by NelsonCorp Wealth Management | Jun 7, 2024 | Chart of the Week

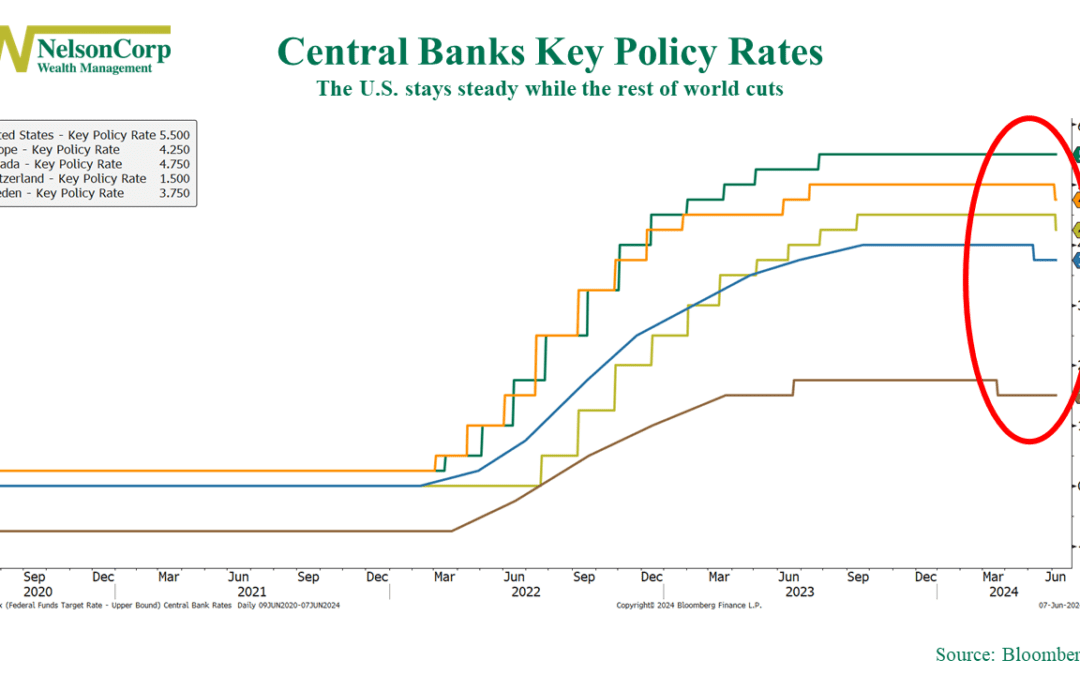

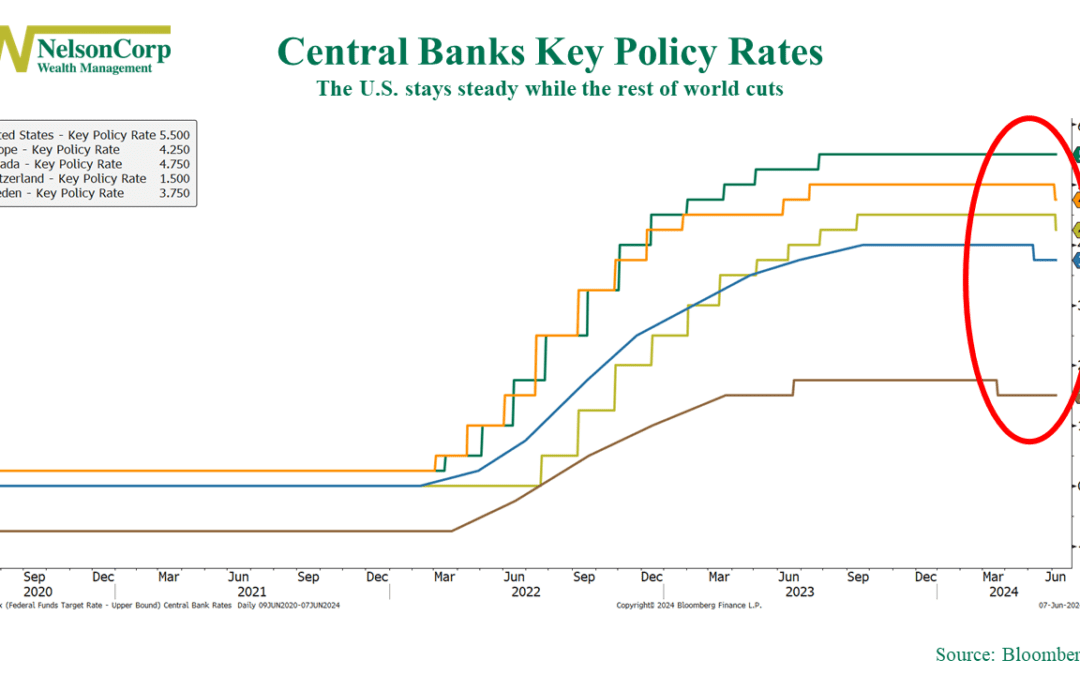

Hikes are out, and cuts are in. That’s the direction the world’s Central Banks have been moving lately. This week, the European Central Bank and Canada joined Sweden and Switzerland in cutting their key policy interest rates. That makes four major...

