by NelsonCorp | Oct 16, 2025 | Indicator Insights

This week I’d like to highlight a fun little indicator called “Don’t Fight the Tape or the Fed.” Technically, it’s a model, because it combines two separate indicators. And while we don’t use it directly in our broader modeling process, it still captures an...

by NelsonCorp | Oct 9, 2025 | Indicator Insights

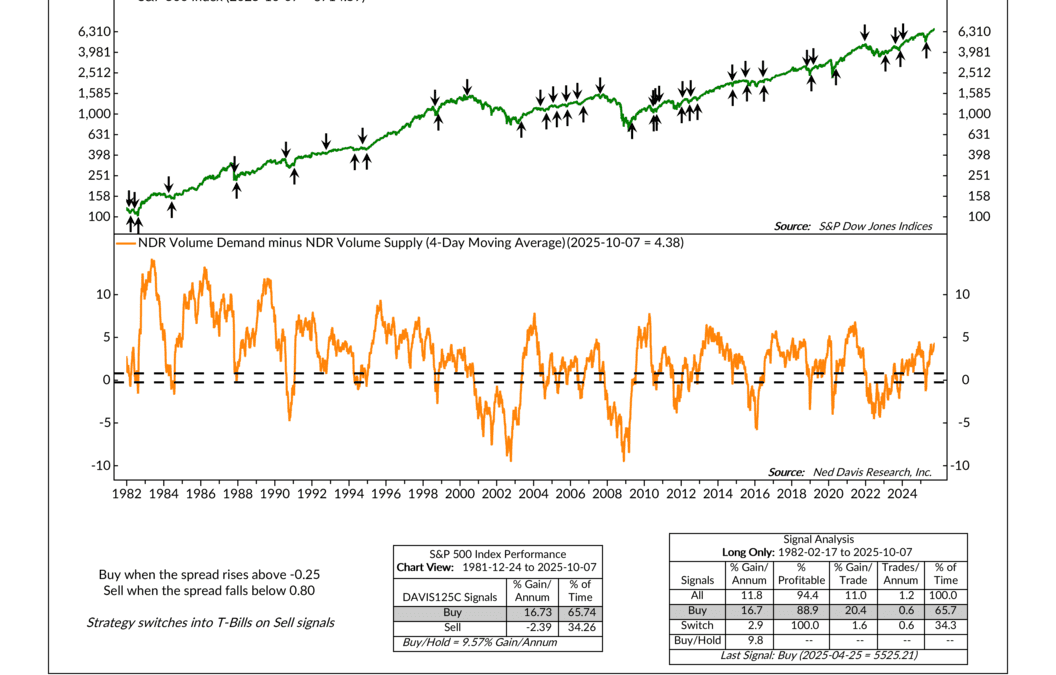

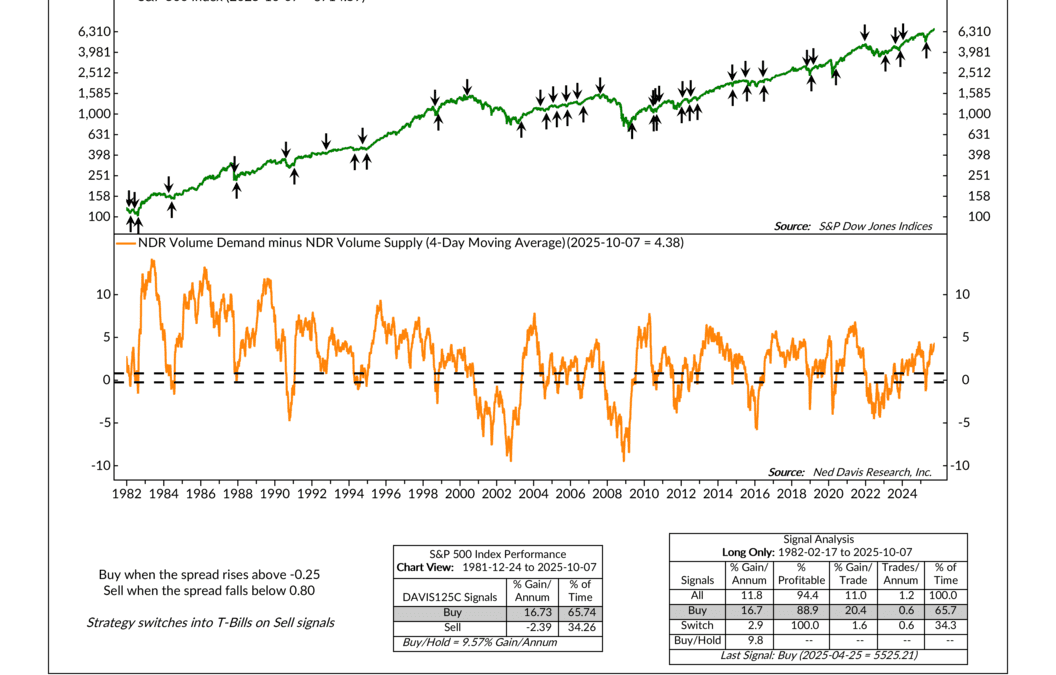

This week’s featured indicator blends two important ideas: volume and conviction. The volume part is fairly straightforward. We measure how much trading activity happens in stocks that are going up—what we call Volume Demand—and compare it to the activity in...

by NelsonCorp | Oct 2, 2025 | Indicator Insights

There’s a well-known saying in science the correlation does not equal causation. We know this to be true. Just google “spurious correlations” and you’ll find endless examples of two completely unrelated data points that appear to move together. For example,...

