by NelsonCorp Wealth Management | Apr 14, 2023 | Chart of the Week

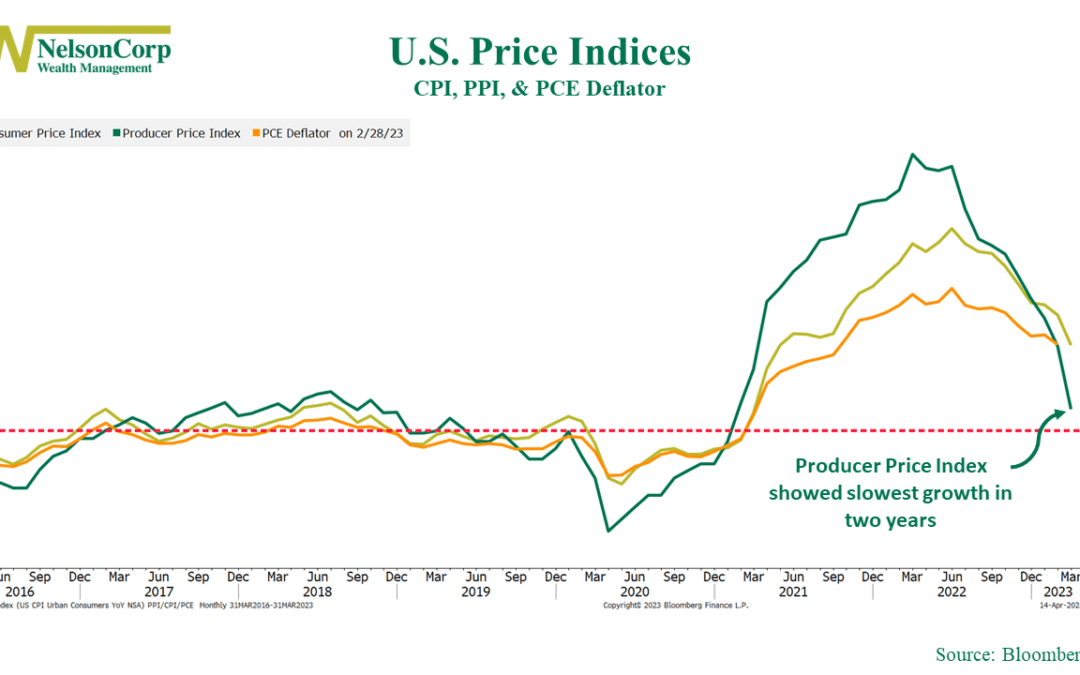

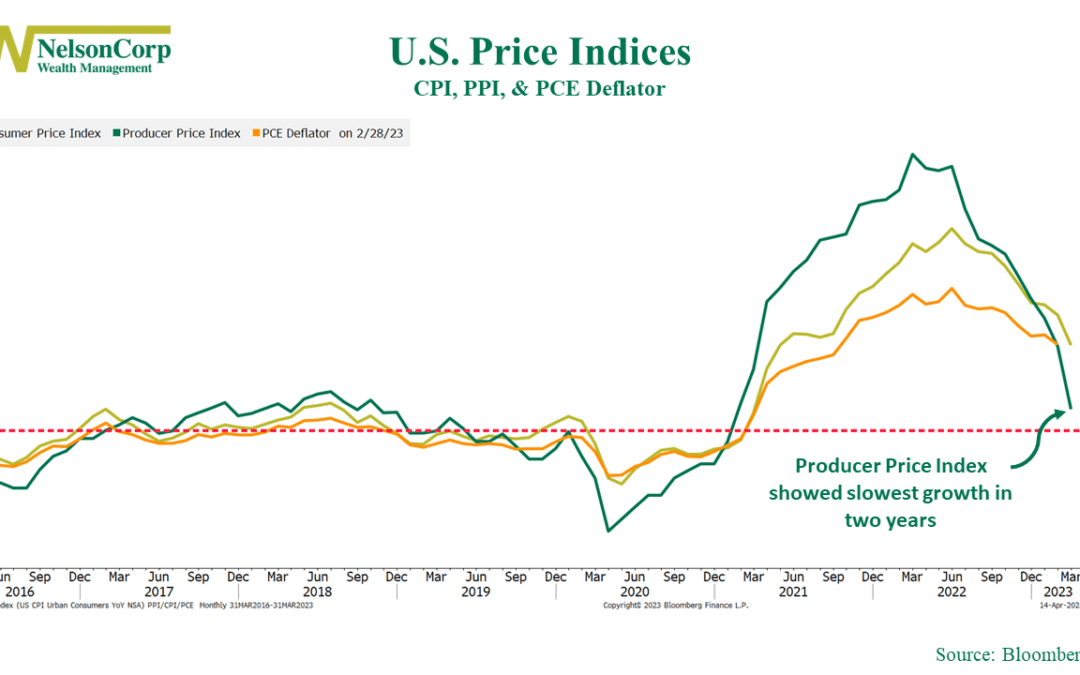

We continue to see encouraging signs that inflation is cooling off in the economy. Our featured chart above illustrates that the U.S. Consumer Price Index (CPI), Producer Price Index (PPI), and PCE Deflator have all exhibited declines in their year-over-year...

