by NelsonCorp Wealth Management | Sep 5, 2024 | Indicator Insights

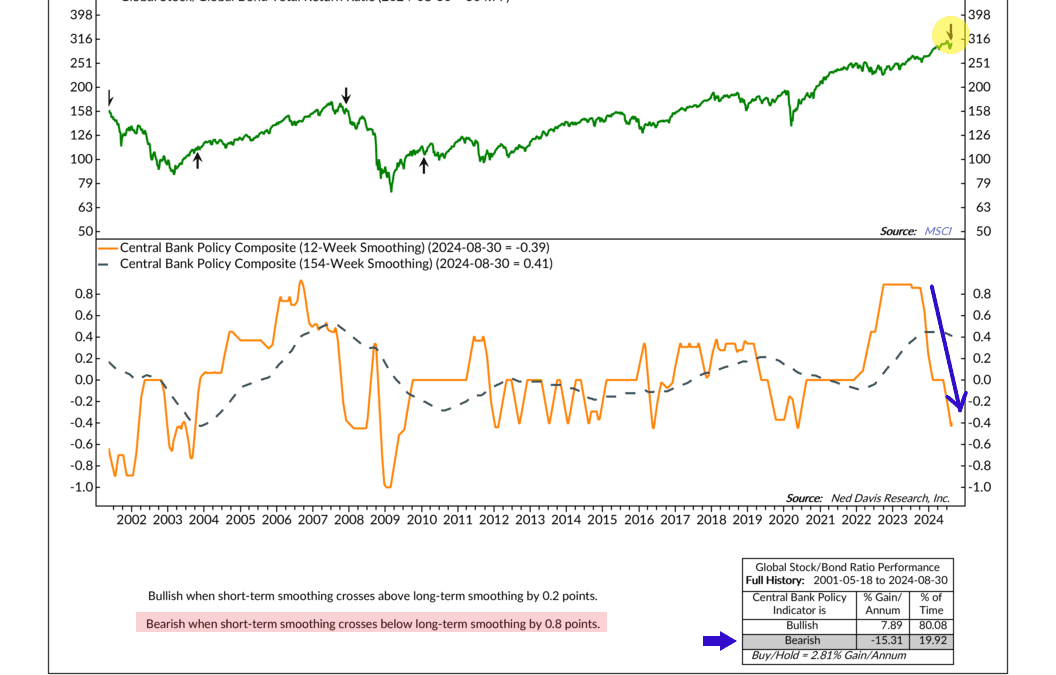

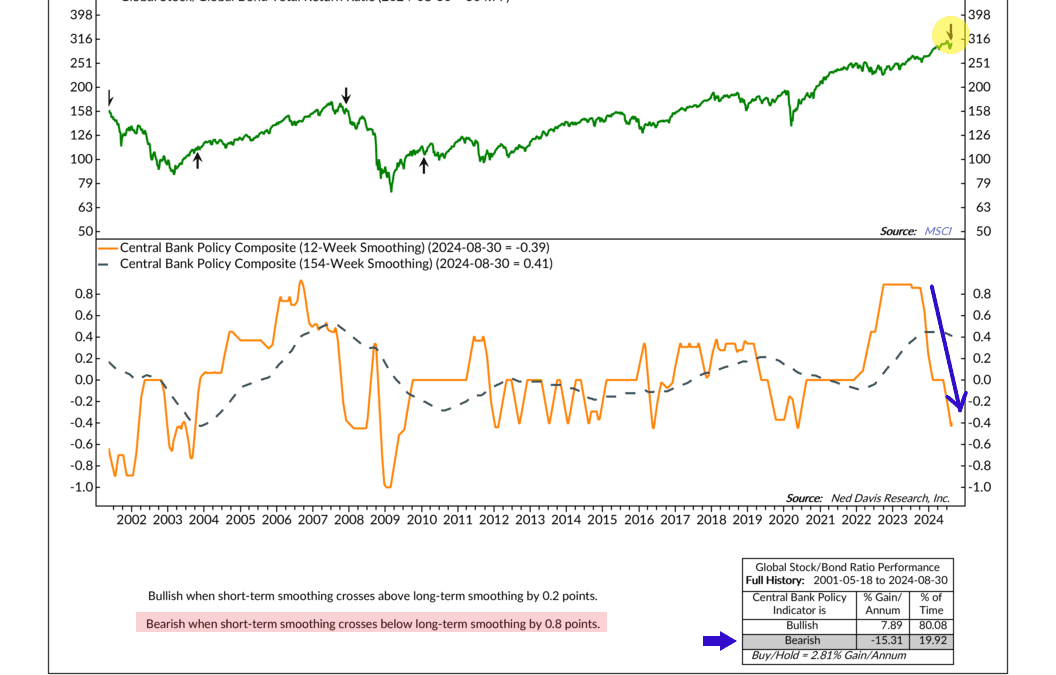

When it comes to financial markets, central banks matter. They’re a big player. What they do affects almost everything in the economy, so it’s important to keep an eye on their moves and know their policies. That’s where this week’s indicator comes into...

