by NelsonCorp Wealth Management | Jun 17, 2022 | Chart of the Week

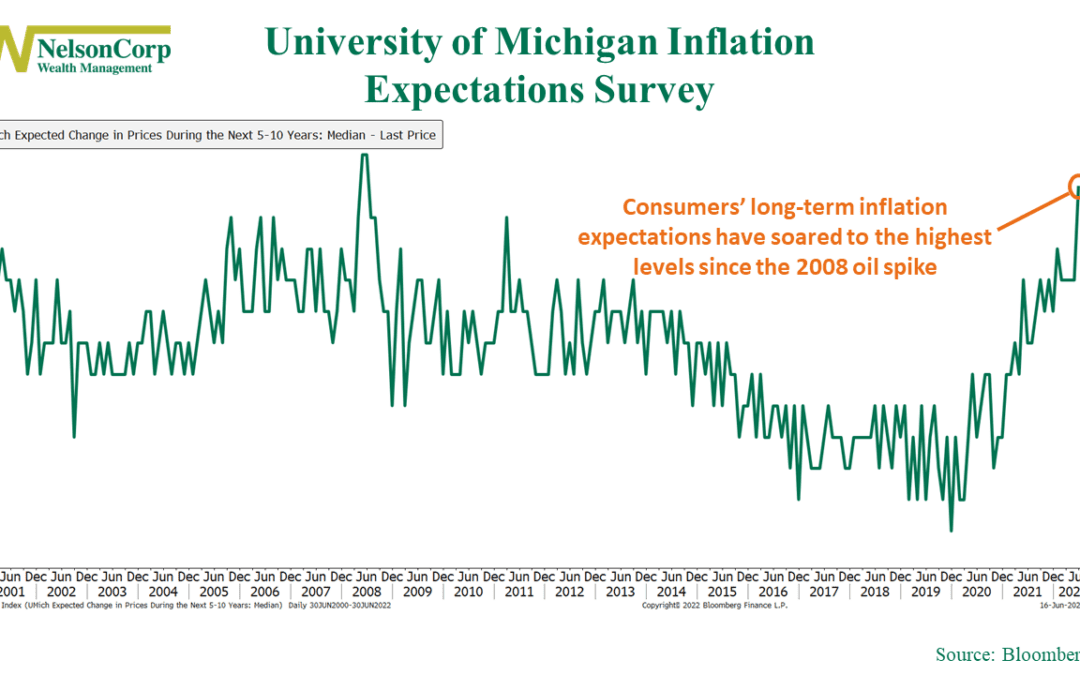

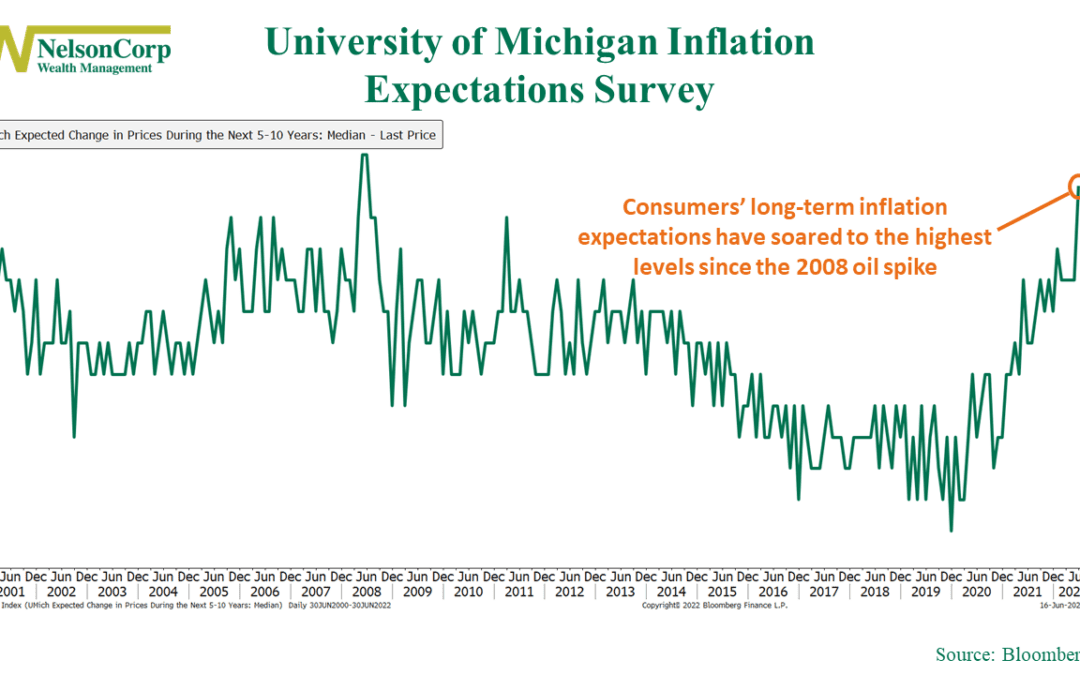

This week’s big news was the Fed’s announcement that it’s raising its benchmark interest rate by 75 basis points (0.75 percentage points). That was the Fed’s biggest interest-rate increase since 1994. This surprise move was in direct response to the...

by NelsonCorp Wealth Management | Jun 10, 2022 | Chart of the Week

What do you get when you combine dirt-cheap funding with a preference to invest in companies heavy on intangible assets? Two words: zombie companies. According to a new research paper by the University of Minnesota, the percentage of U.S. public firms with zero...

