by NelsonCorp | Jan 2, 2026 | Chart of the Week

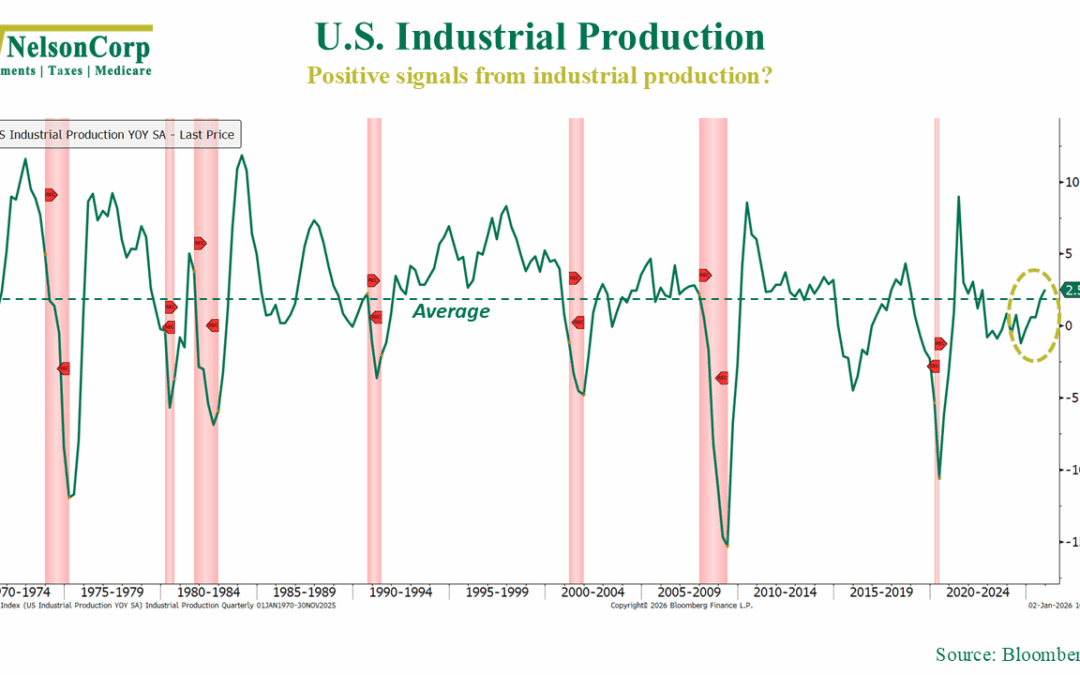

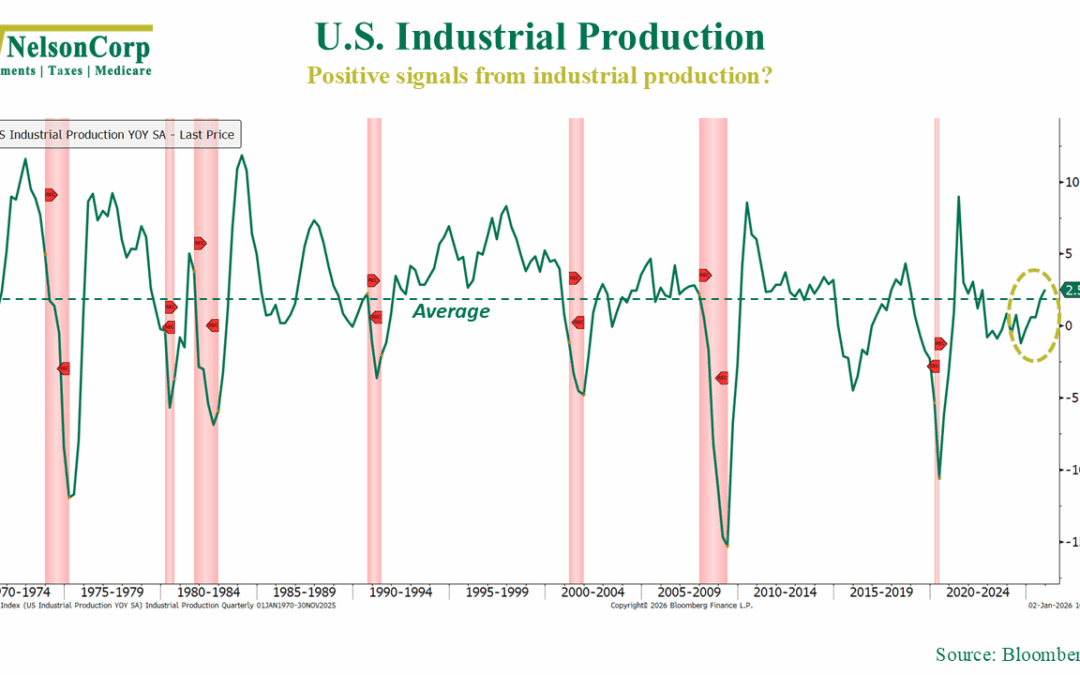

Heading into the new year, one question we get a lot is: How is the economy doing? Now, it can be hard to answer a question like that, because what one means by “the economy” can be different for different people. Are we talking about economic growth?...

