by NelsonCorp Wealth Management | Dec 9, 2022 | Chart of the Week

The S&P 500 Index is a popular stock market index often used to measure the overall health of the U.S. stock market. One way to gauge the strength of the market is to look at the number of days the index spends below its prior high. As I’ve pointed out on...

by NelsonCorp Wealth Management | Dec 2, 2022 | Chart of the Week

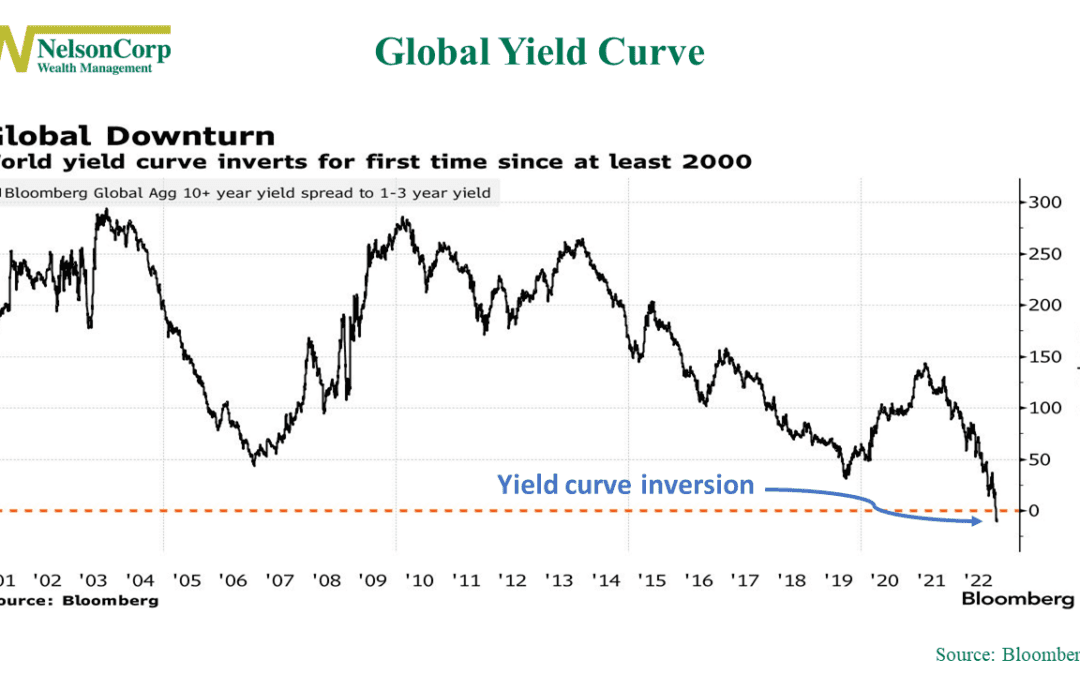

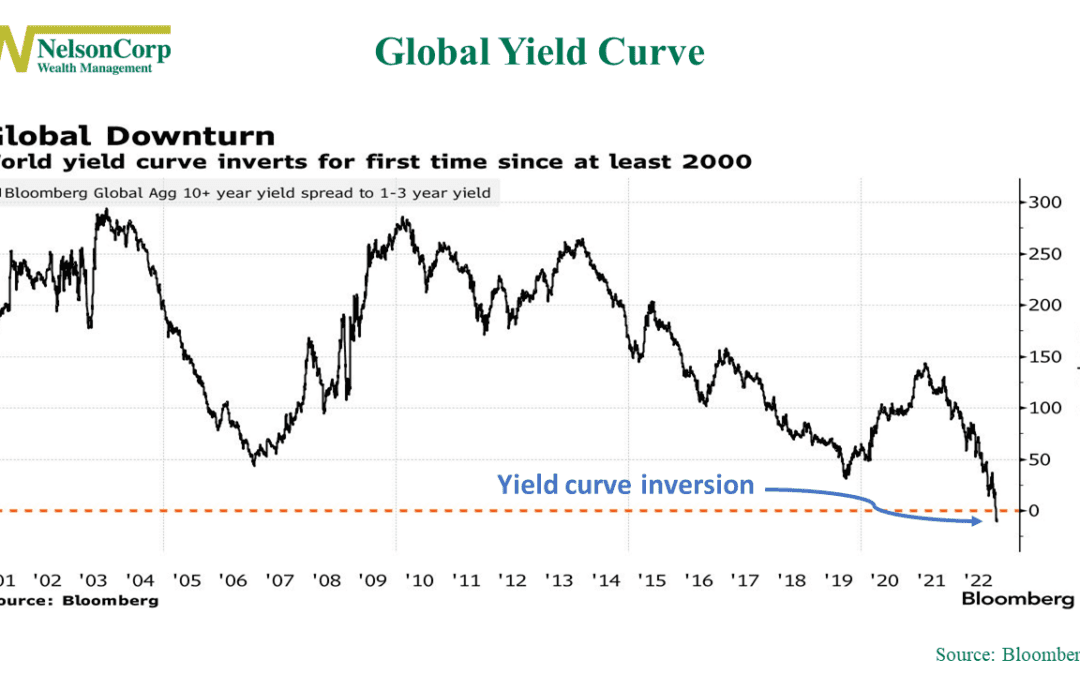

We’ve talked some this year about the U.S. yield curve and how its inversion is signaling that a recession could be right around the corner. But it’s not just a U.S. problem. Global bonds joined the party this week. The chart above shows that the average yield...

