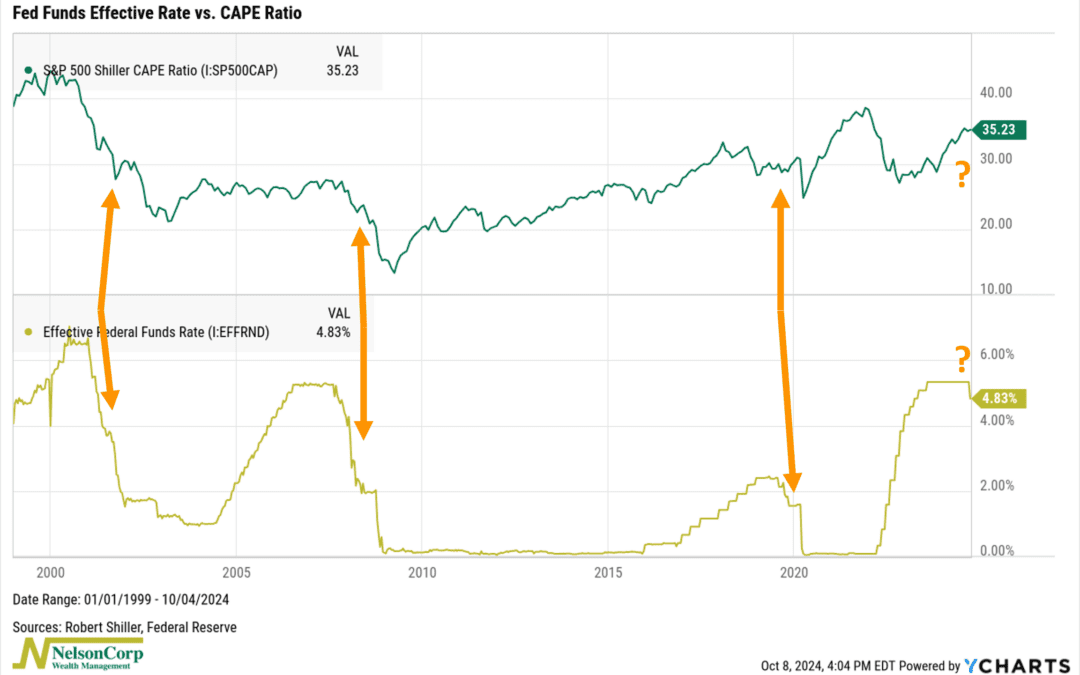

by NelsonCorp Wealth Management | Oct 11, 2024 | Chart of the Week

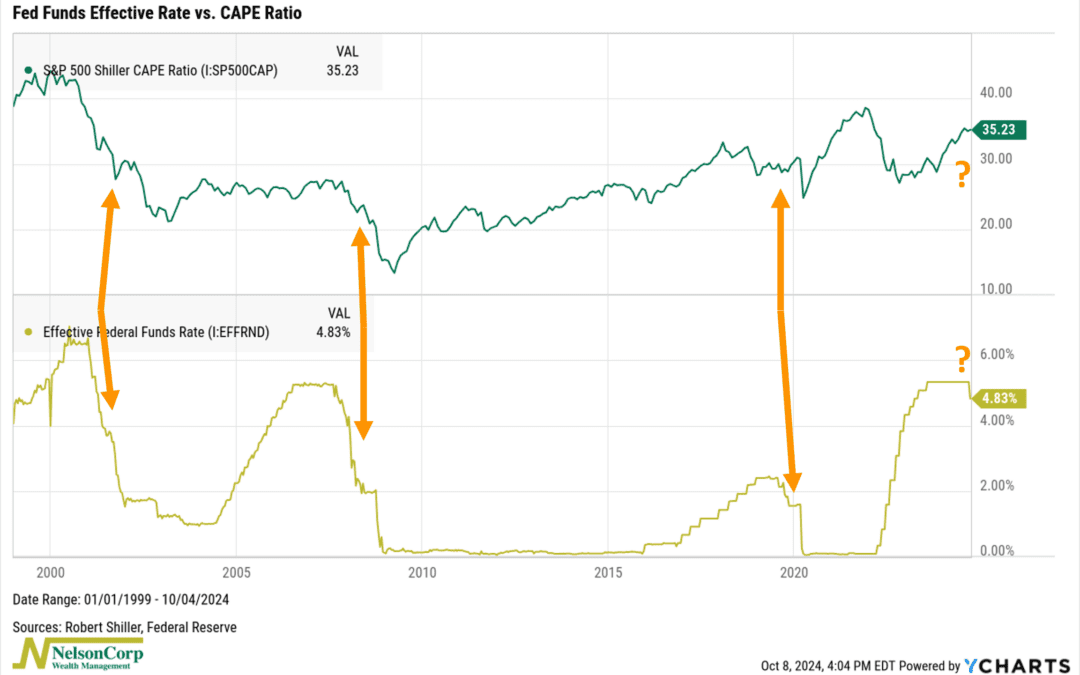

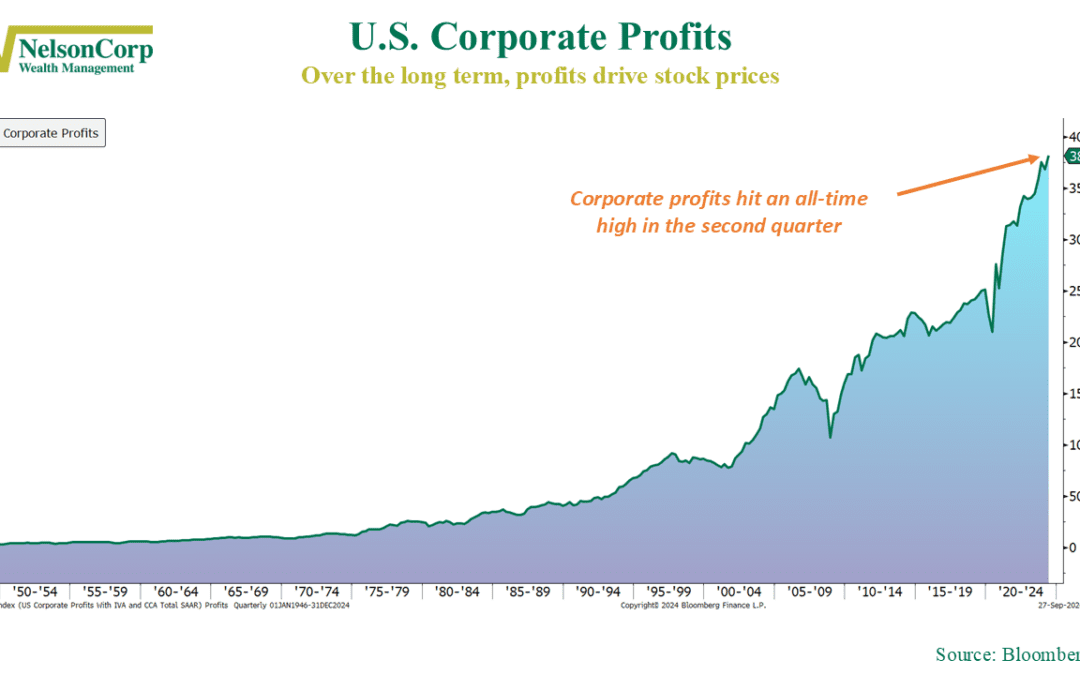

This week’s chart highlights a key connection between the Fed Funds Rate and stock market valuations, as measured by the CAPE ratio. But first, some definitions. The Fed Funds Rate is controlled by the Federal Reserve and influences all other interest rates....

