by NelsonCorp Wealth Management | May 11, 2023 | Indicator Insights

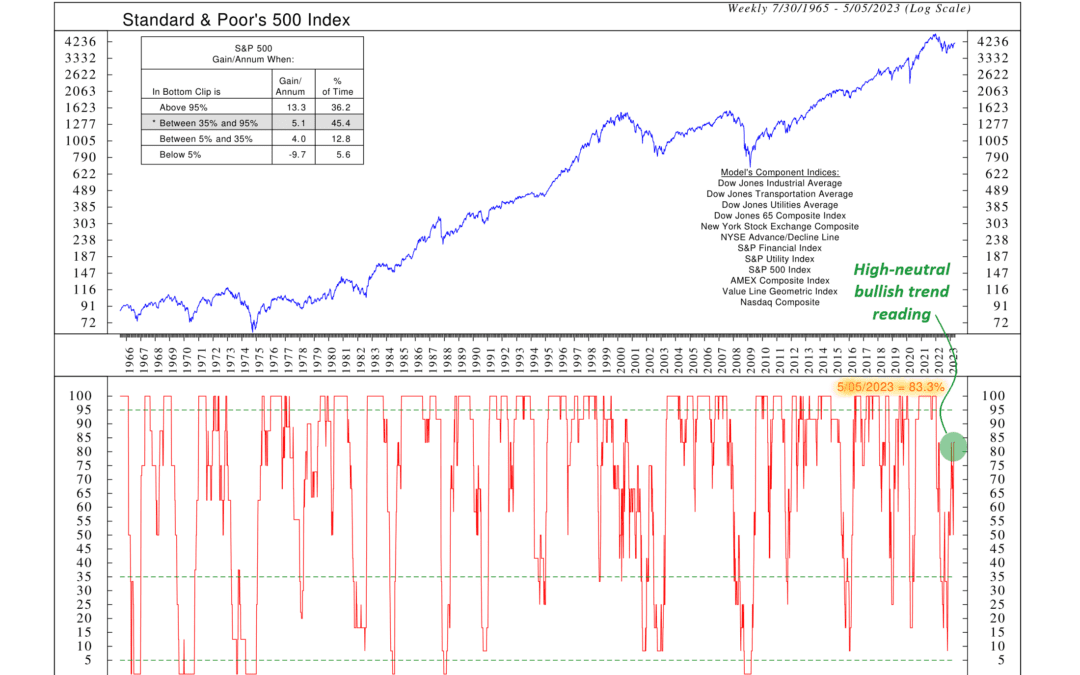

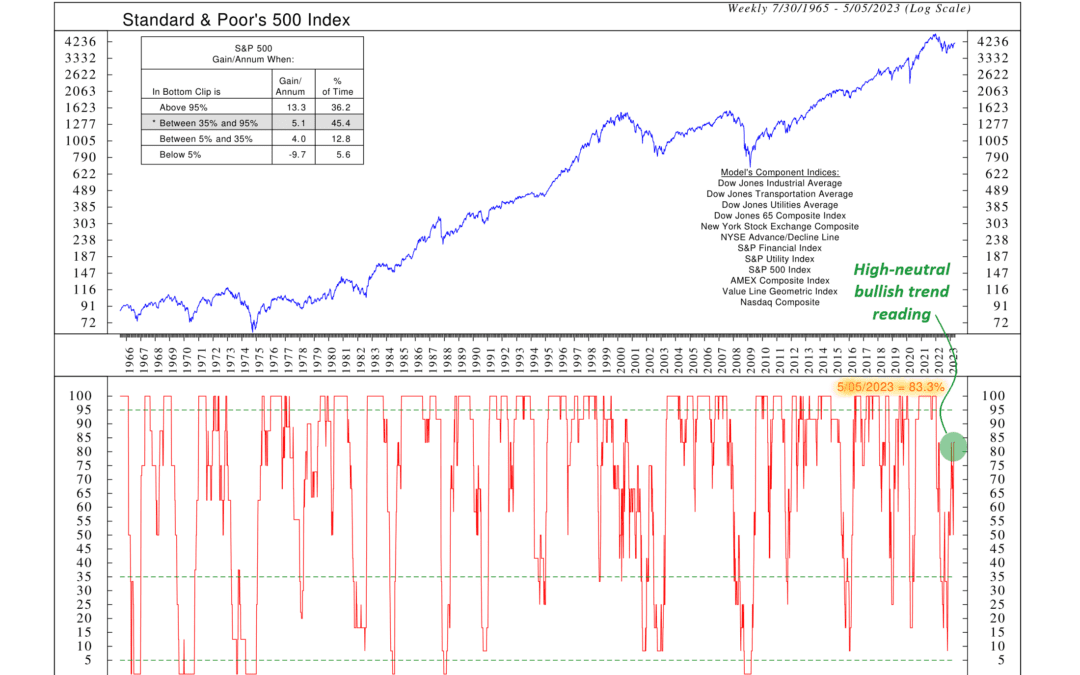

A lot of investing success comes from being able to stay on the right side of a trending market. This principle is encapsulated by the industry phrase “Keep the trend your friend.” In other words, it’s not a good idea to fight your friend, and it’s...

