by NelsonCorp Wealth Management | Mar 30, 2023 | Indicator Insights

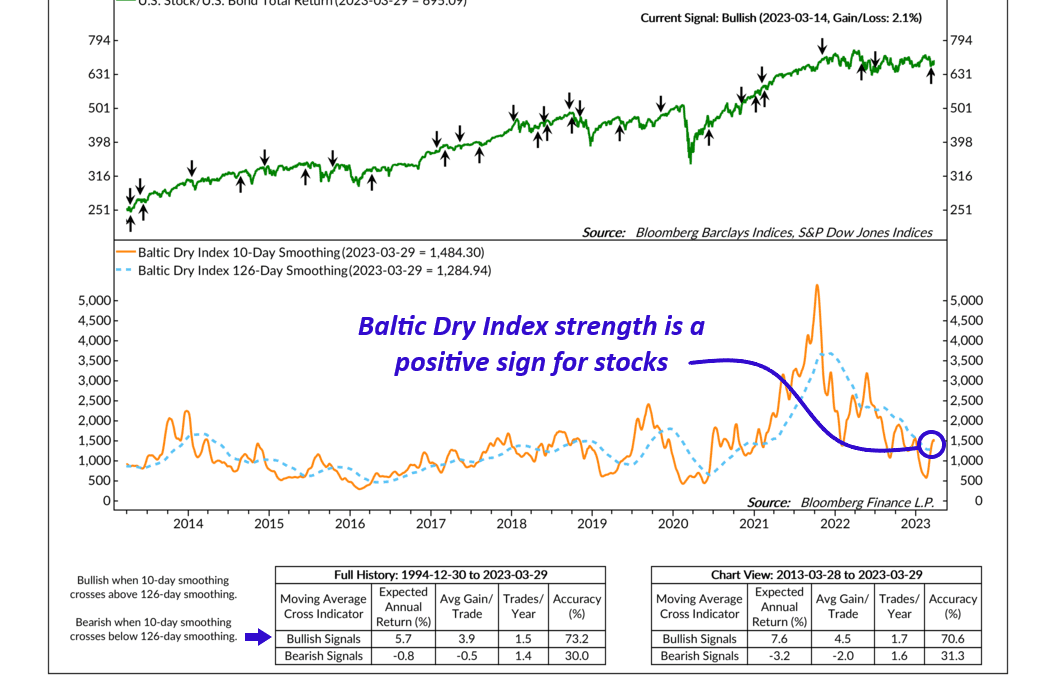

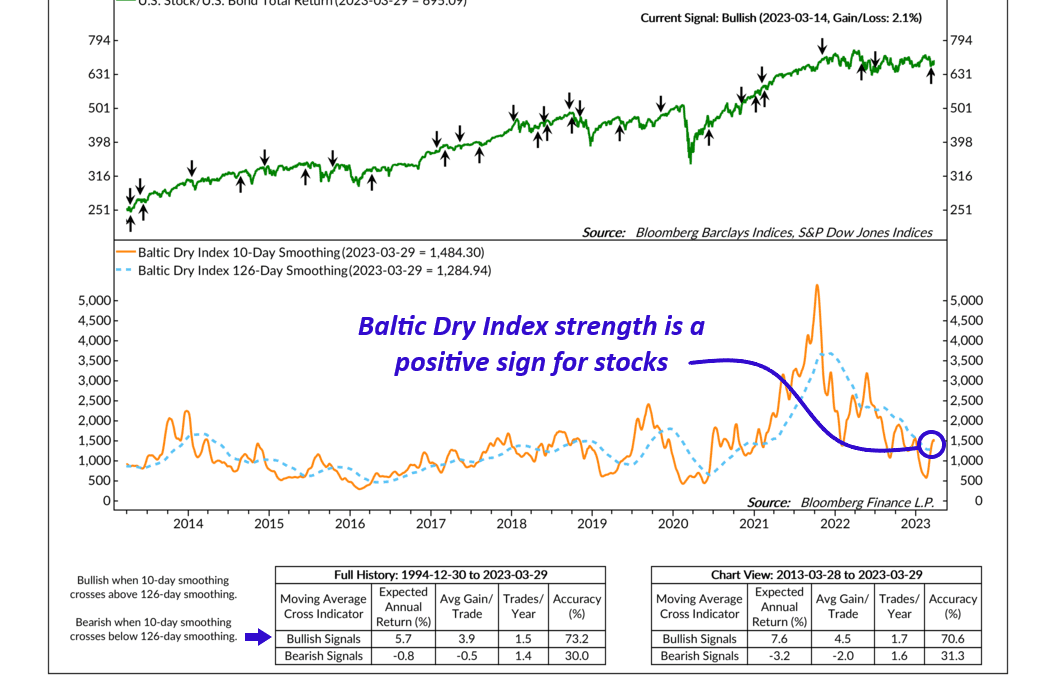

The Baltic Dry Index (BDI) is a financial index that measures the average cost to ship various dry bulk materials—such as coal and steel—around the world. Because it reflects the supply and demand for important materials used in manufacturing, the BDI is...

