Top Watch

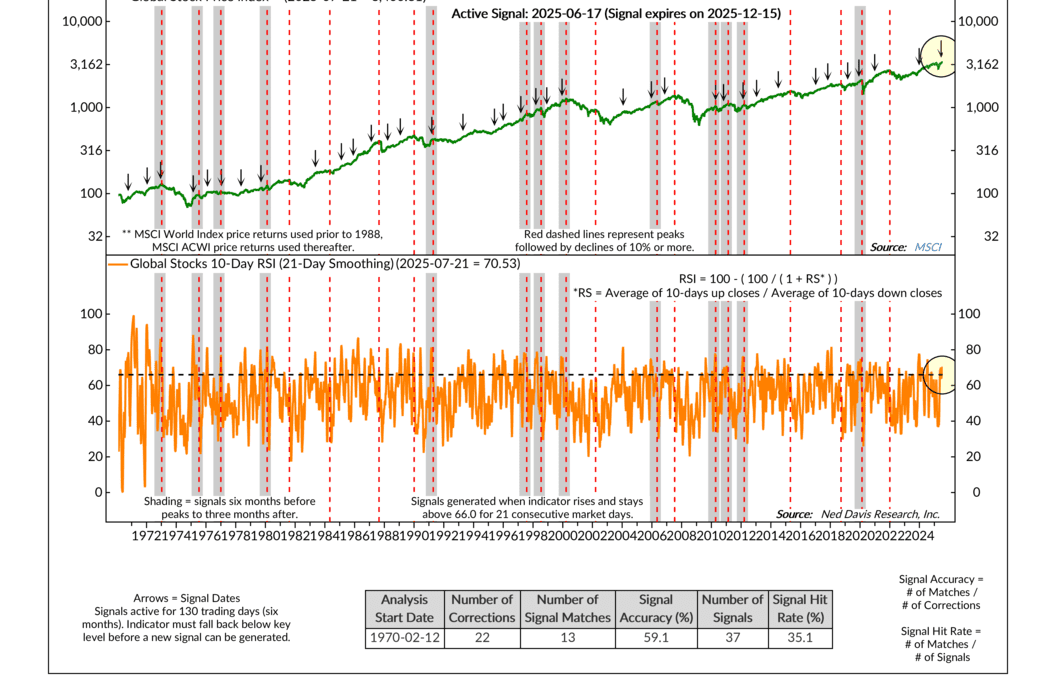

Global stocks just triggered a key warning signal that’s flagged major tops in the past. Find out what it means—and why another market might be gearing up to take the spotlight.

Global stocks just triggered a key warning signal that’s flagged major tops in the past. Find out what it means—and why another market might be gearing up to take the spotlight.

