by NelsonCorp Wealth Management | Apr 26, 2024 | Chart of the Week

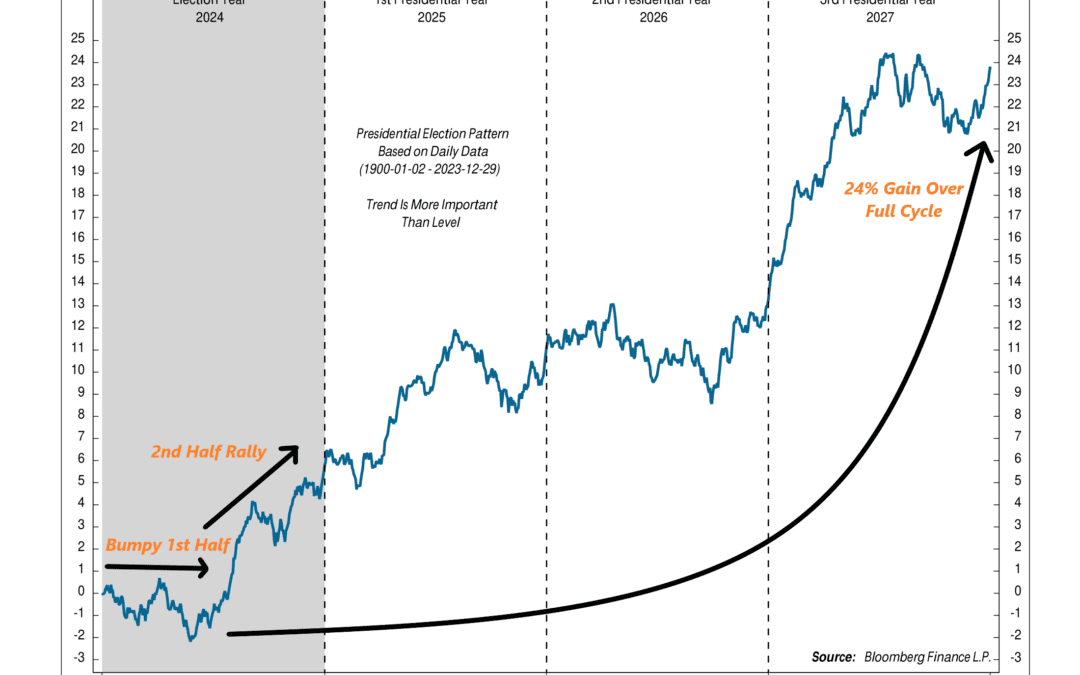

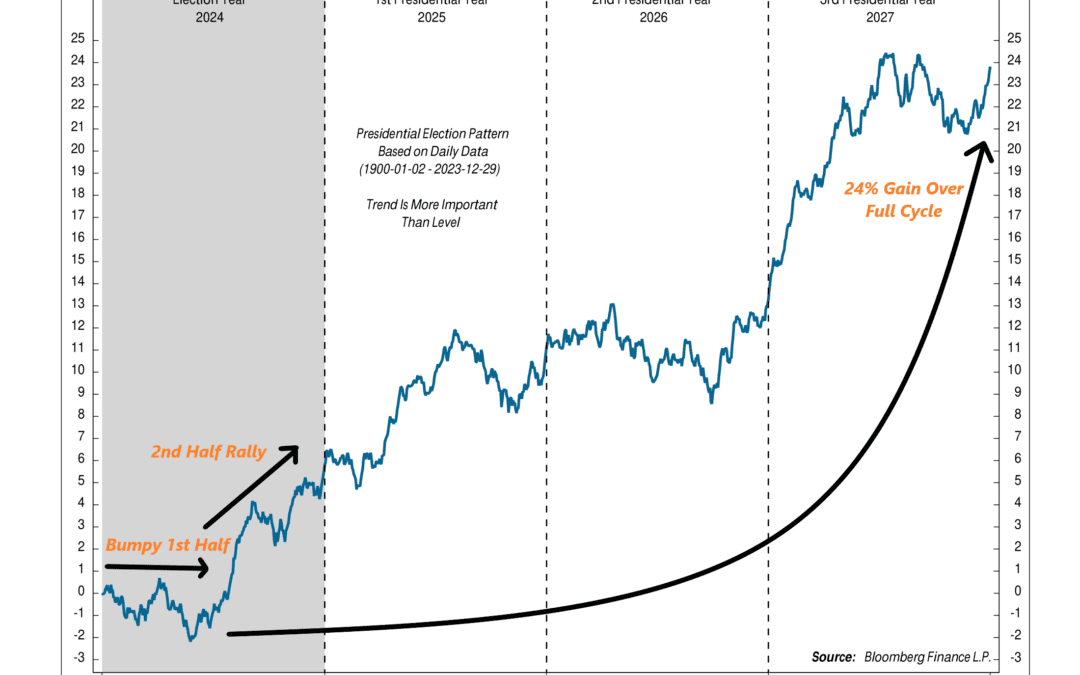

Have you ever wondered how the stock market does during a presidential election year? Well, let’s take a look! This week’s chart shows how the Dow Jones Industrial Average, which is used as a representation of the stock market, typically performs over a...