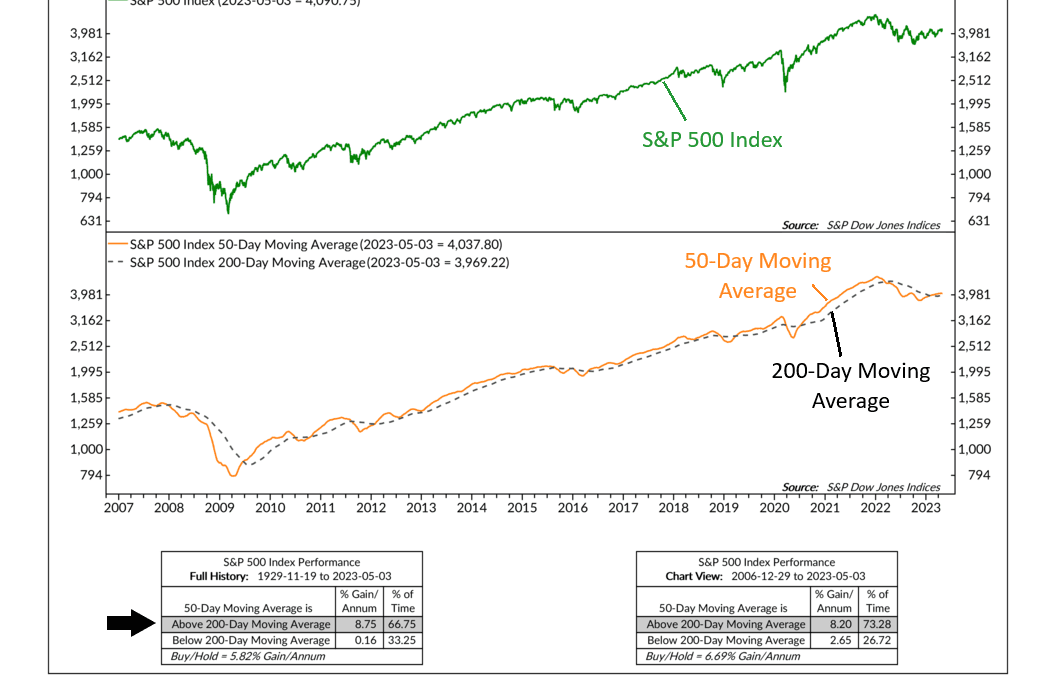

by NelsonCorp Wealth Management | May 4, 2023 | Indicator Insights

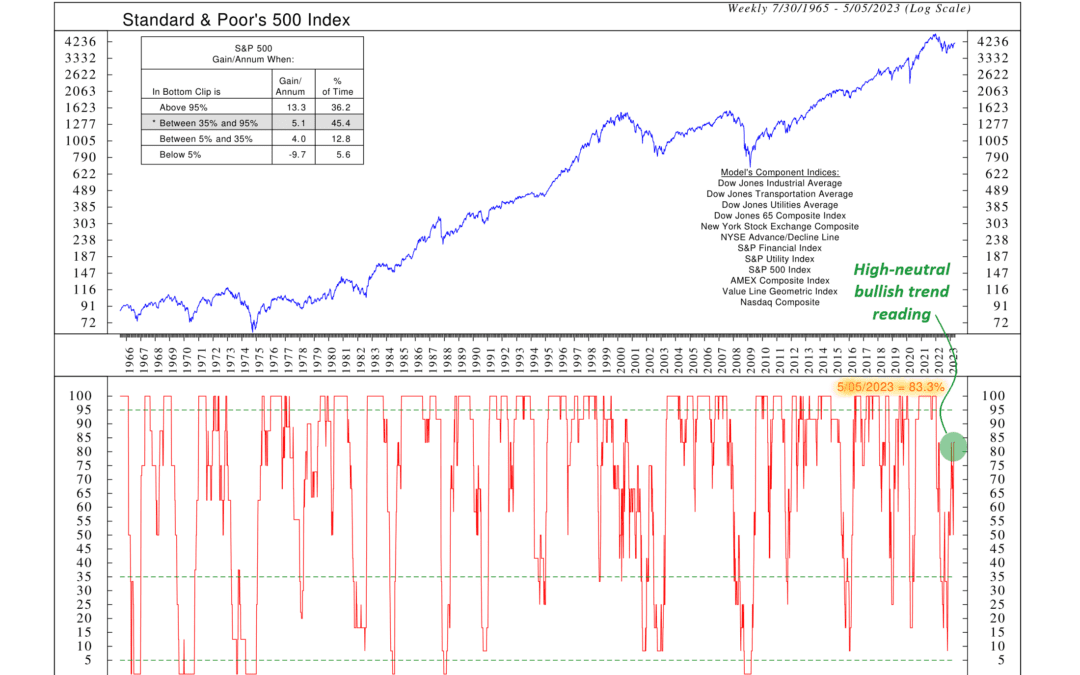

Investors have long been searching for ways to forecast stock returns. But with so much data available, it can be overwhelming. An easy solution is to simplify the process. One approach that has proved particularly useful over the years is the use of moving...

