by NelsonCorp Wealth Management | Feb 11, 2022 | Chart of the Week

It looks like an era of easy money is coming to an end. One of the most visible indications of this is the recent rapid decline in the amount of negative-yielding bonds globally. As you can see on the chart above, the amount now stands around $4.9 trillion,...

by NelsonCorp Wealth Management | Feb 4, 2022 | Chart of the Week

This week, we’ll take a look at a chart from the interest rate markets: the 1-year forward cash rate. The cash rate (or fed funds rate) is the interest rate that banks charge to lend to each other on an overnight basis. This is the rate that the Federal Reserve...

by NelsonCorp Wealth Management | Jan 28, 2022 | Chart of the Week

This past Monday, the S&P 500 index gained 0.28%. That seemed like a pretty normal day—nothing to write home about there. However, like a duck frantically kicking its legs under the surface of the pond, the S&P 500 had to stage quite the comeback...

by NelsonCorp Wealth Management | Jan 21, 2022 | Chart of the Week

Here’s a remarkable fact that might be surprising to some: Nearly 40% of the stocks in the Nasdaq Composite are down at least 50% from their one-year high. And yet, the Nasdaq itself was only down about 7% at the start of the week. That’s a pretty big...

by NelsonCorp Wealth Management | Jan 7, 2022 | Chart of the Week

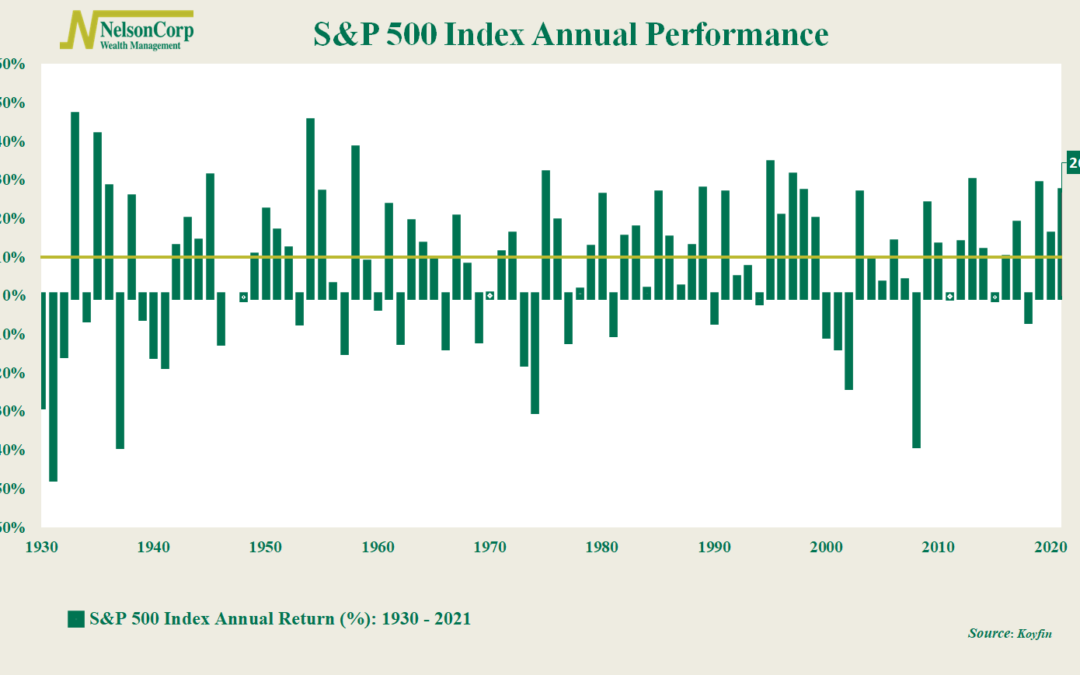

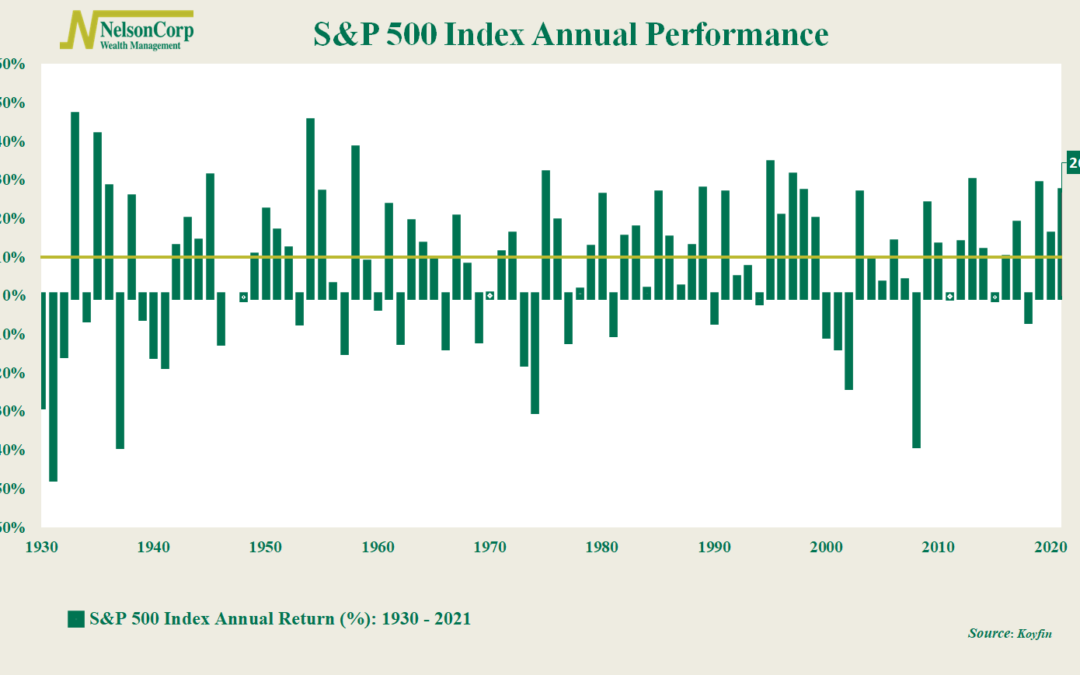

The theme of this week’s chart is comparable to your favorite sports team who just completed a “three-peat”—winning three championships in a row—but instead, it’s applied to the S&P 500 stock index. Each green bar on the chart above represents the annual...