by NelsonCorp Wealth Management | Apr 19, 2024 | Chart of the Week

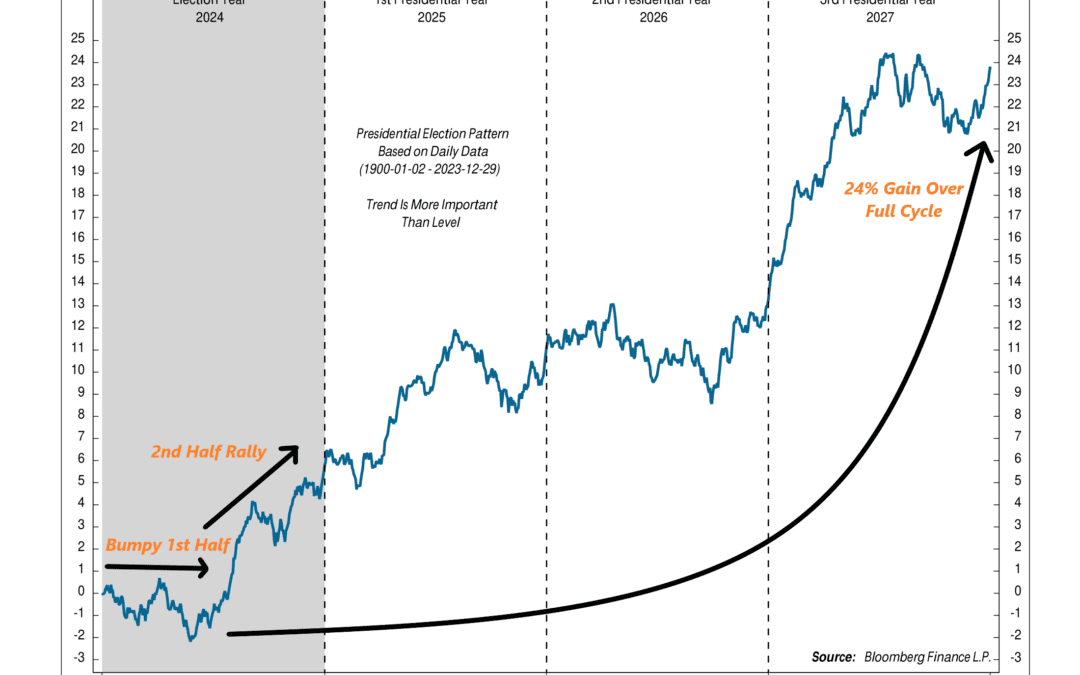

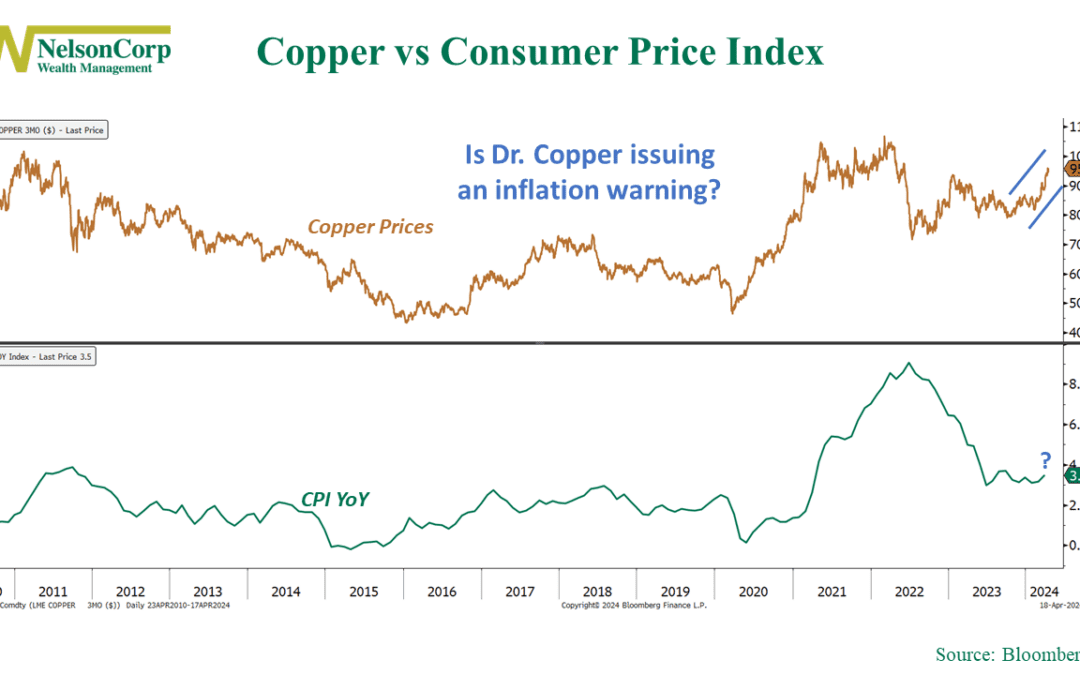

There’s this saying on Wall Street that copper is the commodity with a PhD in economics. Why? Because it’s an industrial metal that sees its demand wax and wane with economic growth. The higher the growth, the higher the demand for copper, and vice versa. Well,...