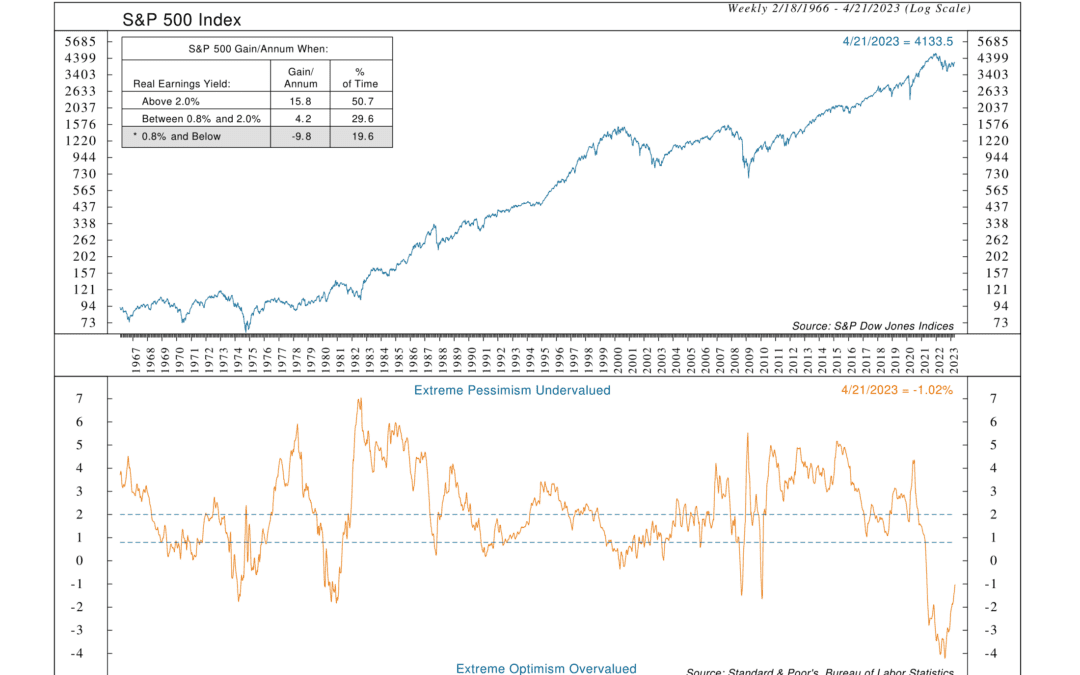

by NelsonCorp Wealth Management | Apr 27, 2023 | Indicator Insights

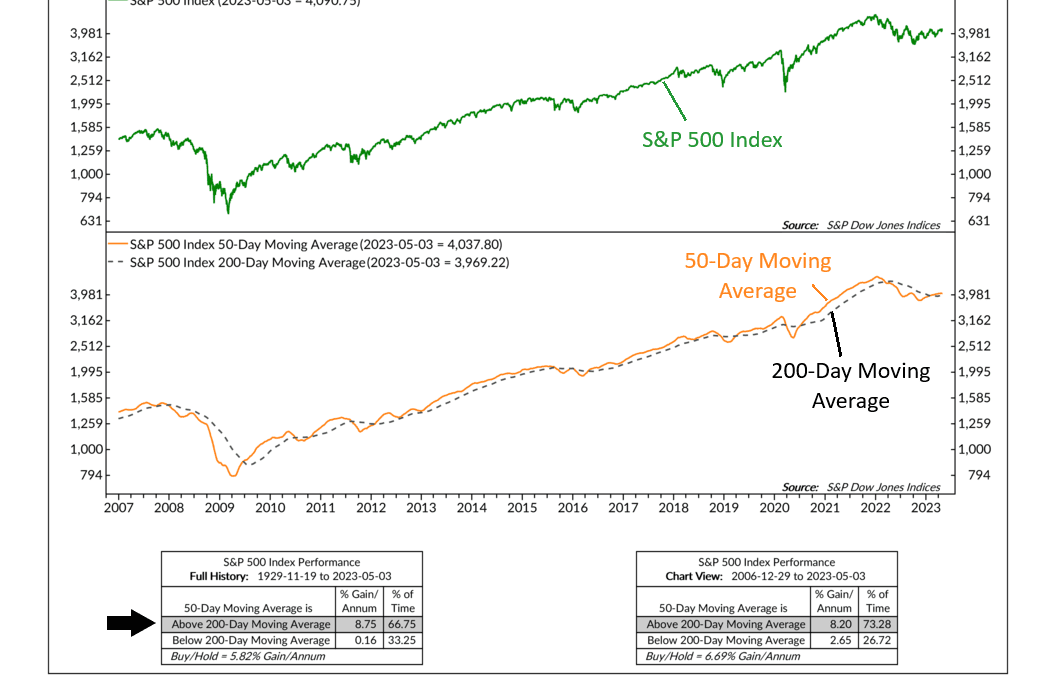

Now that inflation is on the decline, investors are increasingly focusing on stock market earnings. So for this week’s indicator, we will look at both inflation and corporate earnings in the form of the real earnings yield. What is the real earnings yield?...