by NelsonCorp | Sep 25, 2025 | Indicator Insights

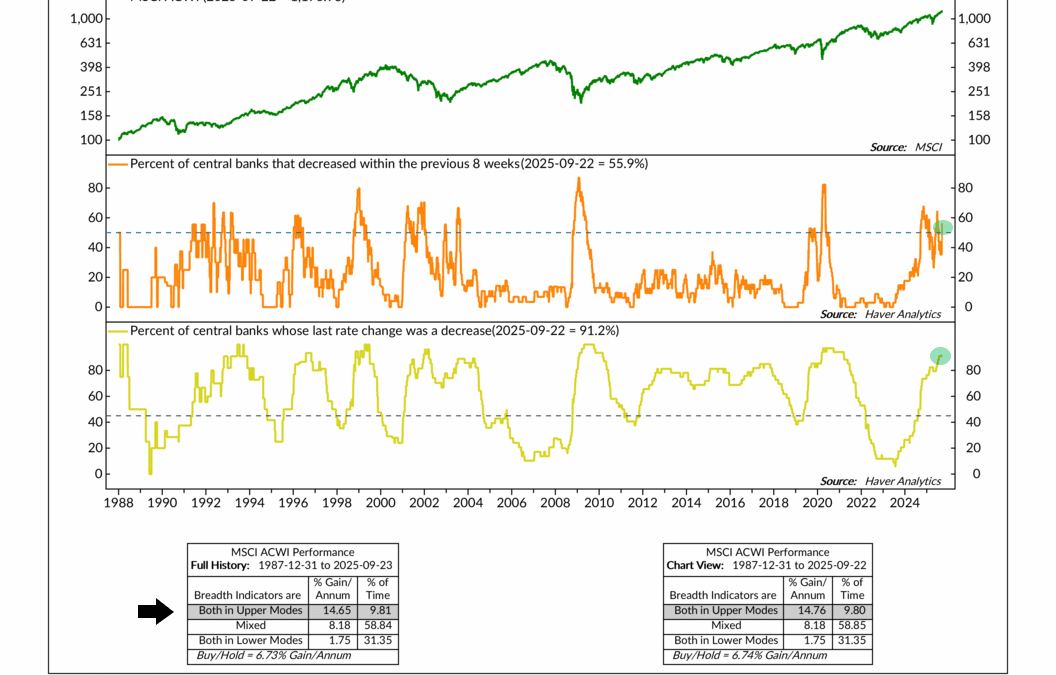

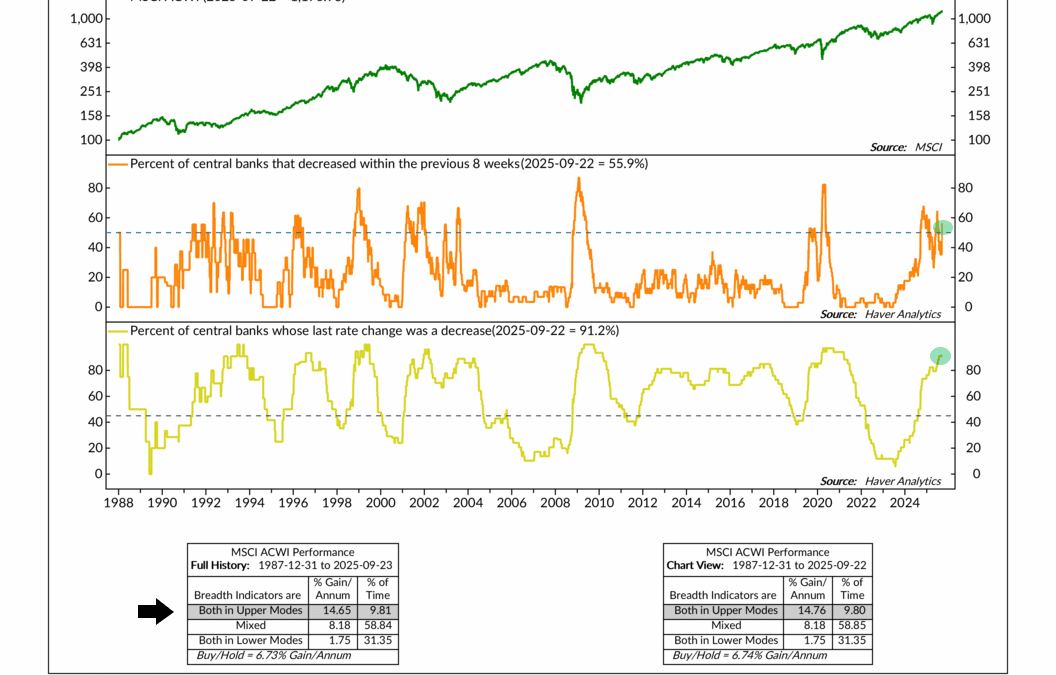

This week’s indicator is all about central banks. What are central banks? They’re like the “money boss” of a country. They decide how much money should be in circulation and set interest rates to help maintain price stability. It’s the setting of interest rates...