by NelsonCorp Wealth Management | Apr 12, 2024 | Chart of the Week

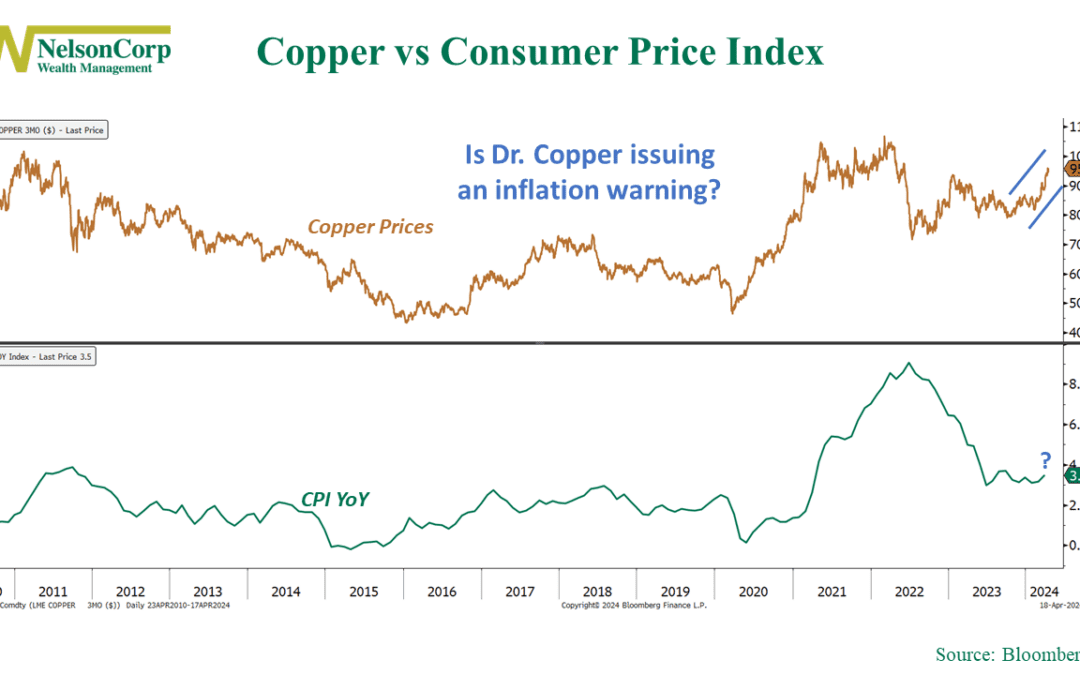

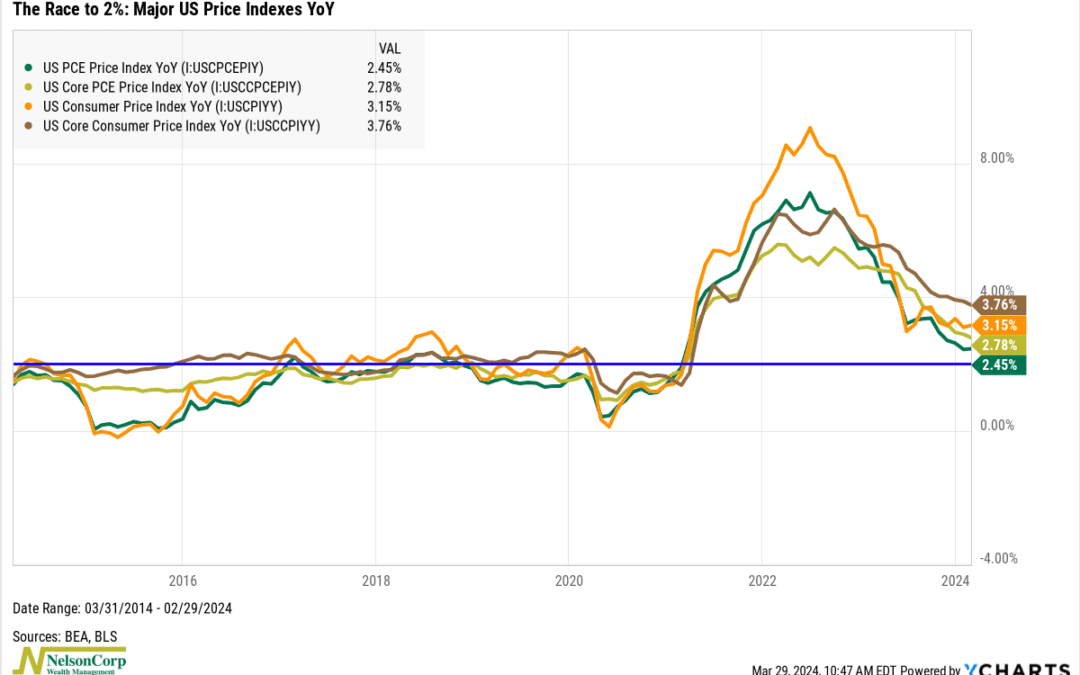

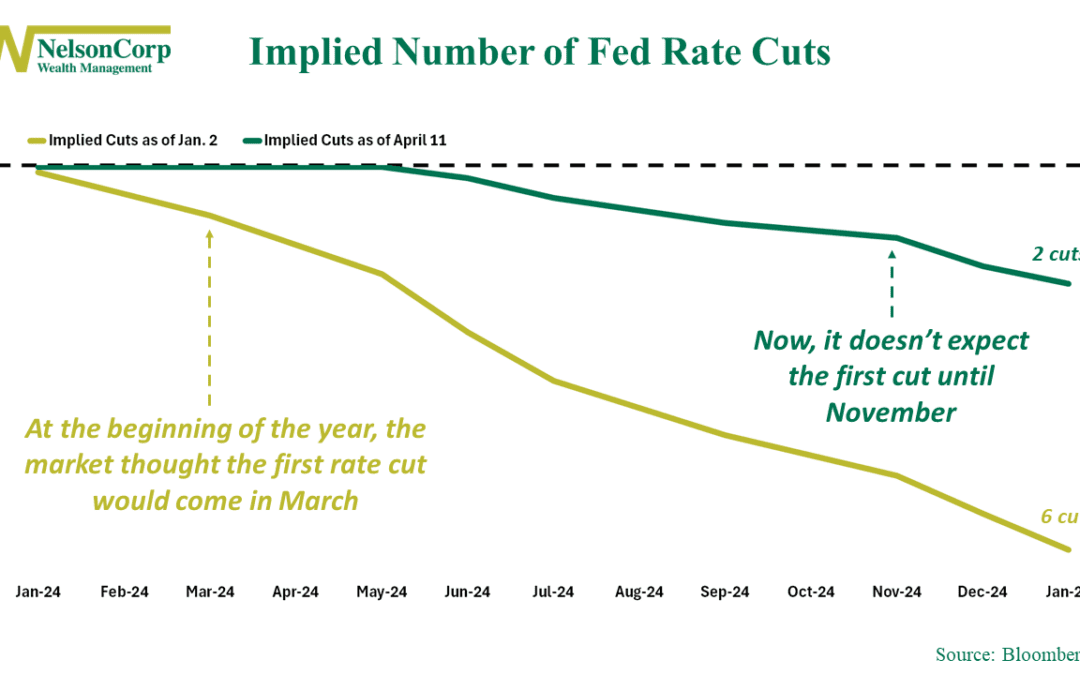

This week’s big news was the release of the March CPI (consumer inflation) numbers. As feared, it came in hotter than expected. The year-over-year change in the CPI picked up to 3.48% last month. As you can see on the chart below, it’s been stuck in a narrow range...