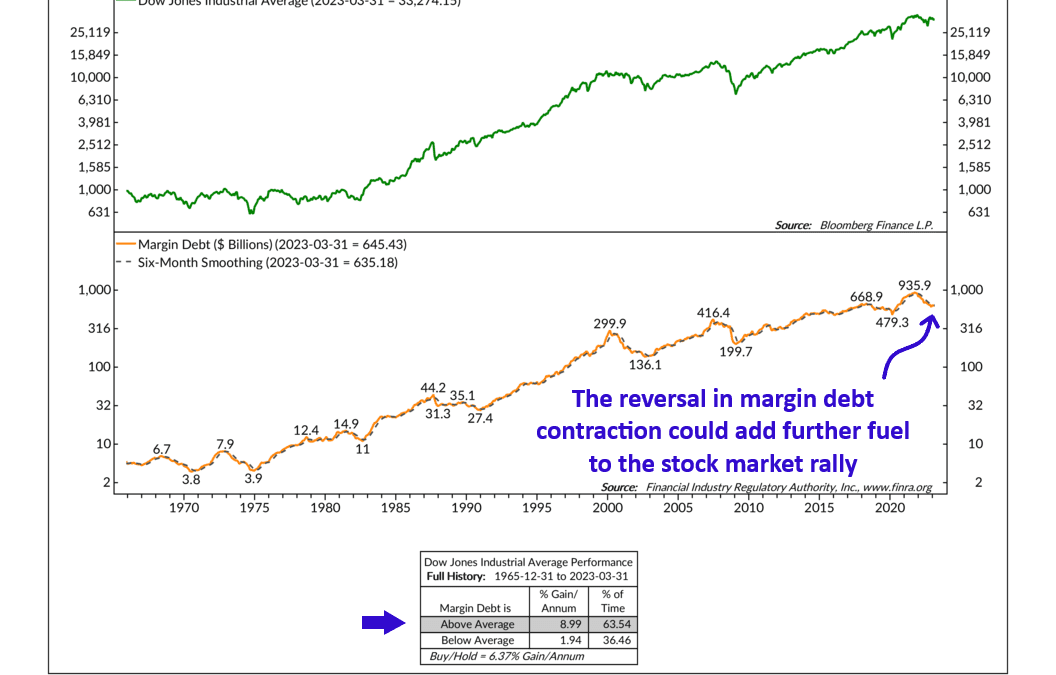

by NelsonCorp Wealth Management | Apr 20, 2023 | Indicator Insights

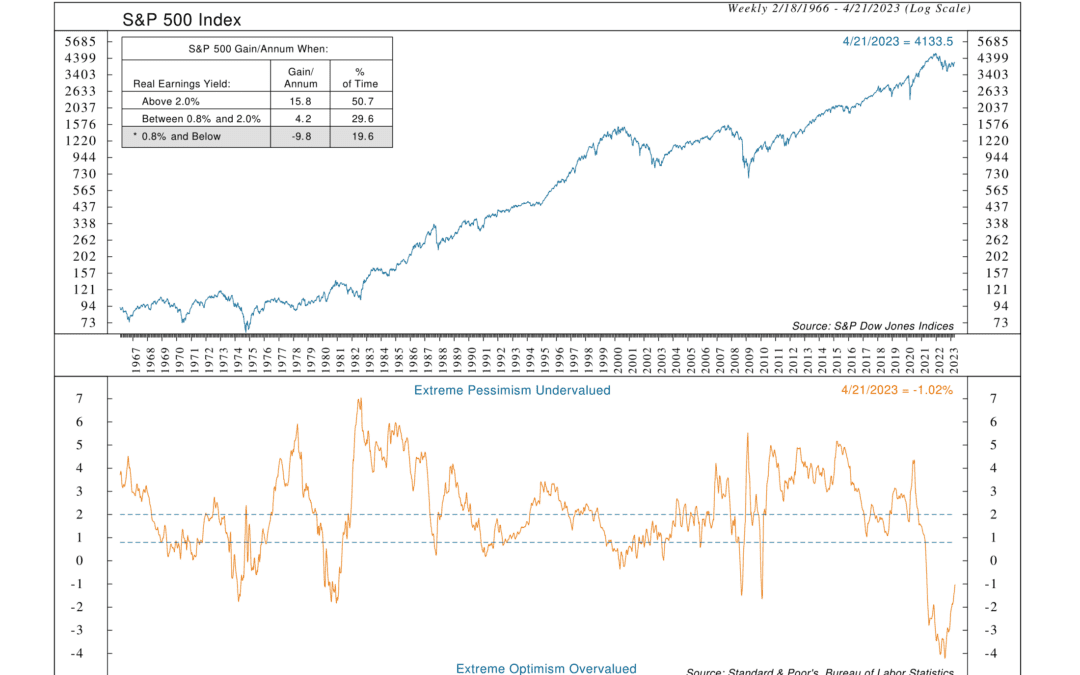

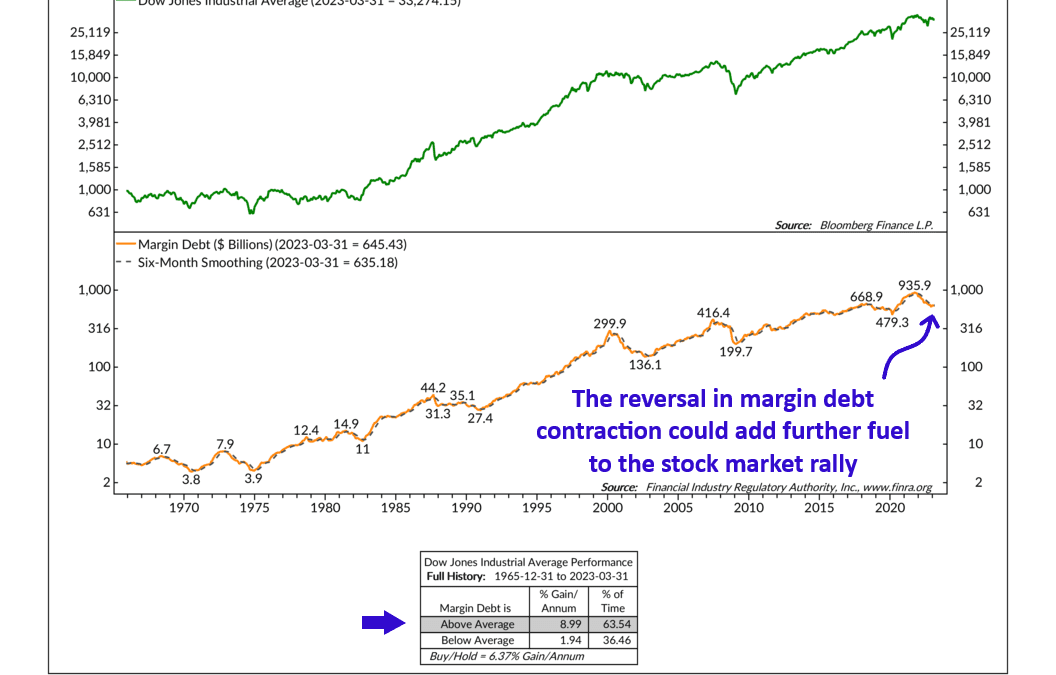

Margin debt is the topic of this week’s indicator. What is margin debt? It’s simply money borrowed from a broker for the purpose of buying stock. Typically, you see it used by speculators who wish to leverage their stock purchases, making it a great gauge of...

