by NelsonCorp Wealth Management | Mar 15, 2024 | Chart of the Week

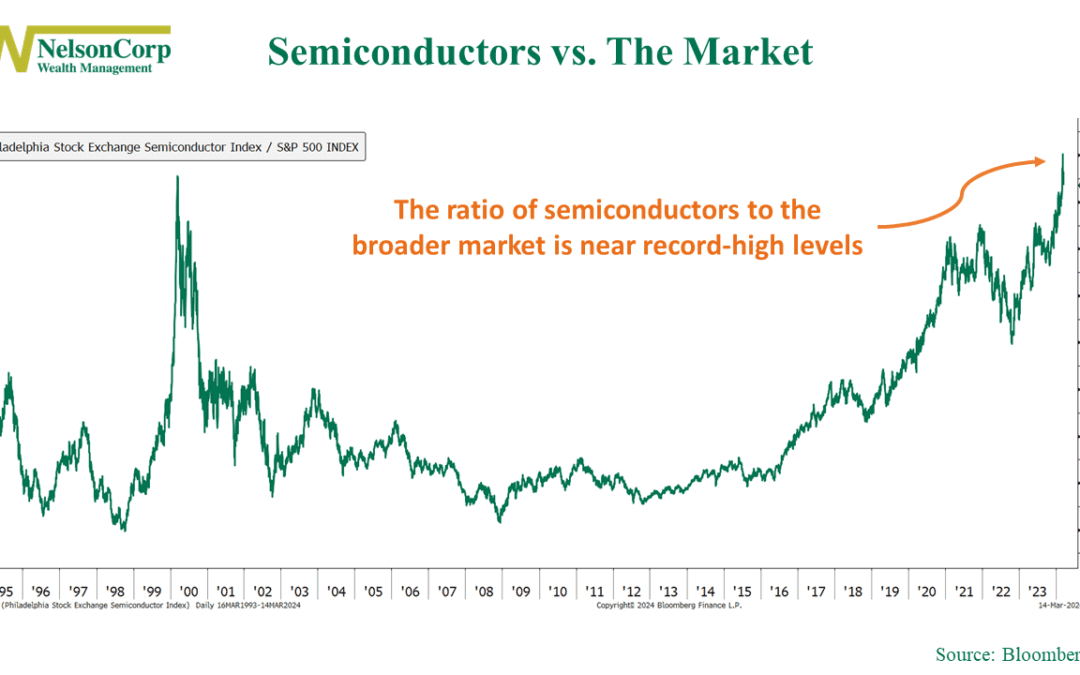

Some have said semiconductors are the new oil. The stock market agrees. Our featured chart this week shows the ratio of the Philadelphia Stock Exchange Semiconductor Index to the S&P 500 Index. This essentially illustrates how the semiconductor sector has...