by NelsonCorp Wealth Management | Apr 7, 2023 | Chart of the Week

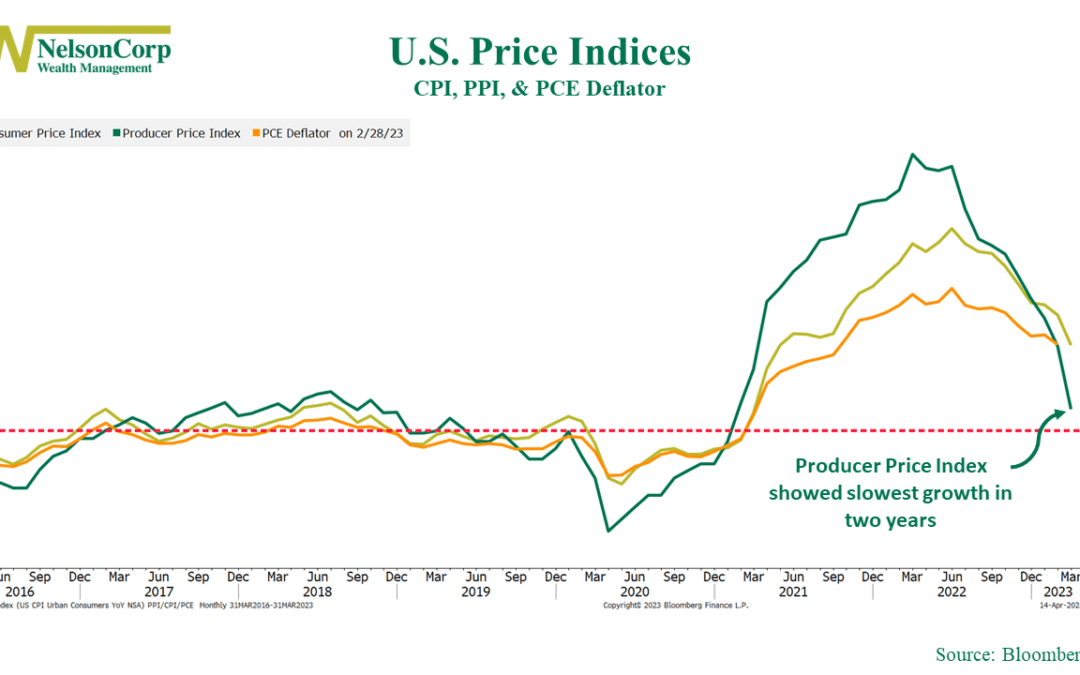

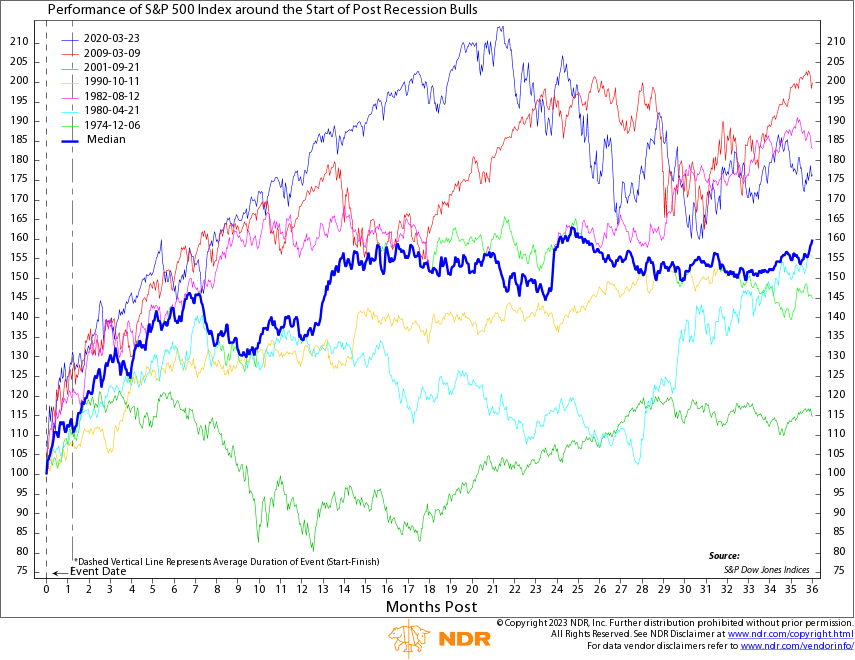

The topic of a potential recession, that dreaded “R” word, has been the subject of much discussion lately. Yet, our highlighted chart this week provides some hopeful news, indicating that bull markets generally exhibit strong performance following...