by NelsonCorp Wealth Management | May 31, 2024 | Chart of the Week

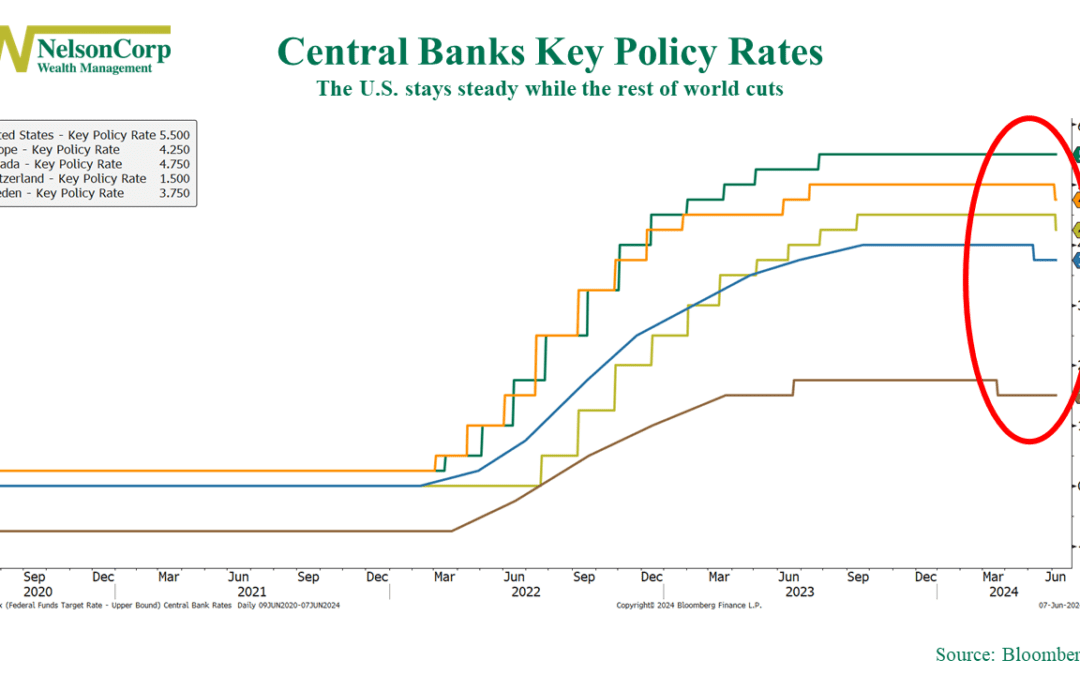

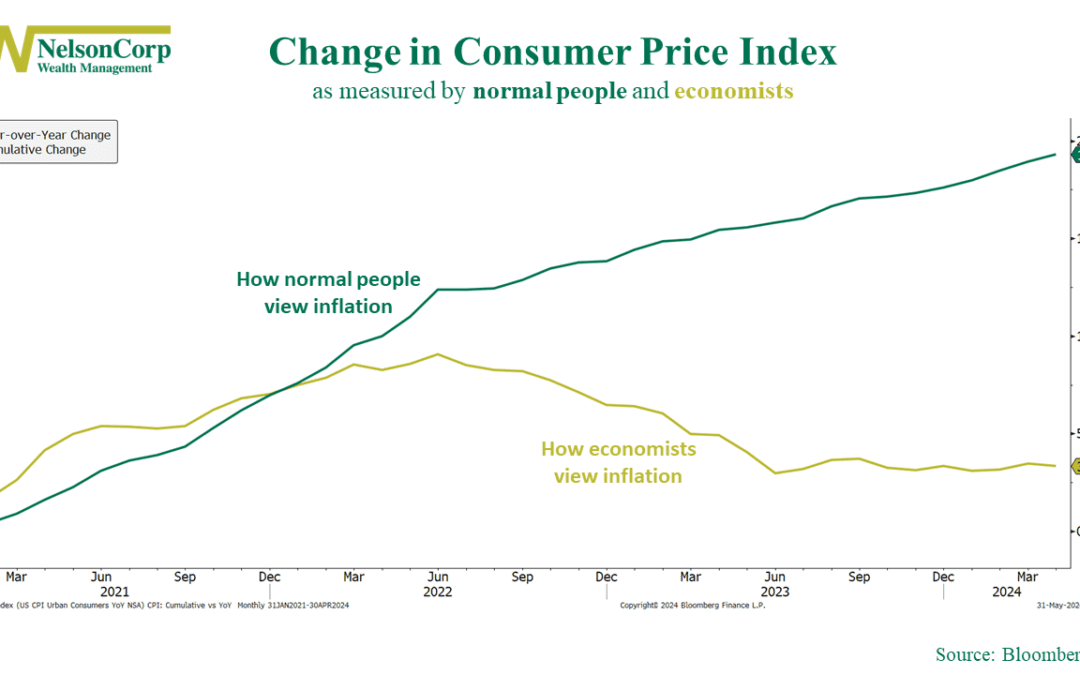

If you were to ask a random person on the street their thoughts on inflation, they’d likely say, “It’s ridiculously high right now.” But ask that same question to an economist, and you’d probably get a different answer. They’d say something like, “It’s come down...