by NelsonCorp | Dec 26, 2025 | Chart of the Week

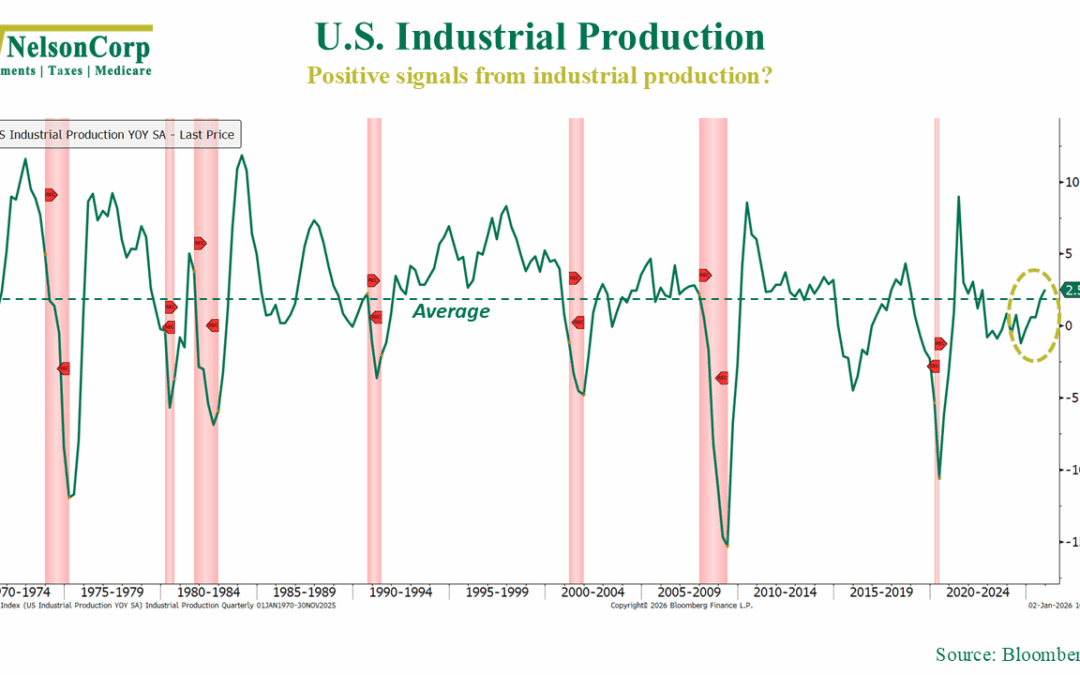

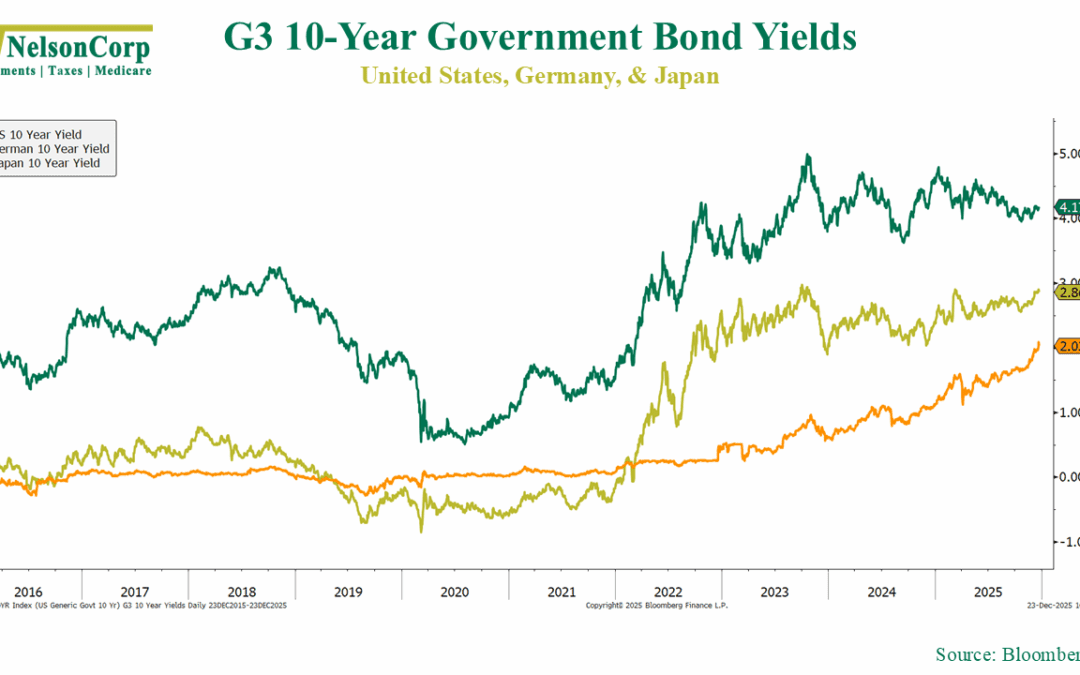

We got some encouraging economic news this week. In the third quarter, real GDP grew at a 4.3% annualized pace, the fastest growth in two years and well above expectations. That strength is welcome, but it also helps explain something else we’ve been living...