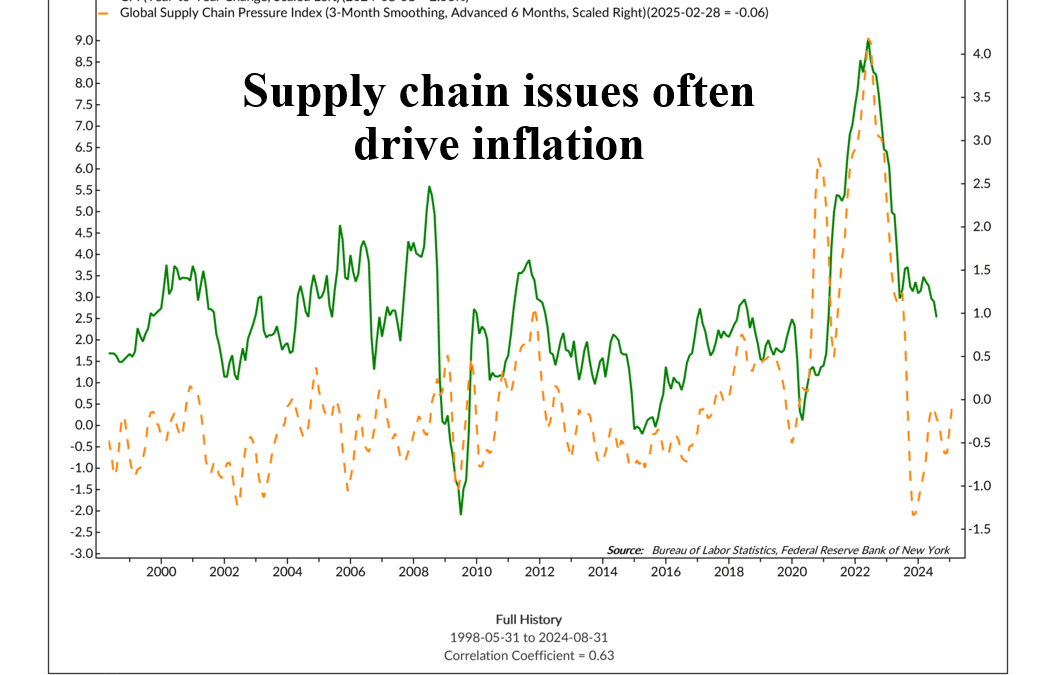

by NelsonCorp Wealth Management | Oct 4, 2024 | Chart of the Week

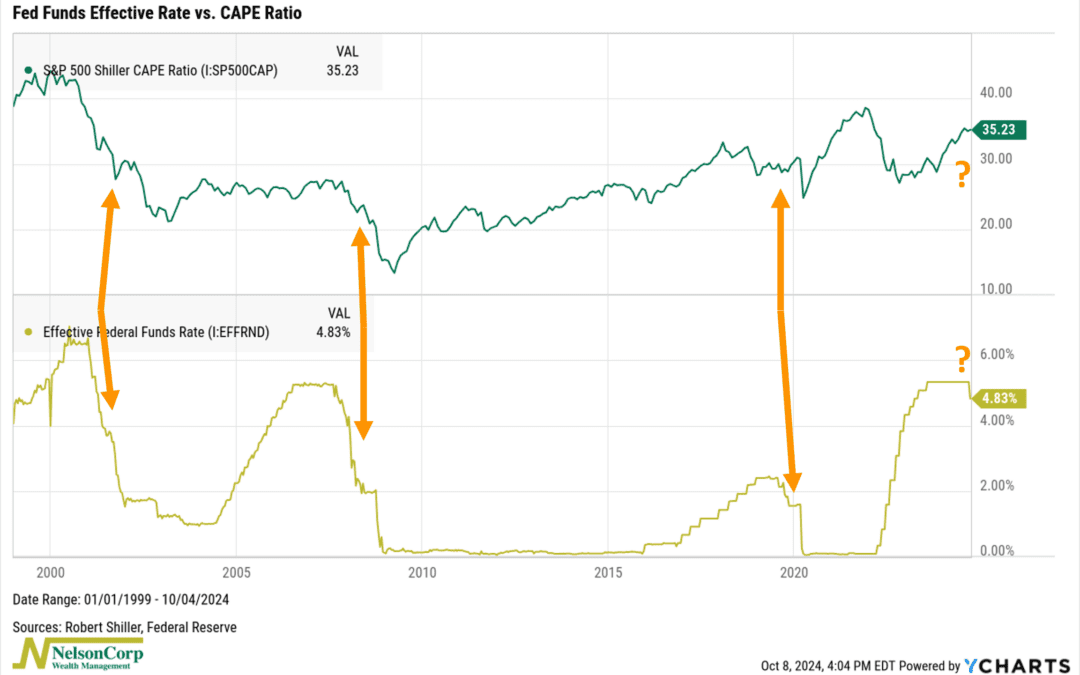

This week, attention was on the East Coast dockworkers’ strike, which threatened to disrupt supply chains and push inflation higher. Fortunately, a deal was made on Thursday, avoiding what could have been a major issue. I bring this up because this event...