by NelsonCorp | Sep 18, 2025 | Indicator Insights

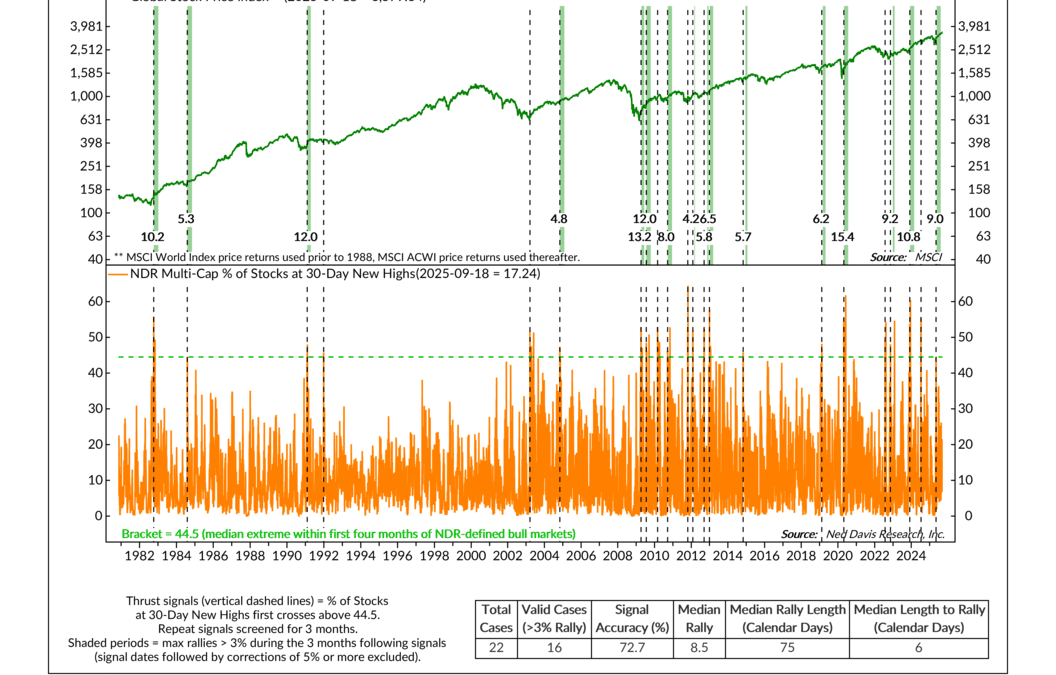

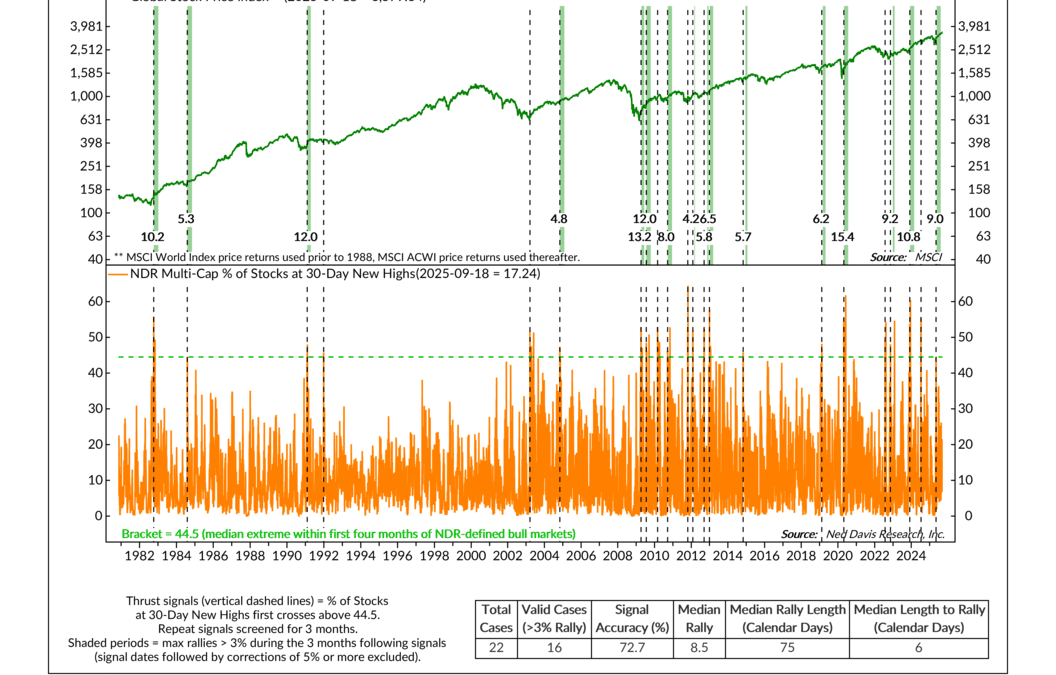

Markets love confirmation. Sure, it’s one thing to see stock prices climb higher, but it’s another to see a broad swath of companies participating in the move. That’s what’s this week’s featured indicator is all about. It measures the percentage of global...

