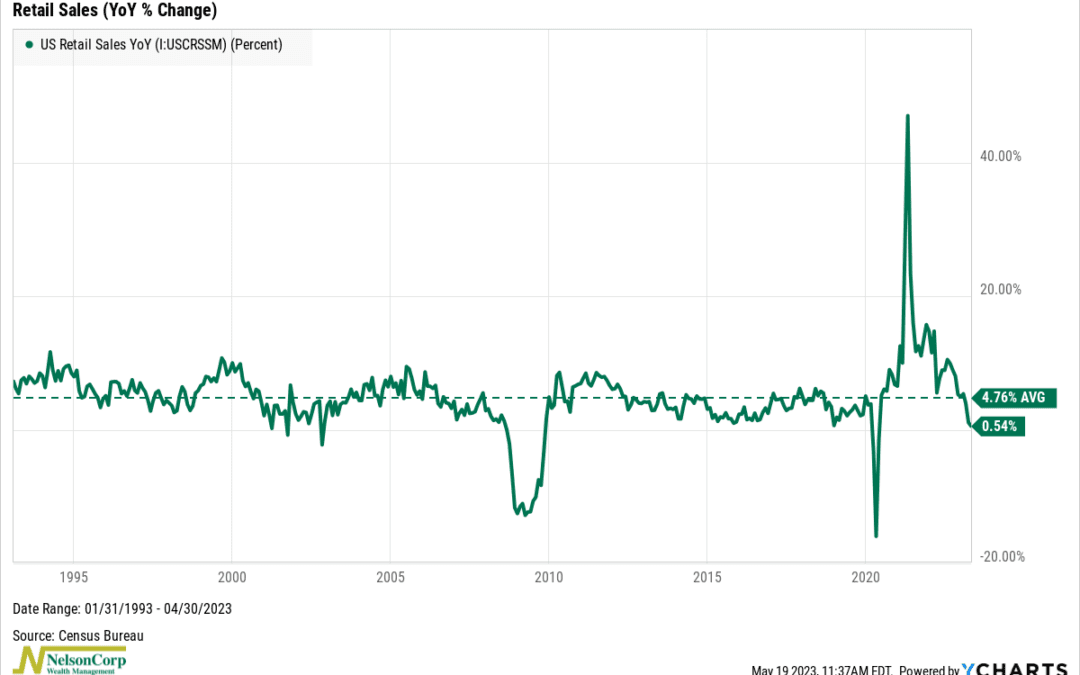

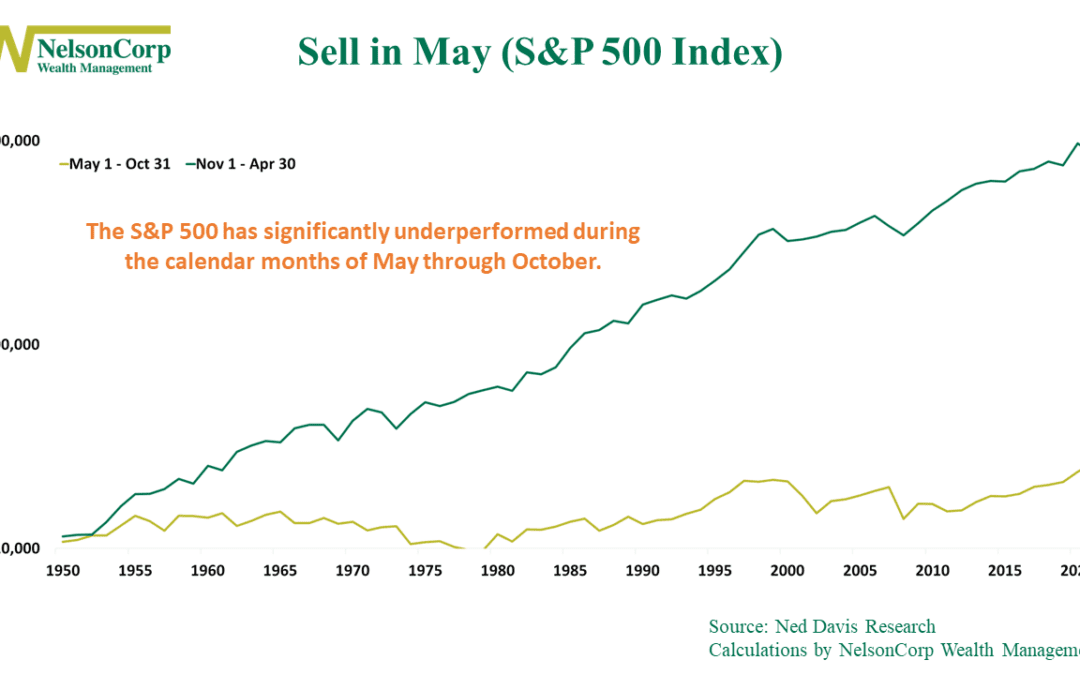

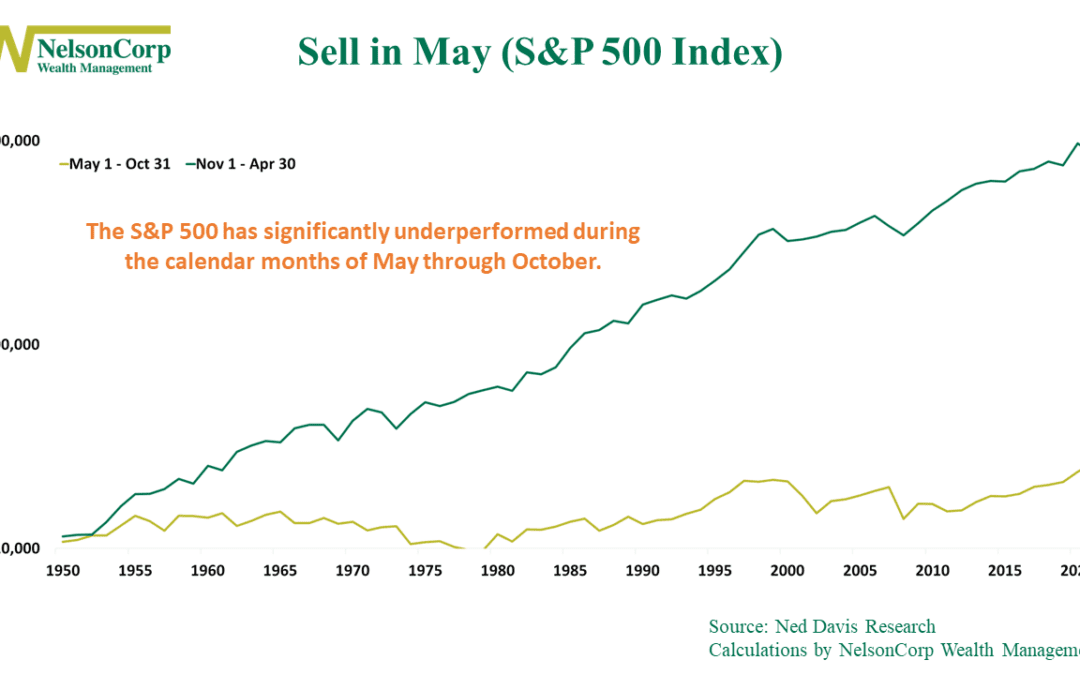

There’s an adage on Wall Street that goes something like, “Sell in May and walk away.” It refers to the stock market’s tendency to underperform for the six calendar months of May through October and outperform from November through April. Just how big is the...

