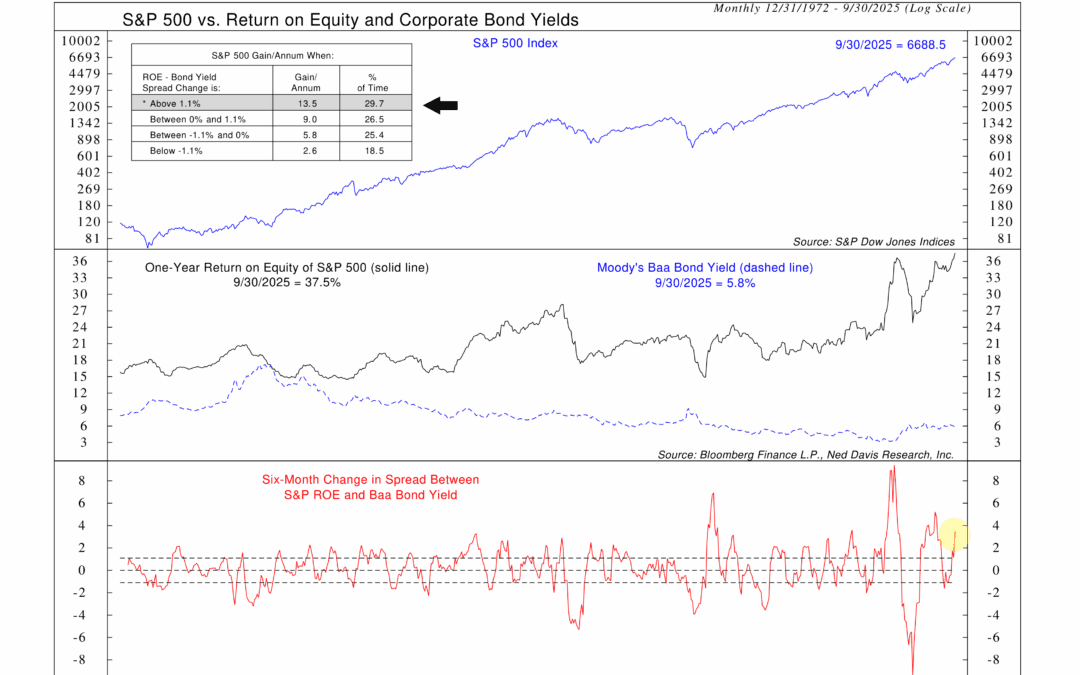

by NelsonCorp | Nov 20, 2025 | Indicator Insights

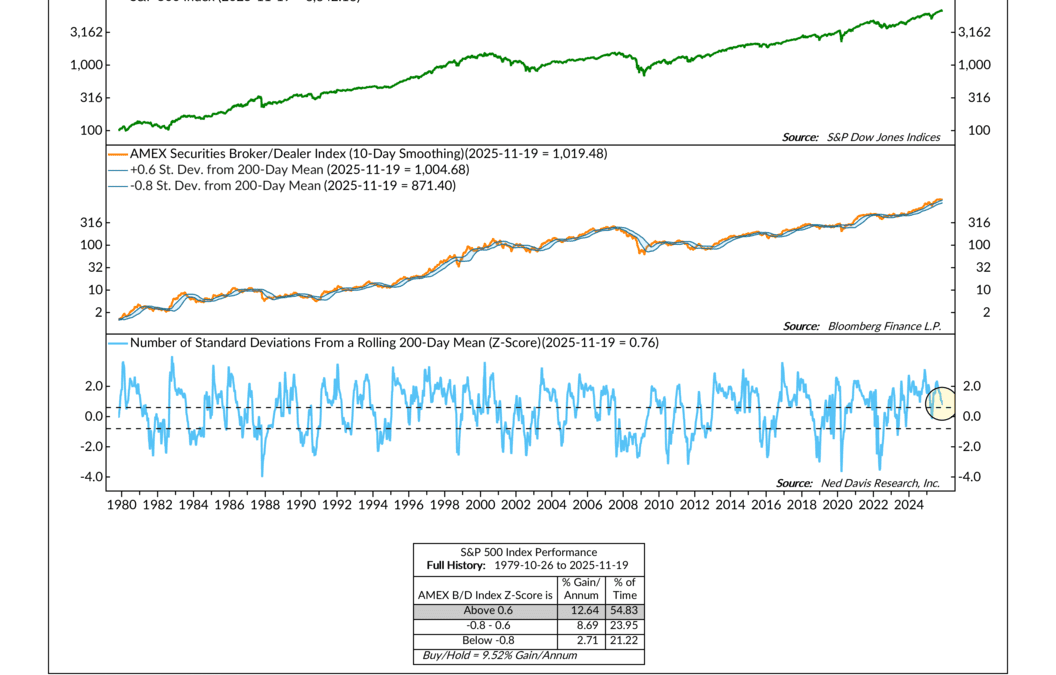

This week’s indicator focuses on the AMEX Securities Broker/Dealer Index. If you’re not familiar with it, this index tracks companies in the securities brokerage business and related areas. It works like a barometer for activity inside the investment services...

