by NelsonCorp | Jan 22, 2026 | Indicator Insights

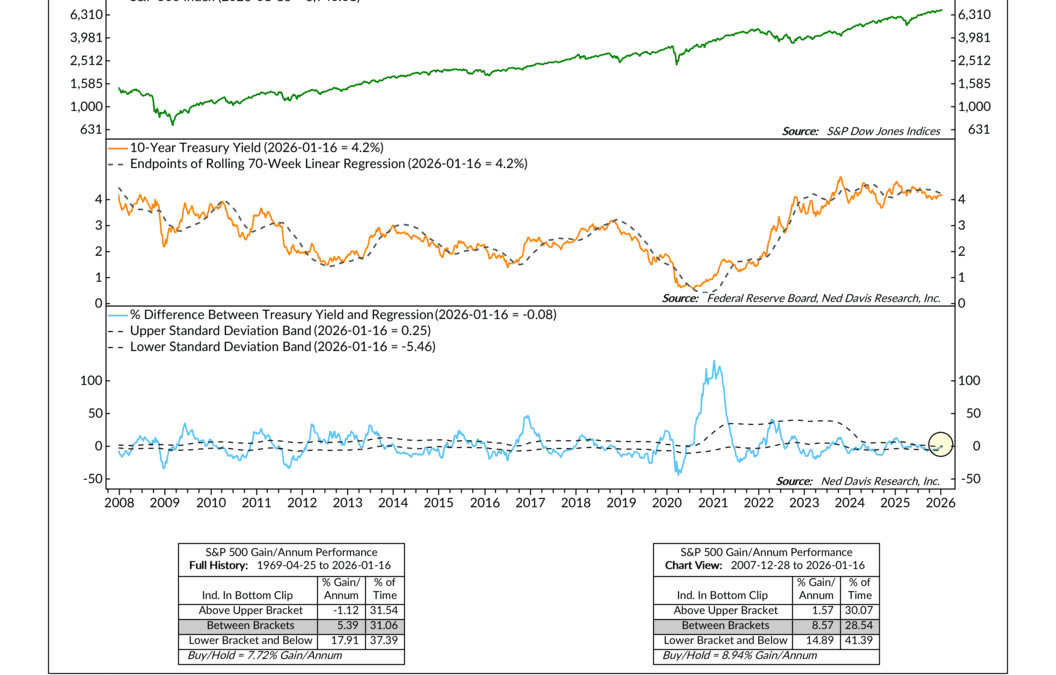

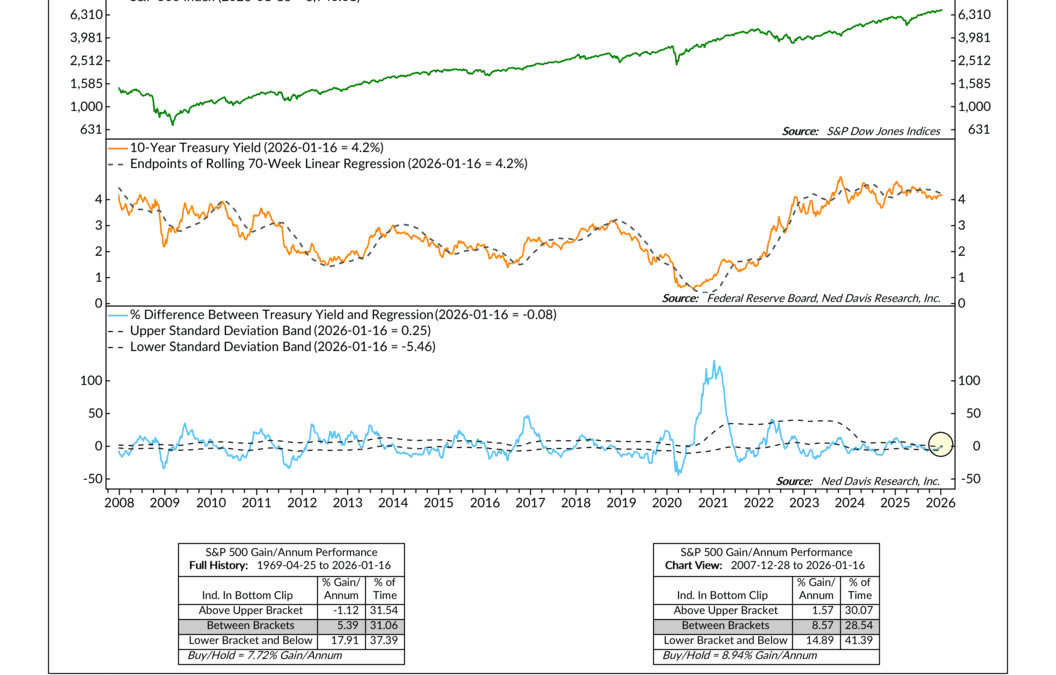

Interest rates are important for the stock market. In a technical sense, they’re what we call the “discount rate.” This is the rate at which the future cash flows generated by the companies in the stock market get discounted back to the present. Because of how...