by NelsonCorp Wealth Management | Aug 29, 2024 | Indicator Insights

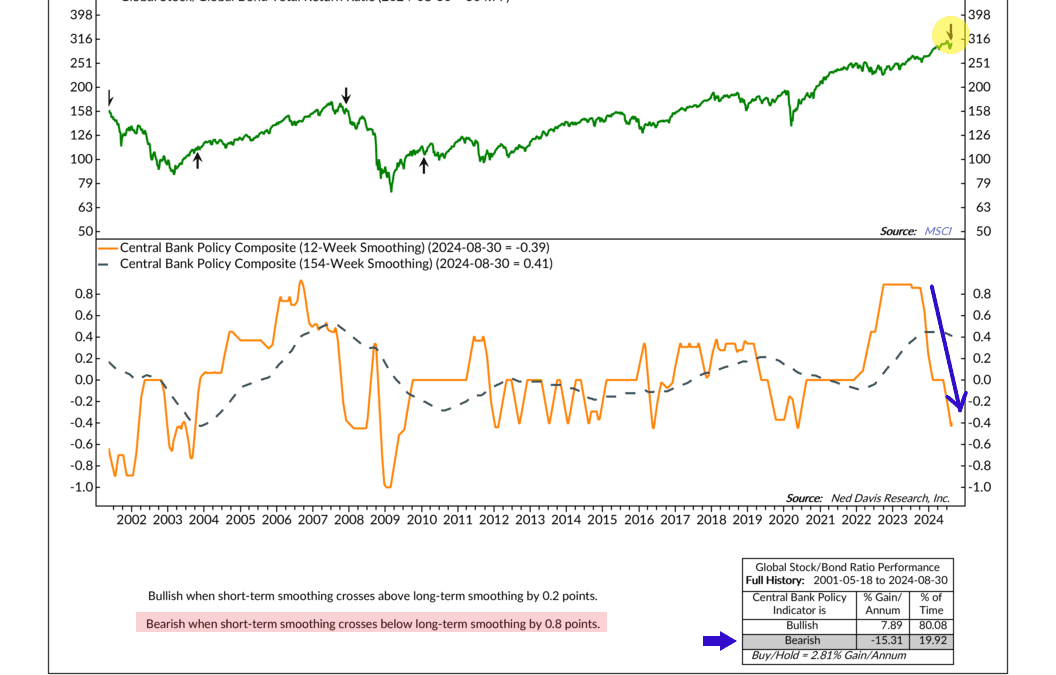

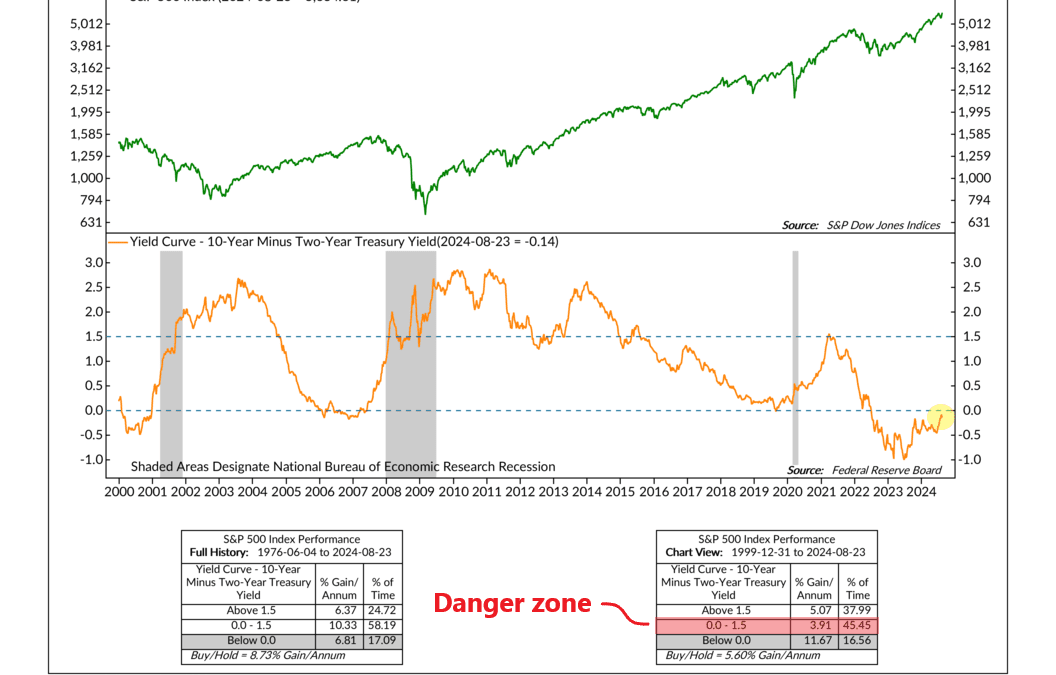

If you’ve kept your eye on financial markets the past few years, you’ve likely heard some buzz about the yield curve. It went negative over two years ago, meaning short-term rates (2-year Treasury rates) rose above long-term rates (10-year Treasury rates)....