by NelsonCorp Wealth Management | Apr 5, 2024 | Chart of the Week

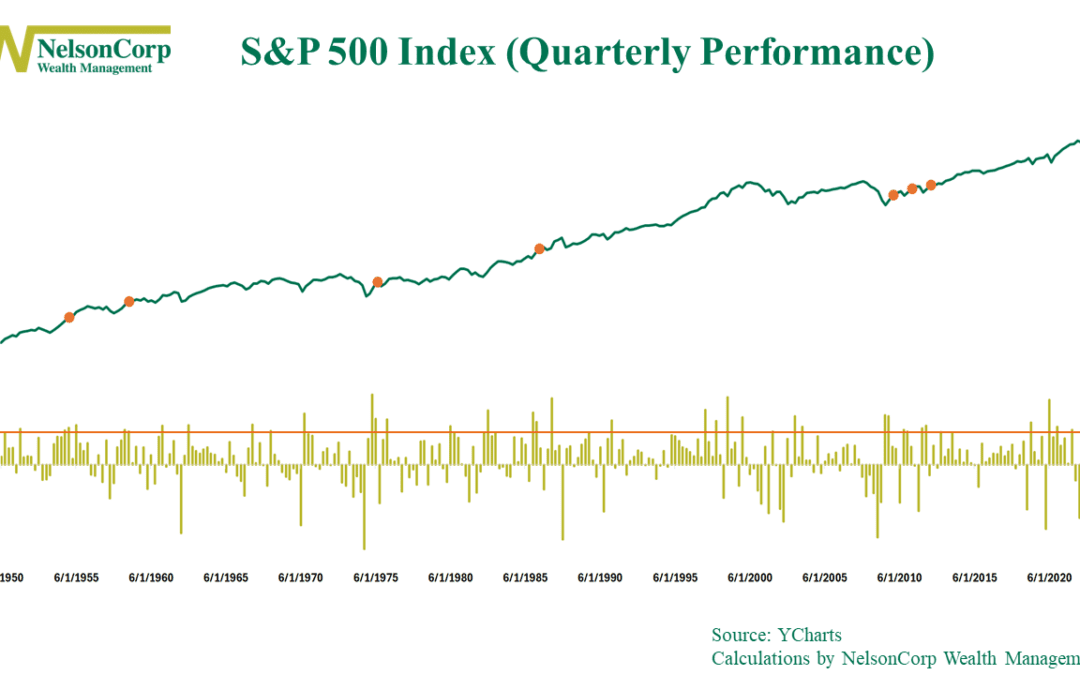

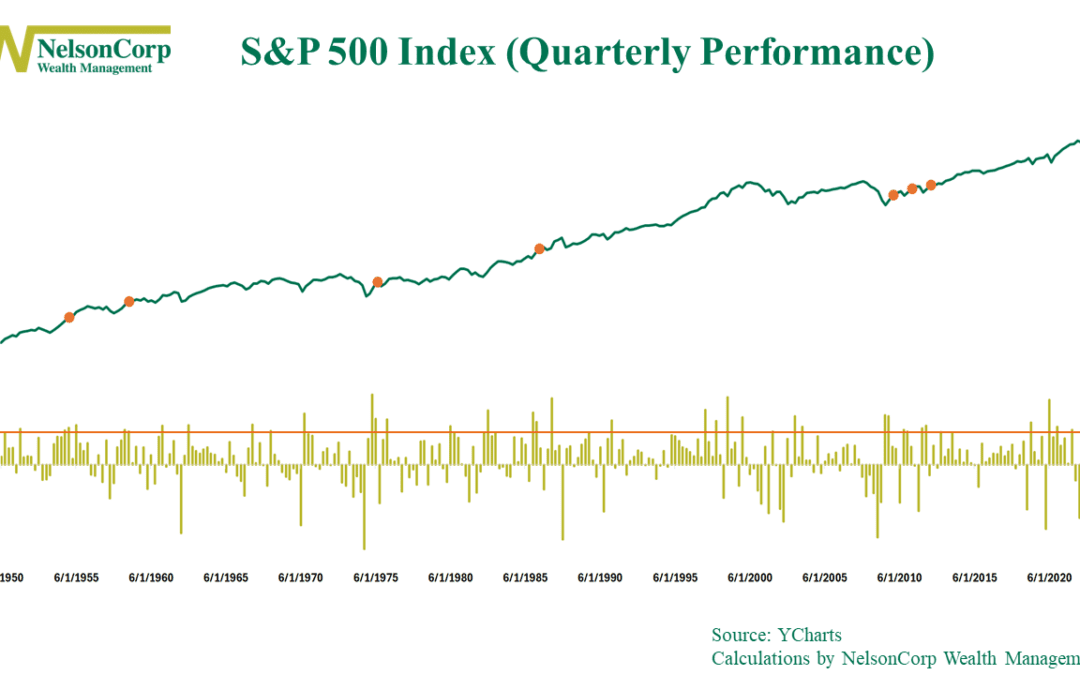

We closed out the first quarter last week—and it was a good one. Over the first three months of the year, the S&P 500 stock Index rose 10.16%. The three months before that, it was up 11.24%. That’s back-to-back quarterly gains of 10% or more for the first...