by NelsonCorp | Dec 19, 2025 | Chart of the Week

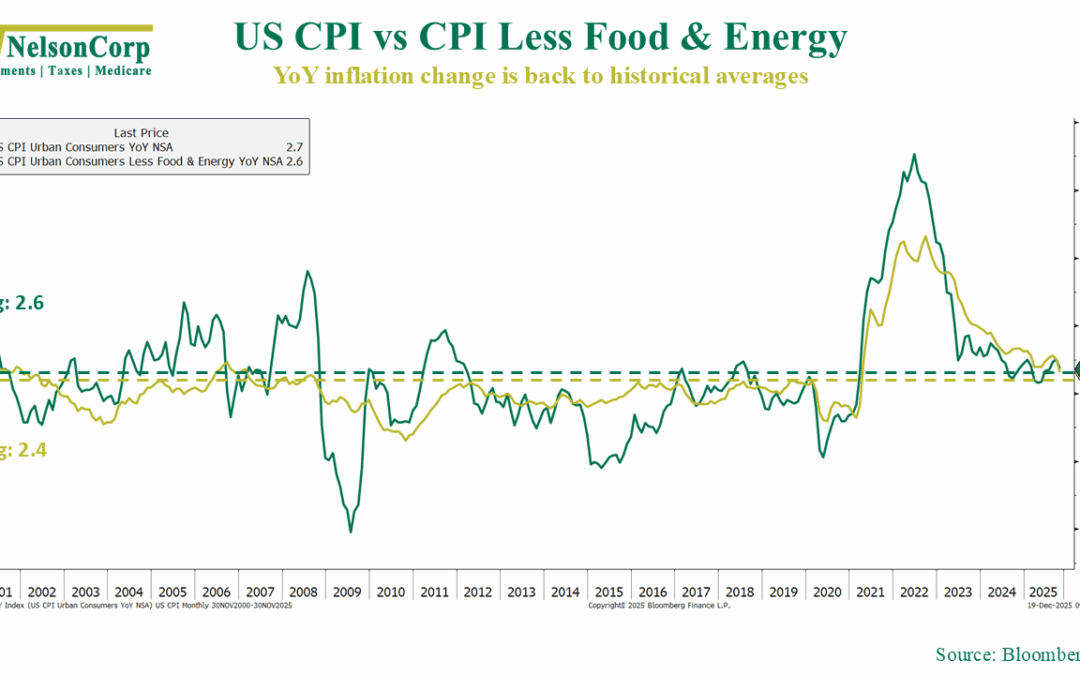

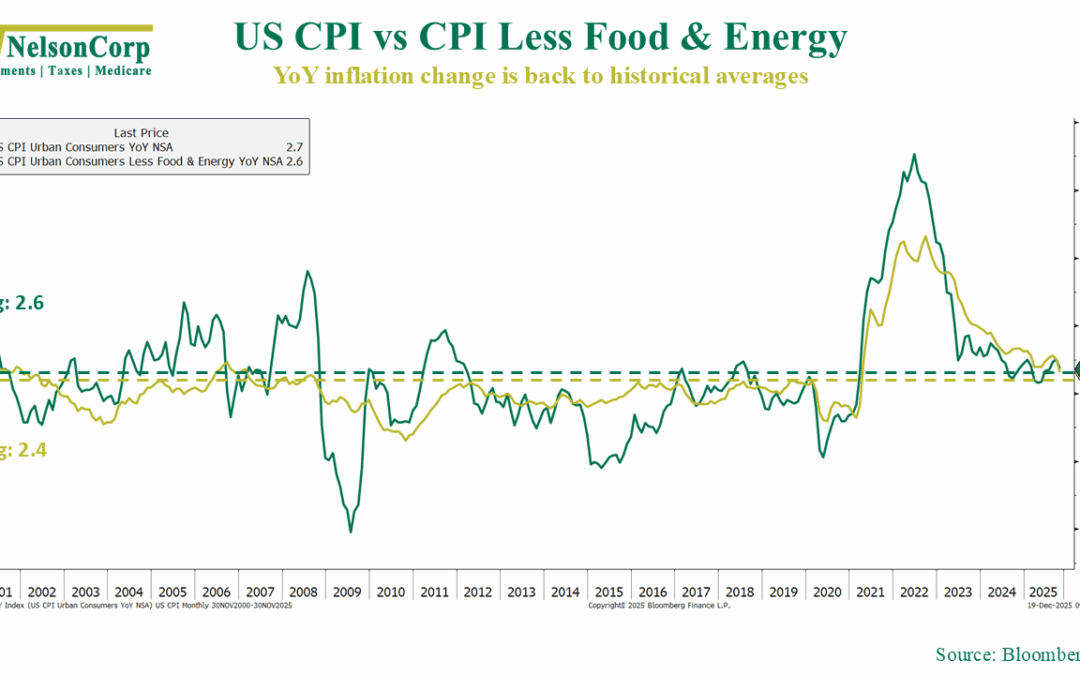

The big news in the finance world this week was the release of the November inflation numbers. On the surface, it was a good report. The headline Consumer Price Index (CPI) posted a 2.7% y/y gain, down from 3% in September. And if we back out food and energy...