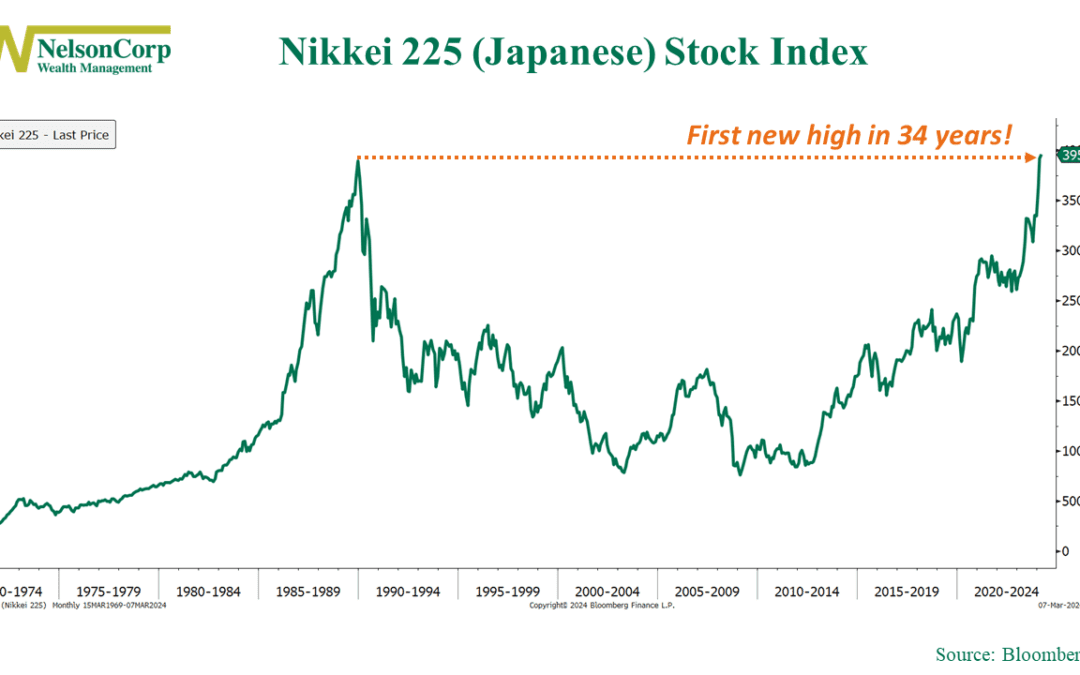

by NelsonCorp Wealth Management | Mar 8, 2024 | Chart of the Week

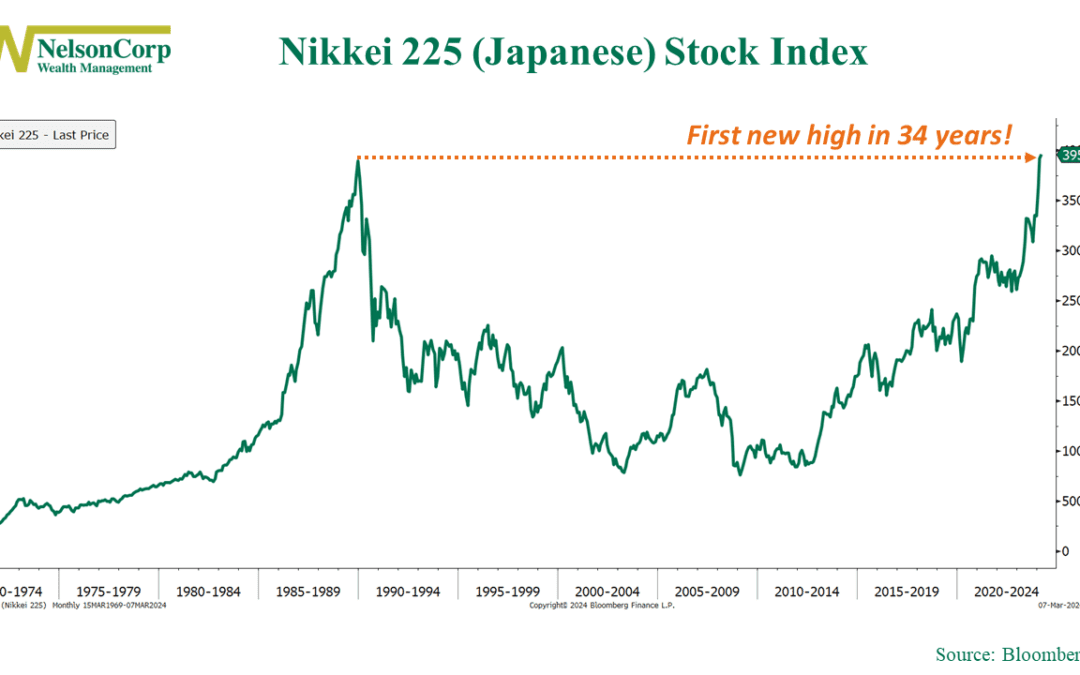

It’s been a while, but the Japanese stock market finally hit a new all-time high this month. It reminds me of that scene in the movie Titanic where the old woman who survived the tragic incident starts her story by saying, “It’s been 84 years…” Okay, maybe it hasn’t...