by NelsonCorp | Sep 11, 2025 | Indicator Insights

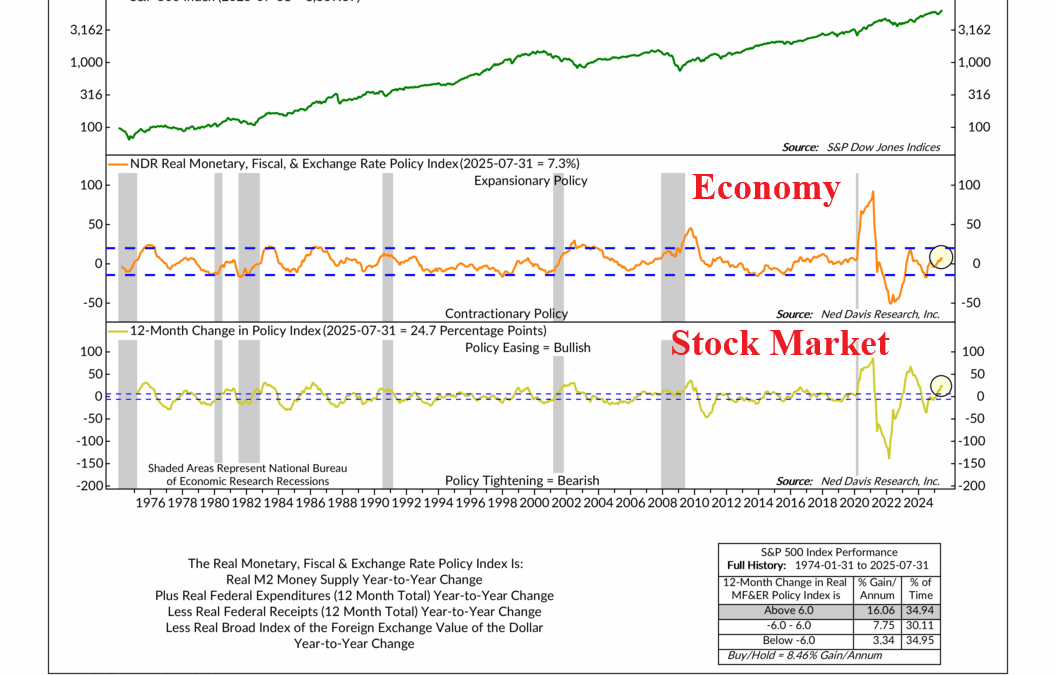

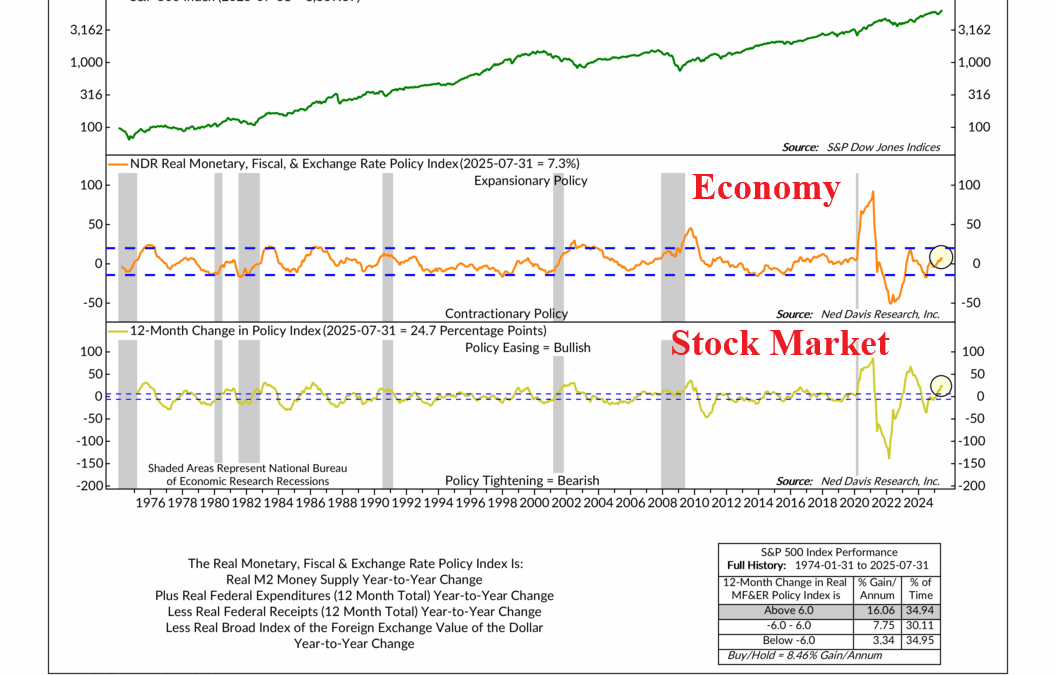

This week’s insight starts with a quick trip down economic history lane. For decades, two schools of thought have debated what really drives the economy. Monetarists believe the answer lies in the money supply. In times of economic weakness, increases in the...