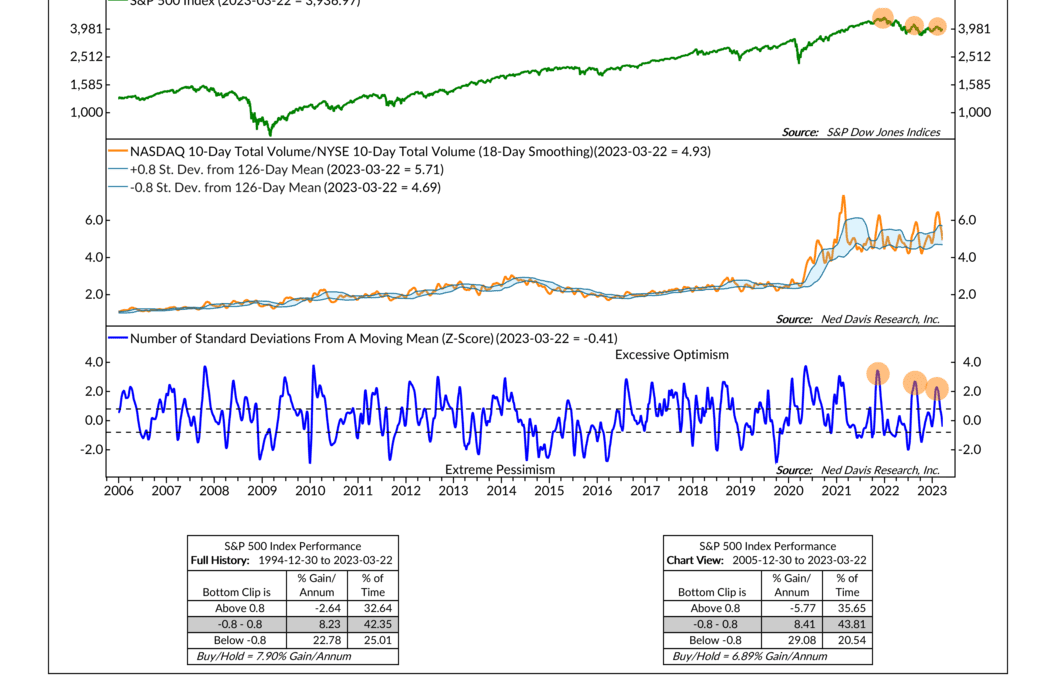

by NelsonCorp Wealth Management | Mar 23, 2023 | Indicator Insights

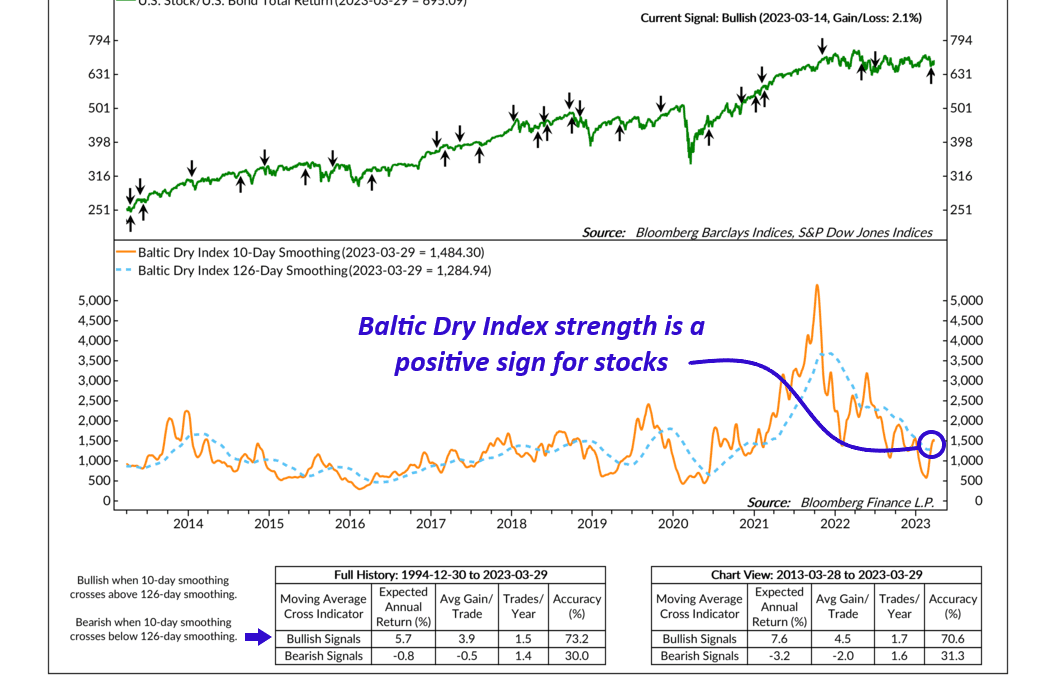

This week’s indicator uses the ratio of total Nasdaq volume to total NYSE volume to gauge sentiment in the stock market. The key takeaway is that the ratio is falling, a sign of increasing pessimism—which, from a contrarian perspective, could be a bullish...