by NelsonCorp Wealth Management | Mar 29, 2024 | Chart of the Week

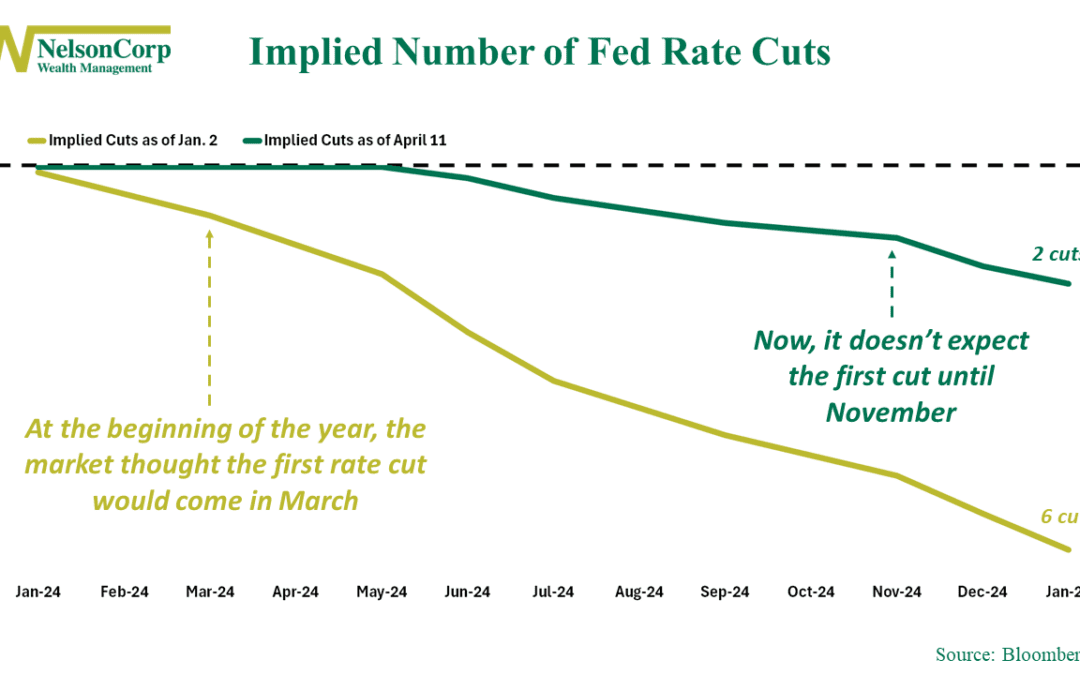

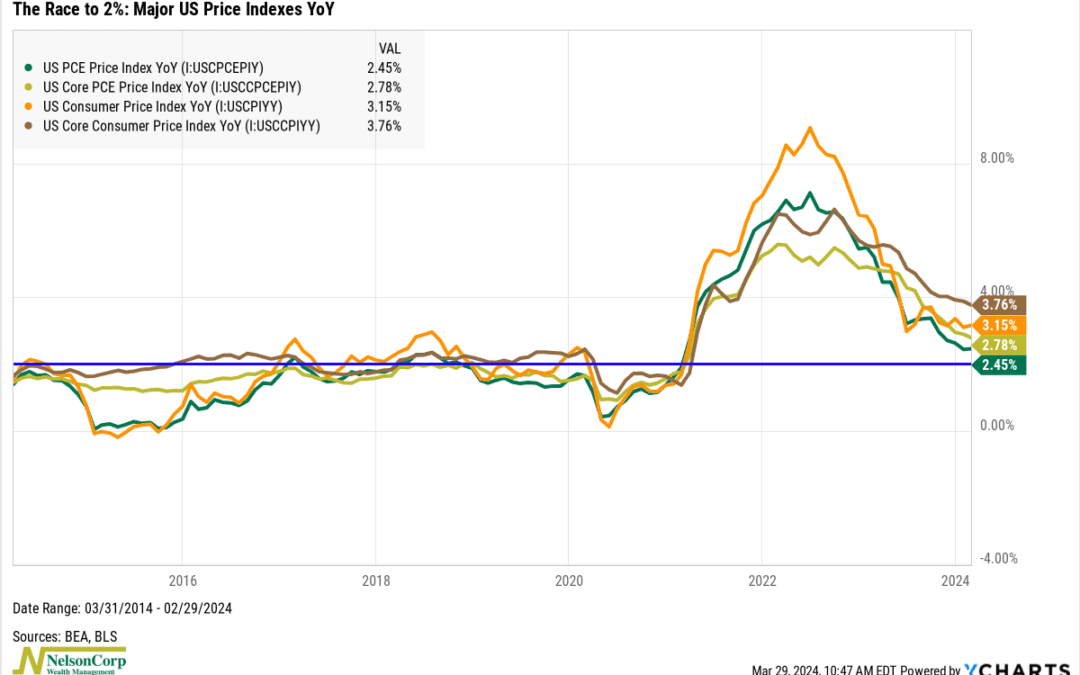

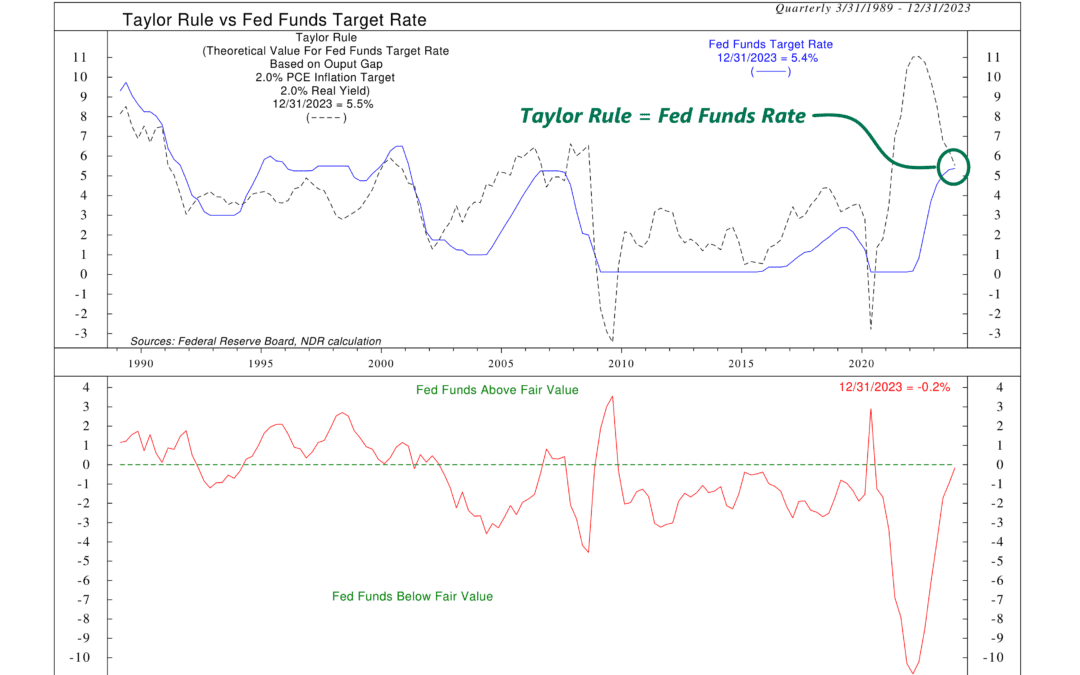

At the latest Federal Reserve meeting, chairman Jerome Powell mentioned that