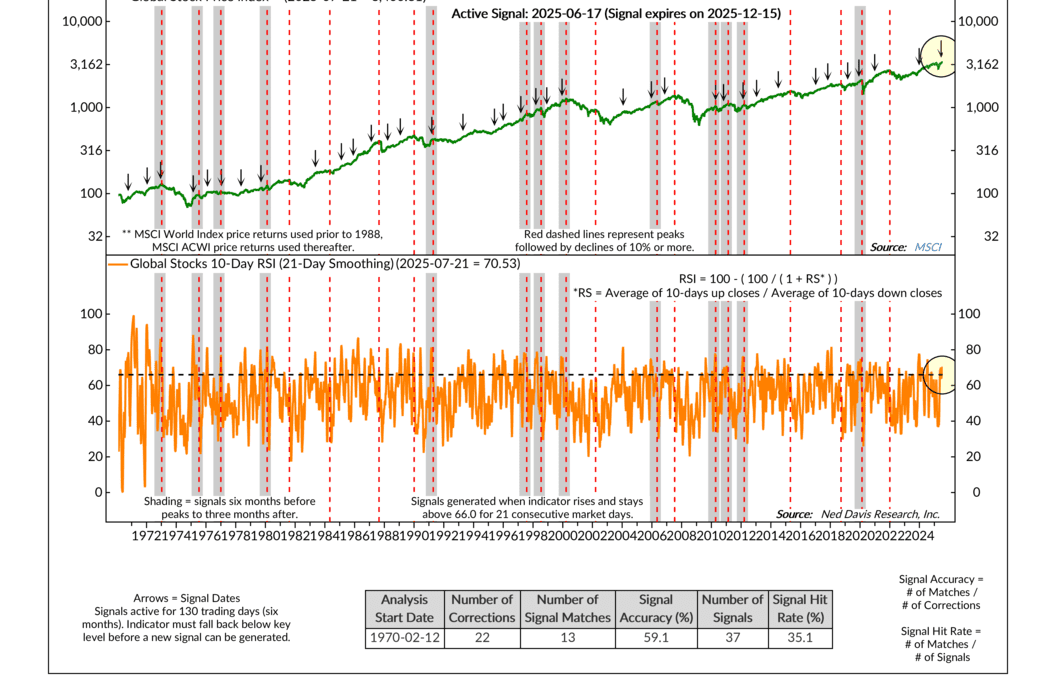

This week’s indicator looks at how different asset classes tend to perform depending on whether inflation is running hot or cool. By comparing inflation to its five-year trend, it offers a clearer picture of which environments have historically favored stocks, bonds, cash, or commodities.