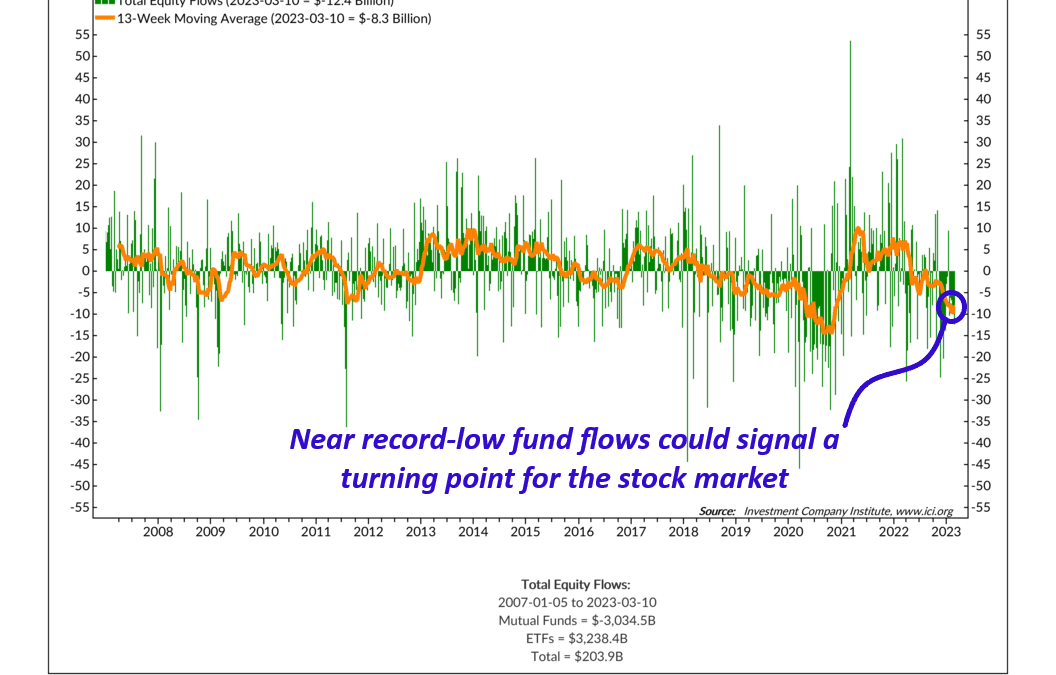

by NelsonCorp Wealth Management | Mar 16, 2023 | Indicator Insights

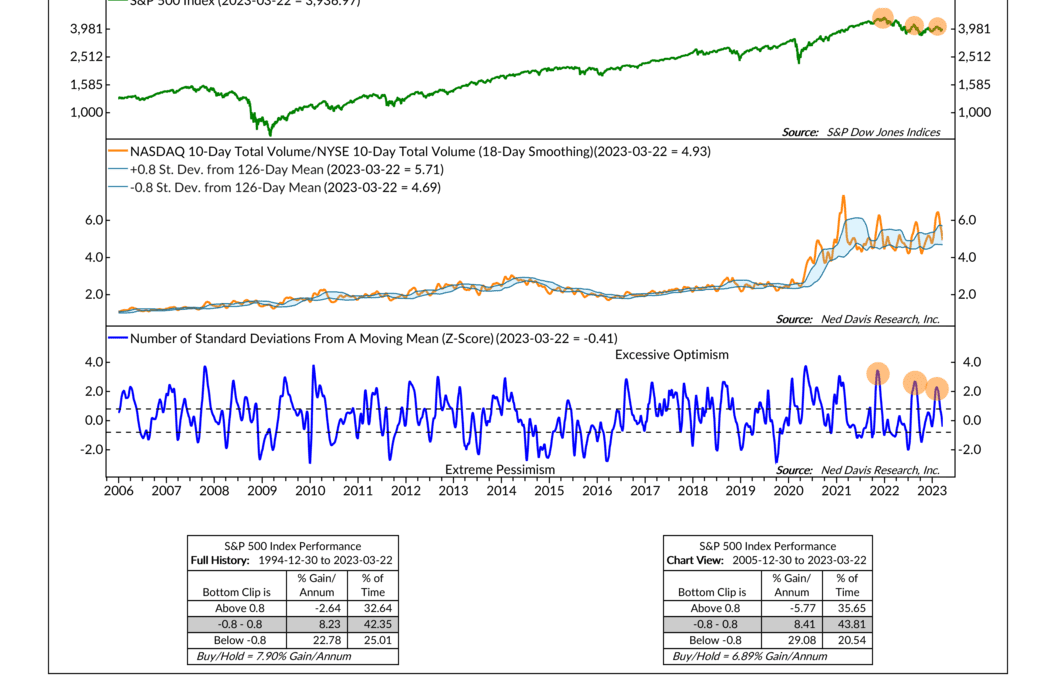

For this week’s indicator, we’re going to look at fund flows and how they affect stock market returns. What is a fund flow? It’s simply the amount of cash flowing into or out of a financial asset. It doesn’t measure the performance of the asset but rather the...