by NelsonCorp Wealth Management | Aug 22, 2024 | Indicator Insights

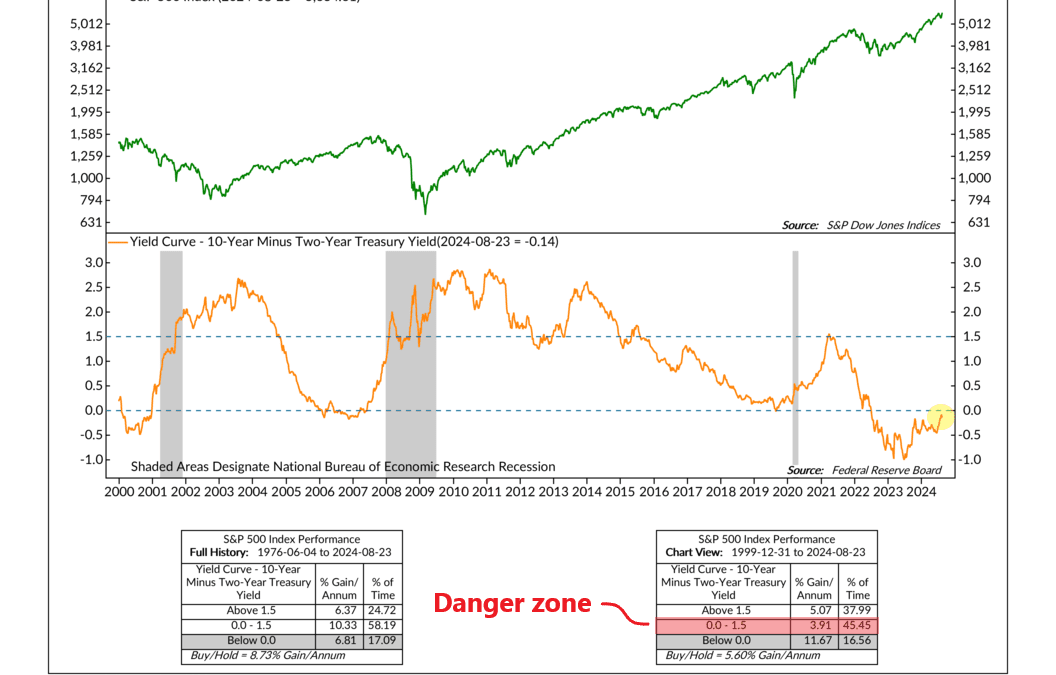

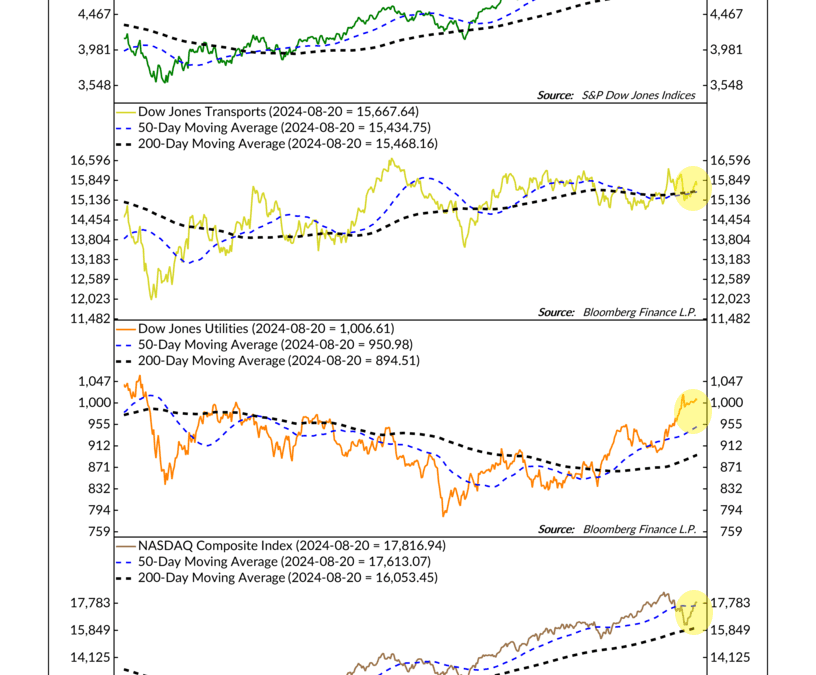

Let’s dive into this week’s indicator: moving averages in technical analysis. What’s a moving average, you ask? It’s simply a way to smooth out the ups and downs in stock prices, giving you a clearer view of the trend. Here’s how it works: imagine you’re...