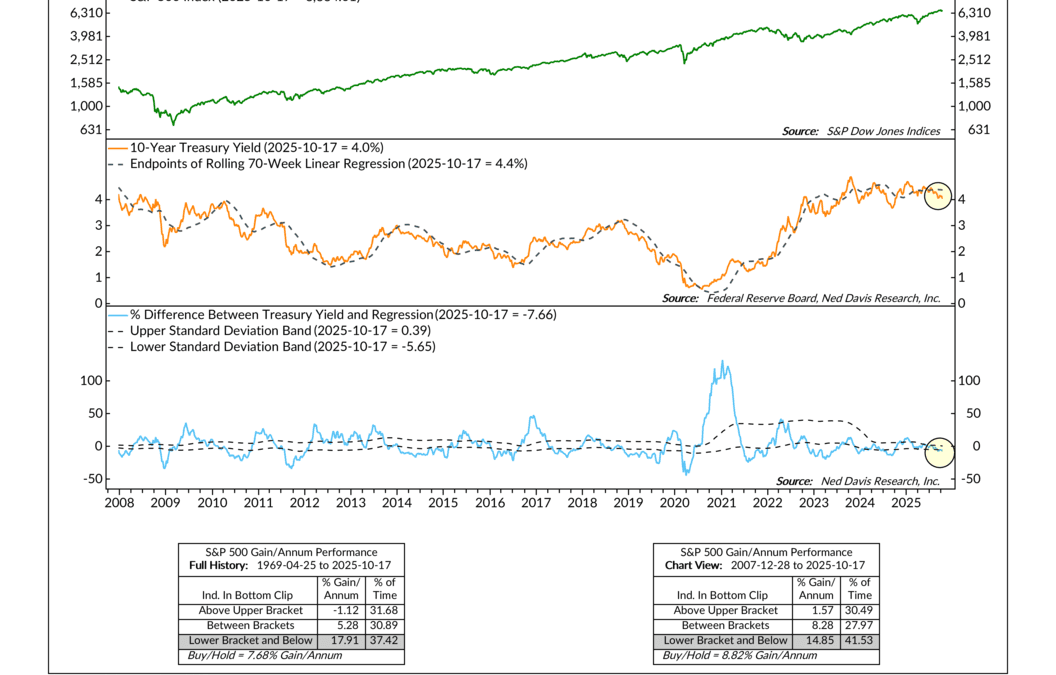

by NelsonCorp | Nov 13, 2025 | Indicator Insights

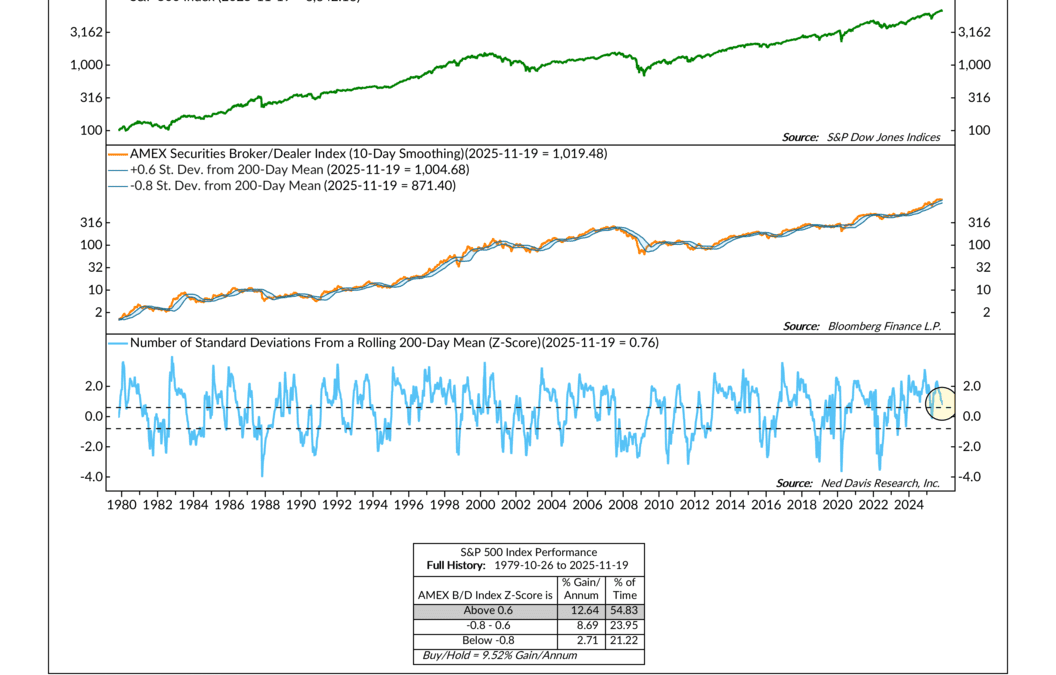

This week’s indicator is what we call an overbought and oversold indicator. The simplest way to think of it is like a rubber band. Pull it gently and nothing happens. Stretch it far enough and you start to feel the tension build. Keep pulling, and eventually...