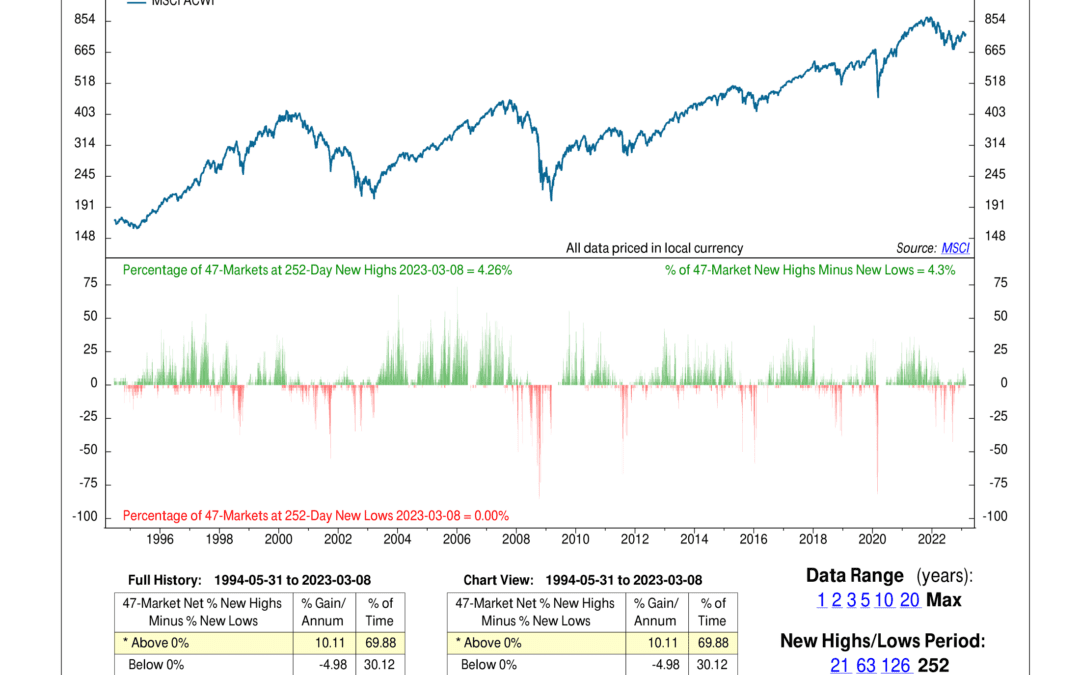

by NelsonCorp Wealth Management | Mar 9, 2023 | Indicator Insights

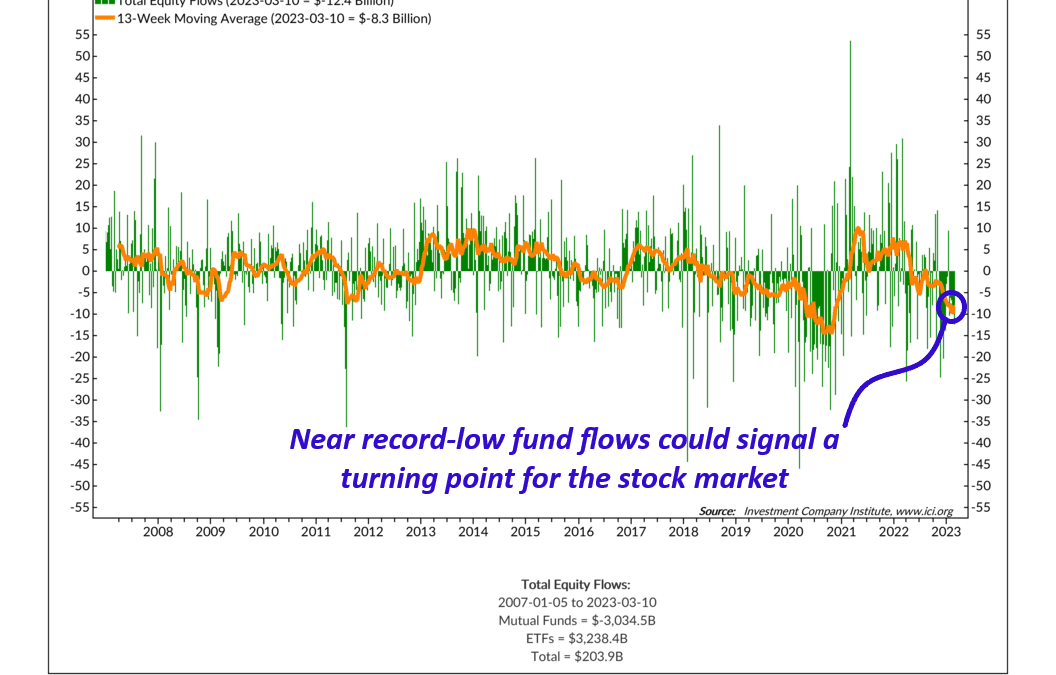

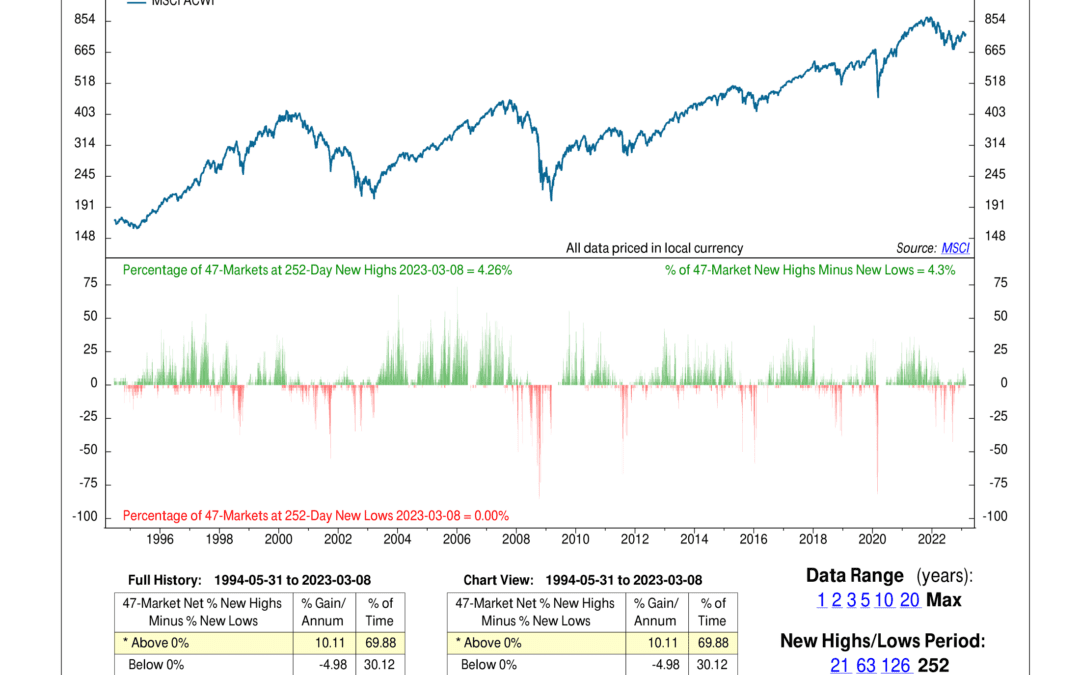

This week’s featured indicator focuses on breadth, or participation, in global financial markets. On the top half of the graph, we have the MSCI All-Country World Index, a benchmark index for the global stock market performance. On the bottom half of the graph,...