inflation continues to “move down gradually on a sometimes bumpy road to 2%.” Why is 2% such a big deal? Well, hitting that target gives the Fed the green light to consider cutting...

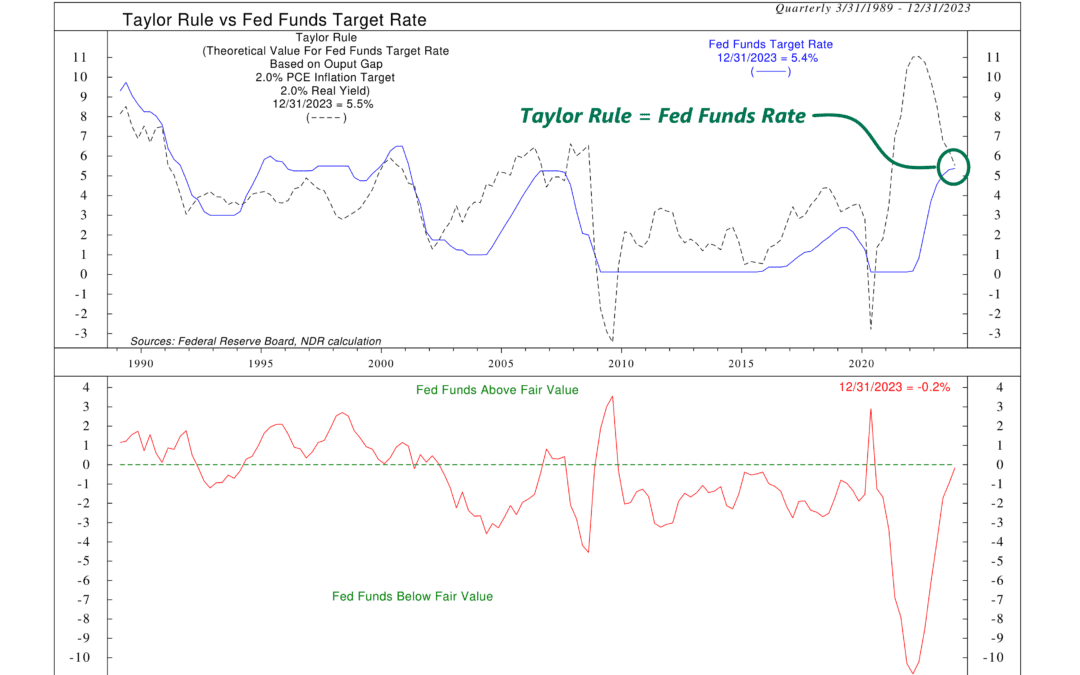

by NelsonCorp Wealth Management | Mar 22, 2024 | Chart of the Week

The big financial news this week was all about the Federal Reserve’s meeting on Wednesday. Pretty much everything happened as expected. The Fed decided to keep its policy rate steady at 5.5% for now, but they’re still thinking about cutting rates up...