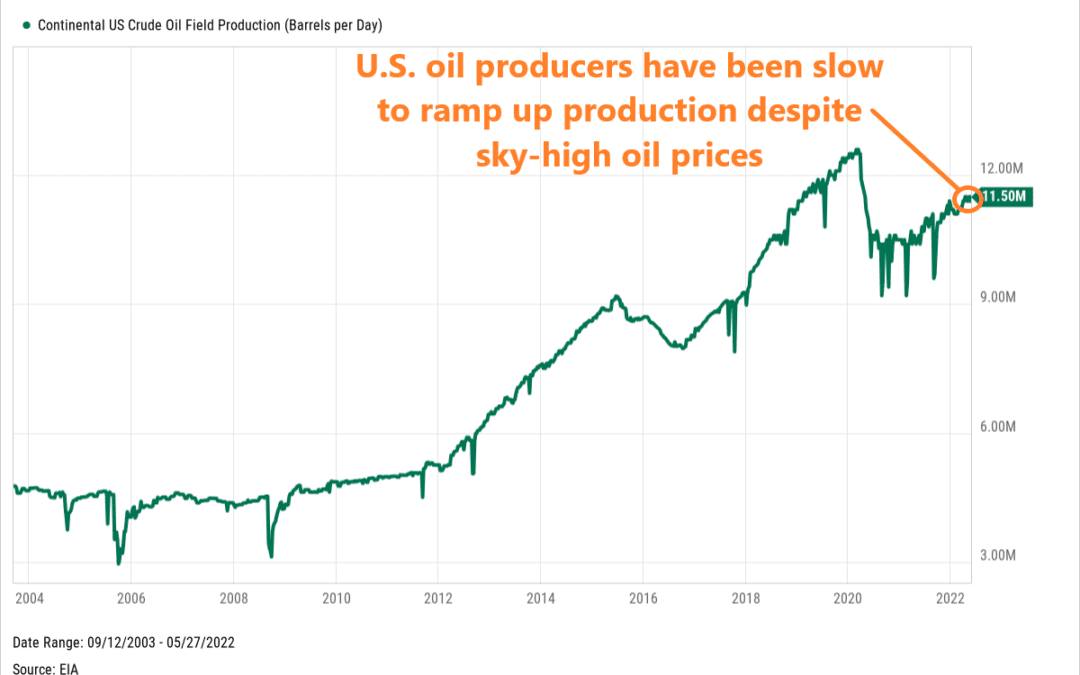

by NelsonCorp Wealth Management | Jun 3, 2022 | Chart of the Week

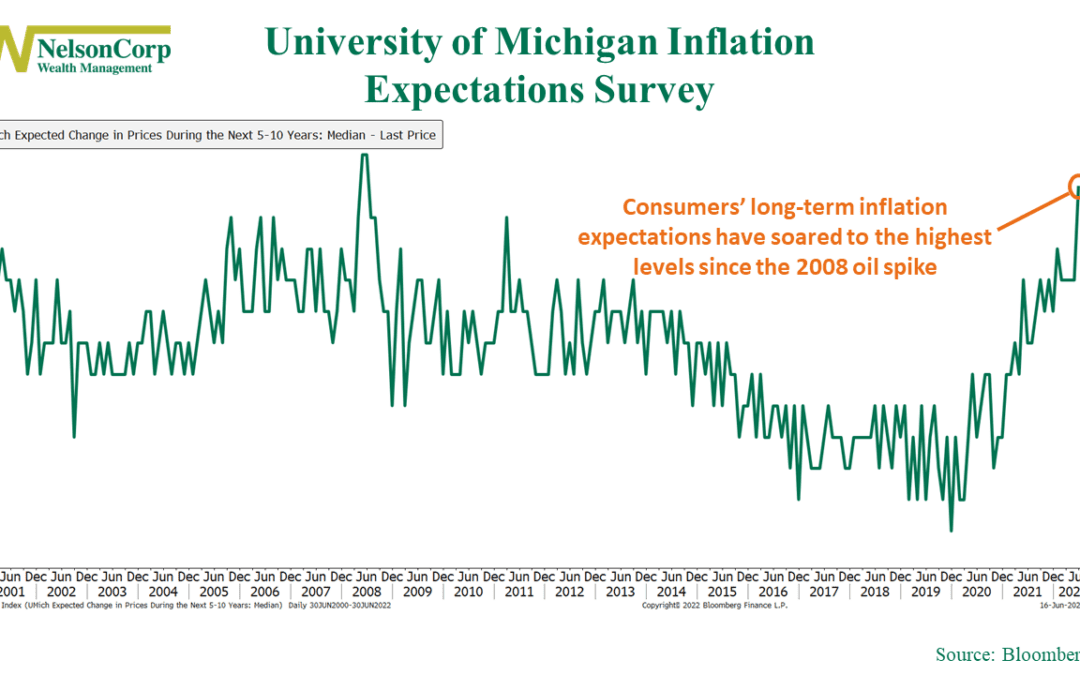

There’s a saying in economics that the cure for high prices is… high prices. In other words, as the price of a commodity increases, it incentivizes producers to produce more of that commodity, but the increased supply then leads to lower prices. That’s the...