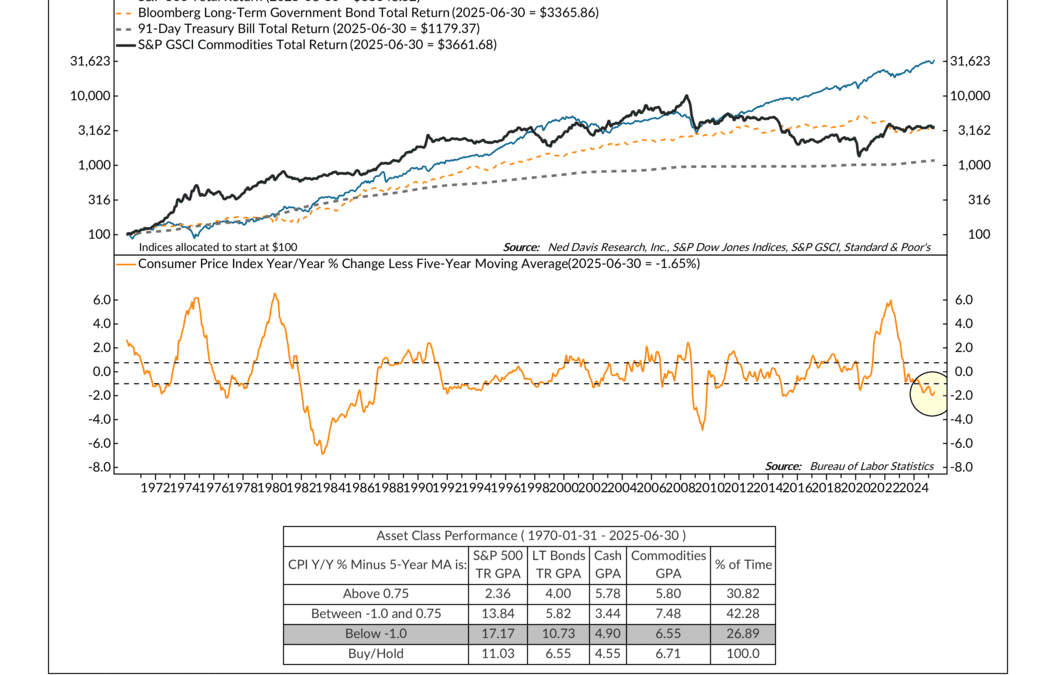

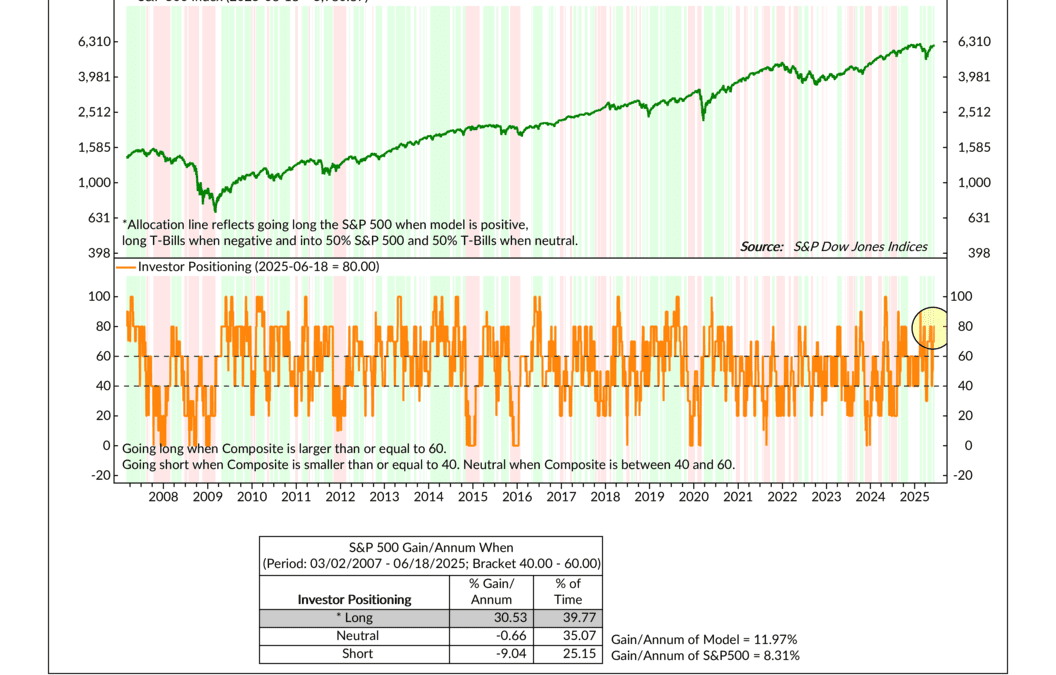

Investors may seem overly optimistic, but context matters—easy financial conditions can make even high sentiment less dangerous. This week’s indicator blends emotion with environment, giving us a clearer view of whether sentiment is truly stretched or just seems that way.