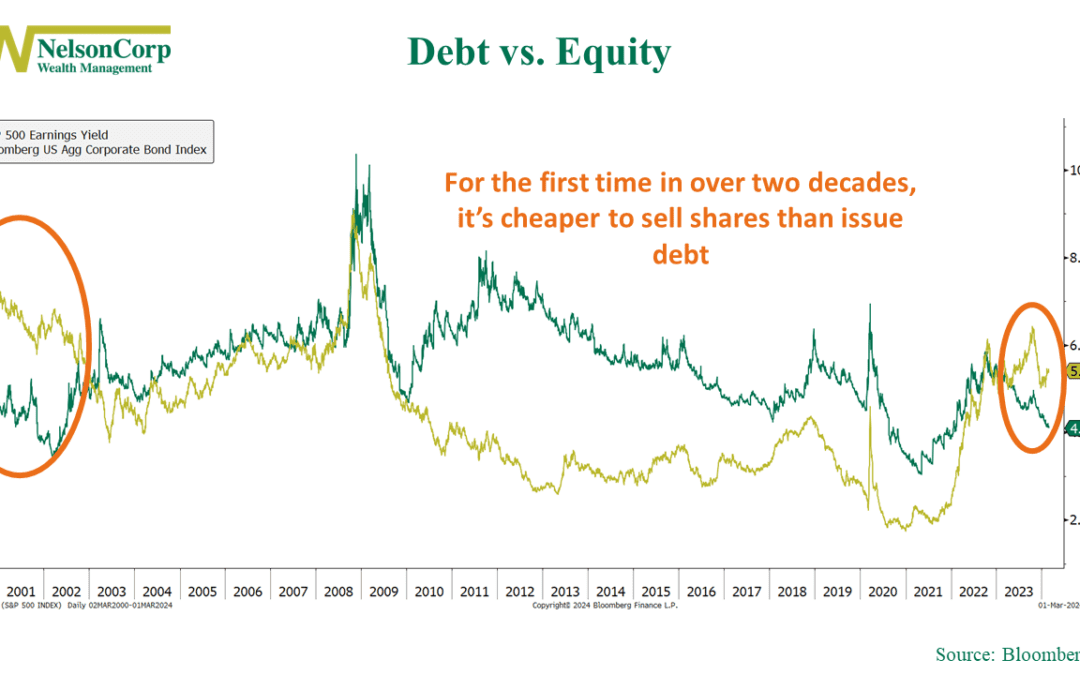

by NelsonCorp Wealth Management | Mar 1, 2024 | Chart of the Week

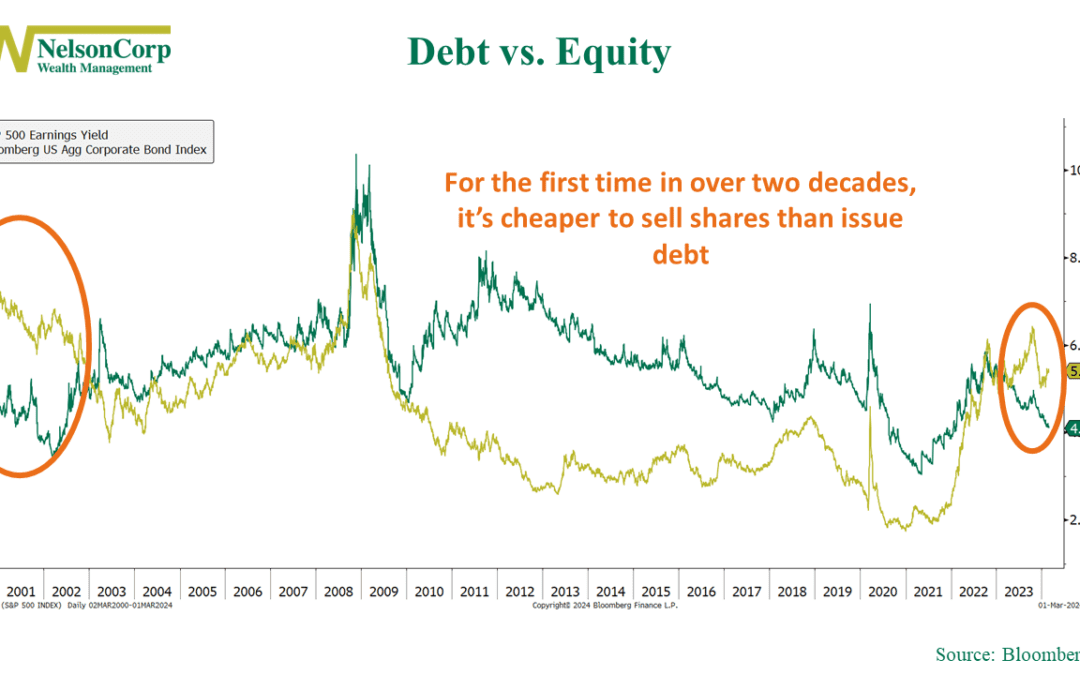

Let’s say you’re a big company and need to raise some cash. You’ve generally got two options: borrow money or sell a piece of your company. Borrowing money has largely been the go-to choice for the past couple of decades. That’s because not only is...