by NelsonCorp | Jan 15, 2026 | Indicator Insights

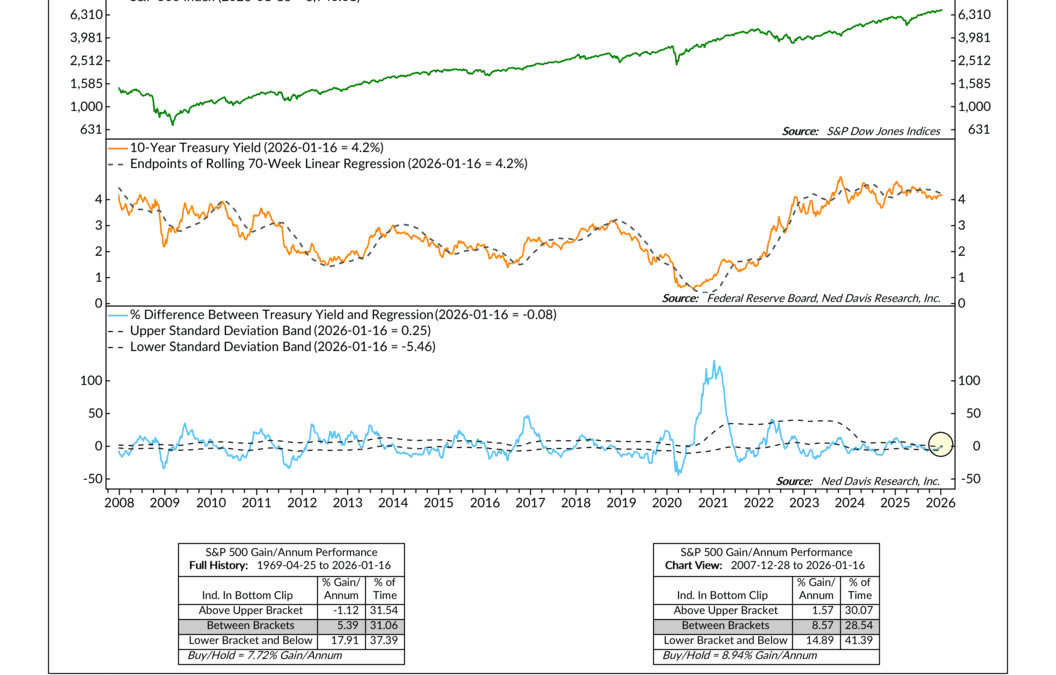

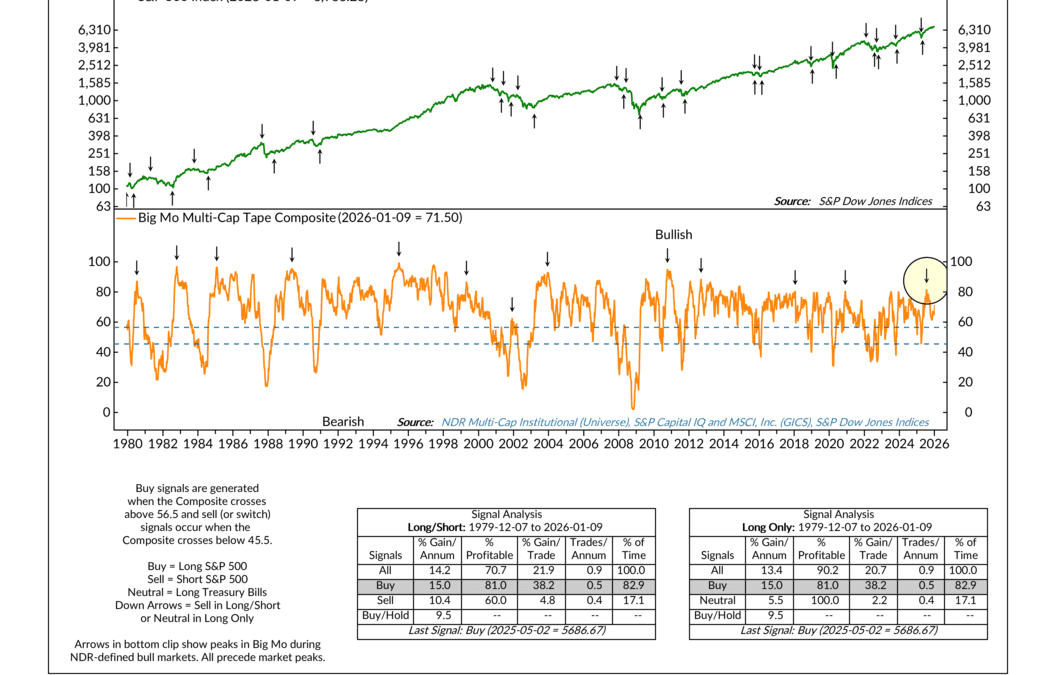

Momentum can be an interesting thing to measure in markets. Due to the nature of how momentum is calculated (a rate of change), it often tends to fade before prices actually peak. Think of it like a homemade rocket. The speed at which it’s rising slows down...