by NelsonCorp Wealth Management | Mar 31, 2023 | Chart of the Week

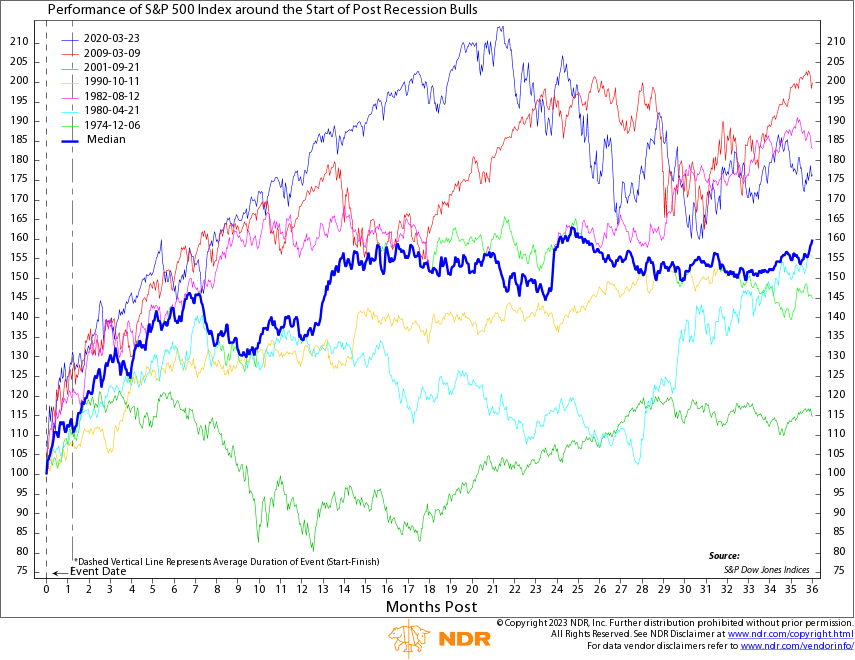

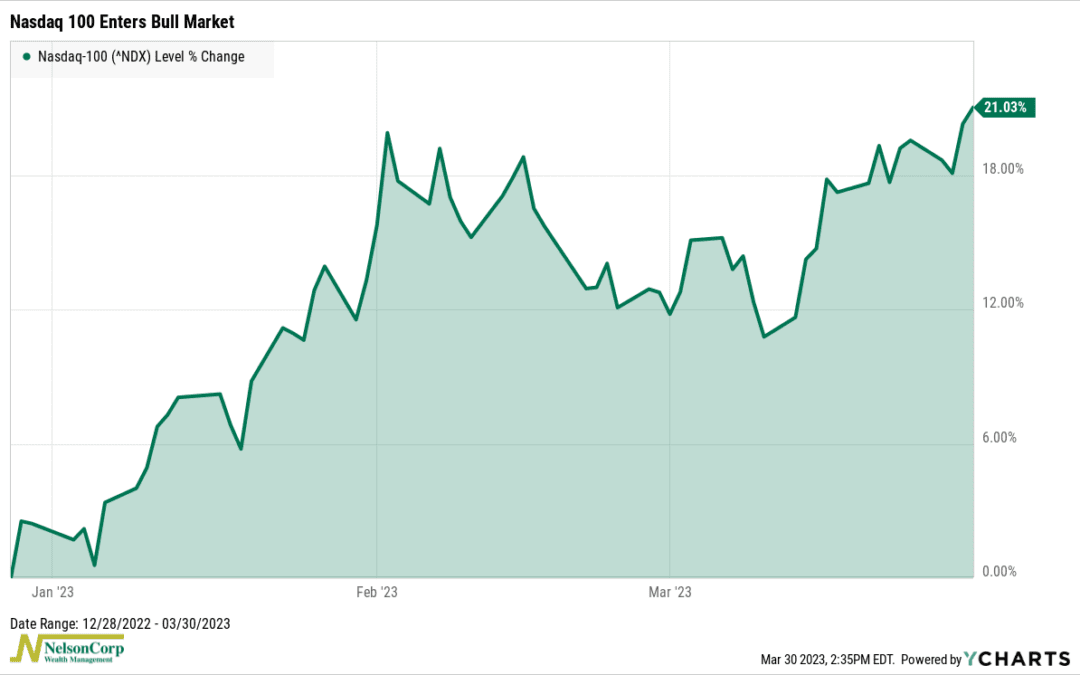

This week’s big news was that the Nasdaq 100 Index—a basket of the 100 largest (mostly tech) stocks traded on the Nasdaq stock exchange—surged into a new bull market on Wednesday. Our featured chart above shows that the tech-heavy index has rallied more...