by NelsonCorp | Dec 12, 2025 | Chart of the Week

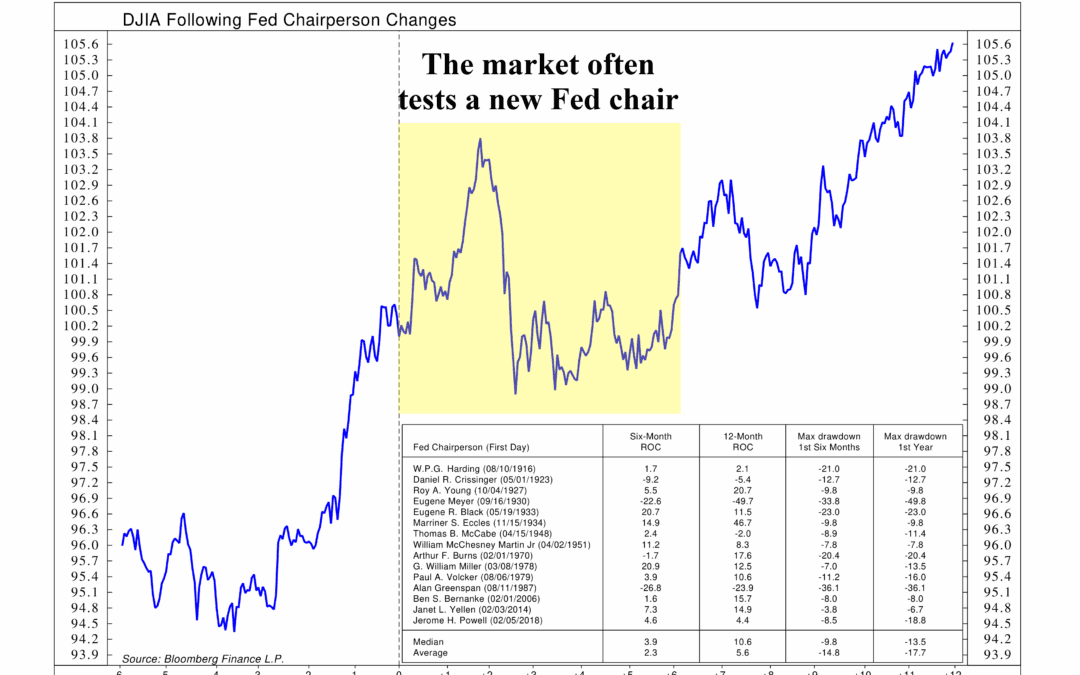

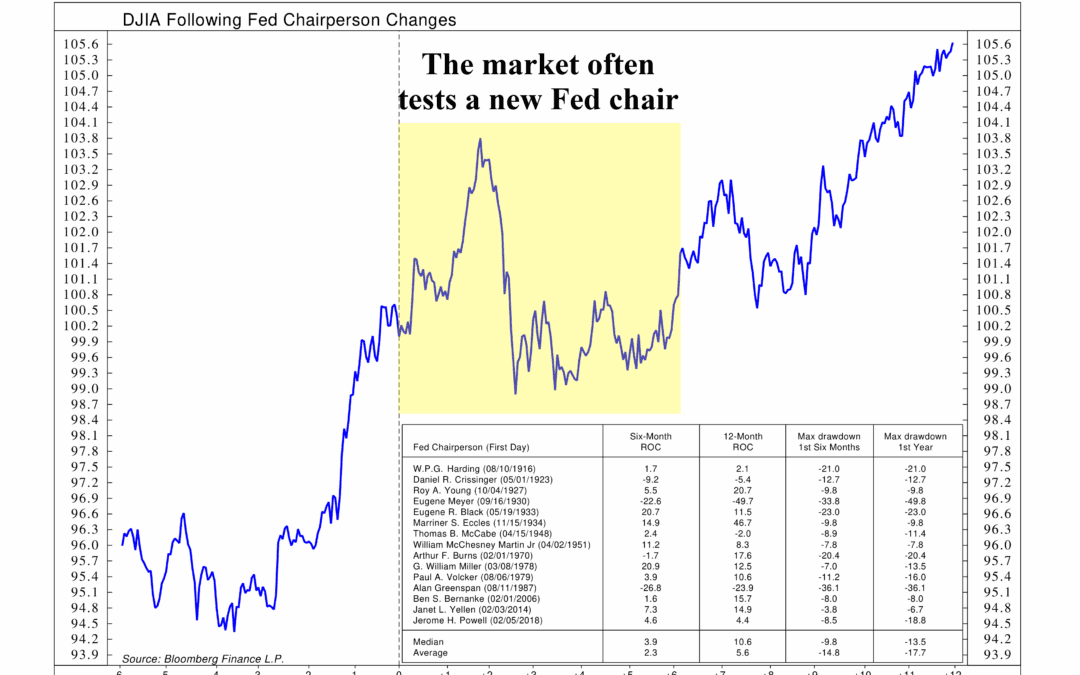

The Fed went ahead and cut rates again this week. It was mostly expected. The bigger question is what comes next. Looking into next year, it is not clear how many additional cuts are actually on the table. Inflation remains above the Fed’s comfort zone, and...