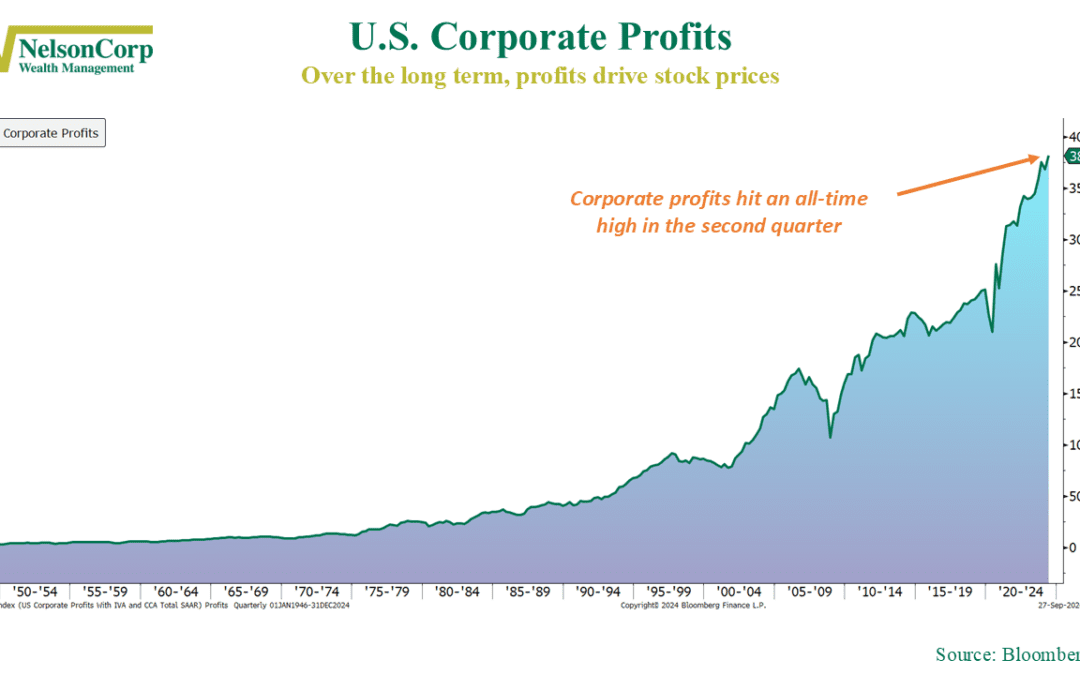

by NelsonCorp Wealth Management | Sep 27, 2024 | Chart of the Week

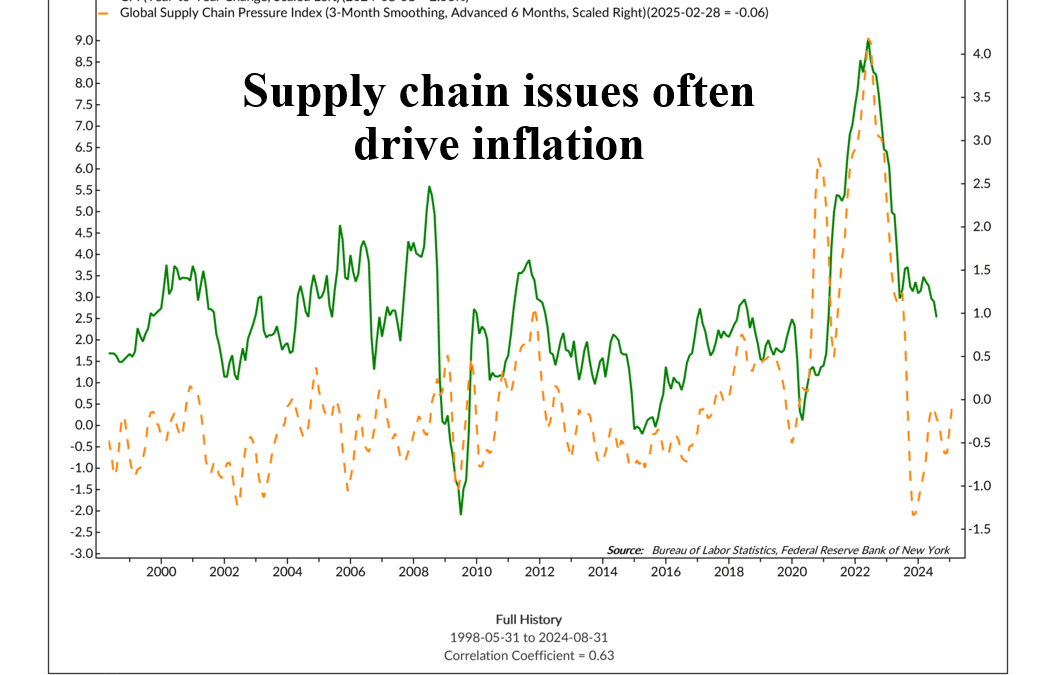

Have you ever wondered what makes stocks go up? The secret sauce is simple: profits. Over the long haul, it’s all about how much money companies are making. When earnings rise, stock prices tend to follow—like a market version of Newton’s law. What...

by NelsonCorp Wealth Management | Sep 20, 2024 | Chart of the Week

In the world of finance, two key interest rates reign supreme: the 10-year Treasury yield and the Fed Funds rate. The Fed Funds rate is set by the Federal Reserve, and changes to this rate are designed to influence the 10-year Treasury yield—a market-based...

by NelsonCorp Wealth Management | Sep 13, 2024 | Chart of the Week

Fast or slow? When it comes to rate cuts, this week’s featured chart suggests that slower is better. The chart shows how the S&P 500 has historically responded to different rate-cut speeds. There have been eight “slow cycles” where the Fed...