by NelsonCorp | Jan 8, 2026 | Indicator Insights

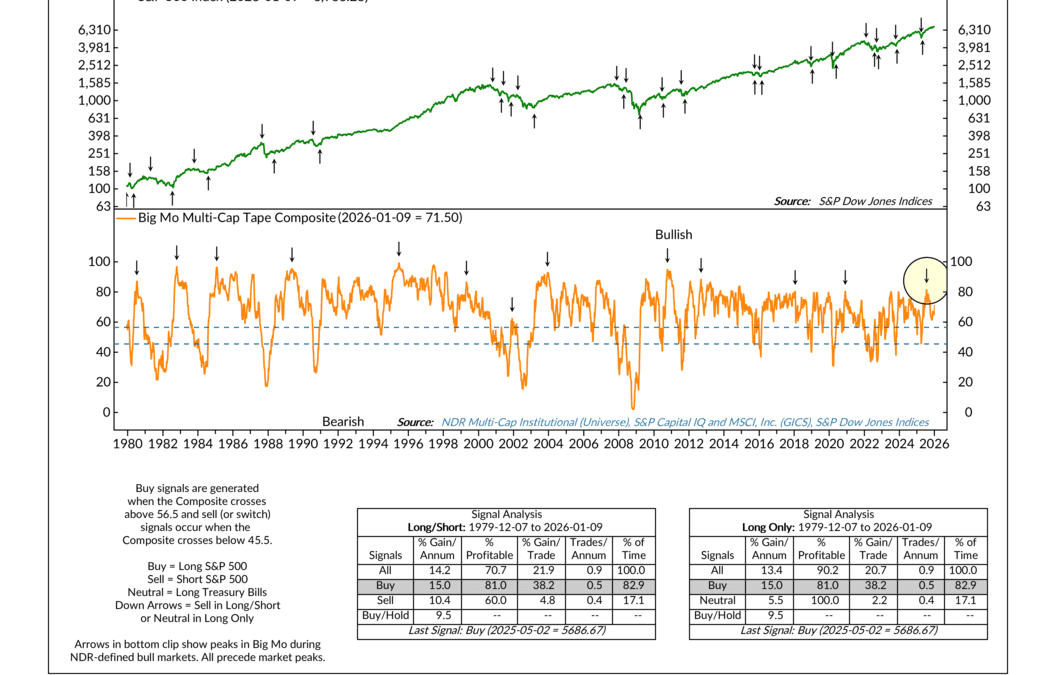

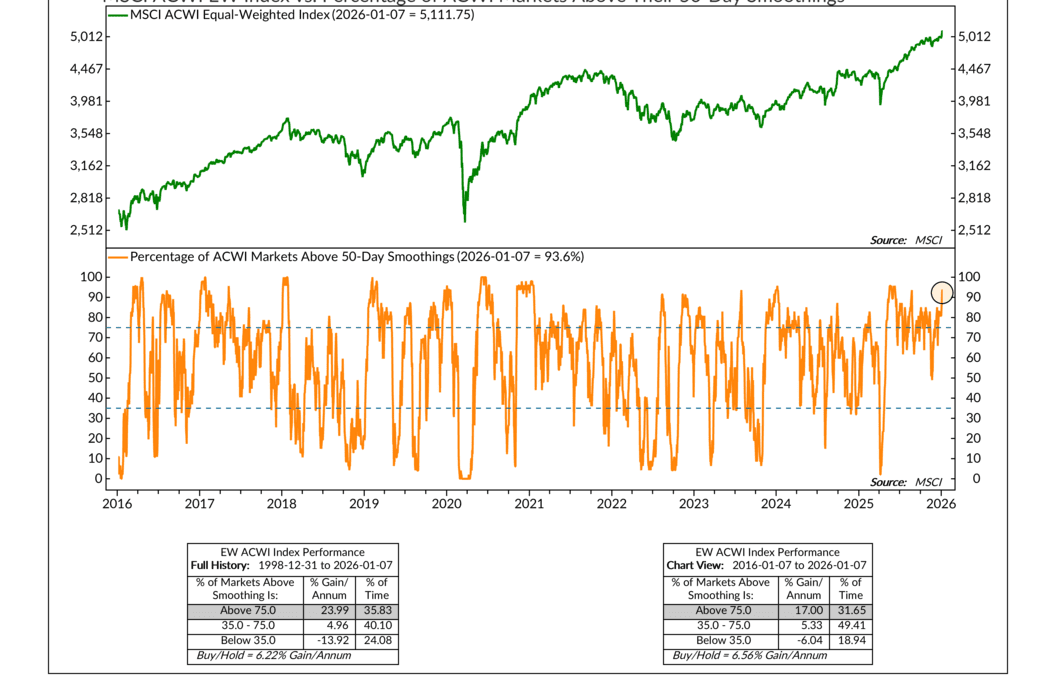

Coming into the new year, we wanted to see markets answer one simple question: Are stocks moving together, or is the rally being carried by just a handful of names? That distinction matters more than most investors realize. Broad participation is often the...