by NelsonCorp Wealth Management | Nov 18, 2022 | Chart of the Week

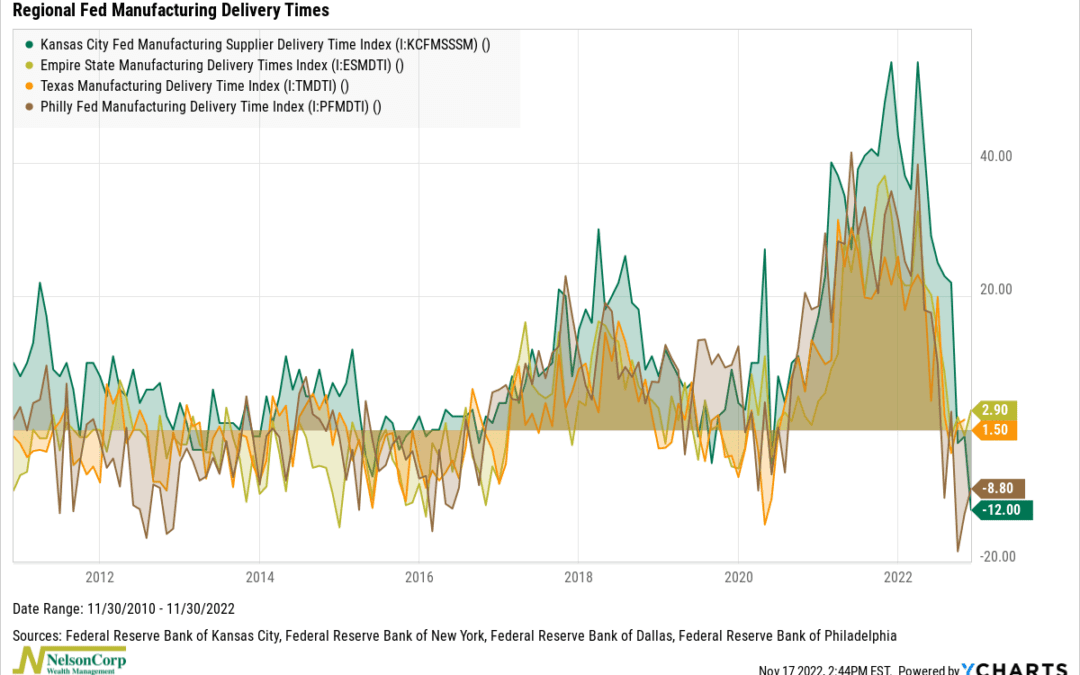

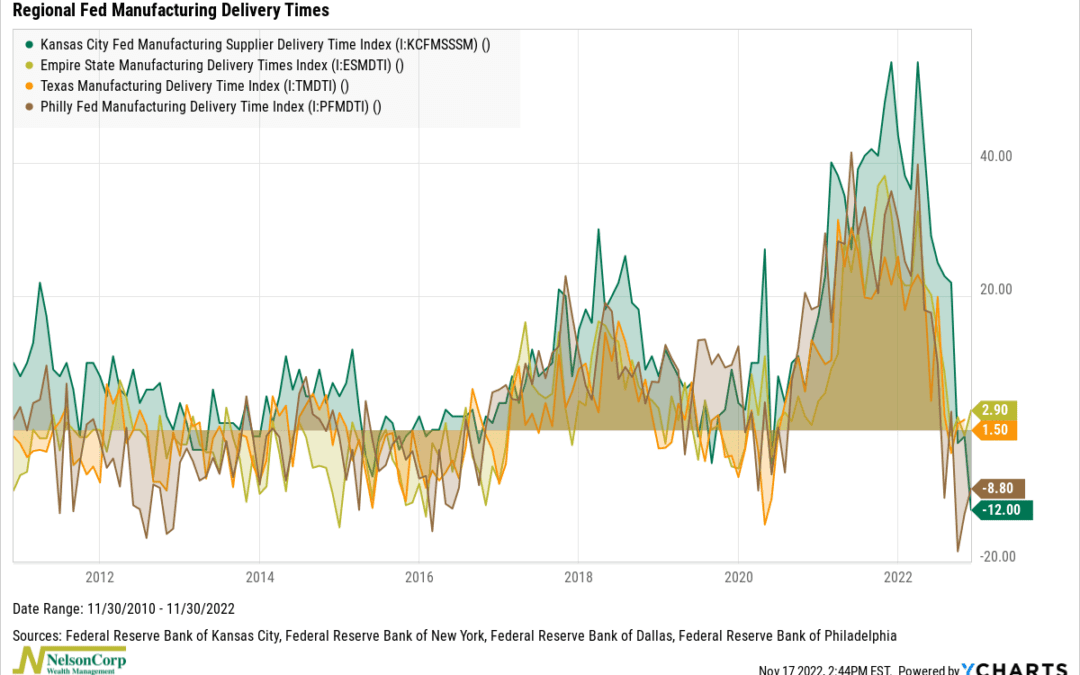

Supply chain stresses are getting better. That’s the message from this week’s featured chart, highlighted above, showing various regional Fed manufacturing indexes of supplier delivery times. Supplier delivery times are one of the most important economic...