by NelsonCorp Wealth Management | Dec 31, 2021 | Chart of the Week

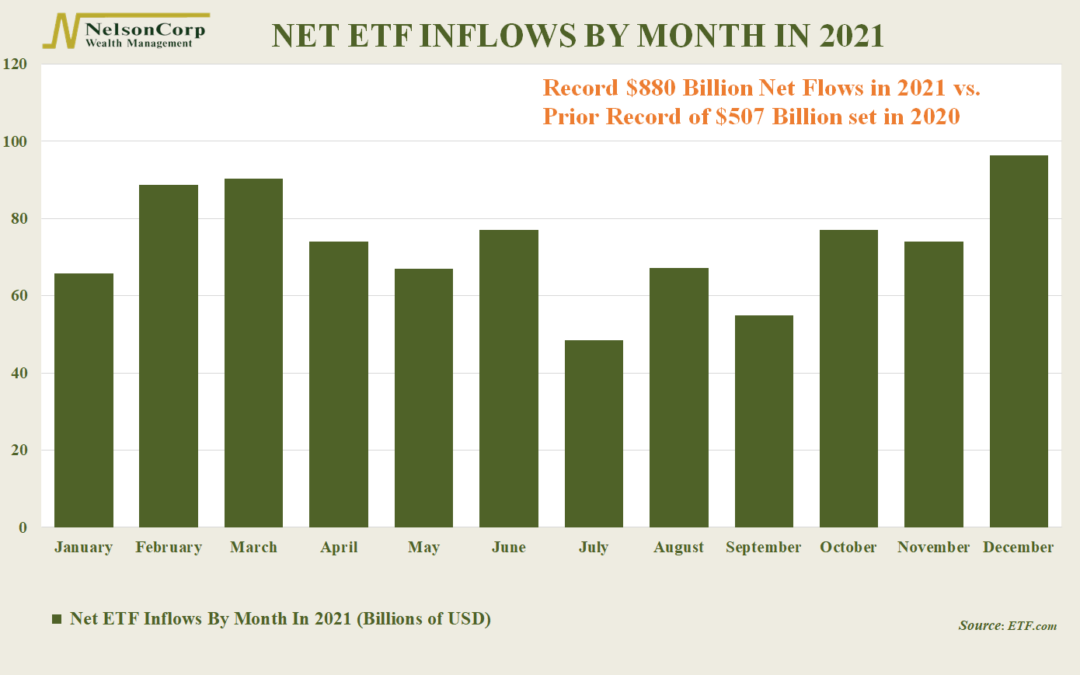

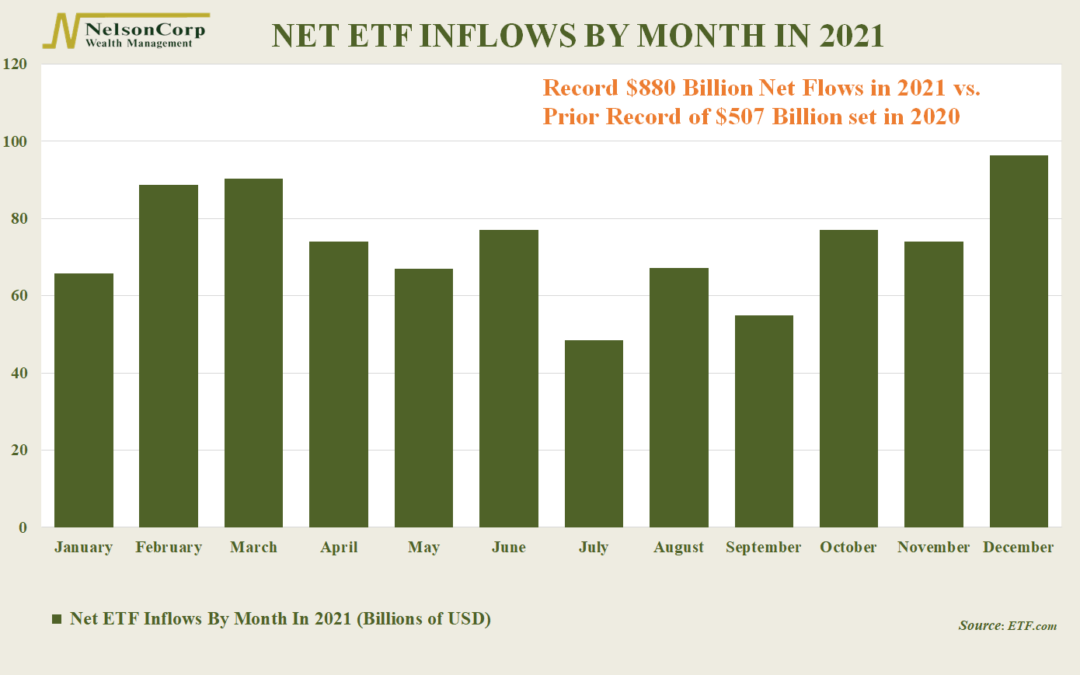

A lot of money flowed into financial products in 2021, but investors made it clear which investment vehicle they preferred the most: the ETF. As our chart above reveals, ETFs saw a record $880 billion inflow of new money this year, beating the previous record...