by NelsonCorp | Jan 1, 2026 | Indicator Insights

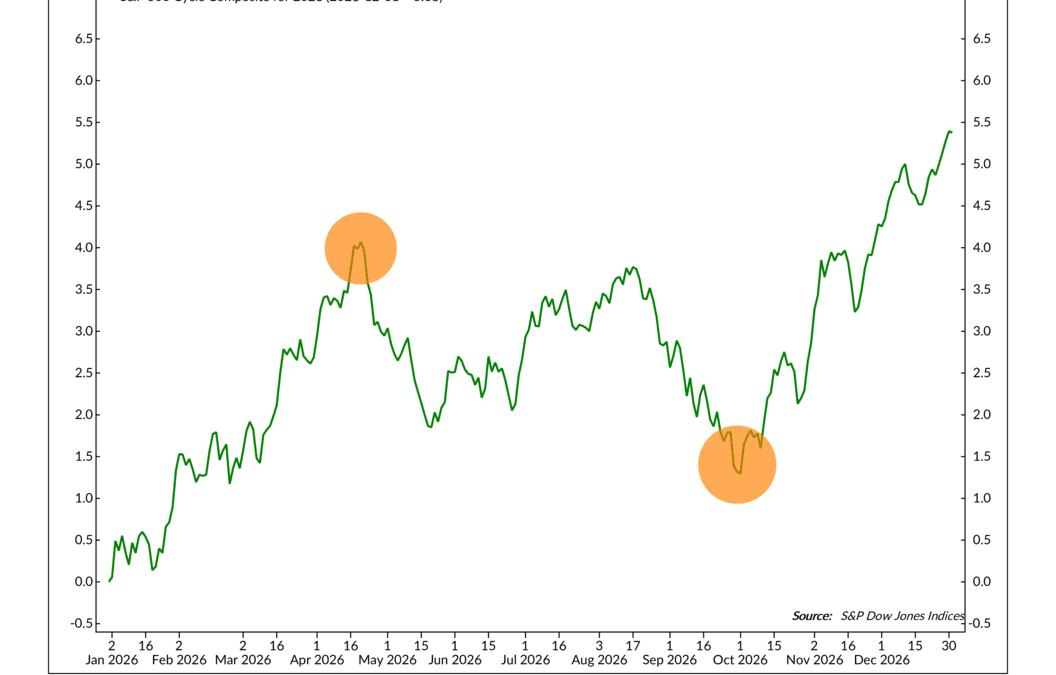

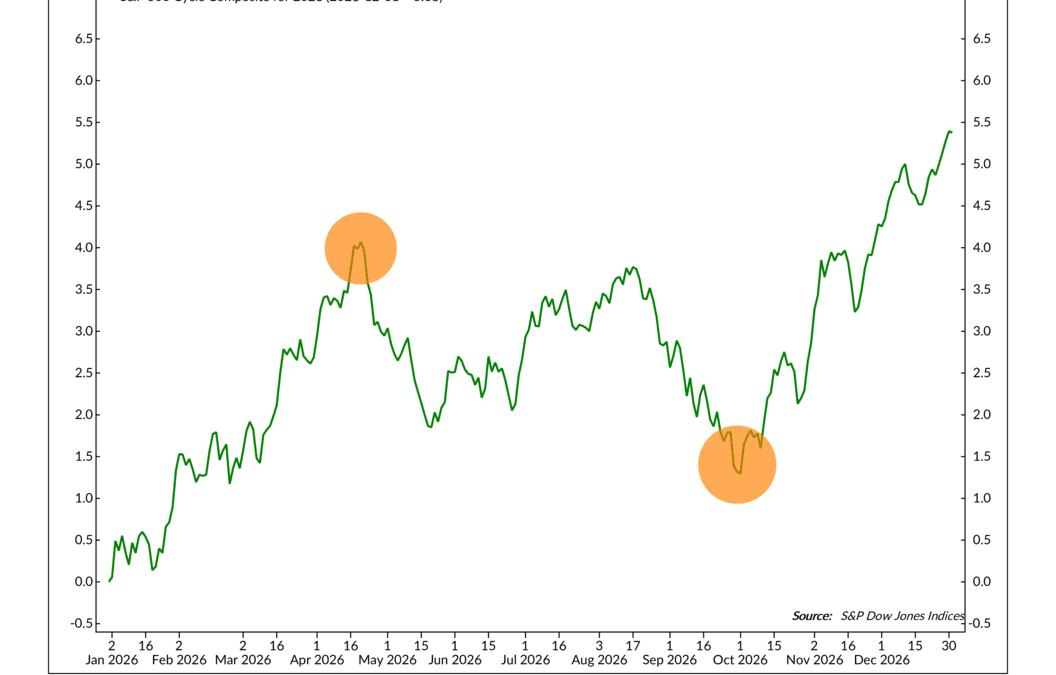

Today officially marks the first day of the new year, so let’s take a look at the NDR Cycle Composite for 2026 to see what the new year has in store for us. Now, this is one of the tools we use to help set expectations, not to make predictions. It’s based...