by NelsonCorp Wealth Management | May 5, 2023 | Chart of the Week

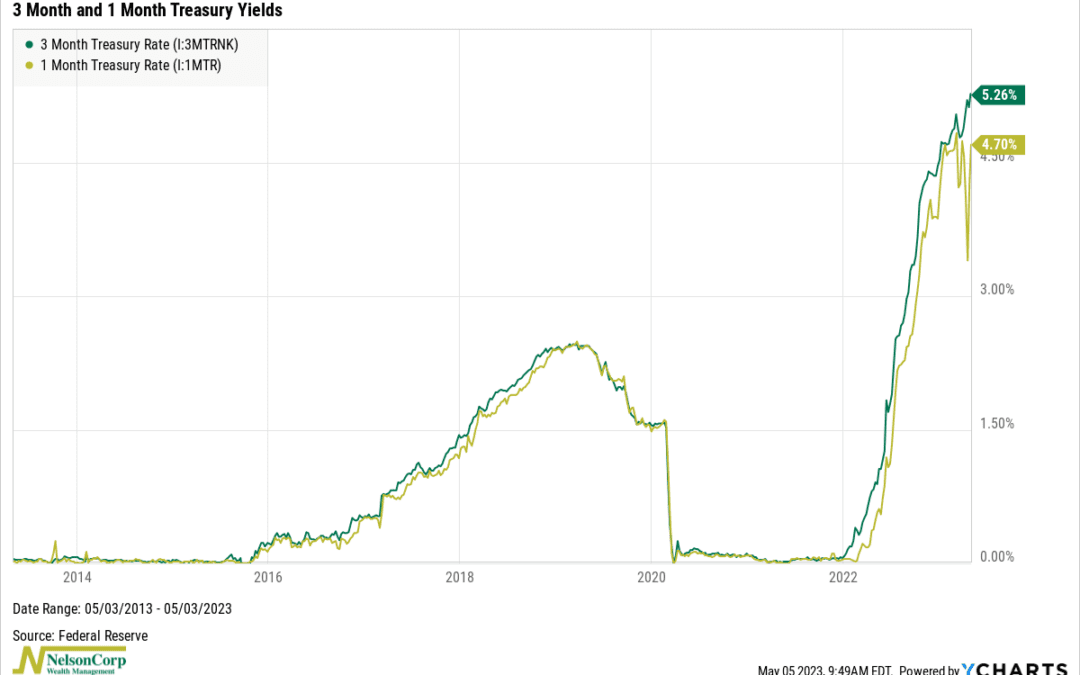

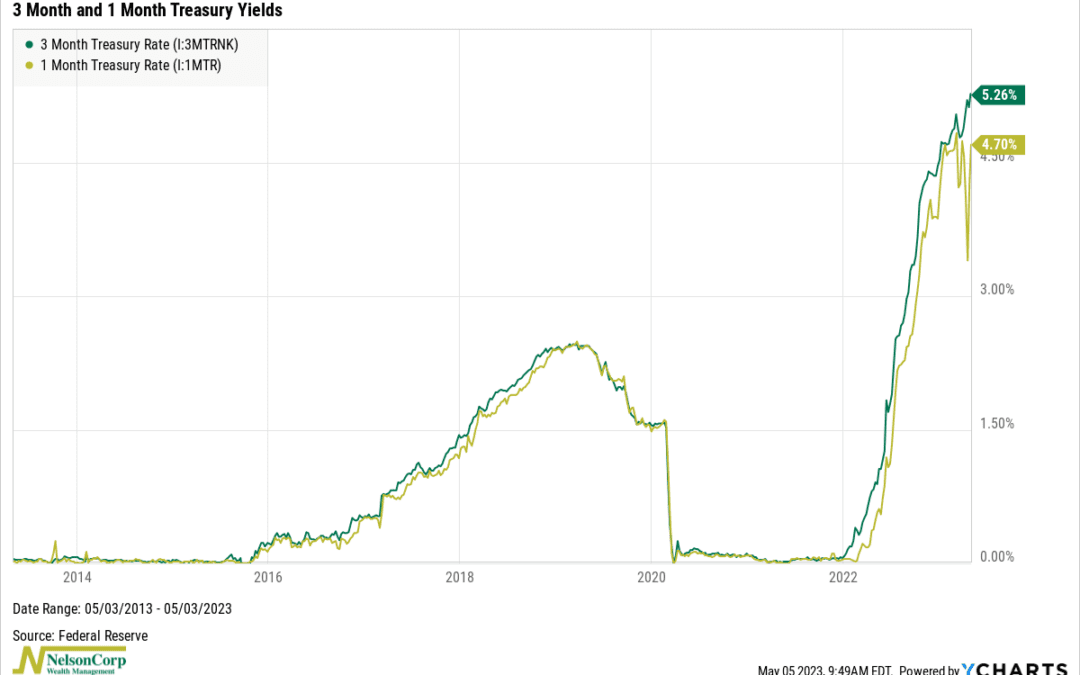

If there’s one thing investors don’t like, it’s uncertainty. Unfortunately, now is one of those times when uncertainty is especially high regarding what is going on in Washington with the upcoming debt ceiling. This week’s featured chart does a great job of...