by NelsonCorp | Dec 5, 2025 | Chart of the Week

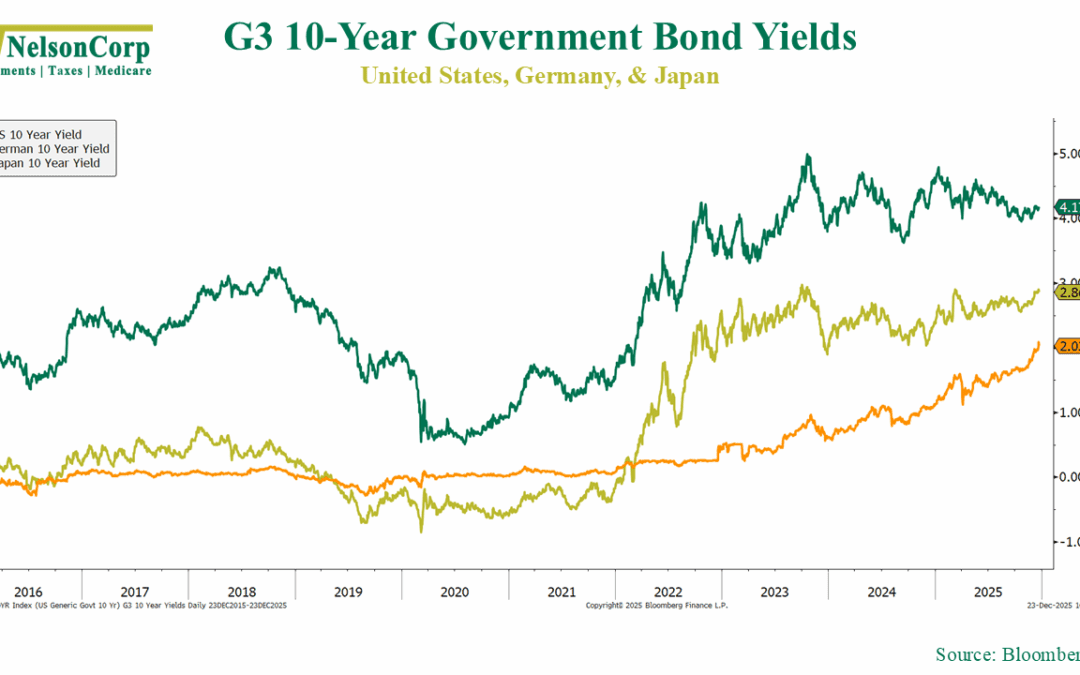

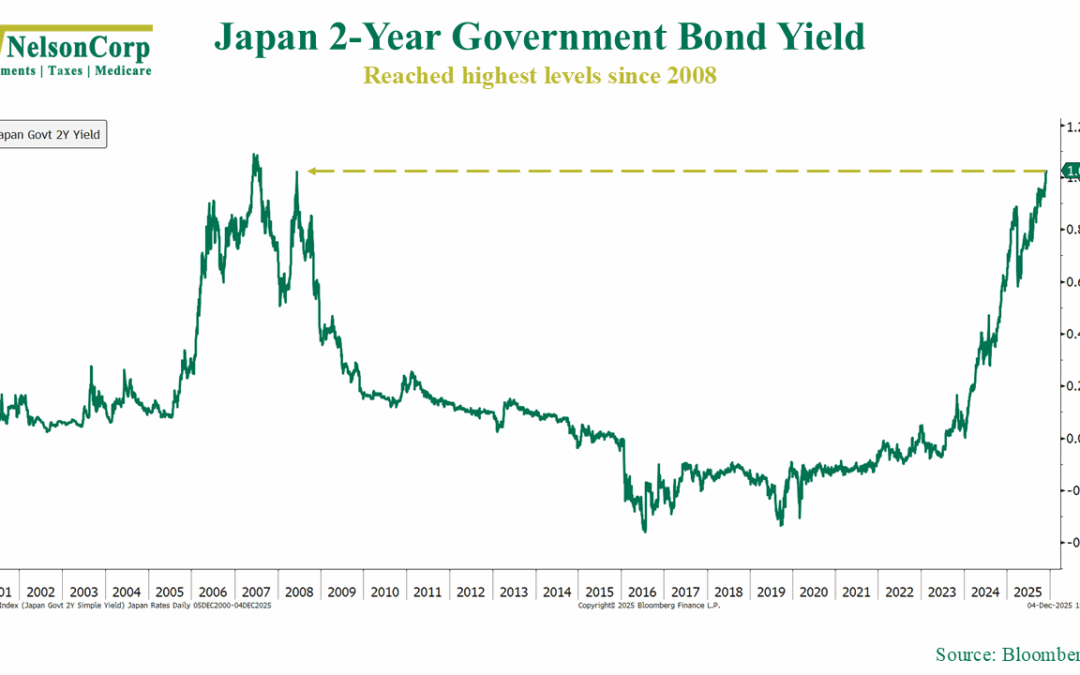

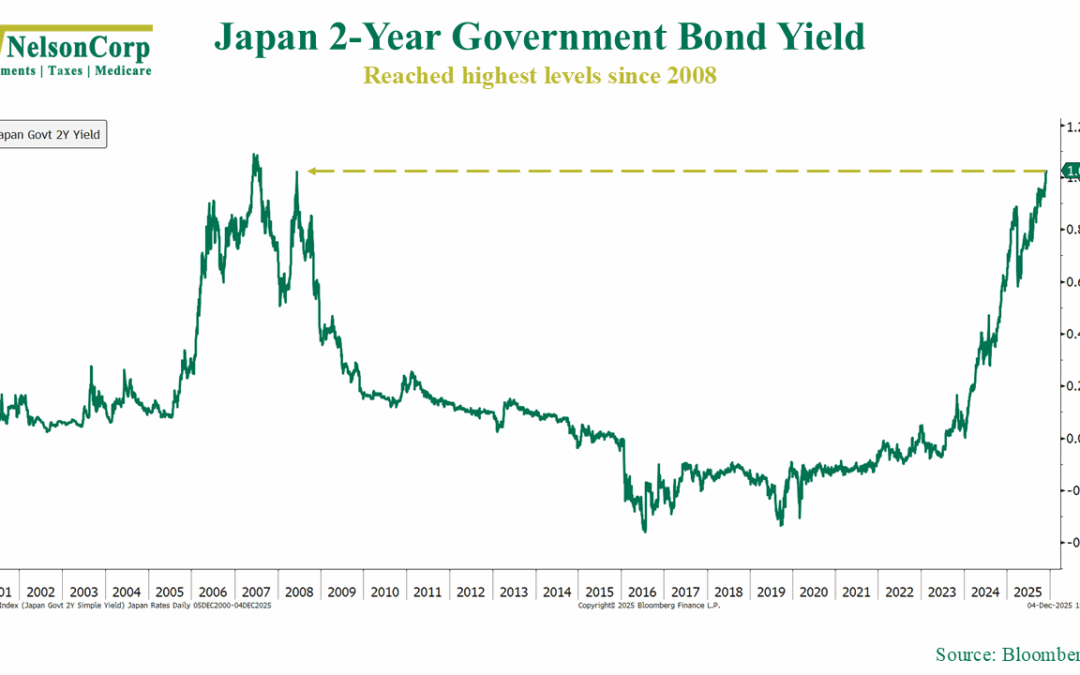

With financial markets under a bit of selling pressure recently, it’s natural to wonder what’s driving things. As always, there are plenty of factors at play. But there’s one important piece that may not be on your radar: Japanese monetary policy. This week’s...