by NelsonCorp Wealth Management | Mar 24, 2023 | Chart of the Week

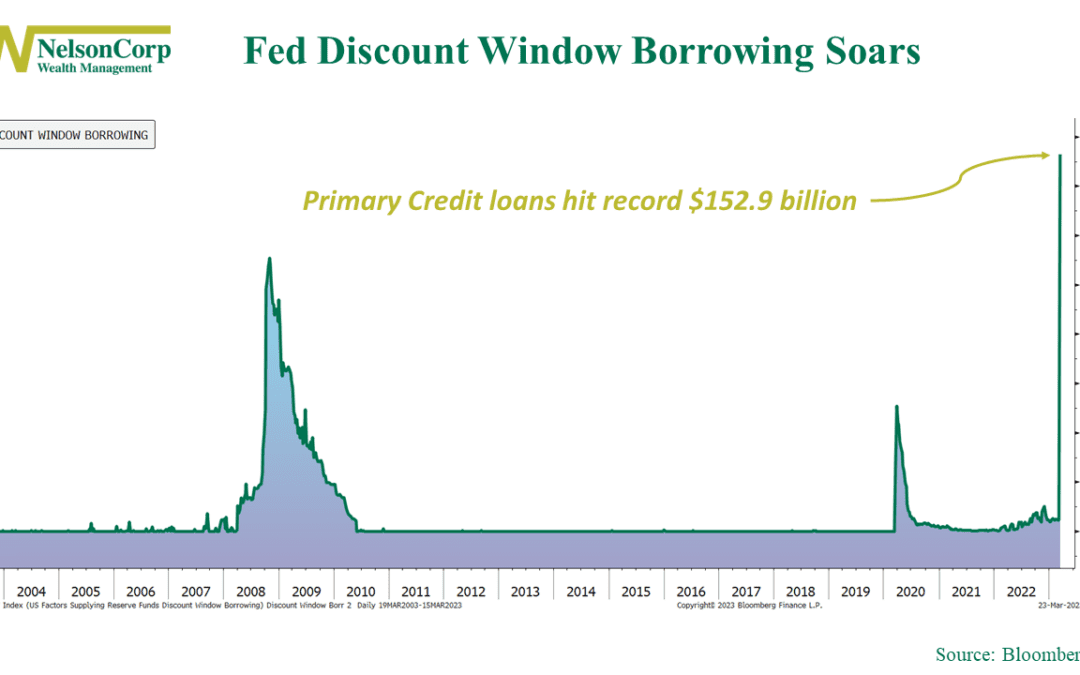

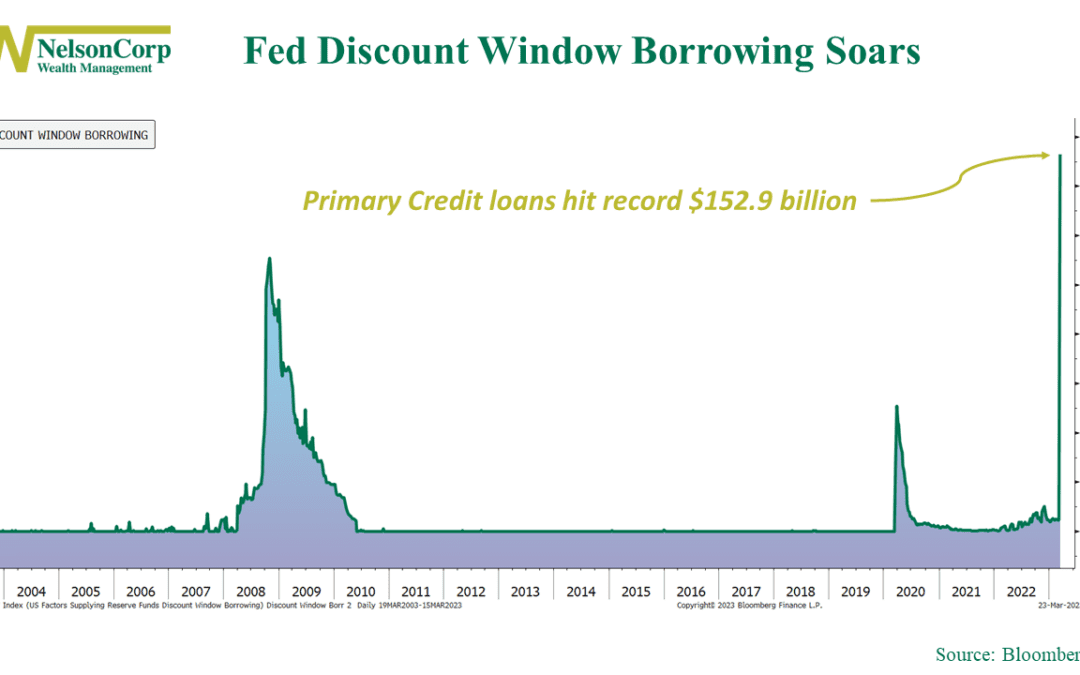

There’s been a lot of stress in the banking system lately. So much so that recent data published by the Fed showed that a record $152.9 billion was borrowed from the Fed’s discount window last week, surpassing the $111 billion reached during the 2008 financial...