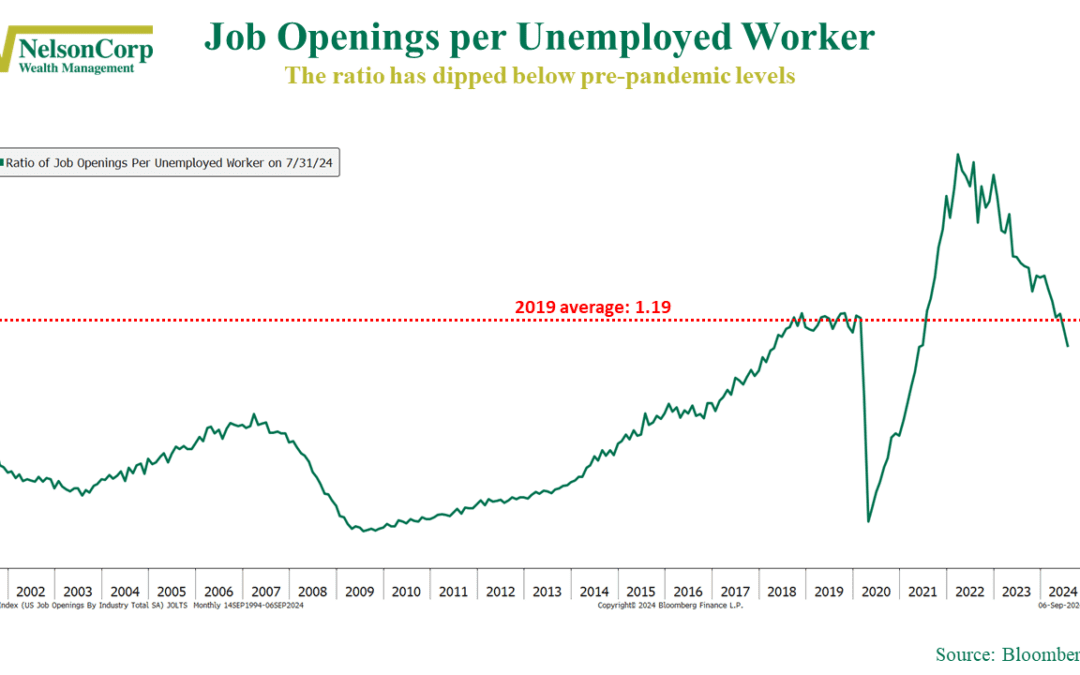

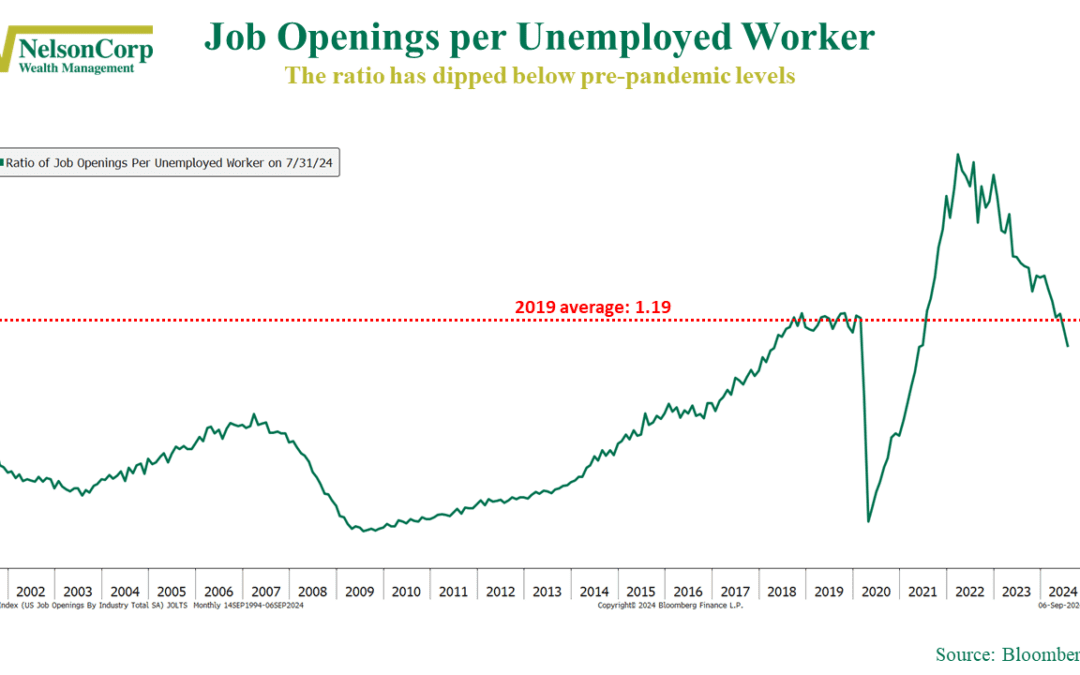

by NelsonCorp Wealth Management | Sep 6, 2024 | Chart of the Week

The market got a jolt from the latest JOLTS (Job Openings and Labor Turnover Survey) report this week. According to the latest data from the Bureau of Labor Statistics, the number of job openings in the U.S. dropped to 7.67 million in July. That’s the lowest...