by NelsonCorp | Nov 6, 2025 | Indicator Insights

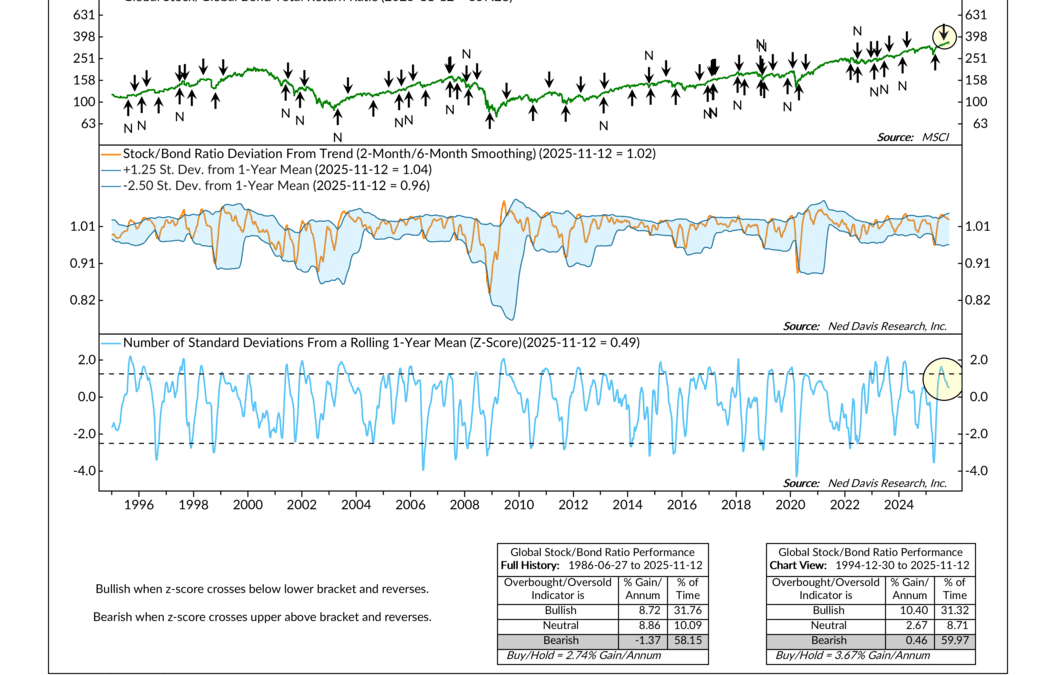

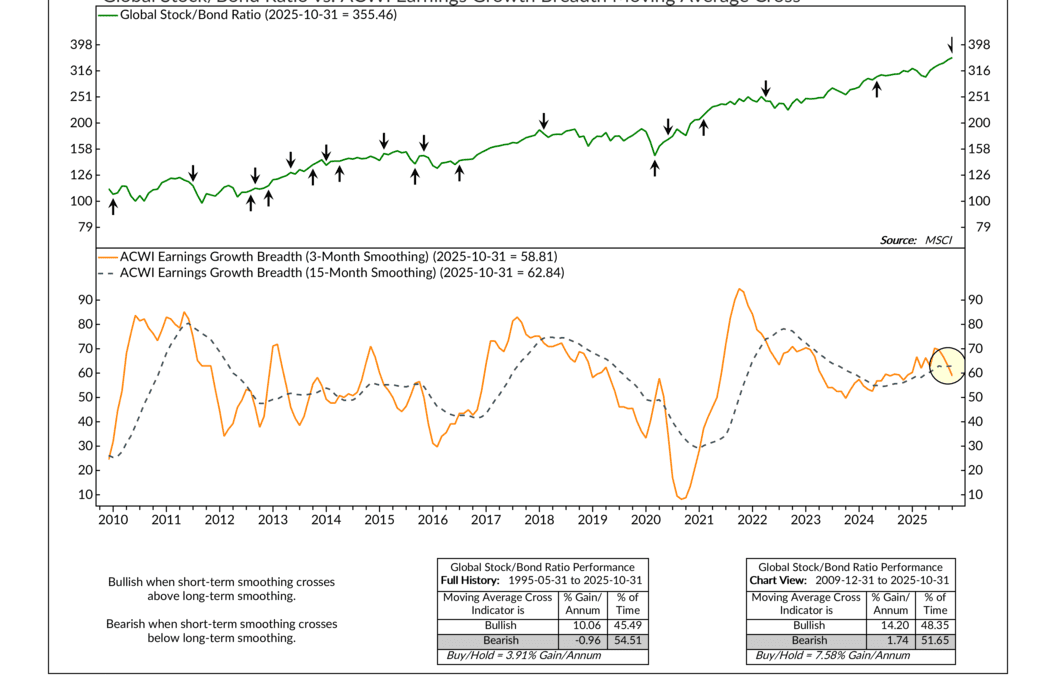

For this week’s indicator, we’re going global. U.S. stocks have been strong this year, but what about the rest of the world? What does the data say about the broader global market? To answer that, we can turn to a measure called Earnings Growth Breadth. This...