by NelsonCorp Wealth Management | May 24, 2024 | Chart of the Week

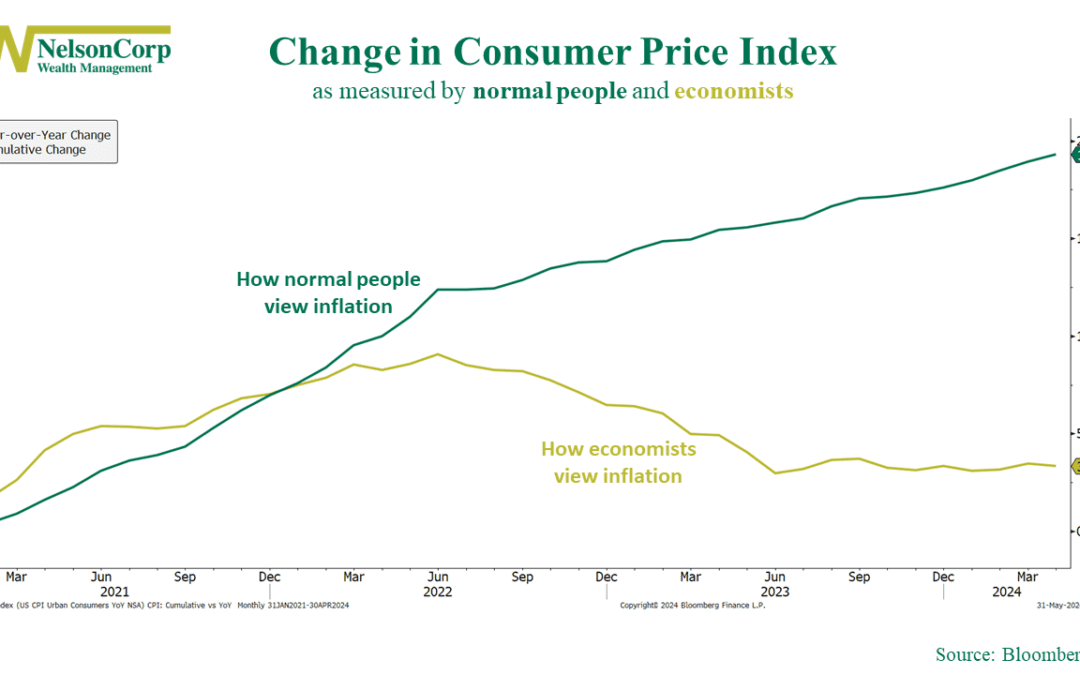

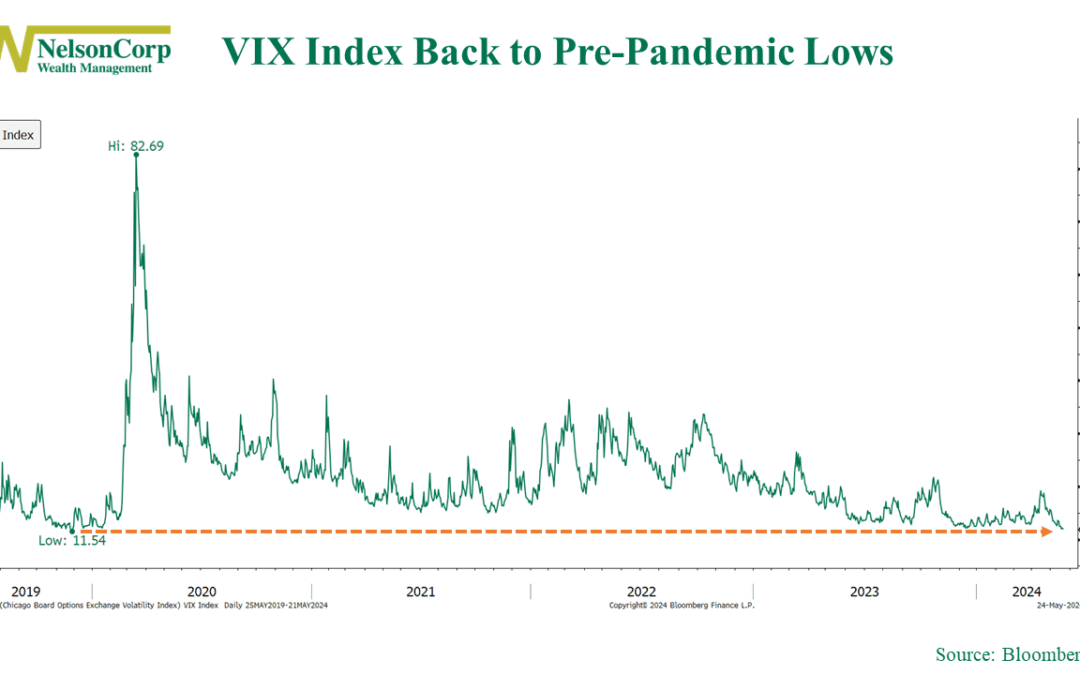

This week’s chart highlights a significant milestone for stock investors: the VIX Index is back to pre-pandemic lows. The VIX, often called the “fear gauge,” measures market volatility implied from S&P 500 options. When it rises, it means investors expect...