by NelsonCorp Wealth Management | May 27, 2022 | Chart of the Week

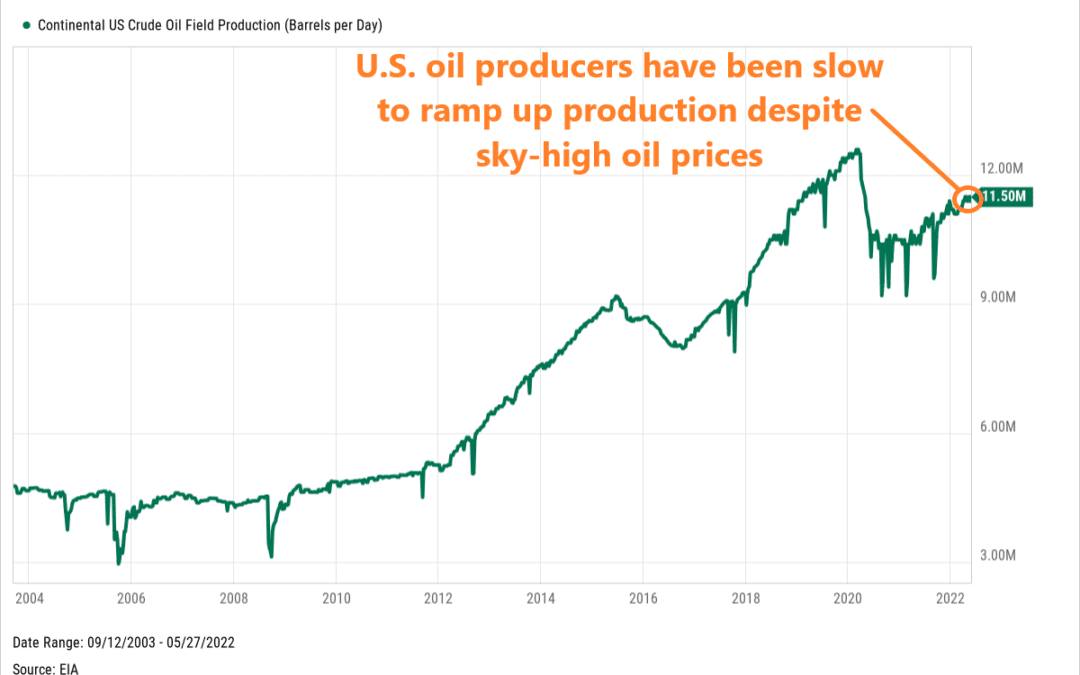

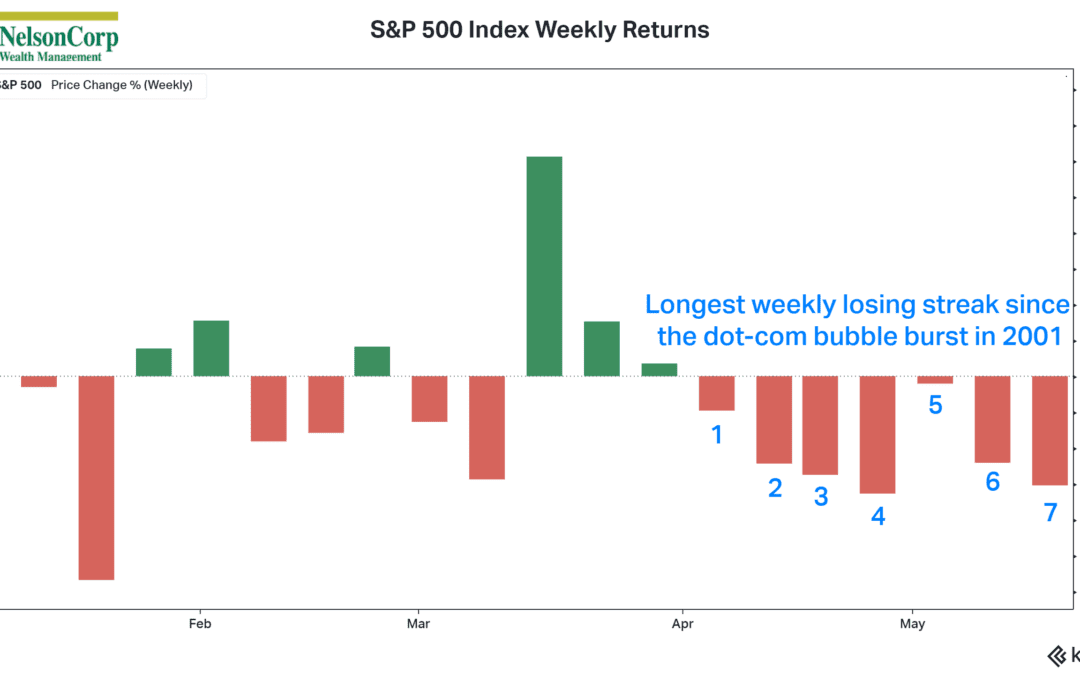

The U.S. stock market has had a rough couple of weeks. Well, more than just a couple. Our Chart of the Week above shows the weekly returns for the S&P 500 this year. The index has now closed lower for its seventh week in a row. You would have to go all the...