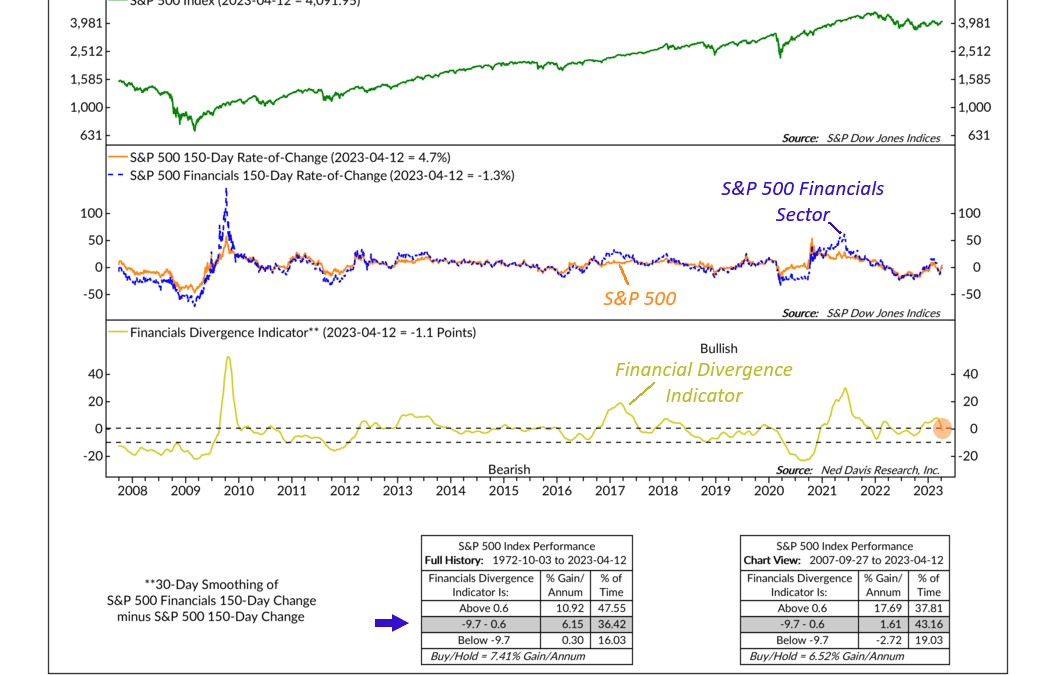

by NelsonCorp Wealth Management | Apr 13, 2023 | Indicator Insights

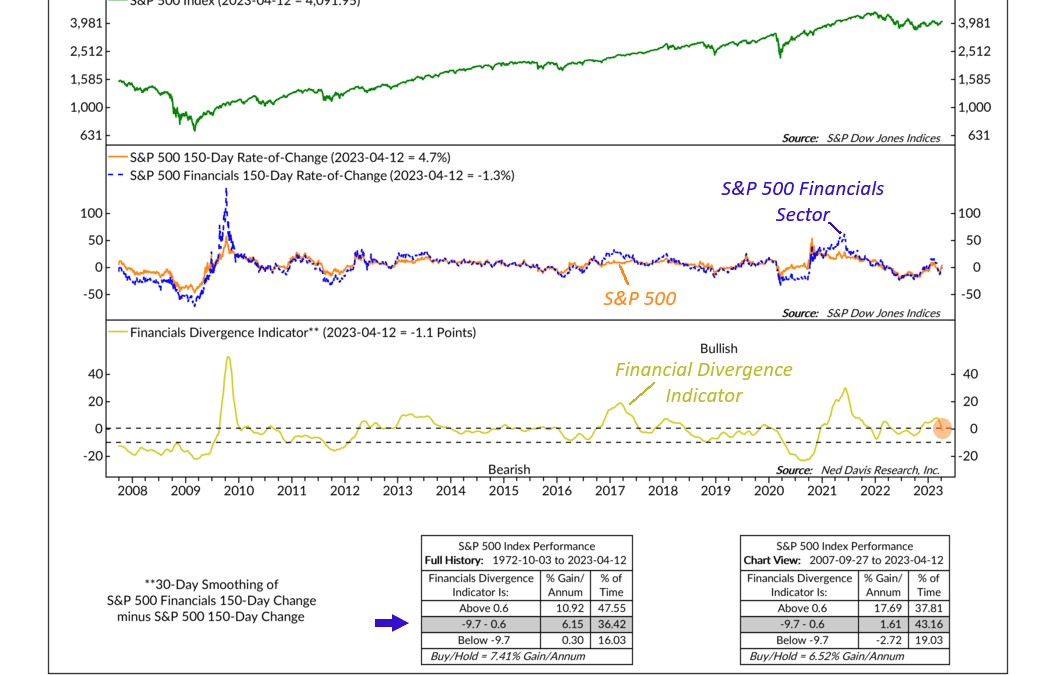

This week’s featured indicator is all about following the leader, just like the popular children’s game. But instead of a 4-year-old, we’ll be keeping an eye on the financial sector of the stock market. Why? Because historically, the broader...