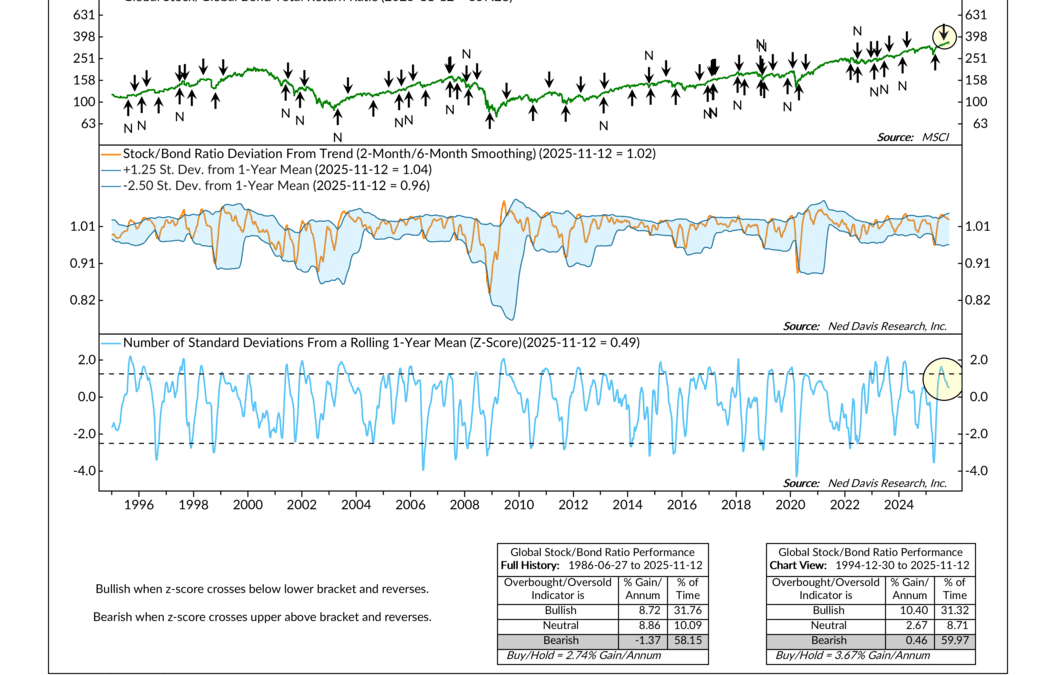

by NelsonCorp | Oct 30, 2025 | Indicator Insights

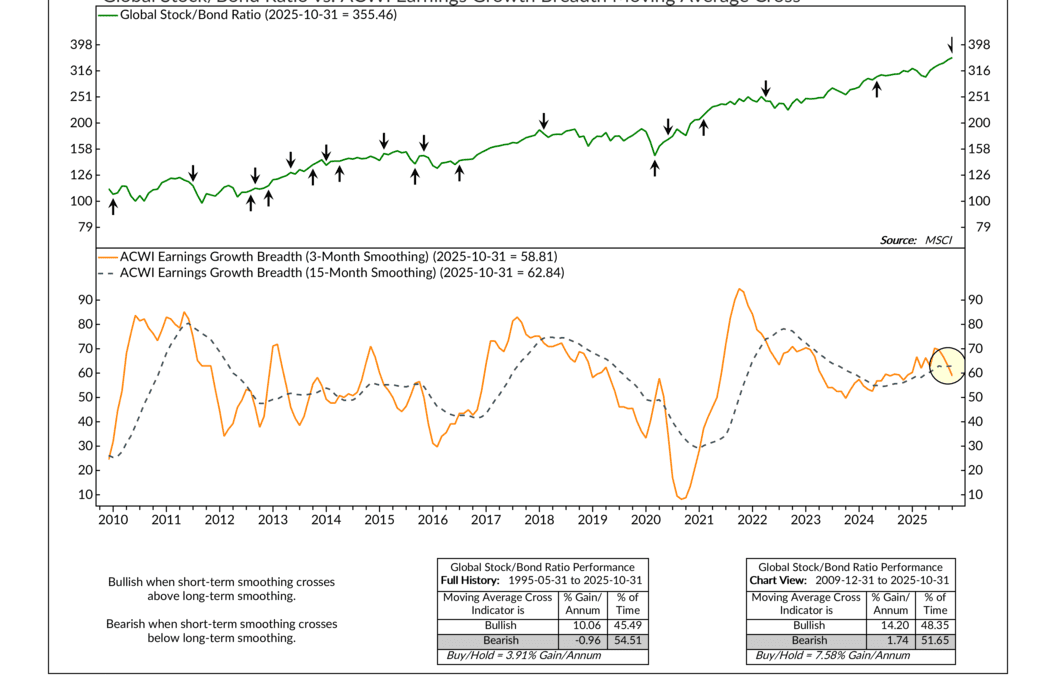

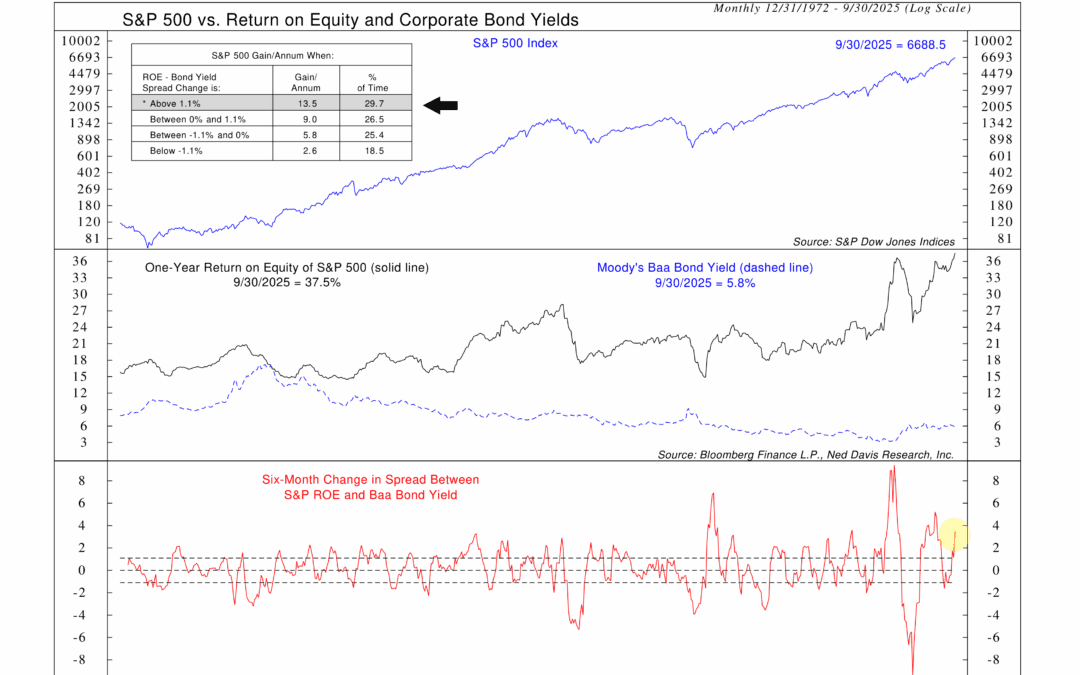

There are a lot of different variables out there that affect the stock market—more than you’d probably like to think about. But there are a handful that really drive stock performance, the ones investors make sure to pay close attention to. Corporate...