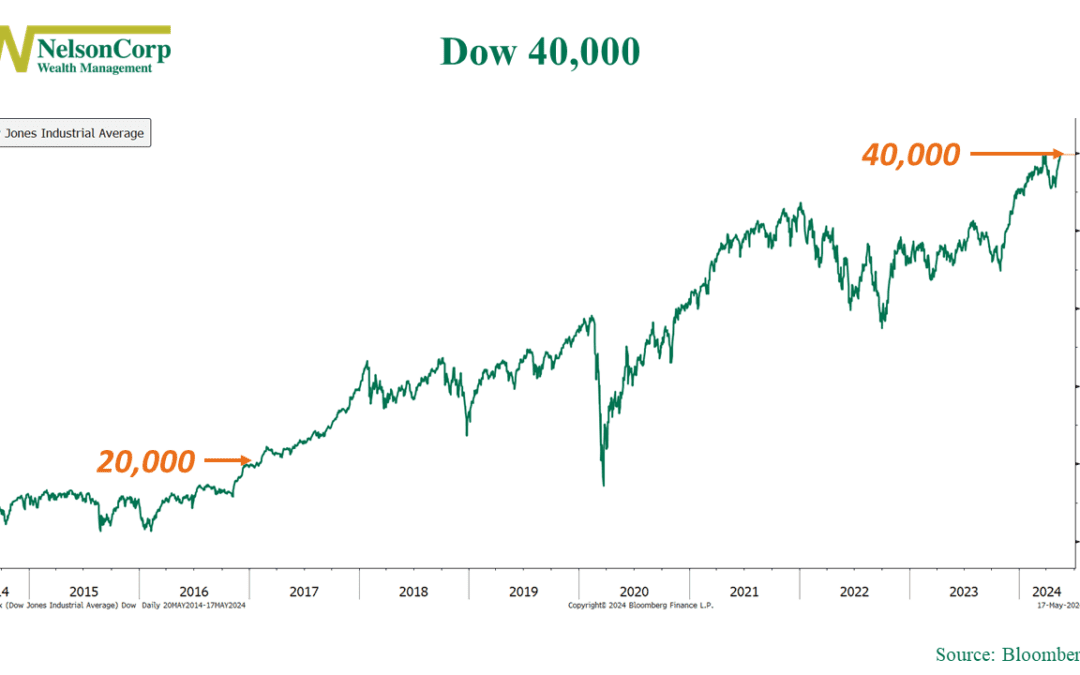

by NelsonCorp Wealth Management | May 17, 2024 | Chart of the Week

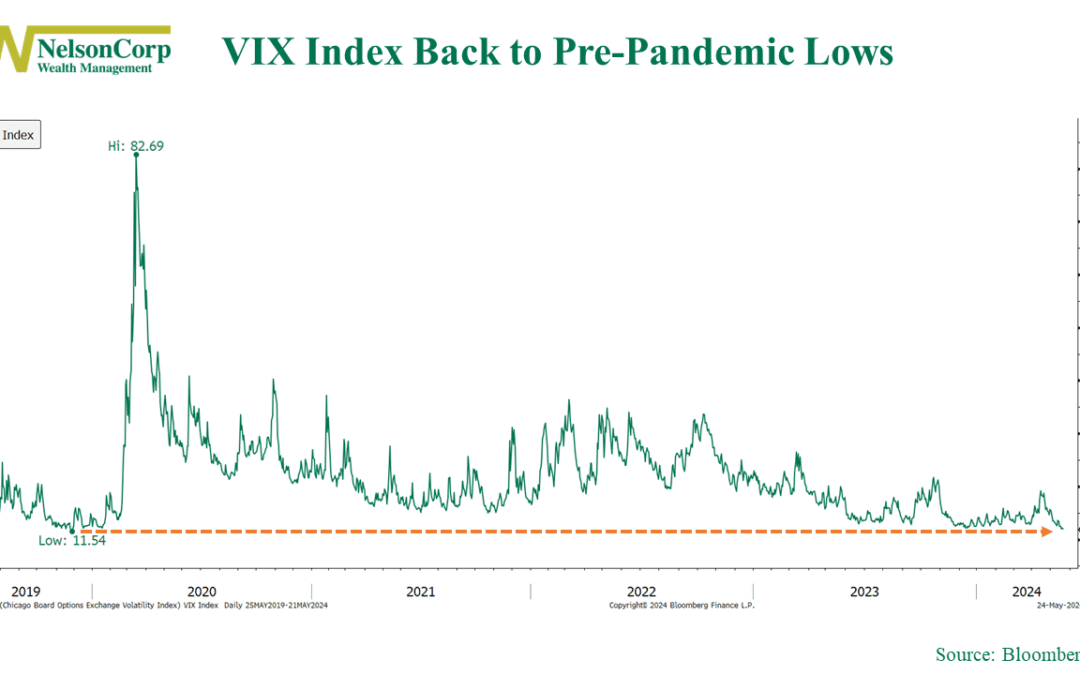

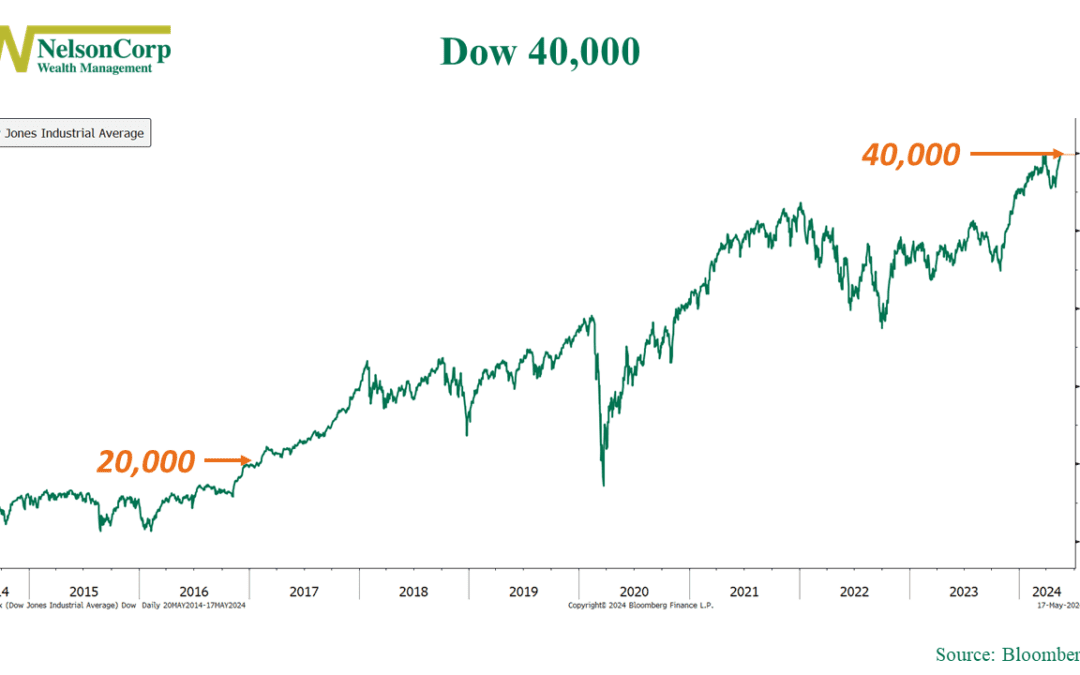

The U.S. stock market reached a major milestone last week as the Dow Jones Industrial Average crossed the 40,000 mark for the first time ever. Looking at the chart, you can see that the Dow first crossed 20,000 in January 2017. So, it took a little over 7 years...