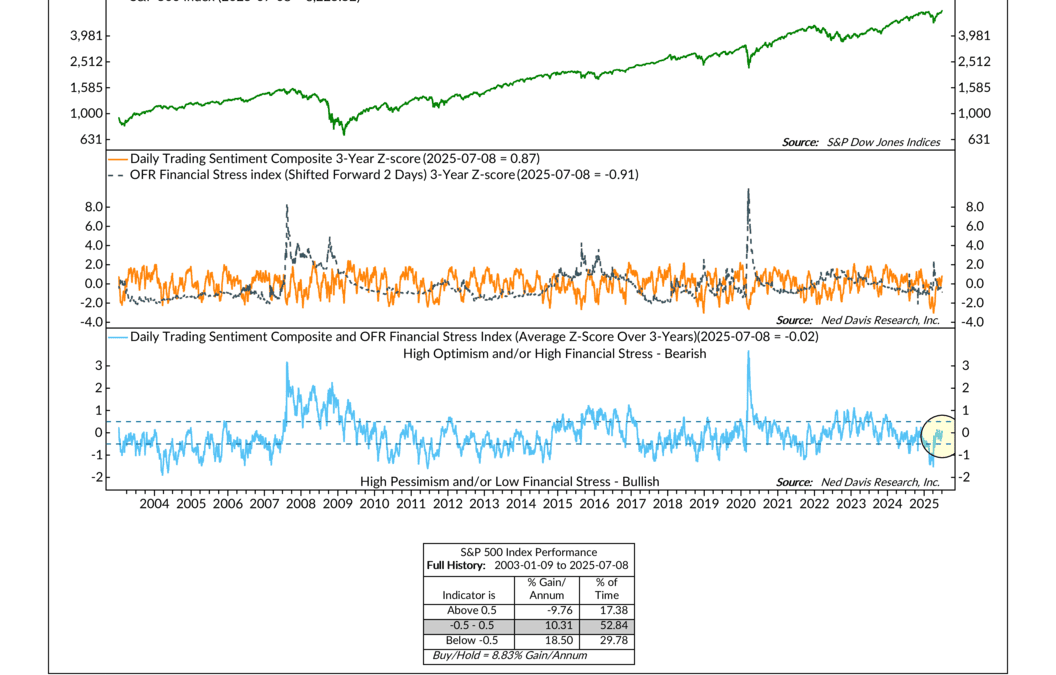

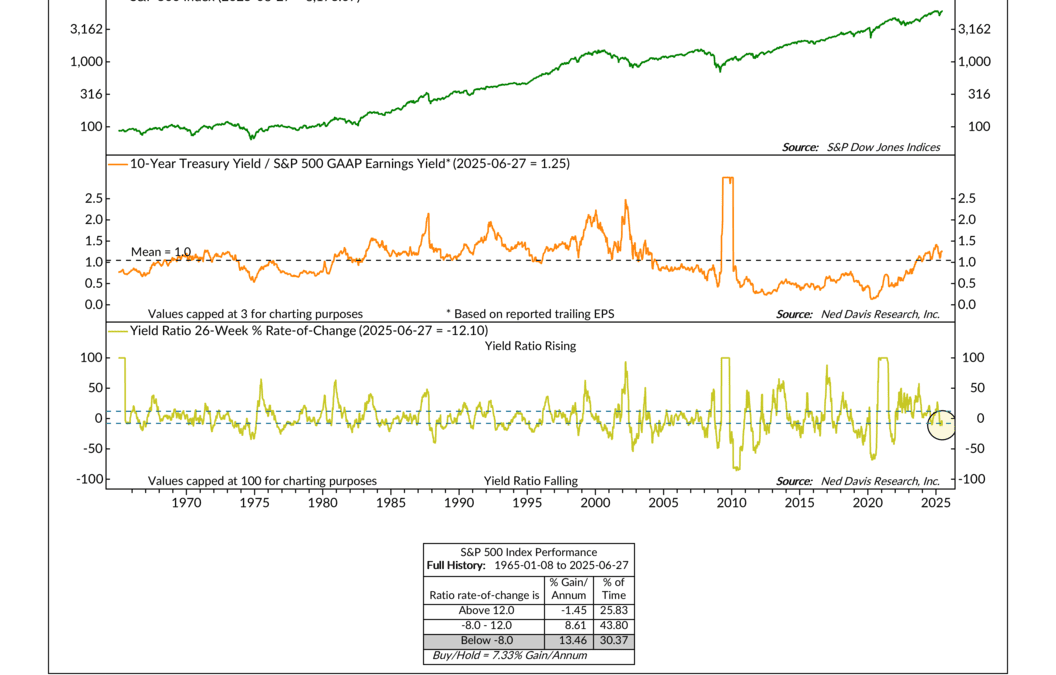

Is the stock market actually expensive—or just pricier than we’re used to? This week’s indicator puts stocks and bonds head-to-head to give us a clearer view of relative value.

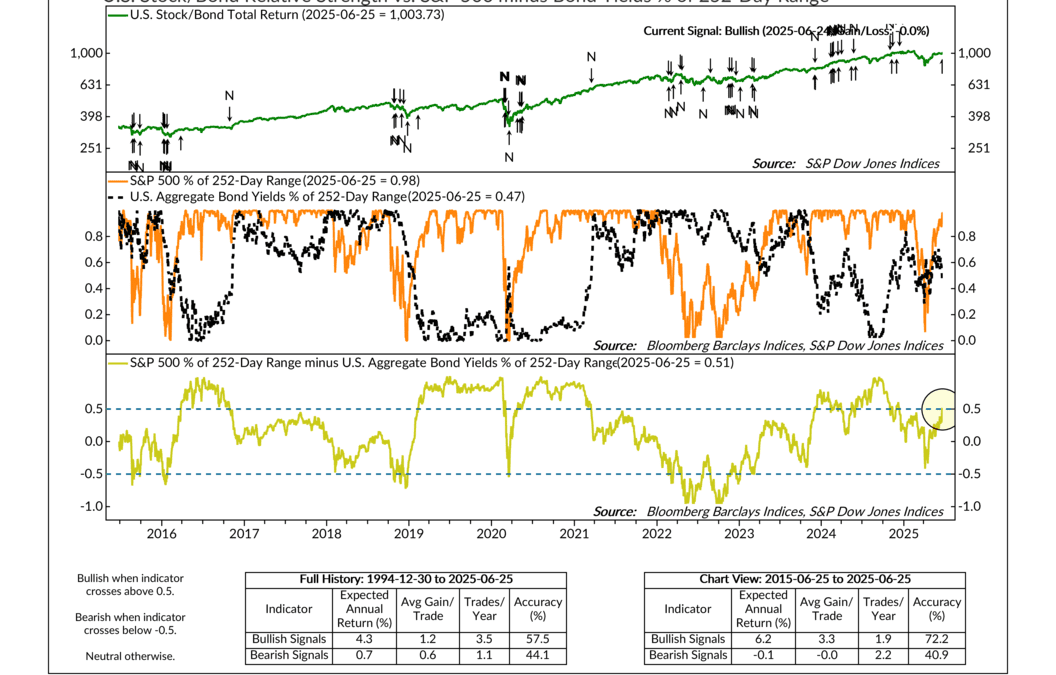

Stocks or bonds? It’s a question every investor wrestles with sooner or later. Check out this week’s indicator, where the battle of the benchmarks is heating up—and a new signal could tilt the field.

Investor surveys tell us what people say—but this week’s featured indicator looks at what they do with their money. With 80% of our positioning signals flashing bullish, history suggests that widespread caution may be setting the stage for further gains.