by NelsonCorp | Dec 25, 2025 | Indicator Insights

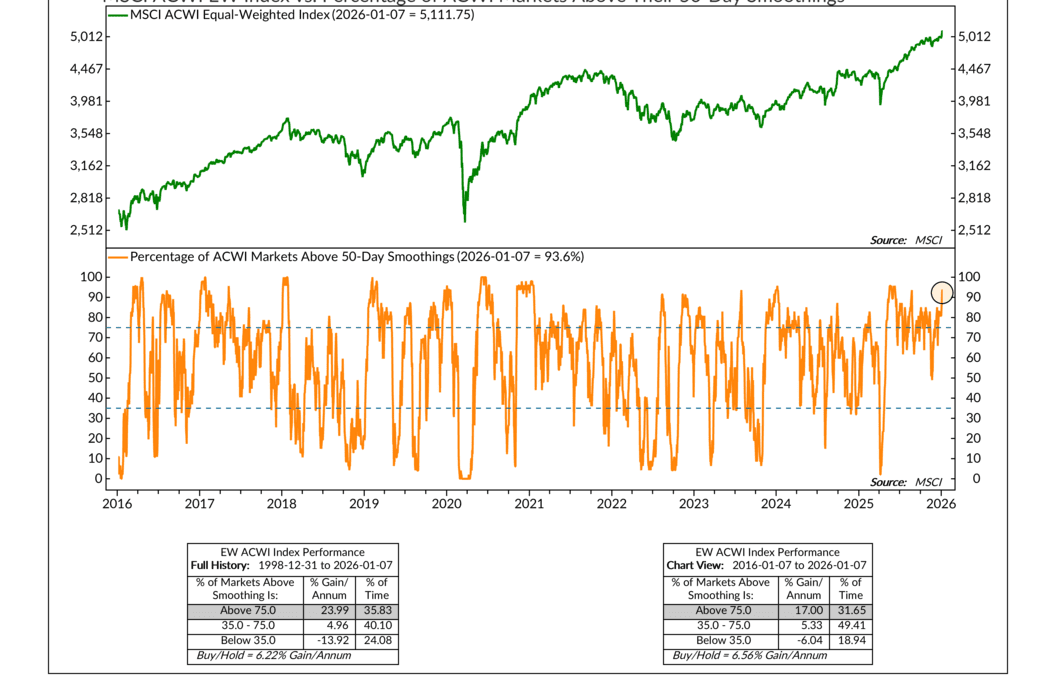

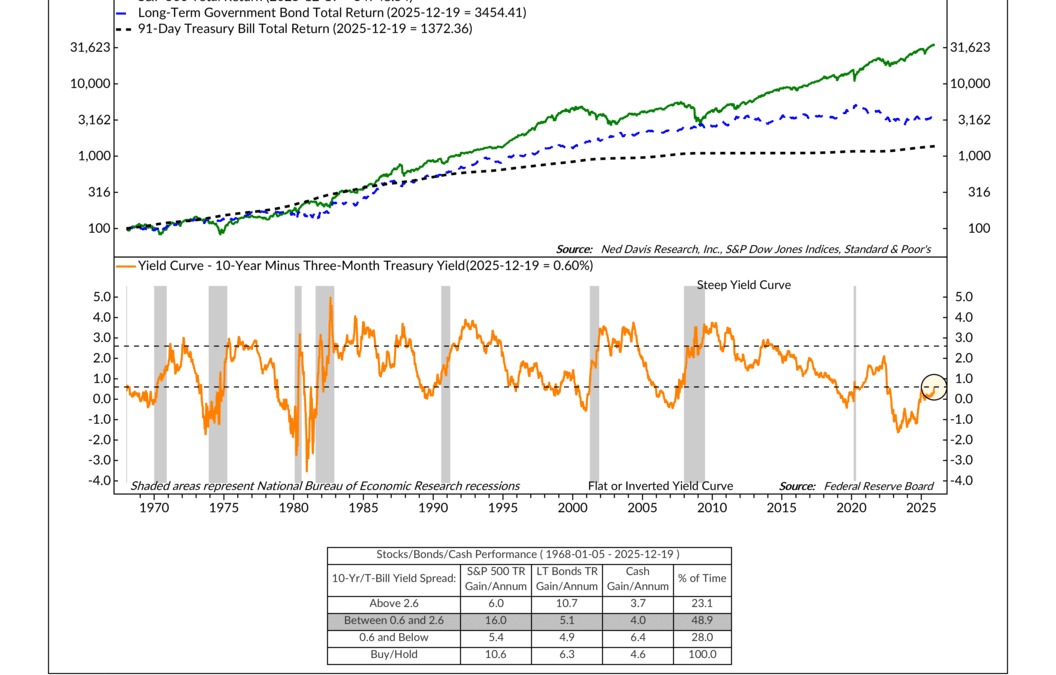

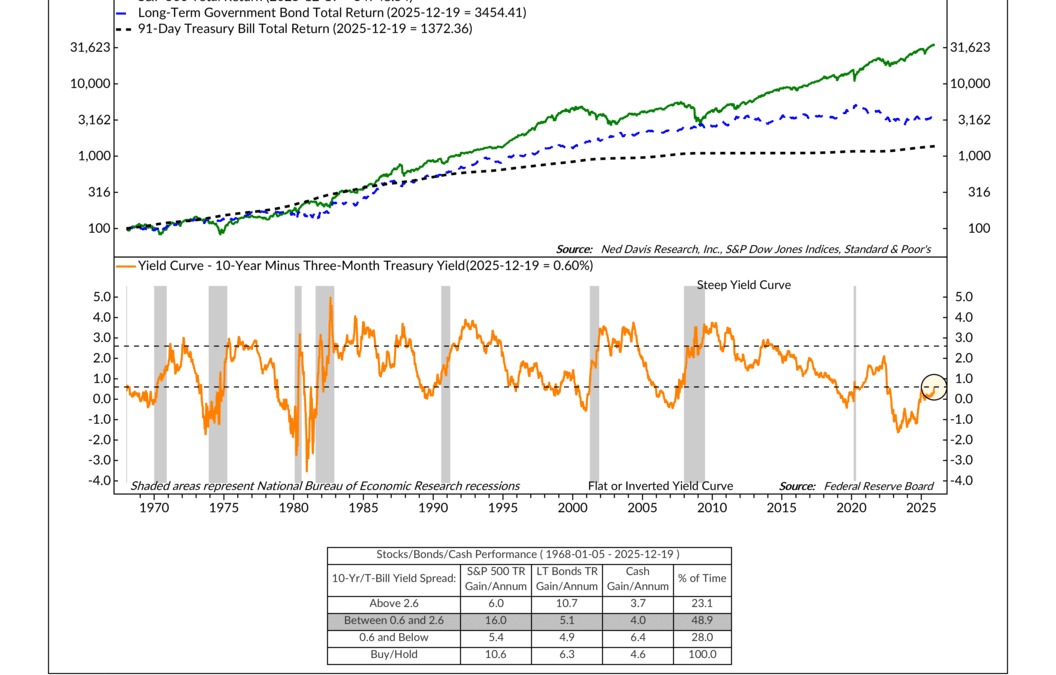

For this week’s indicator, we’re looking at a simple but powerful signal from the bond market called the yield curve. Don’t let the name scare you off. At its core, this indicator just compares two interest rates: the yield on a 10-year U.S. Treasury bond and...