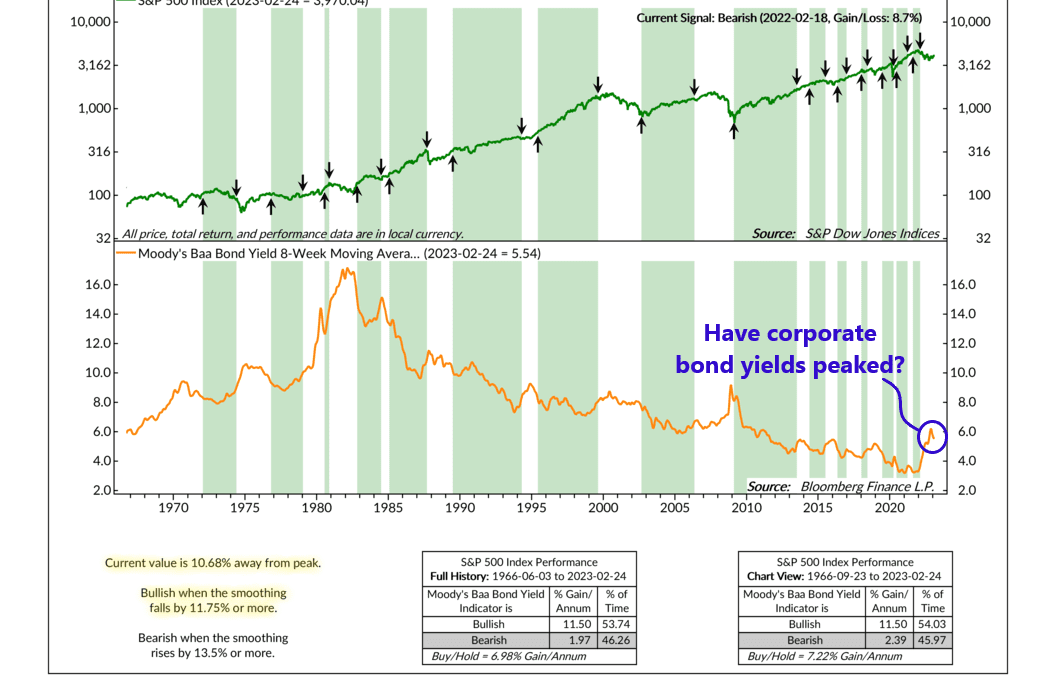

by NelsonCorp Wealth Management | Mar 2, 2023 | Indicator Insights

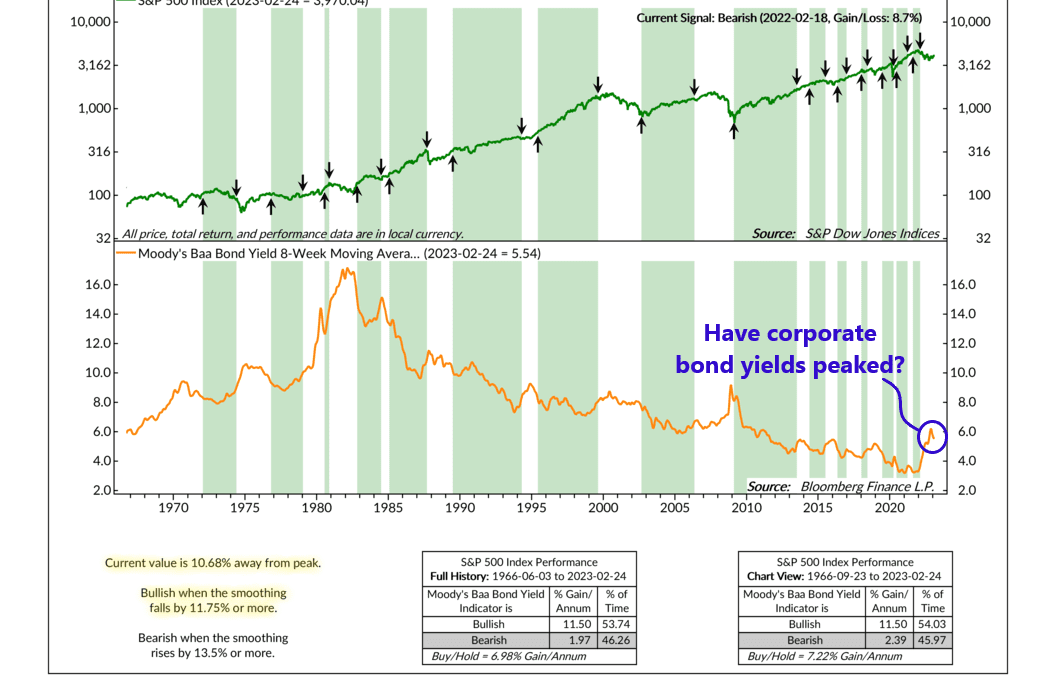

This week’s featured indicator is based on the concept that reversals in bond yields (interest rates) often call the tune of the stock market. Why? Because bond yields compete with stock dividends for investors’ money. Additionally, interest rates affect the...