by NelsonCorp Wealth Management | Nov 11, 2022 | Chart of the Week

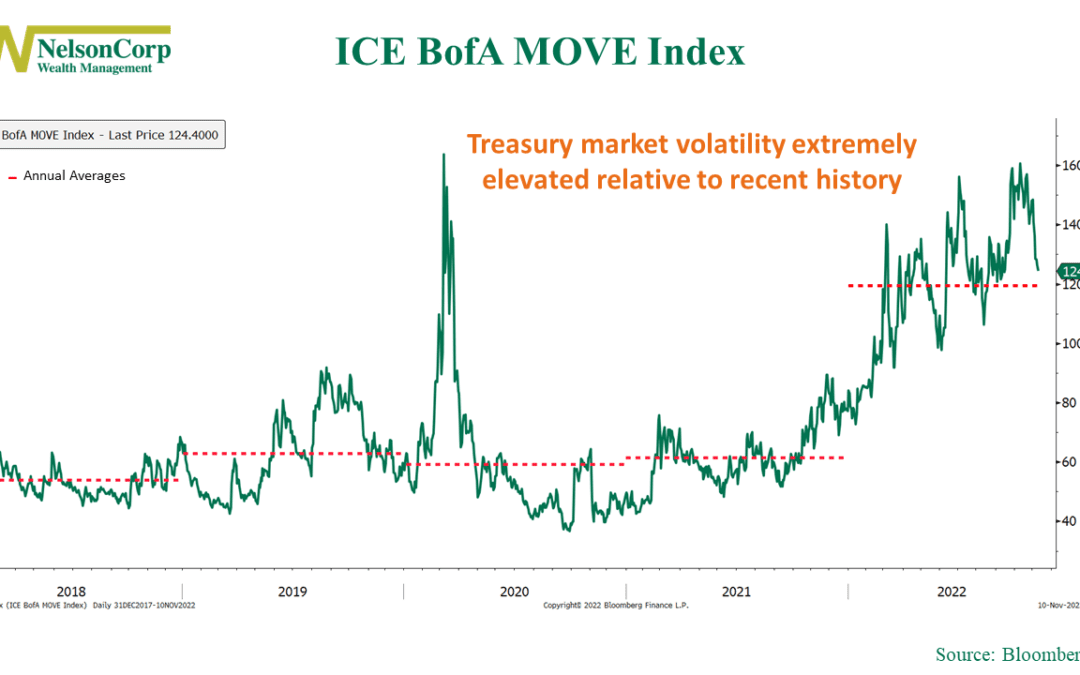

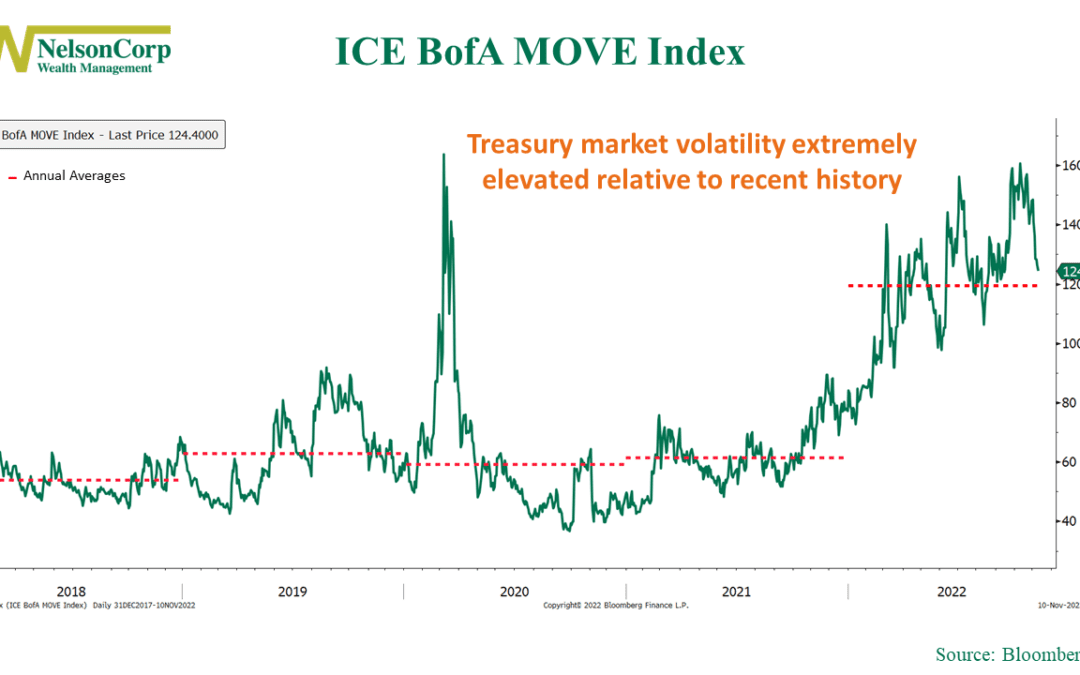

This week’s featured chart is the ICE BofA MOVE Index, a well-known measure of U.S. interest rate volatility. Specifically, the MOVE Index calculates future volatility in U.S. Treasury yields implied by prices of one-month options on Treasuries of various...