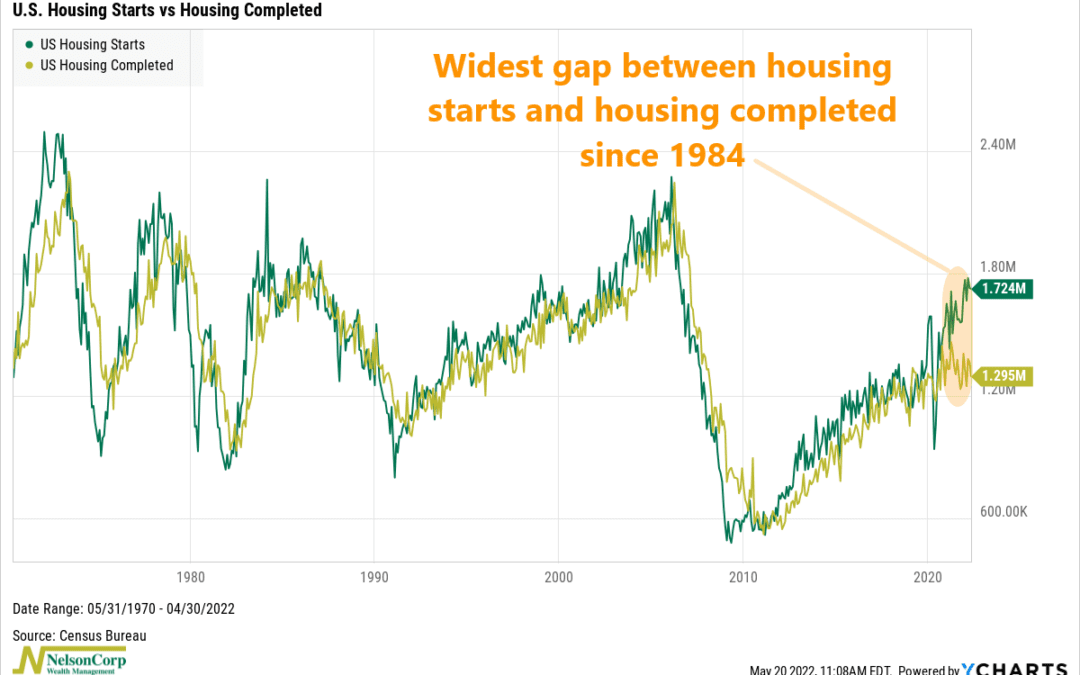

by NelsonCorp Wealth Management | May 20, 2022 | Chart of the Week

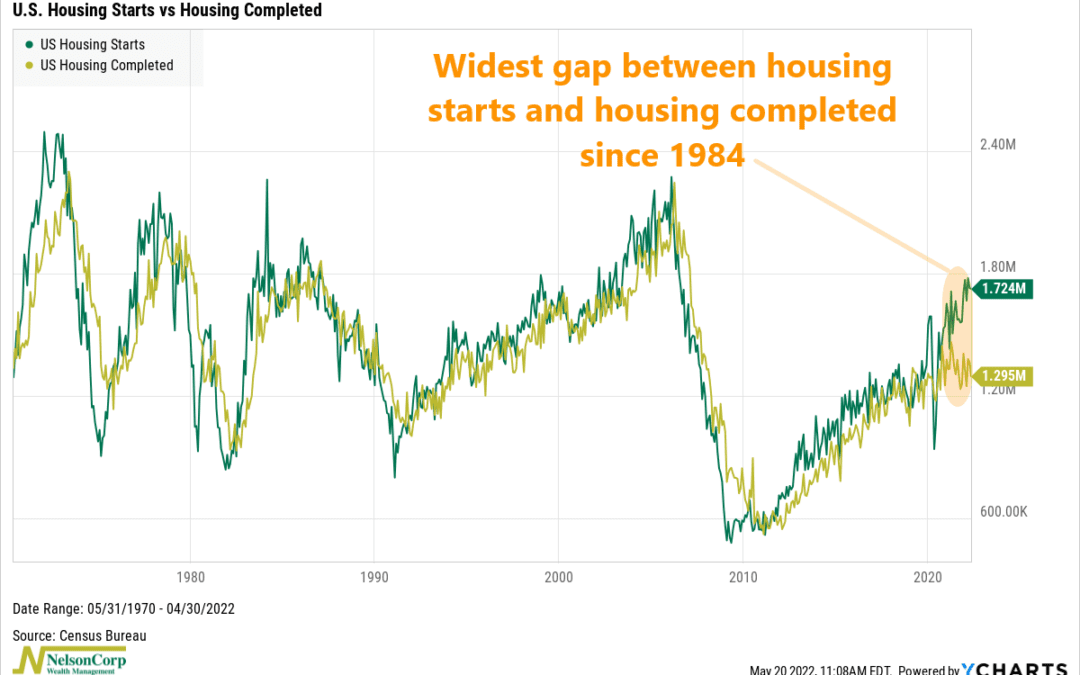

You’ve heard the saying: Don’t start something you can’t finish. Well, it appears that U.S. homebuilders are not heeding that advice. As our featured chart of the week above shows, the gap between the number of new home constructions started and the number of...