by NelsonCorp Wealth Management | Apr 28, 2023 | Chart of the Week

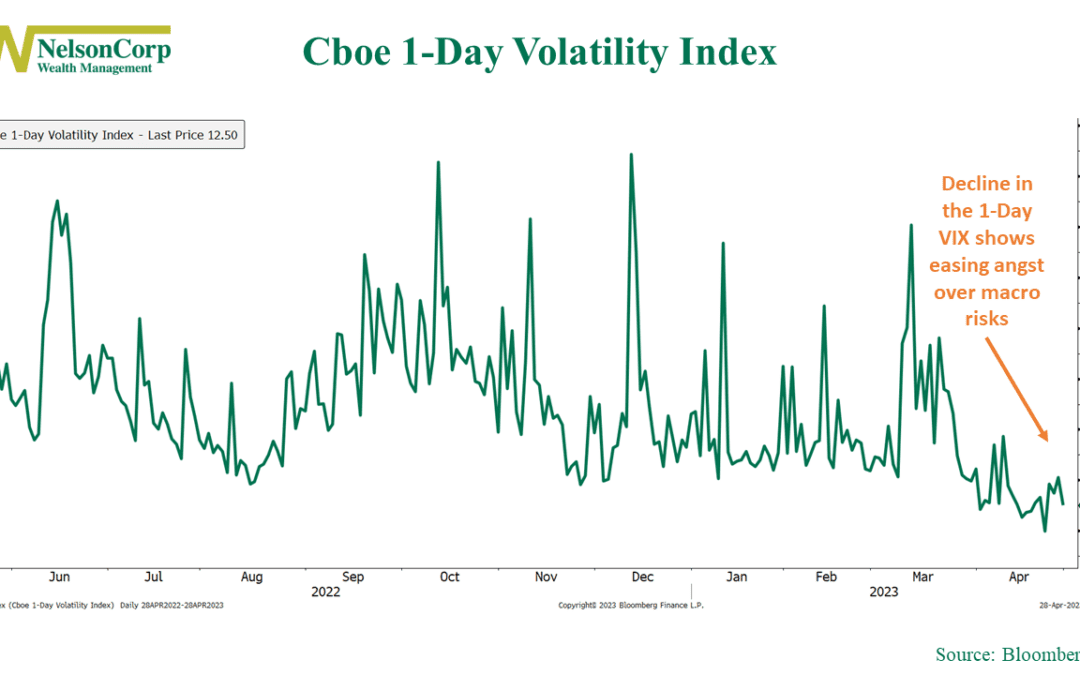

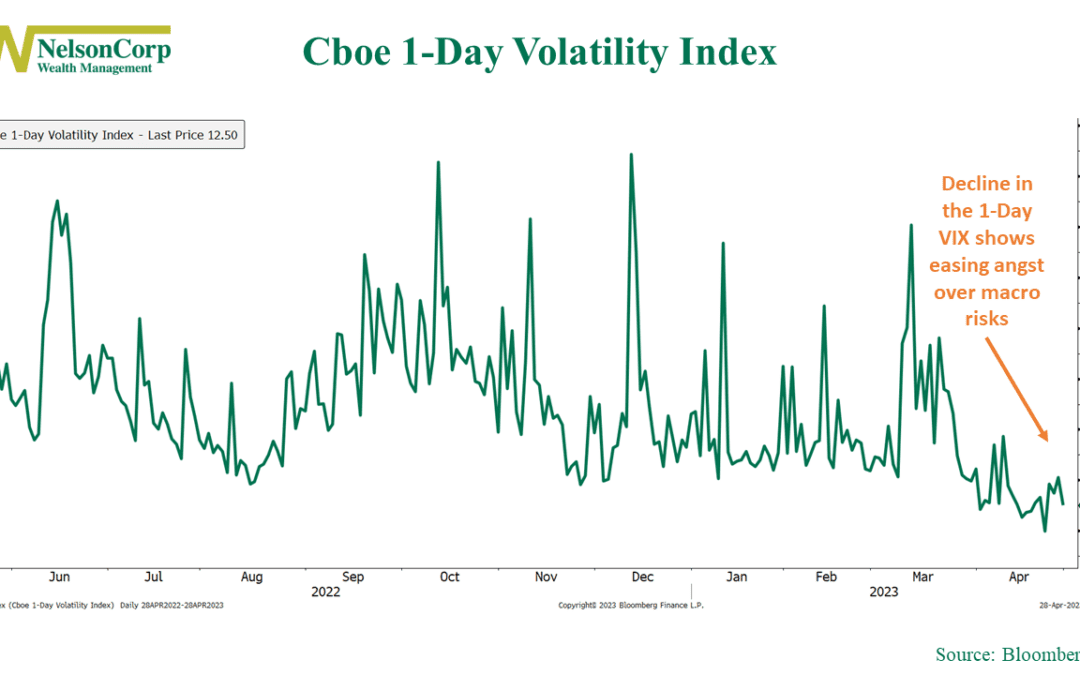

There’s a new type of “fear gauge” on Wall Street: the 1-Day VIX. Launched by the Chicago Board Options Exchange on Monday, the Cboe 1-Day Volatility Index is designed to measure implied volatility in the S&P 500 Index over a single day, as opposed to its...