by NelsonCorp Wealth Management | Mar 17, 2023 | Chart of the Week

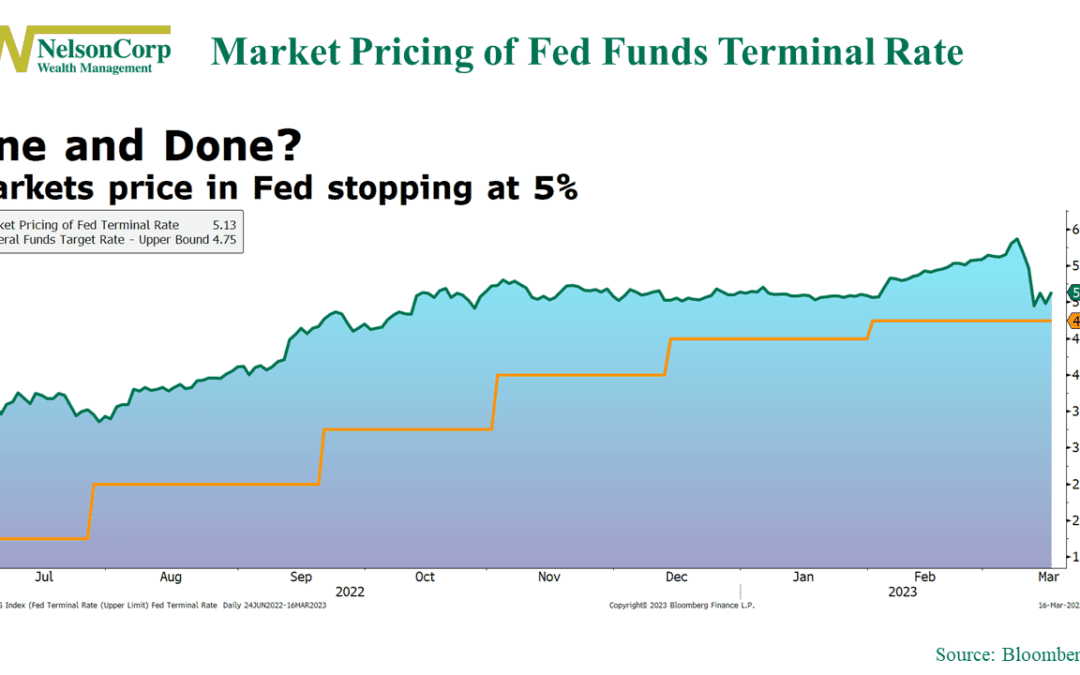

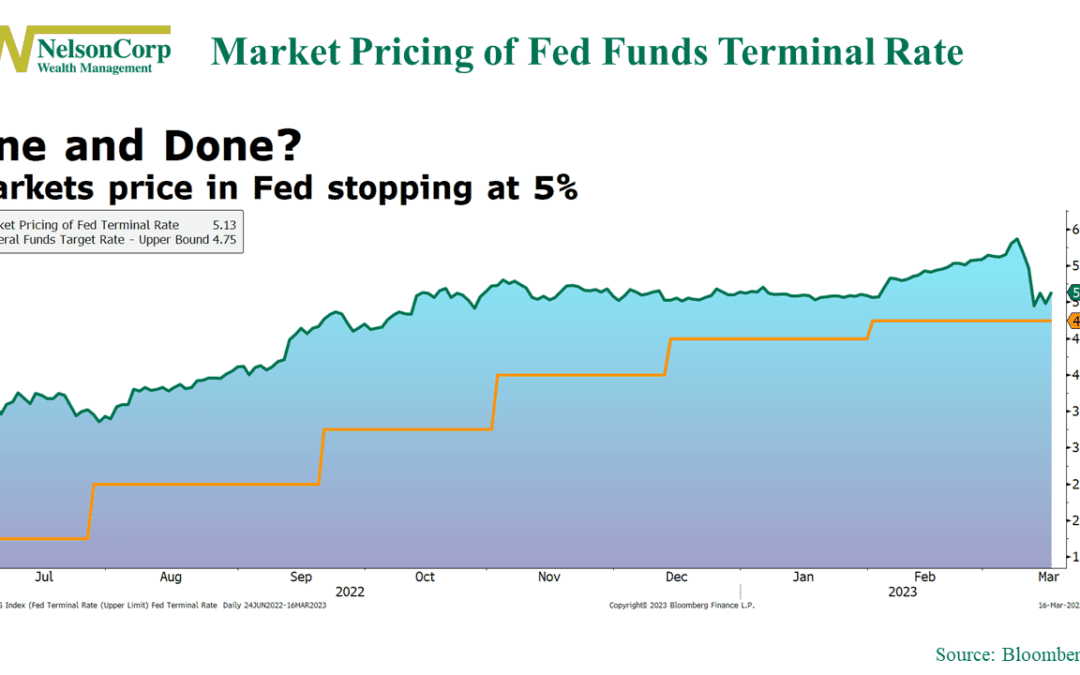

I’ve got a couple of charts this week showing just how quickly expectations can change in financial markets. The first chart, shown above, compares the market’s expectations for the terminal level of the federal funds rate (green line) vs. the current target...