by NelsonCorp Wealth Management | Nov 4, 2022 | Chart of the Week

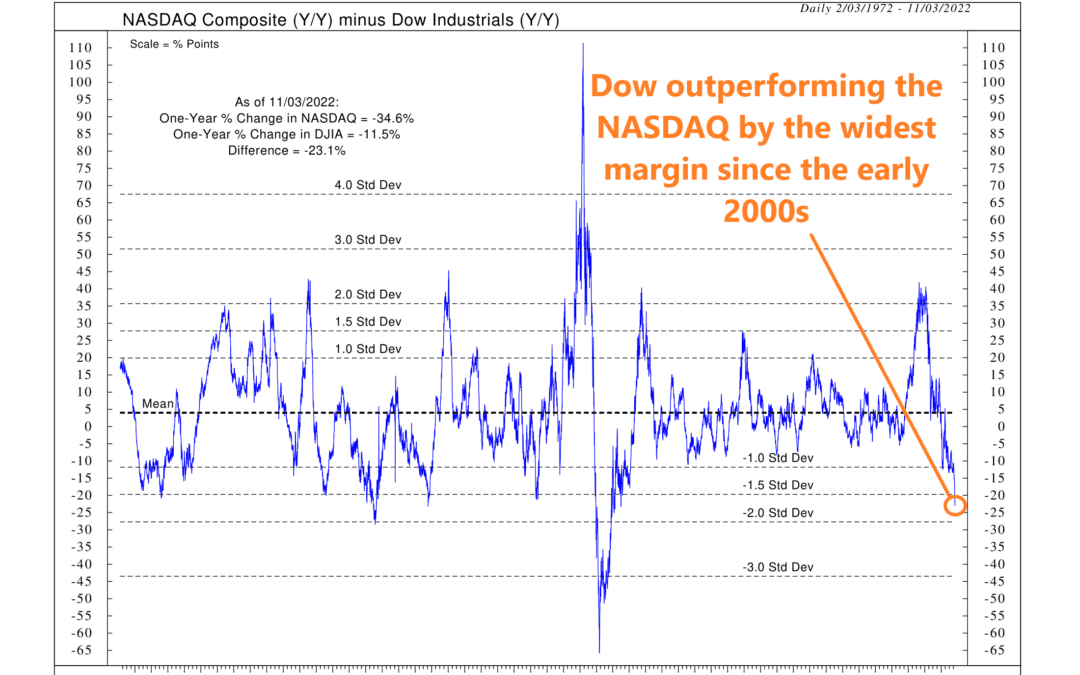

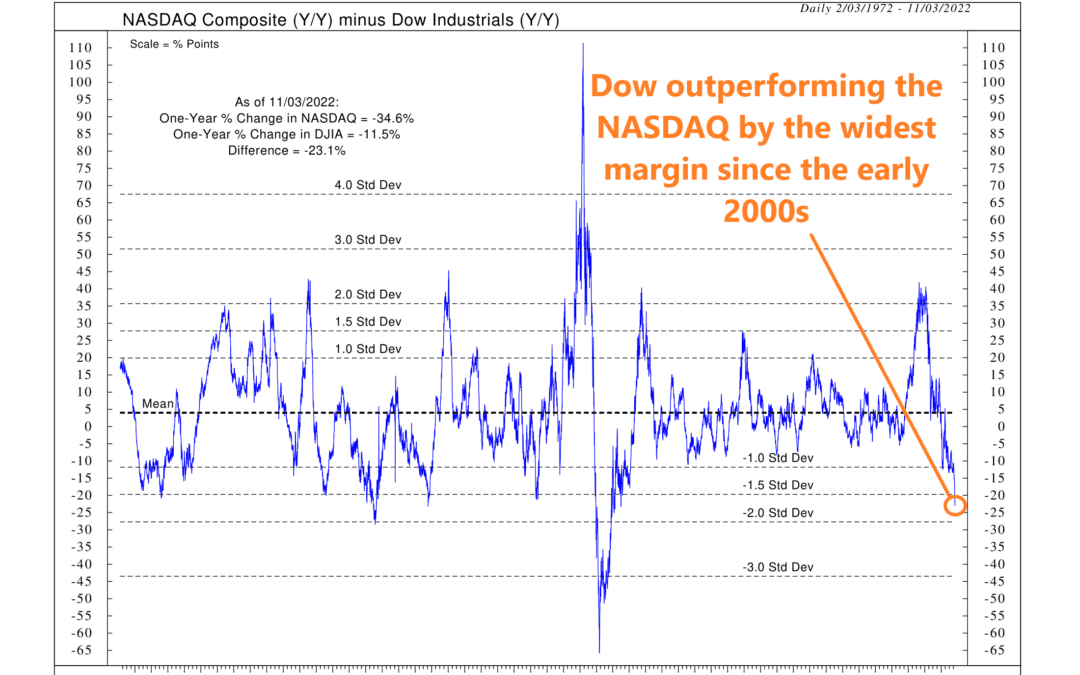

This week’s featured chart compares the annualized returns of two of the most popular stock mark indexes in the United States: The NASDAQ Composite and the Dow Jones Industrial Average. The blue line represents the annualized returns of the NASDAQ composite...