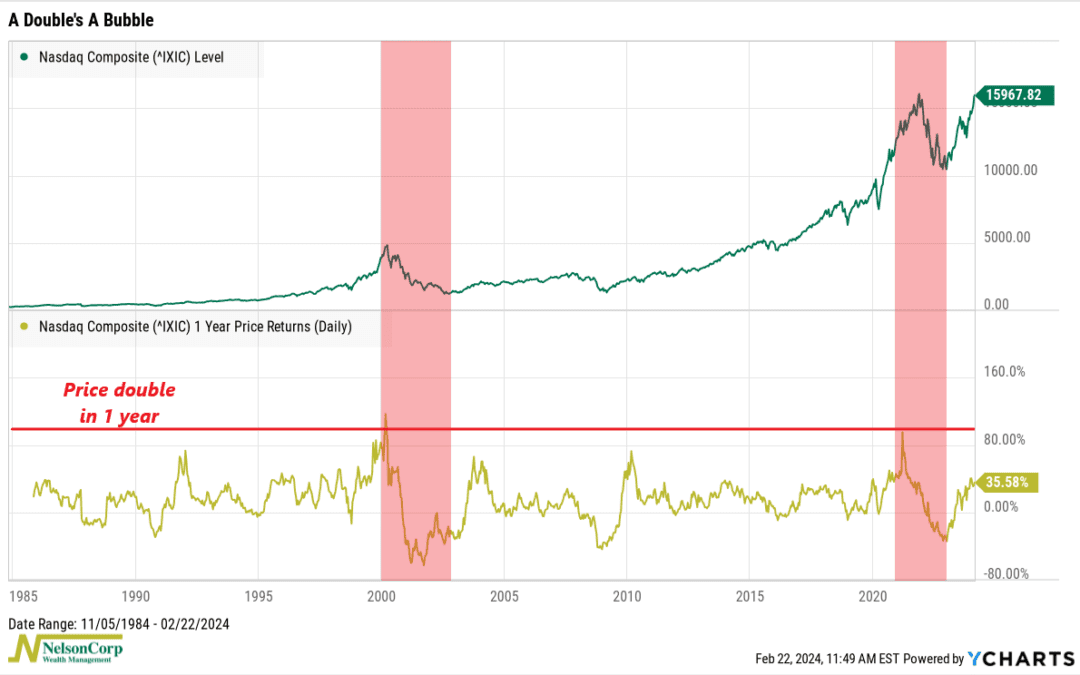

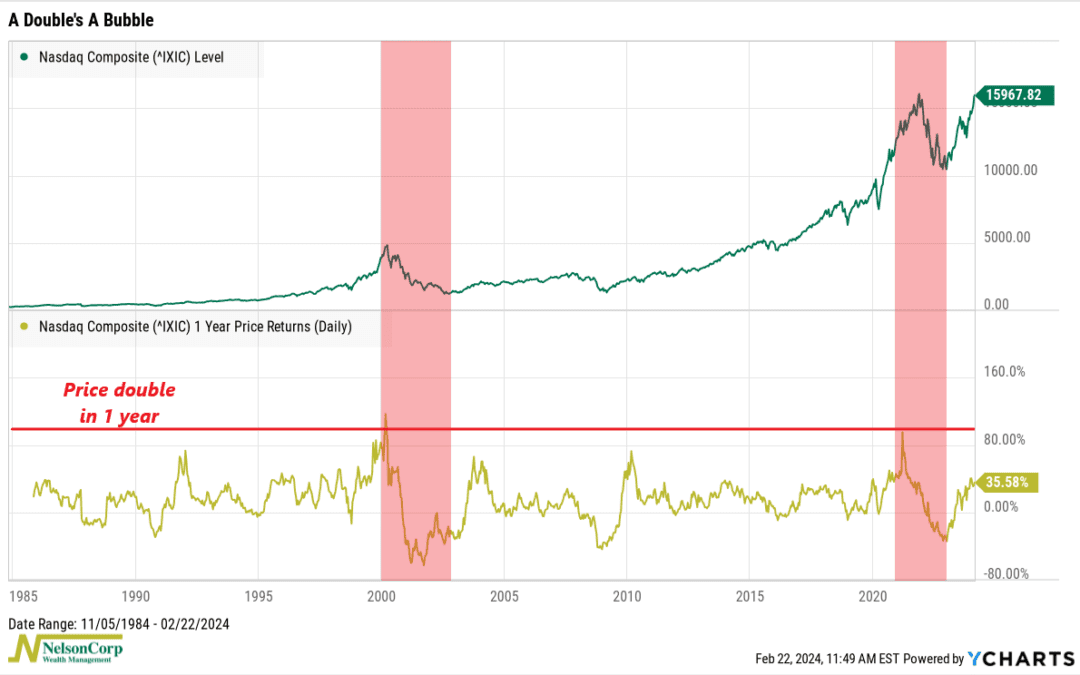

by NelsonCorp Wealth Management | Feb 23, 2024 | Chart of the Week

The tech sector has been booming lately. Since the January 2023 low, the Nasdaq Composite—a good measure of tech stock performance—has gained roughly 55%. Naturally, that’s got investors asking: is the tech sector overvalued? One way to answer this is by...