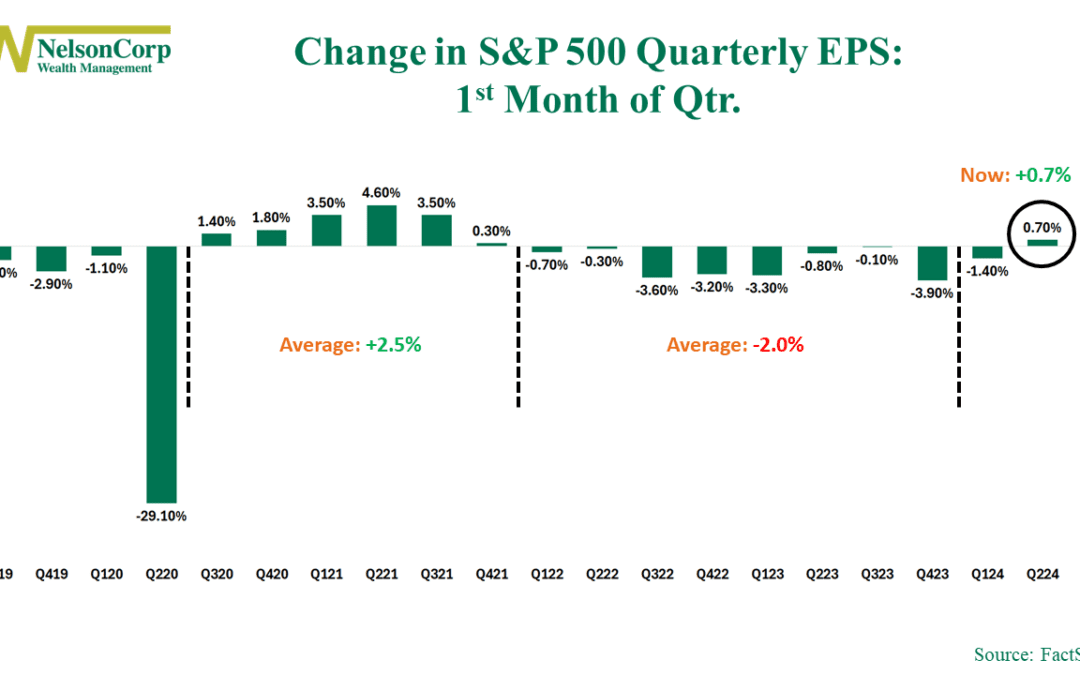

by NelsonCorp Wealth Management | May 10, 2024 | Chart of the Week

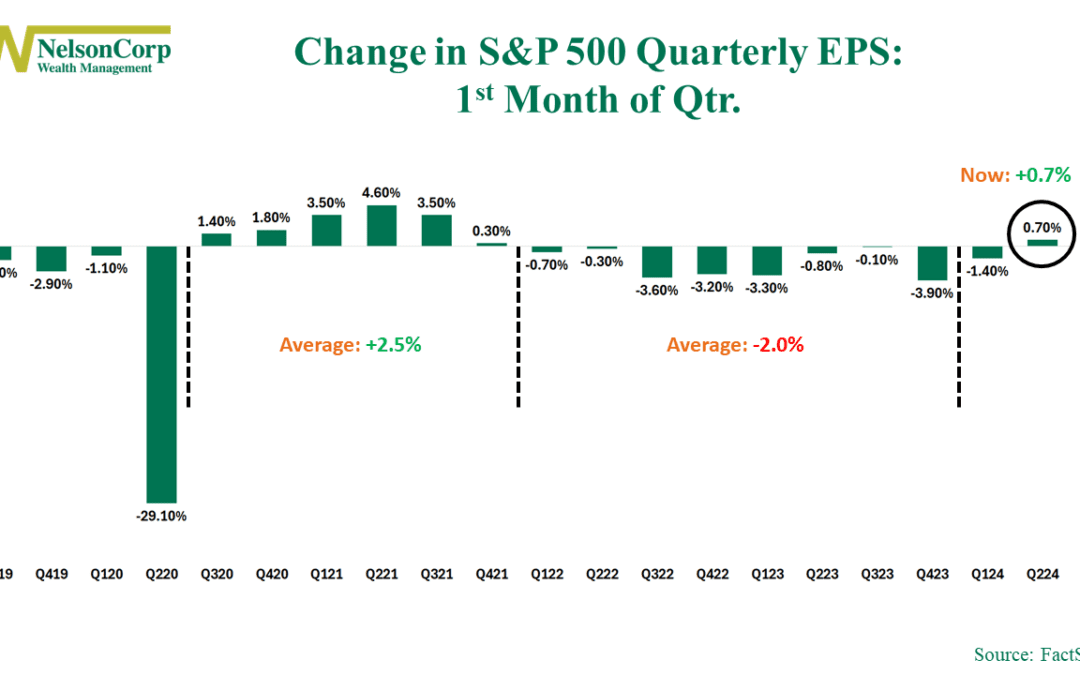

April brought a surprising turn of events in the world of stock market forecasts: for the first time since 2021, stock analysts actually boosted their earnings per share (EPS) estimates for the current quarter. As our featured chart above shows, analysts...