by NelsonCorp Wealth Management | Aug 15, 2024 | Indicator Insights

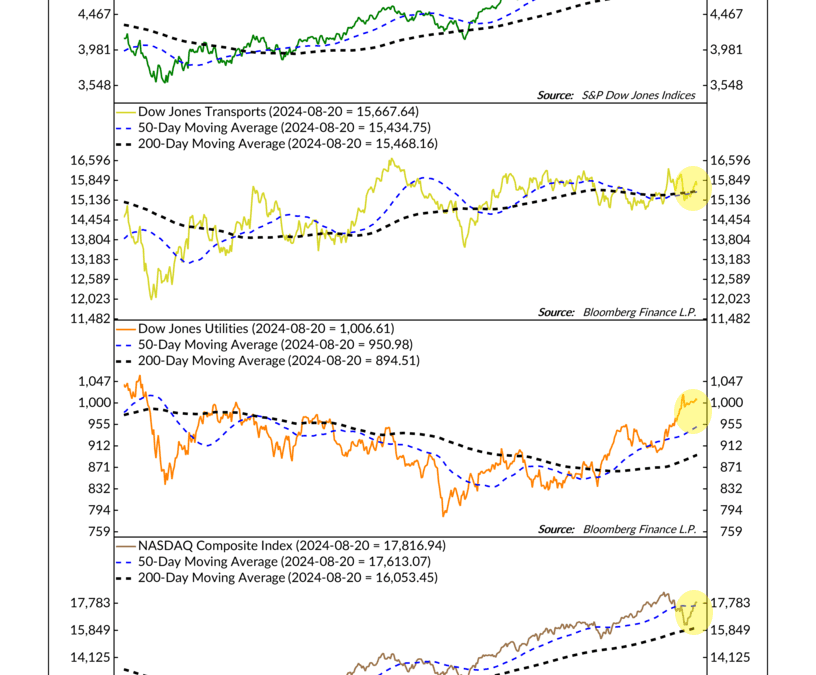

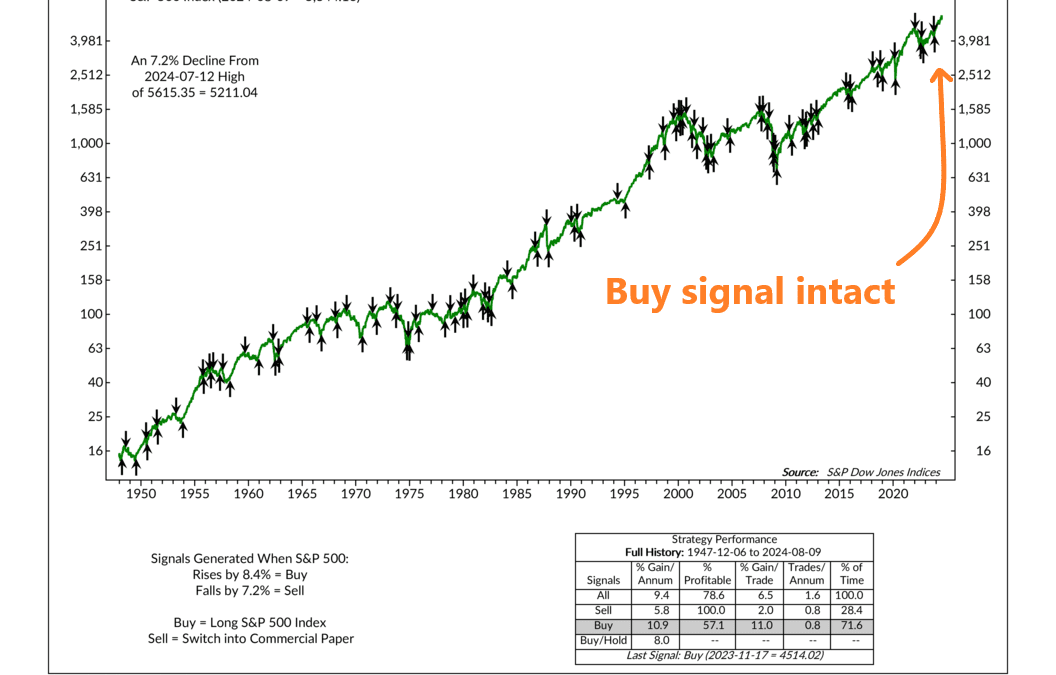

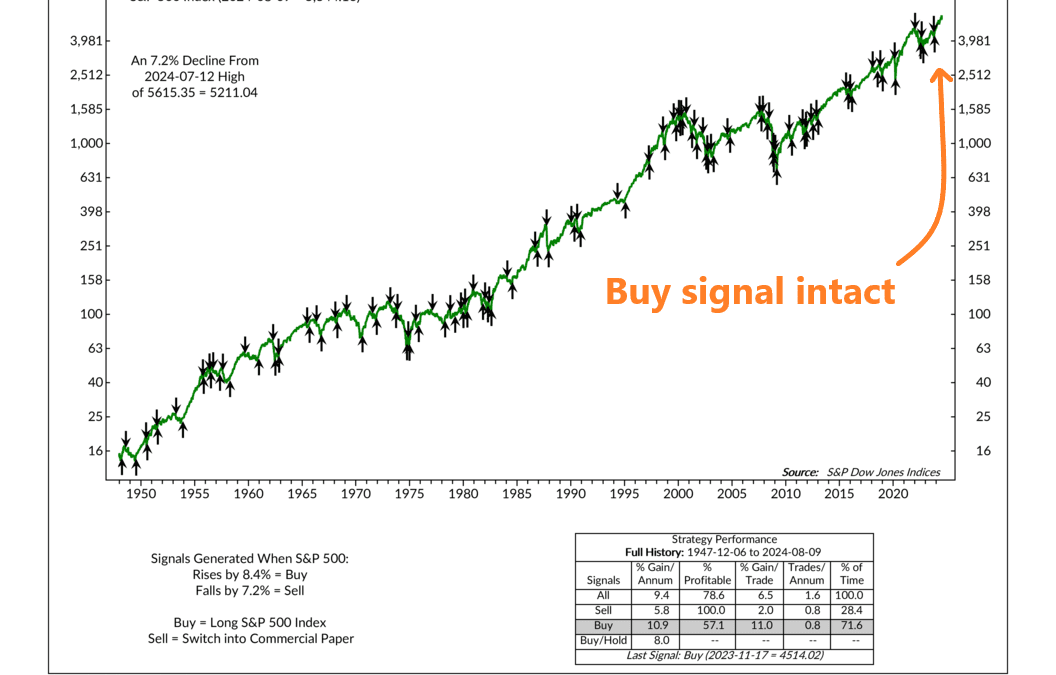

Imagine a simple stock market indicator. It looks at the market each week and determines if it’s going up or down. No bells. No Whistles. Just you and the price action. Pretty easy, right? Well, as a matter of fact, it is. Our featured indicator, shown above,...