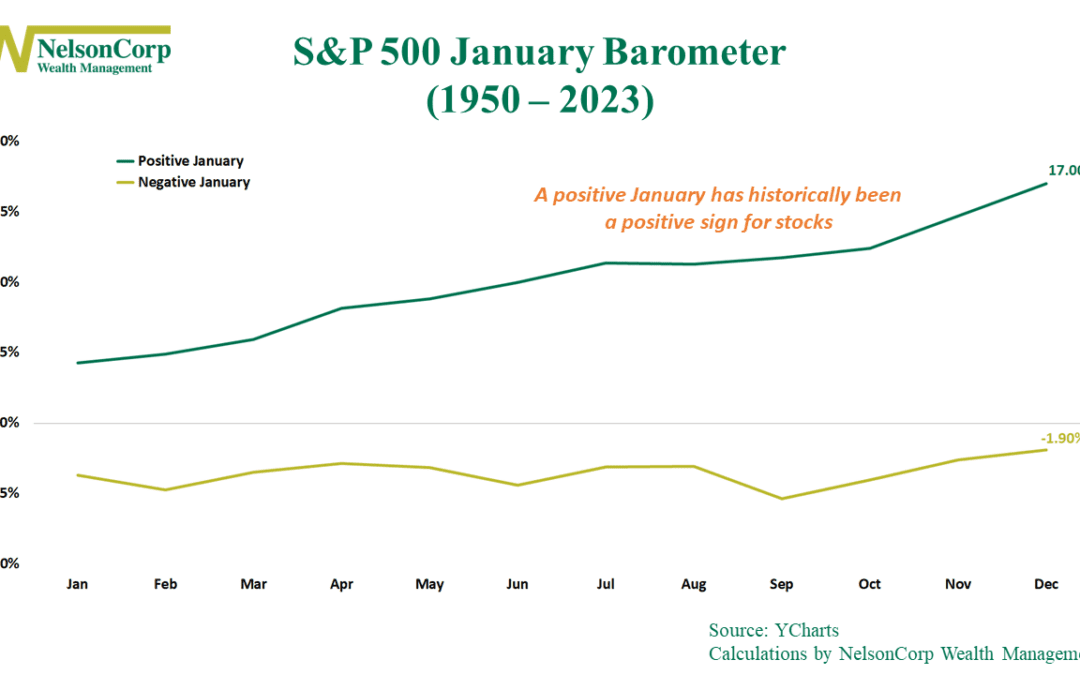

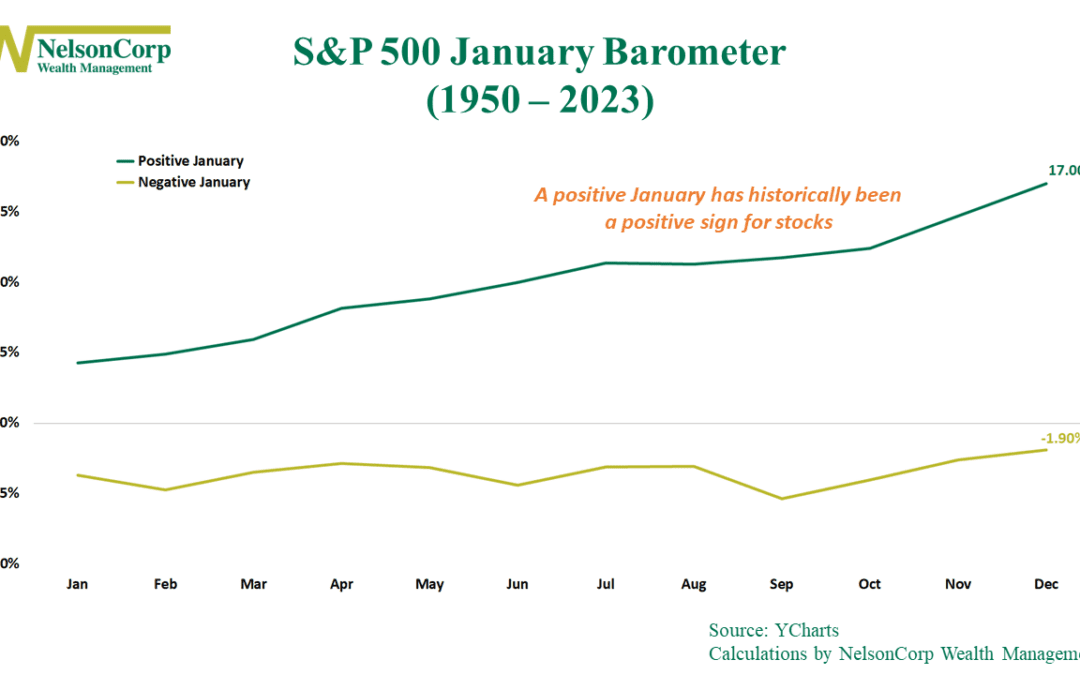

by NelsonCorp Wealth Management | Feb 16, 2024 | Chart of the Week

In 1972, Yale Hirsch, the author of the popular investment guide the “Stock Trader’s Almanac,” uncovered a fascinating stock market pattern he dubbed the “January Barometer.” Simply put, he observed that how the S&P 500 Index performs in January...