by NelsonCorp | Nov 28, 2025 | Chart of the Week

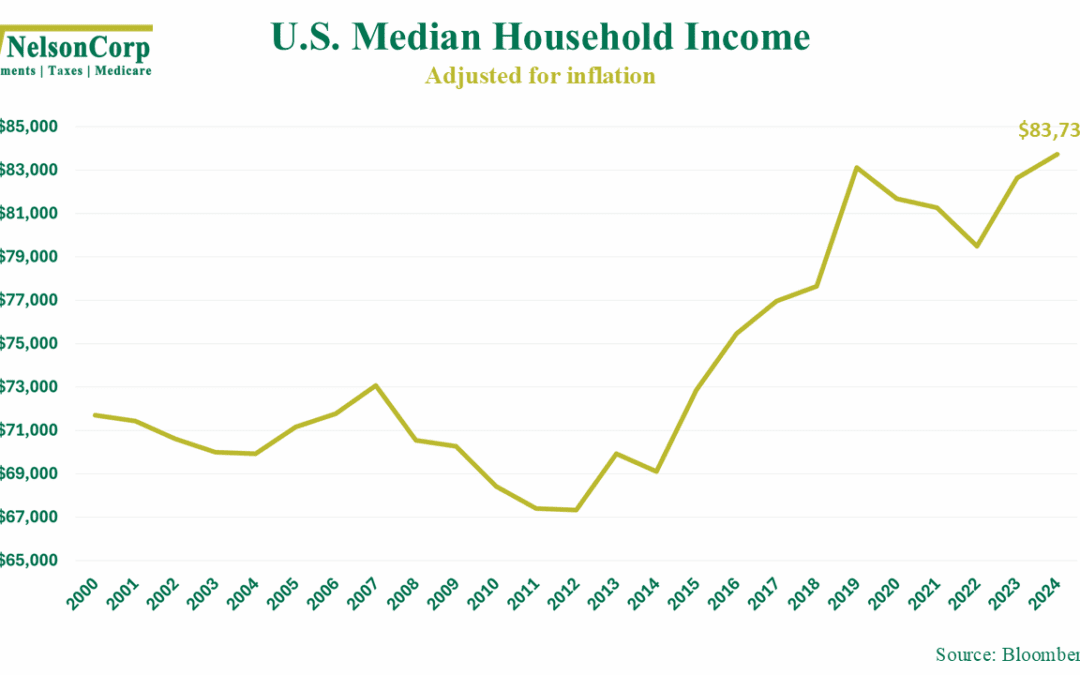

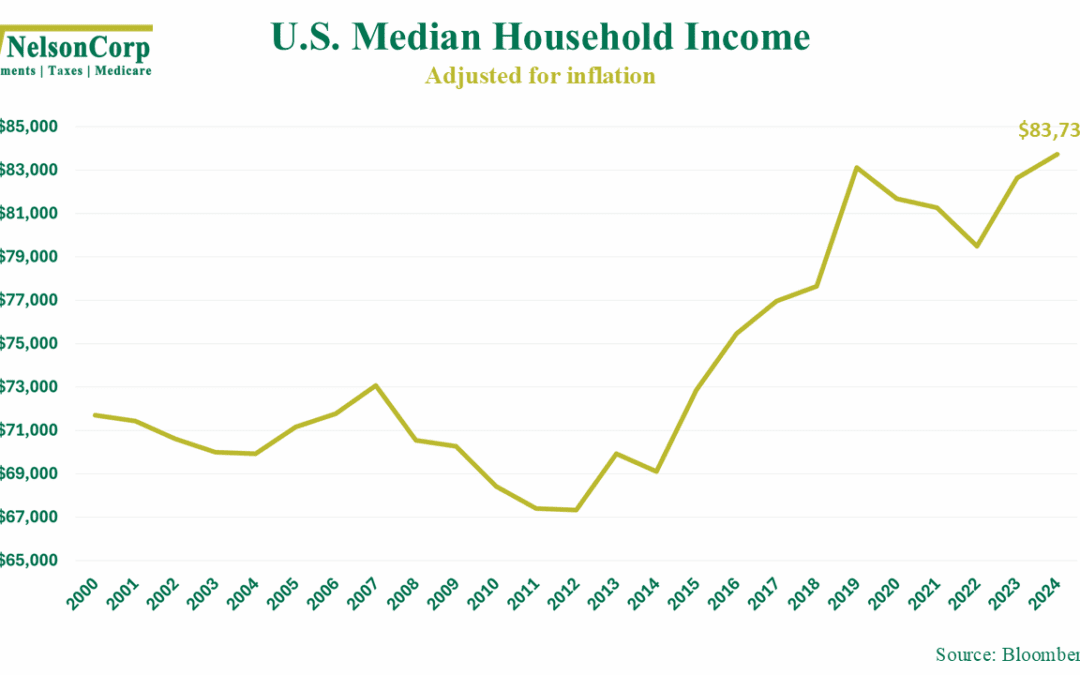

As we head into Thanksgiving and the holiday season, it’s worth pausing to look at a piece of good news that doesn’t always make the headlines. As this week’s chart shows, real median household income in the U.S. climbed to $83,730 last year, the highest level...