by NelsonCorp Wealth Management | Aug 8, 2024 | Indicator Insights

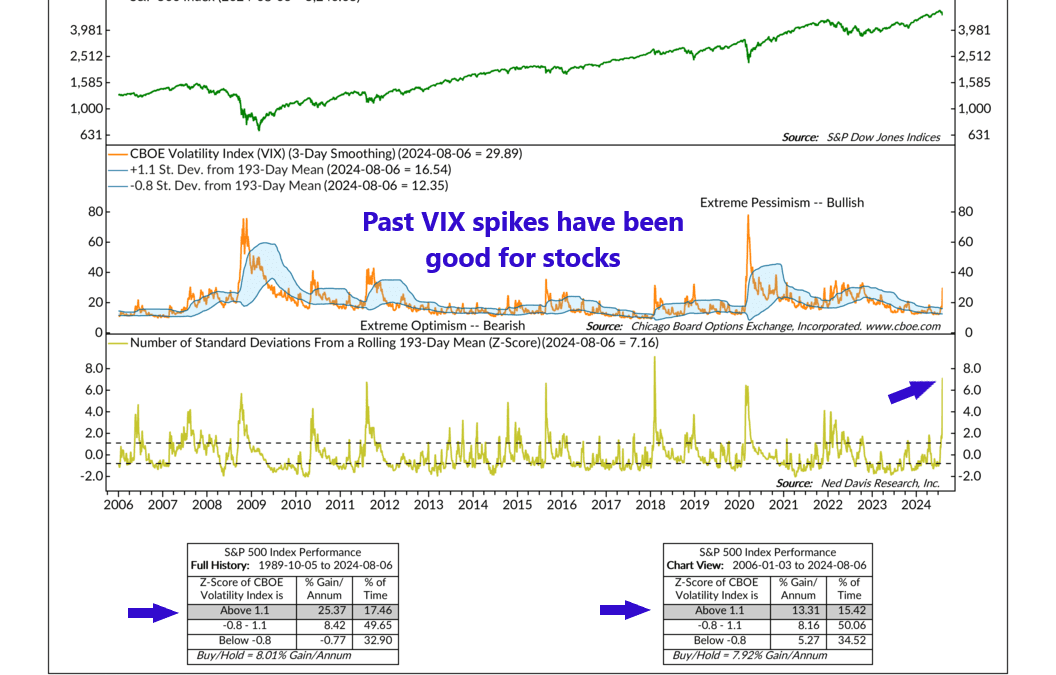

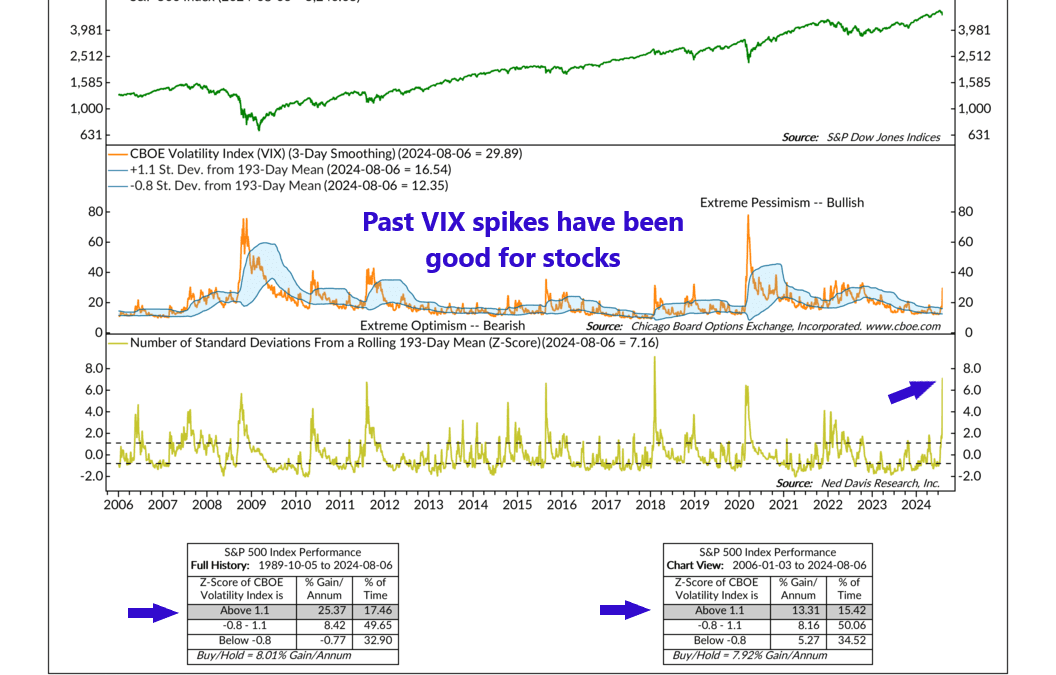

If you’re like me, you’ve probably been catching some Olympic events on TV lately. Volleyball is one of my favorites. There’s something really exciting about watching players leap into the air and powerfully spike the ball over the net. This week, a...