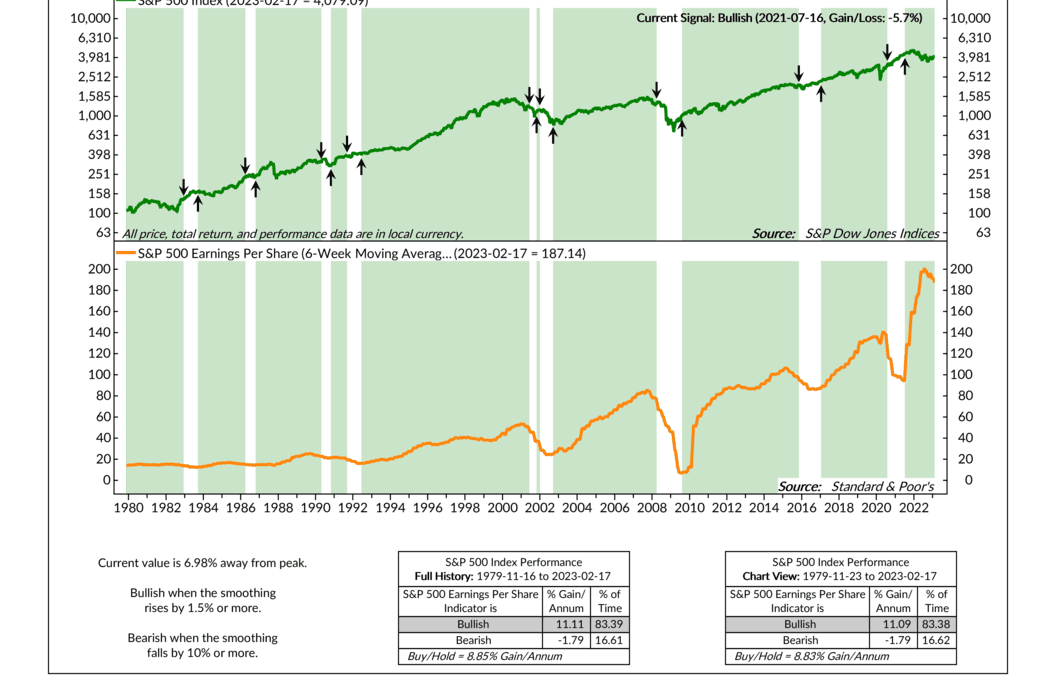

by NelsonCorp Wealth Management | Feb 23, 2023 | Indicator Insights

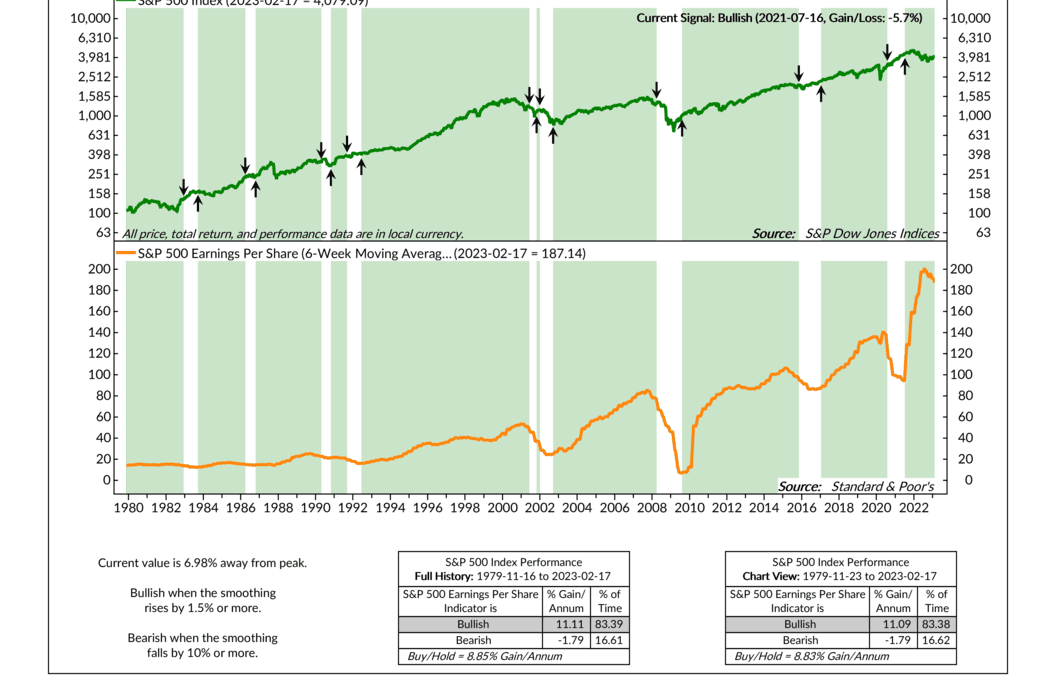

When we think about what drives stock market returns, earnings come to mind. This makes sense. The stock market is comprised of businesses, and the goal of those businesses is to make money—or earnings. On a stock exchange, buyers and sellers come together to...