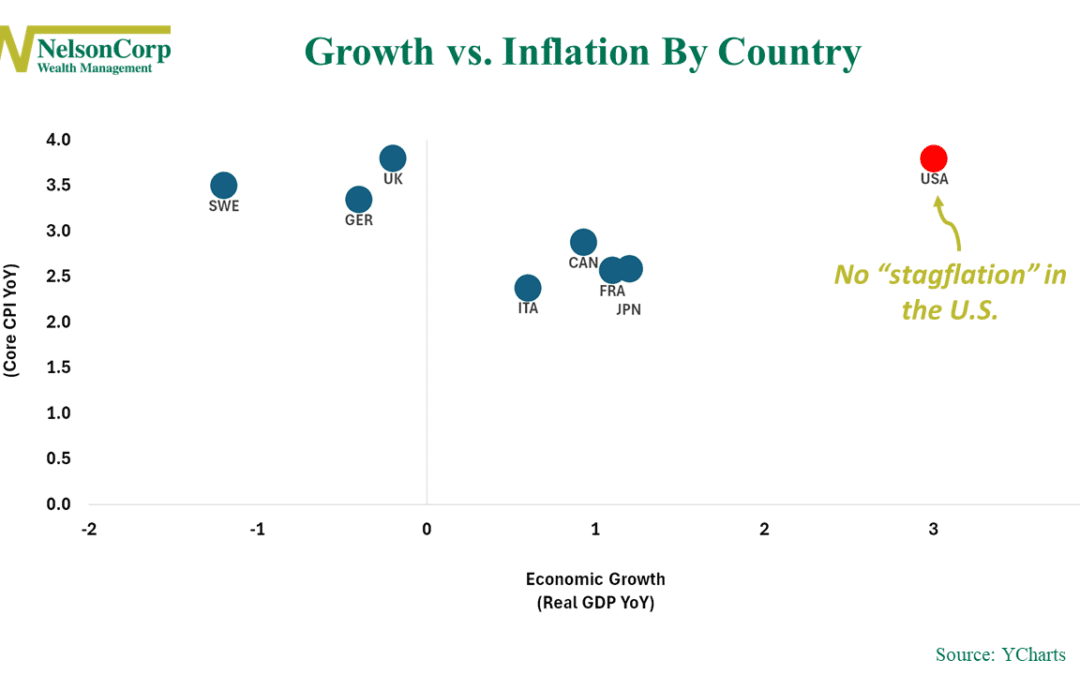

by NelsonCorp Wealth Management | May 3, 2024 | Chart of the Week

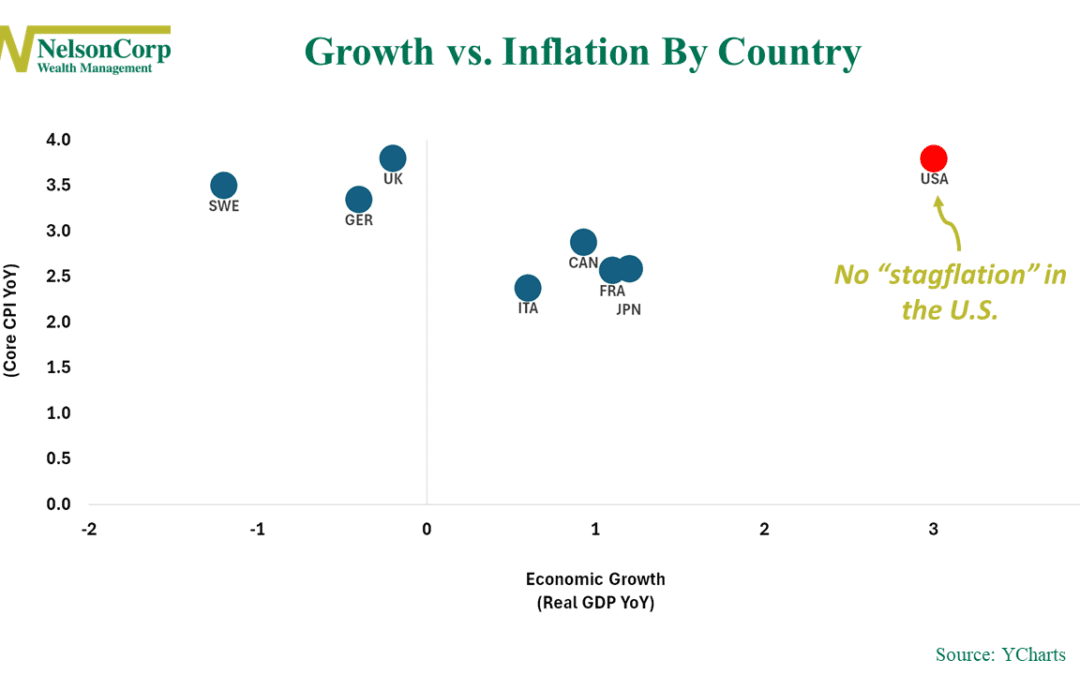

Lately, there’s been a buzz about something called “stagflation” in the global economy. Stagflation happens when a country’s economy gets stuck in a slump with slow growth and high inflation – definitely not a good situation. But should...