by NelsonCorp Wealth Management | Apr 21, 2023 | Chart of the Week

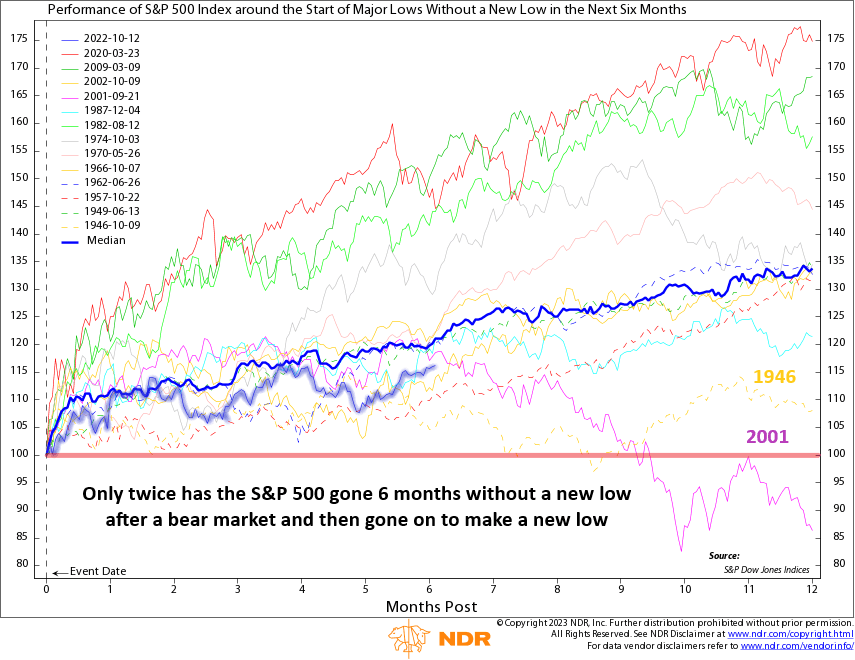

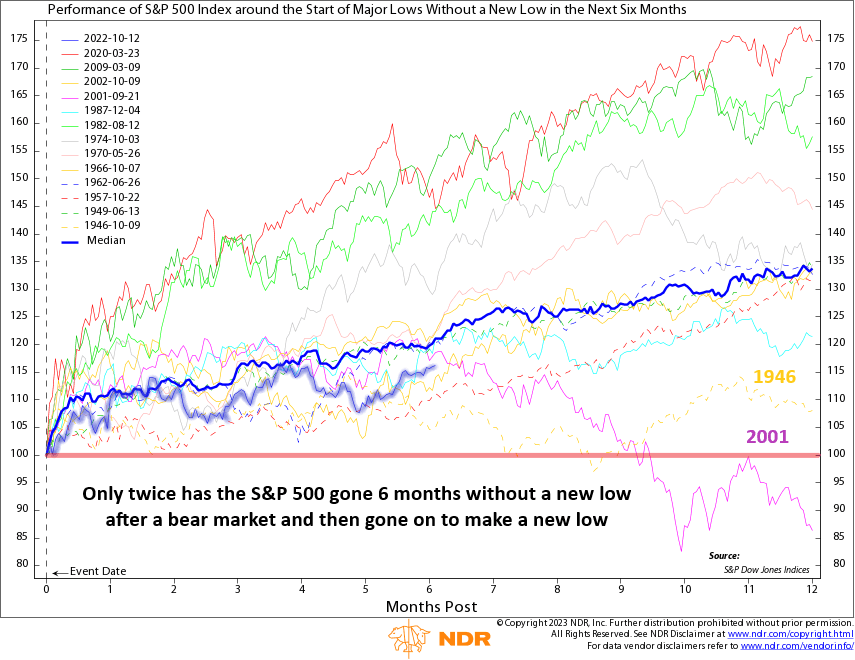

This week, we have a fun little chart showing how the S&P 500 stock index has performed after going six months without a new 52-week low after entering a bear market. Each date on the chart represents the lowest point of significant declines of 20% or more,...