by NelsonCorp Wealth Management | Mar 10, 2023 | Chart of the Week

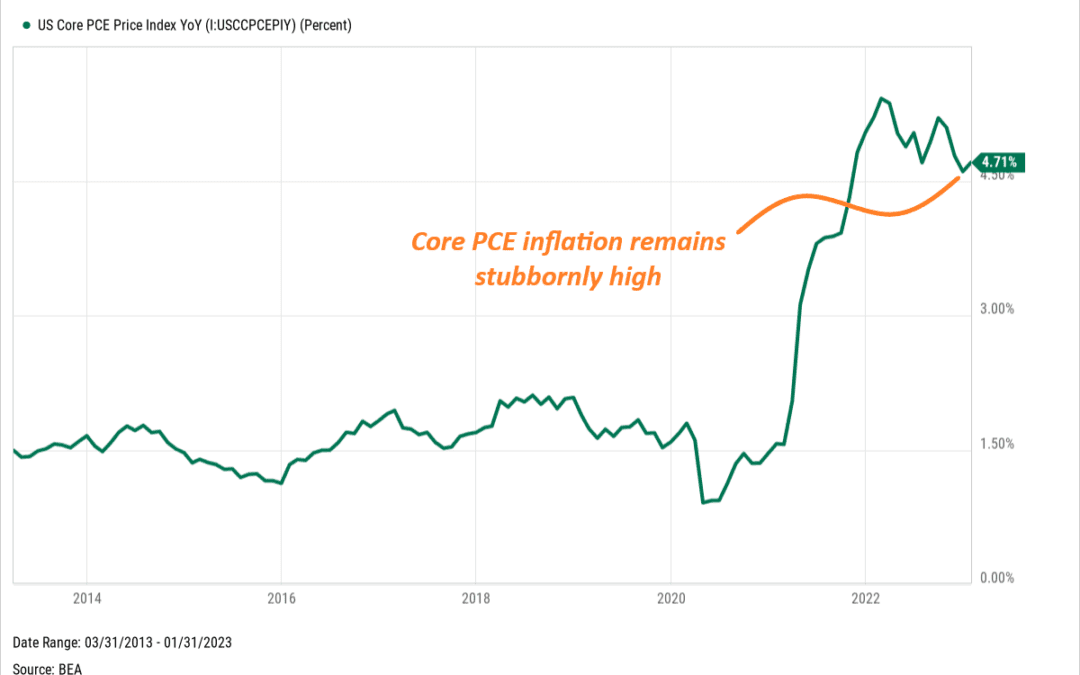

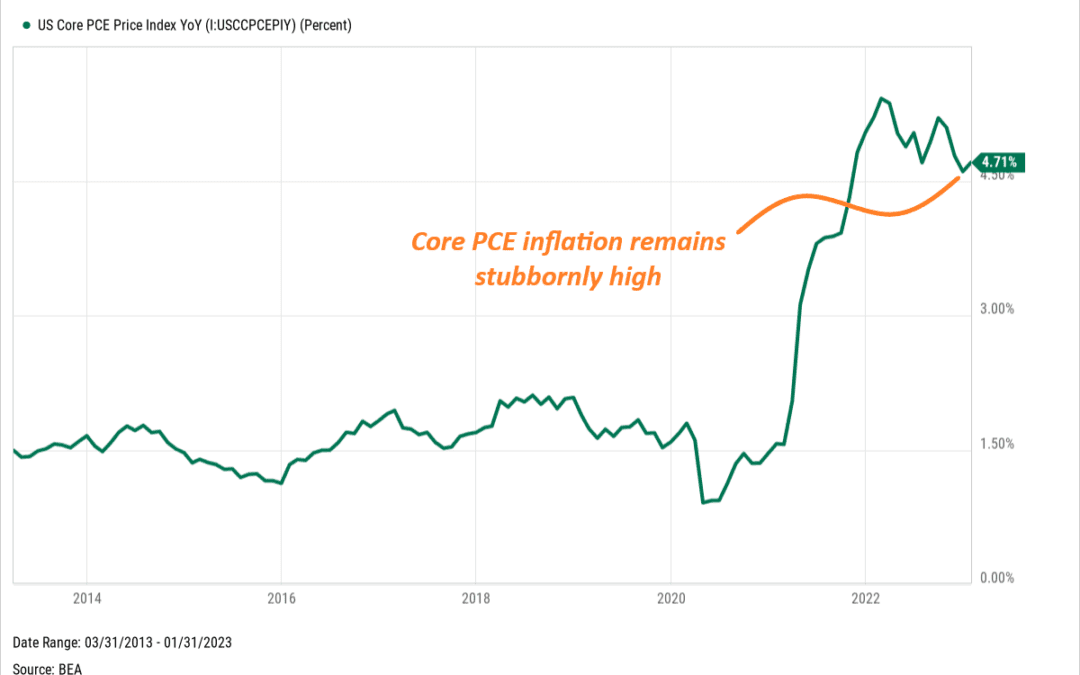

This week’s featured chart shows the year-over-year change in the U.S. Personal Consumption Expenditures Price Index (excluding food and energy). This is a popular measure of core inflation in the economy that the Federal Reserve follows closely. The problem,...