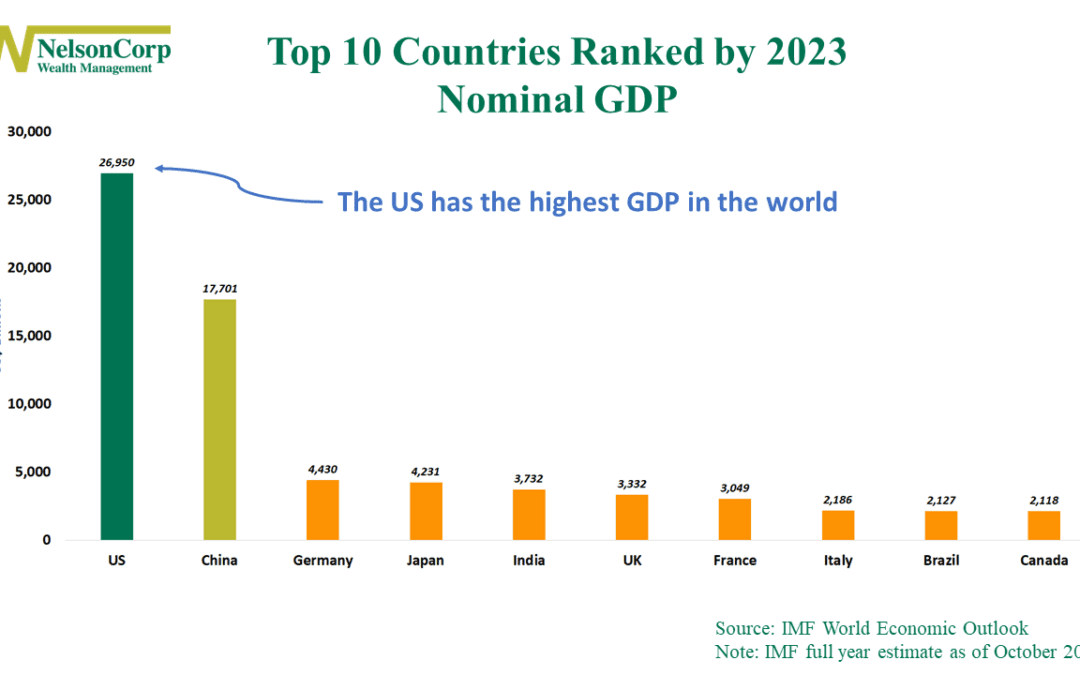

by NelsonCorp Wealth Management | Feb 9, 2024 | Chart of the Week

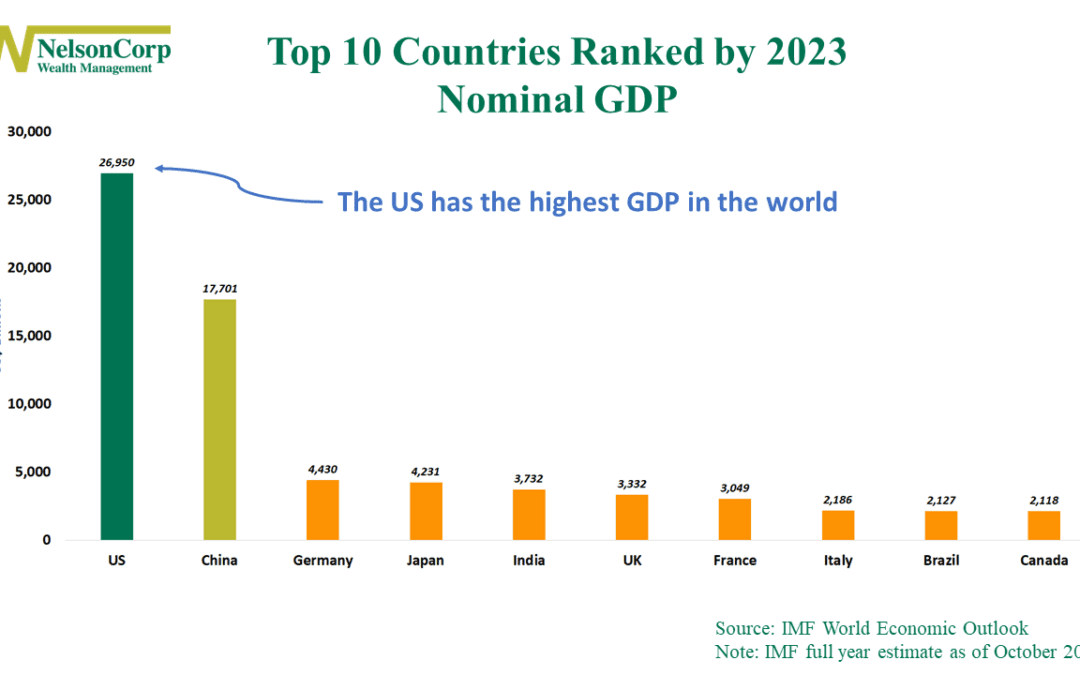

This week’s chart shows the top 10 countries in the world ranked by nominal GDP or economic growth. As you can see, the U.S. continues to dominate the rest of the world—and by a pretty wide margin. According to the latest IMF World Economic Outlook report, the...