by NelsonCorp Wealth Management | Aug 1, 2024 | Indicator Insights

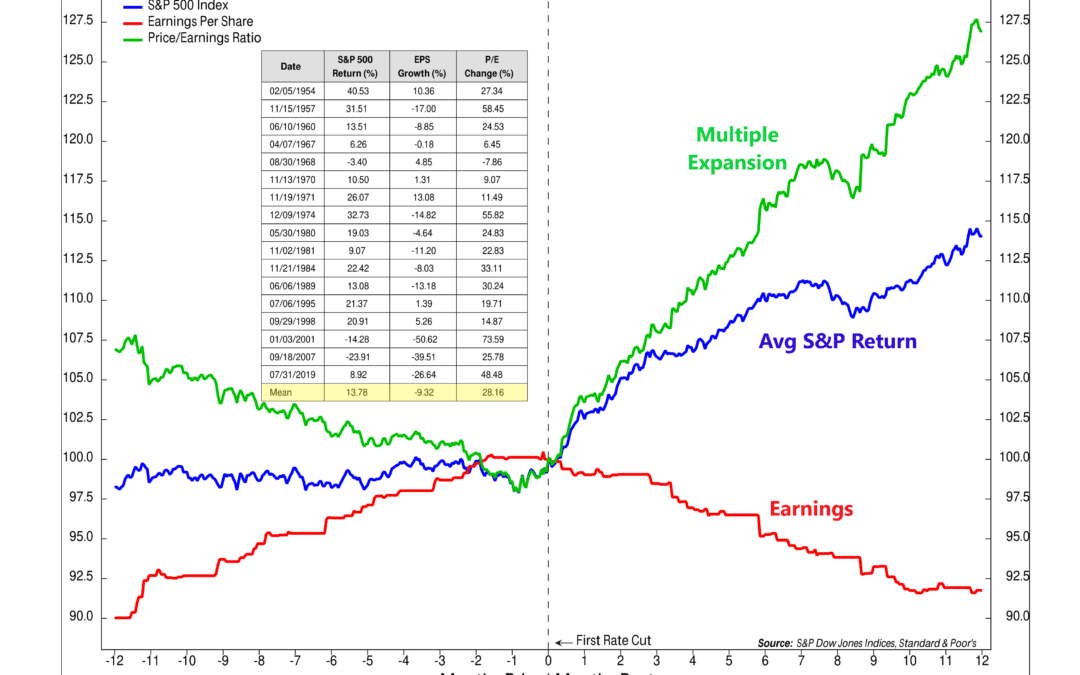

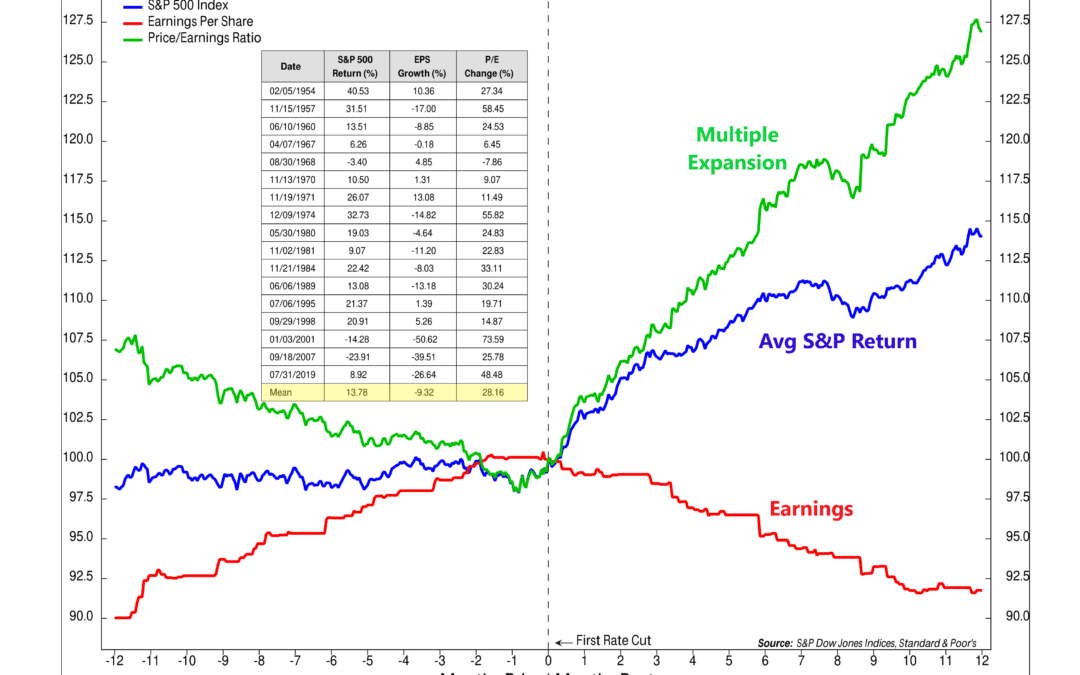

What happens to the stock market after the Federal Reserve first cuts interest rates? With the September FOMC meeting approaching and the Fed expected to make its first rate cut, this question is on many people’s minds. Let’s look at this...