by NelsonCorp | Dec 18, 2025 | Indicator Insights

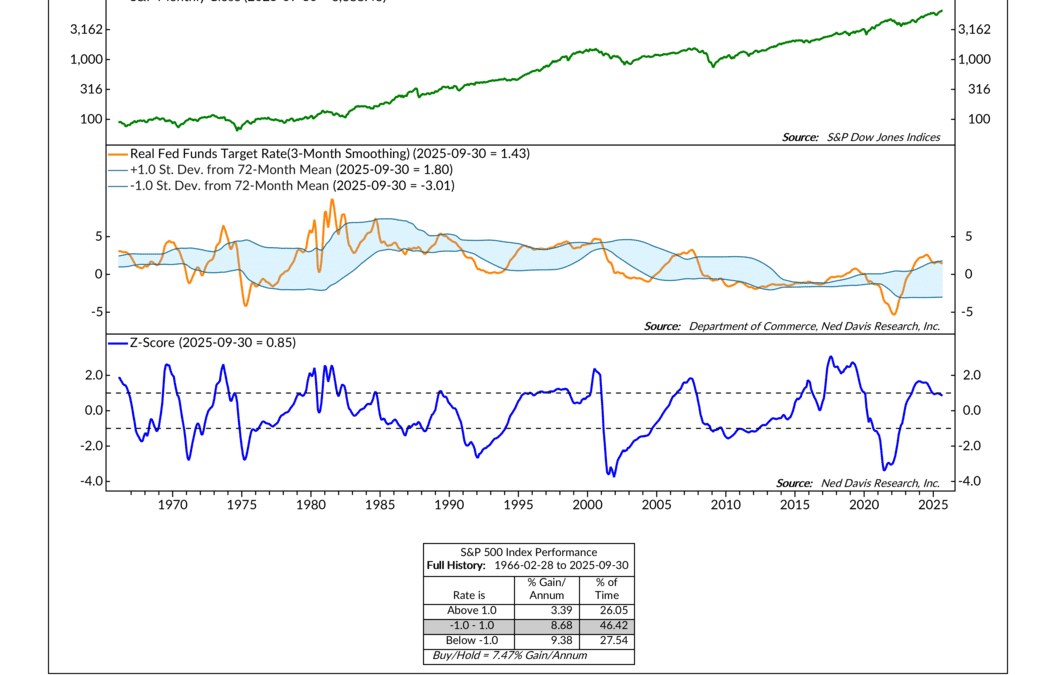

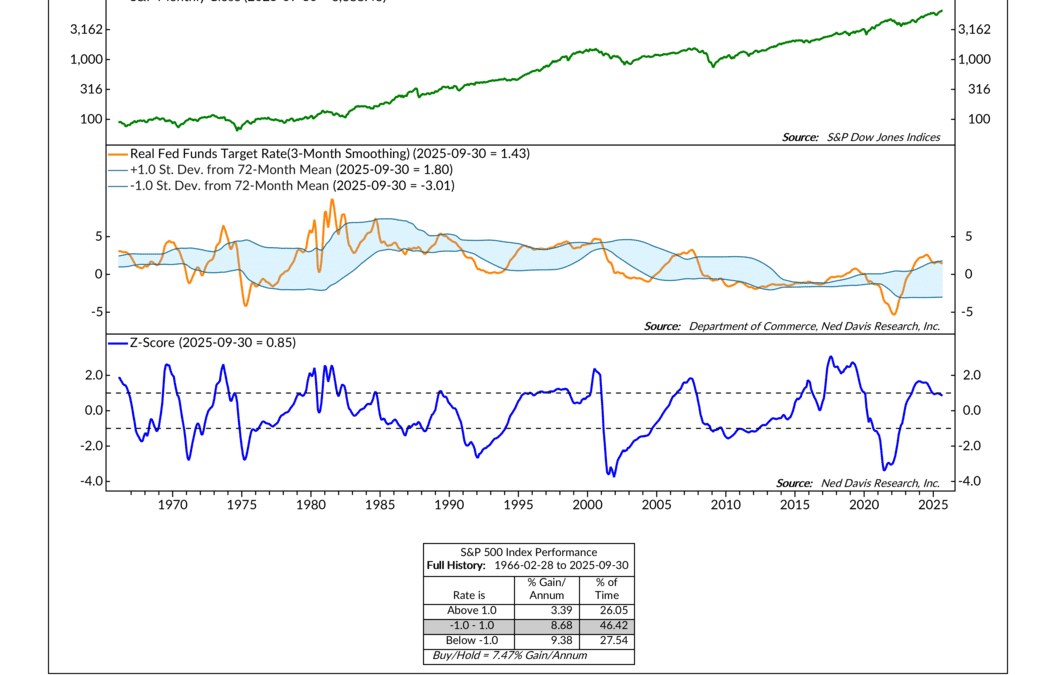

A lot of the time, when talking about interest rates, we talk in nominal terms. Treasury yields, mortgage rates, whatever—the stated, headline rate is the nominal rate. These matter, because they are what borrowers actually pay and lenders actually receive....