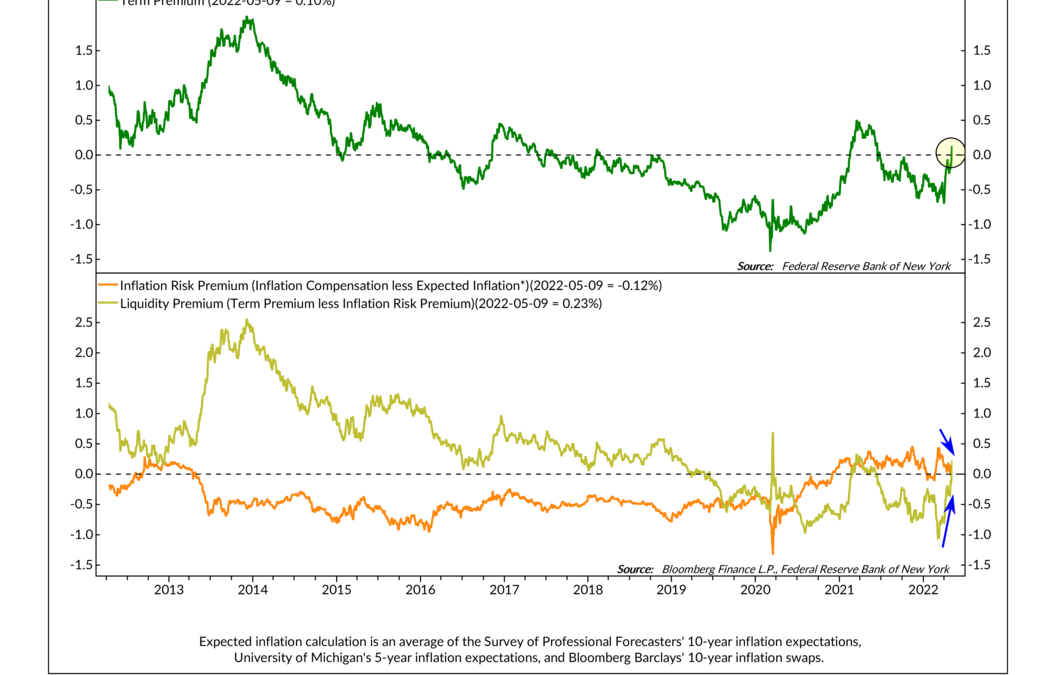

by NelsonCorp Wealth Management | May 13, 2022 | Chart of the Week

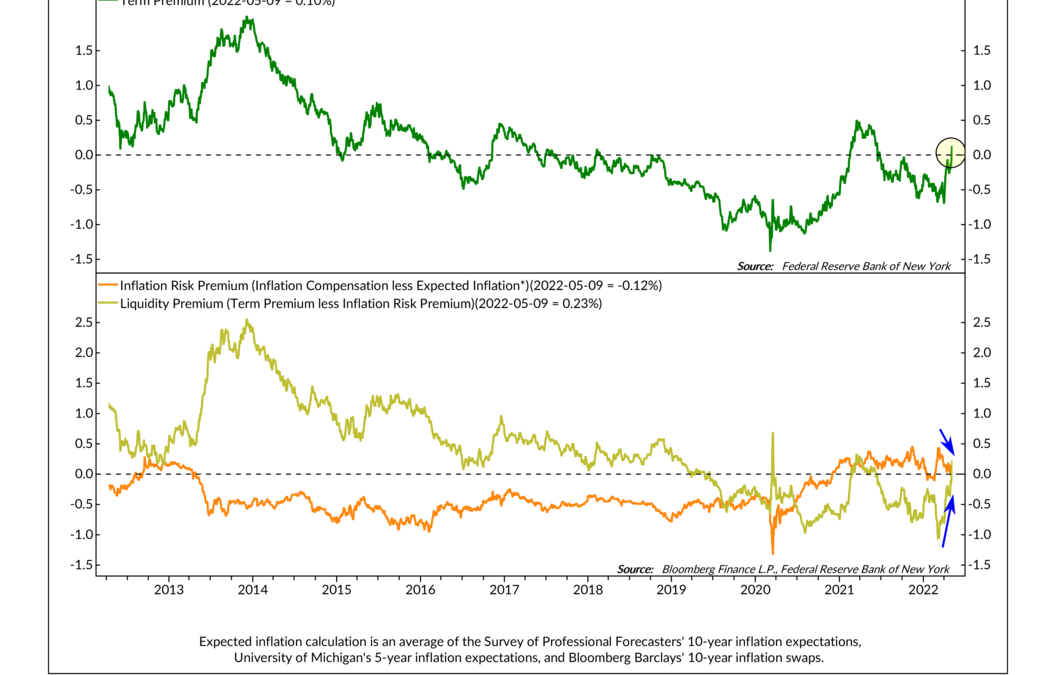

This week’s chart looks at what is called the “term premium” on U.S. government bonds. A term premium is the extra return bond buyers demand to hold a long-term bond instead of a series of short-term bonds. All else equal, term premiums on longer-term bonds...