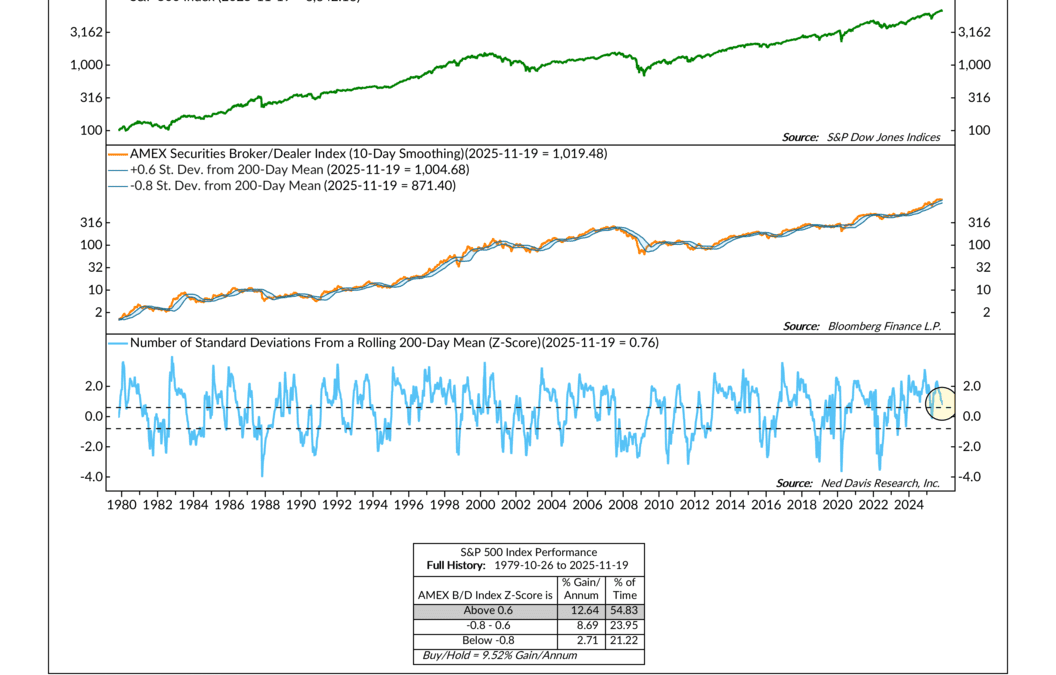

by NelsonCorp | Oct 23, 2025 | Indicator Insights

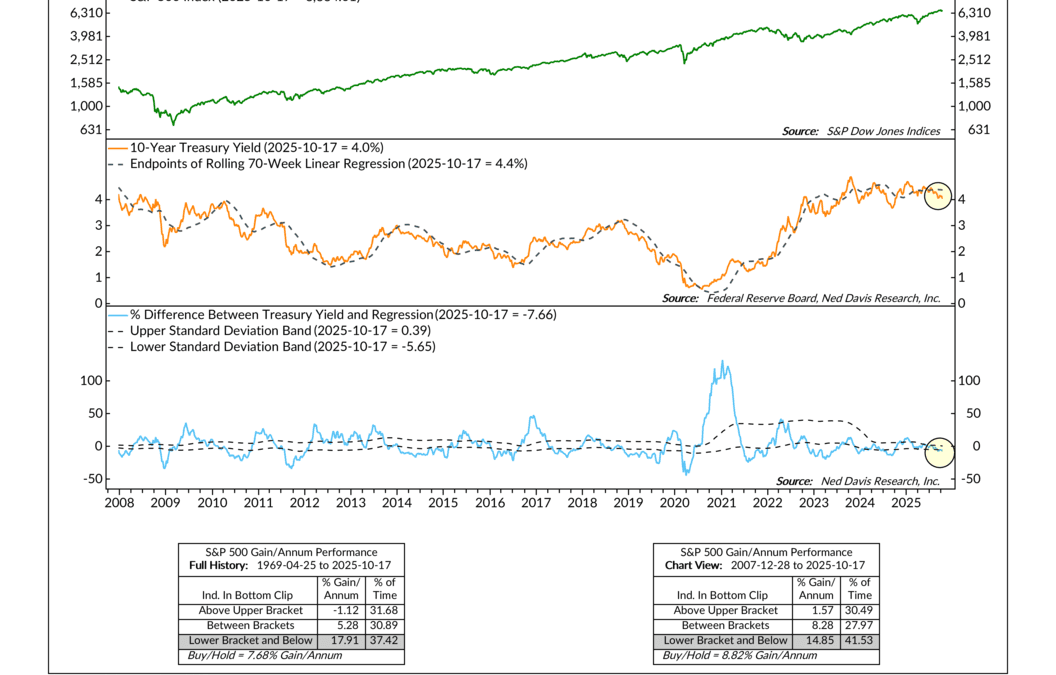

Few relationships have been as important to financial markets as the one between stock prices and interest rates. This week, our featured indicator tracks that relationship by comparing the S&P 500 Index (top panel) to the 10-year Treasury yield and how far...

by NelsonCorp | Oct 16, 2025 | Indicator Insights

This week I’d like to highlight a fun little indicator called “Don’t Fight the Tape or the Fed.” Technically, it’s a model, because it combines two separate indicators. And while we don’t use it directly in our broader modeling process, it still captures an...