by NelsonCorp Wealth Management | Jan 20, 2023 | Chart of the Week

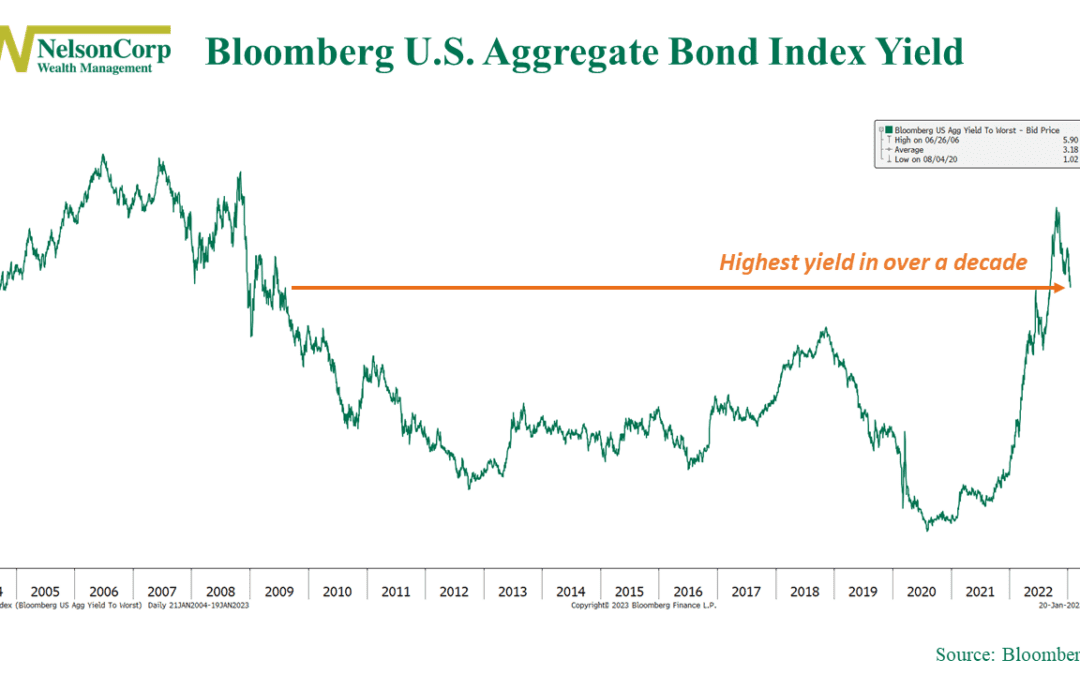

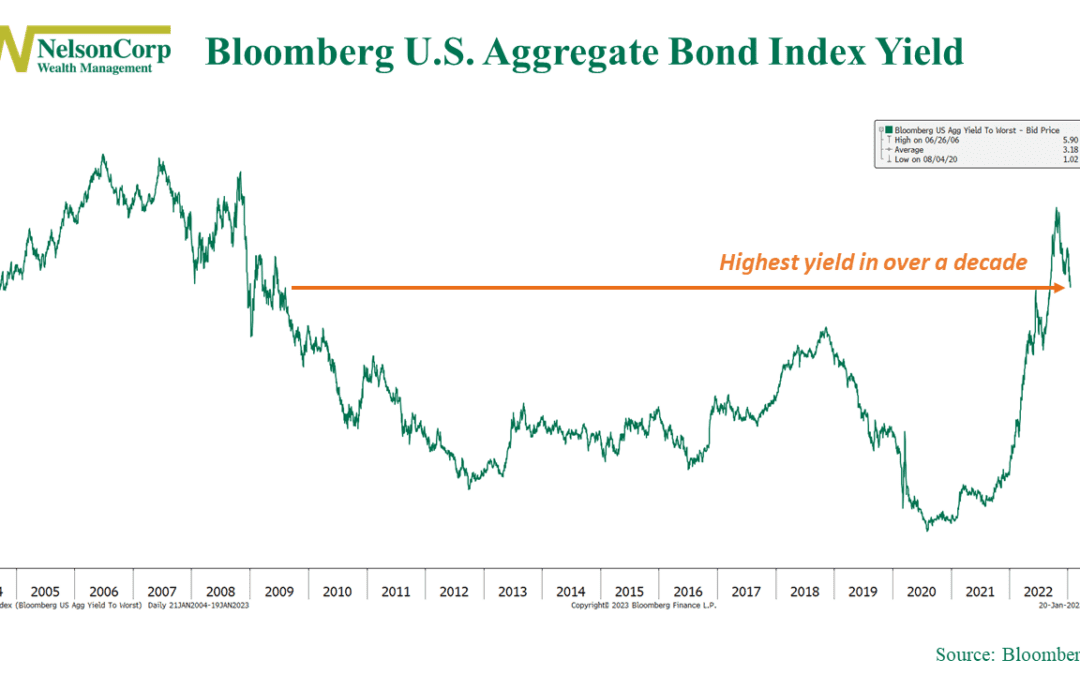

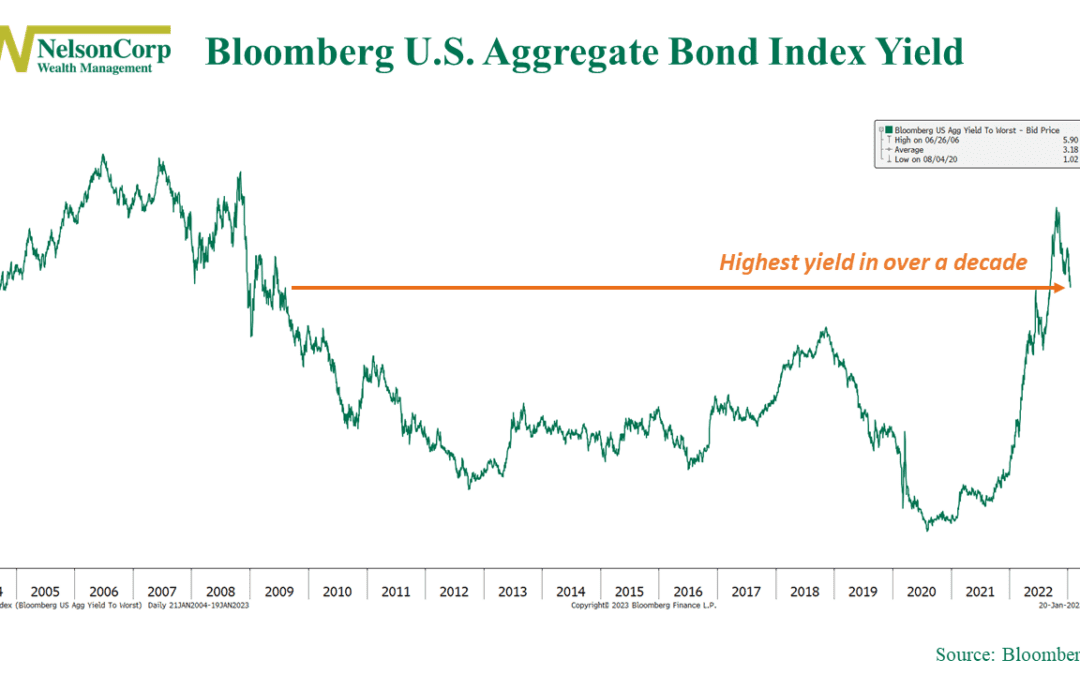

Bond yields are finally looking more appealing. Our featured chart above shows that the yield on the Bloomberg U.S. Aggregate Bond Index—widely considered one of the best total bond market indices—has climbed to roughly 4.2%, its highest level in over a decade....

by NelsonCorp Wealth Management | Jan 13, 2023 | Chart of the Week

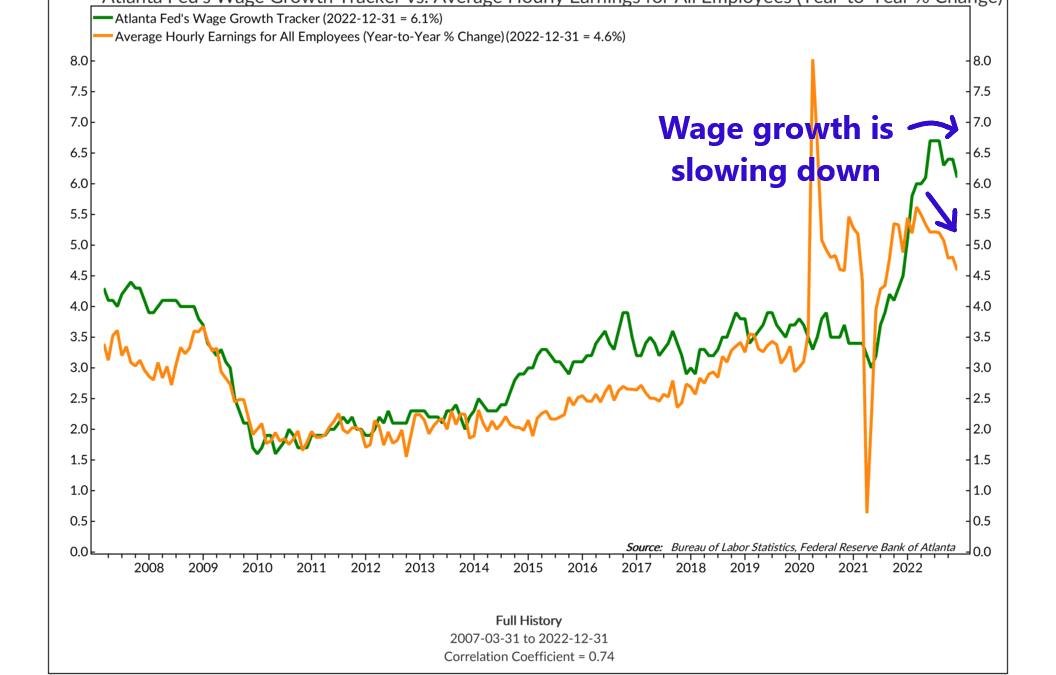

We’ve gotten some good news on the inflation front lately. The latest consumer price index release confirmed that inflation cooled for a sixth straight month. Additionally, last Friday’s employment report revealed a surprising decline in the year-over-year...

by NelsonCorp Wealth Management | Jan 6, 2023 | Chart of the Week

2022 was a wild year. We witnessed a surge in global inflation unlike anything we had seen in decades, and various commodities saw significant price increases. One of those commodities was natural gas. As our chart of the week above shows, natural gas prices...

by NelsonCorp Wealth Management | Dec 30, 2022 | Chart of the Week

Our chart of the week above shows that the US economy faced a contraction in the first half of 2022 as GDP (green bars) declined in the first and second quarters, leading to concerns about a potential recession. However, as the gold bars reveal, consumer...

by NelsonCorp Wealth Management | Dec 23, 2022 | Chart of the Week

Japan’s central bank, the Bank of Japan, made quite a stir in the financial world this week when it announced that it is relaxing the allowed trading band for 10-year Japanese government bonds (known as JGBs) by 25 basis points. This means that, after keeping...

by NelsonCorp Wealth Management | Dec 16, 2022 | Chart of the Week

This week’s chart features two extremely important interest rates for the U.S. economy: the 10-year Treasury rate and the fed funds rate. The 10-year Treasury rate is a longer-term rate that the U.S. government charges on the money it borrows for ten years. By...