by NelsonCorp Wealth Management | Oct 28, 2022 | Chart of the Week

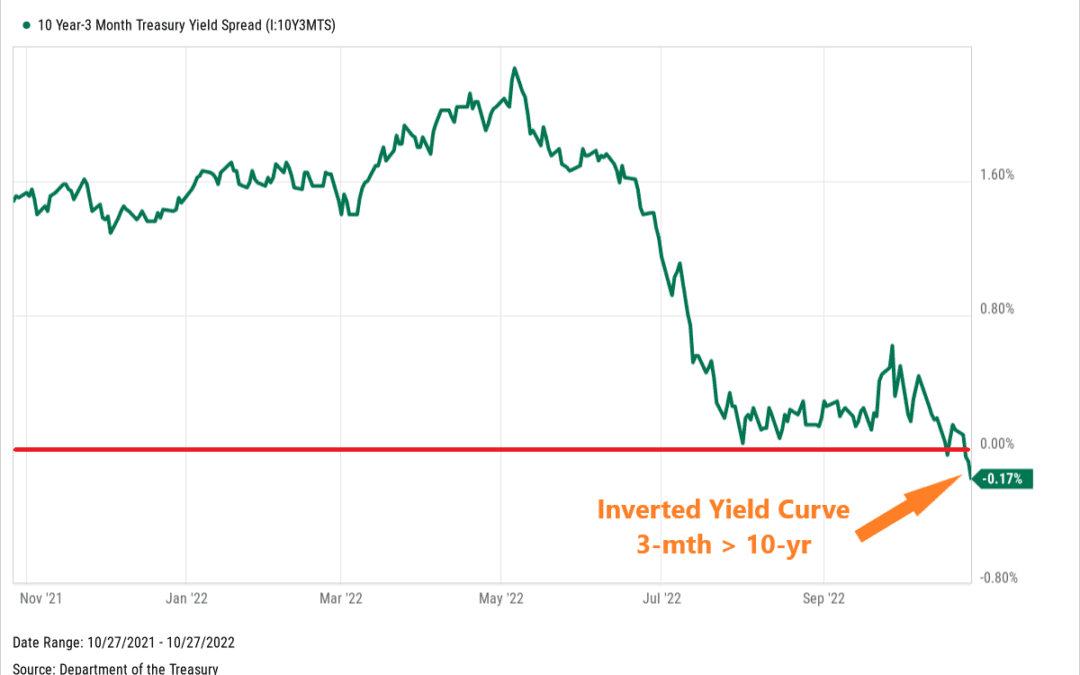

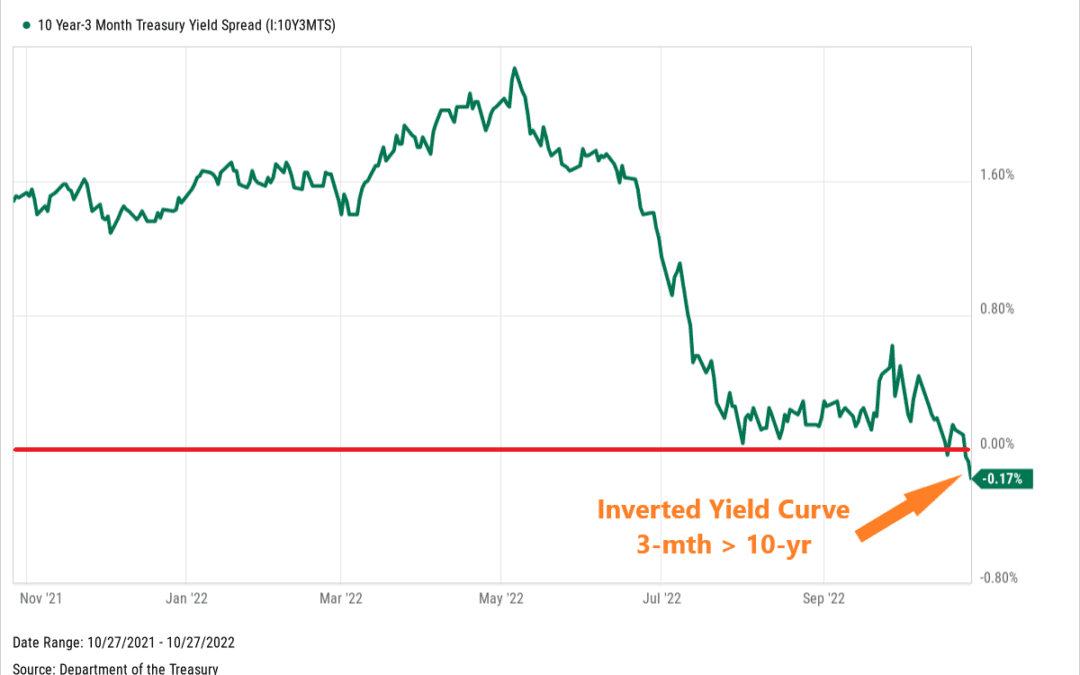

Well, it finally happened. Of all the leading indicators flashing red for the economy, the 3-month/10-year Treasury yield curve was one of the few to remain positive—until now. As our featured chart shows, the 3-month/10-year Treasury yield curve...