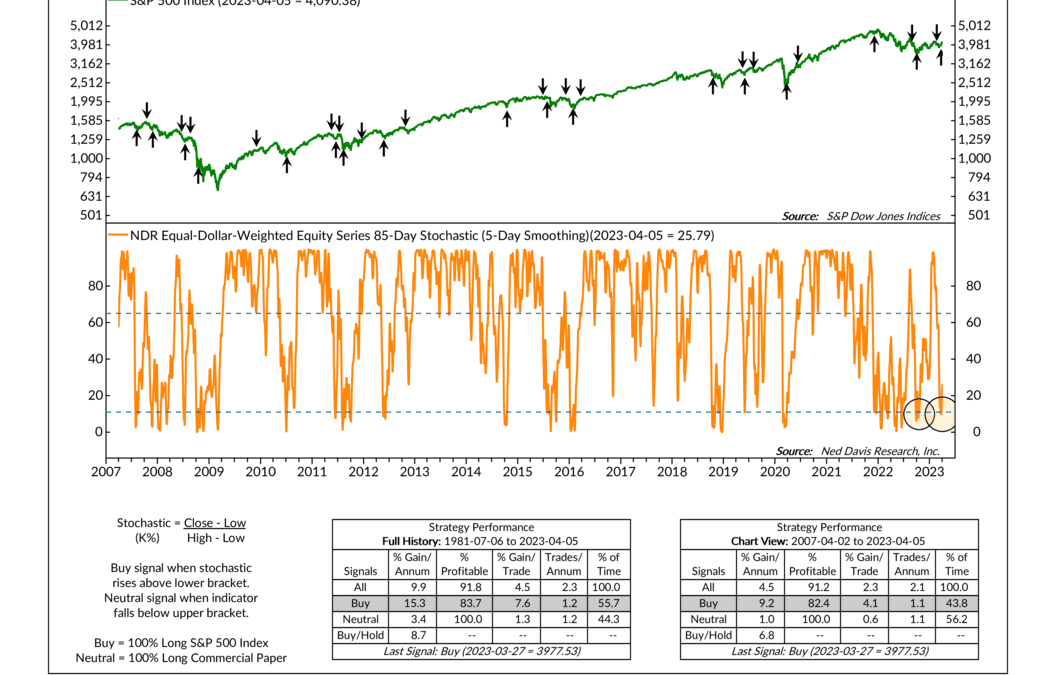

by NelsonCorp Wealth Management | Apr 6, 2023 | Indicator Insights

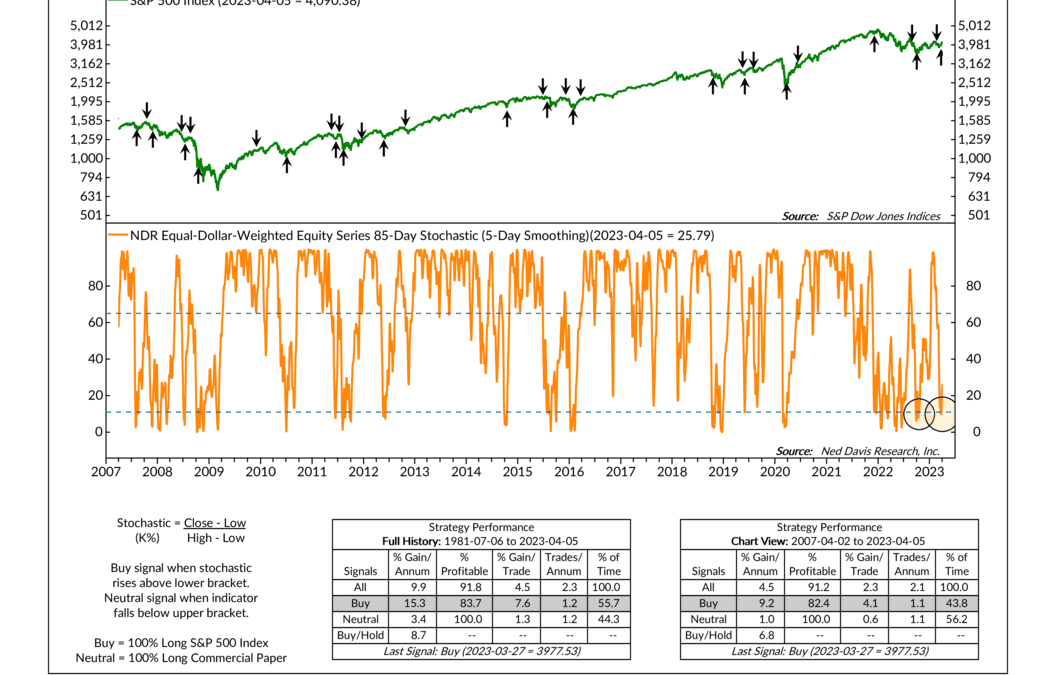

A stochastic indicator is an important technical tool that we use to gauge the stock market’s strength. Unlike some other indicators that use inputs like corporate profits or economic data, a stochastic looks at just the price movement of the stock market...