Pressure Gauge

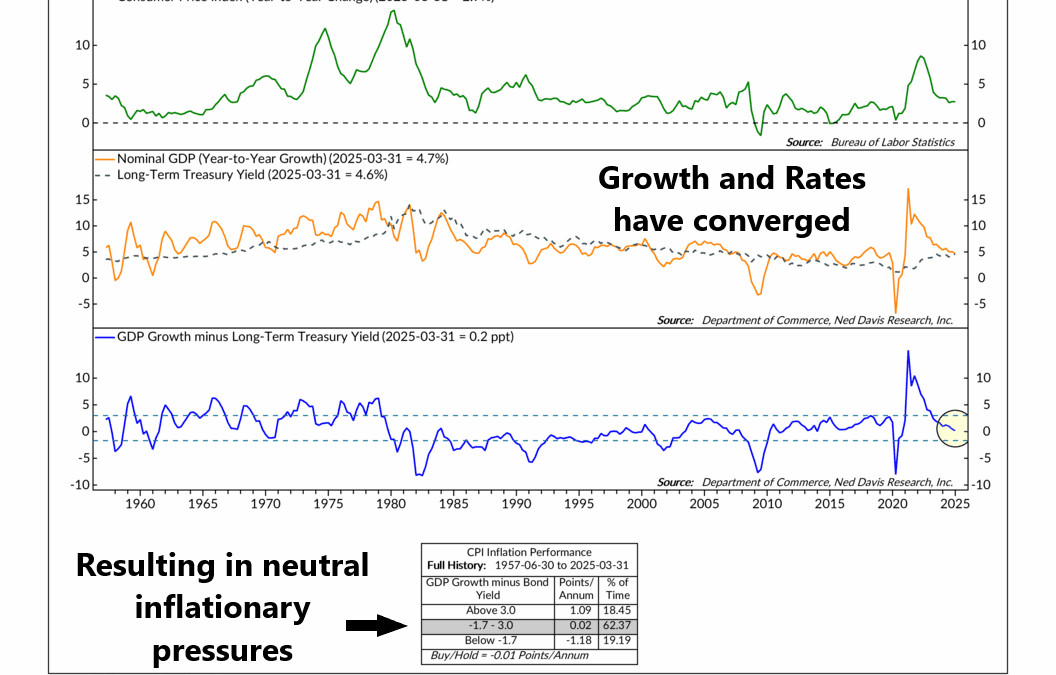

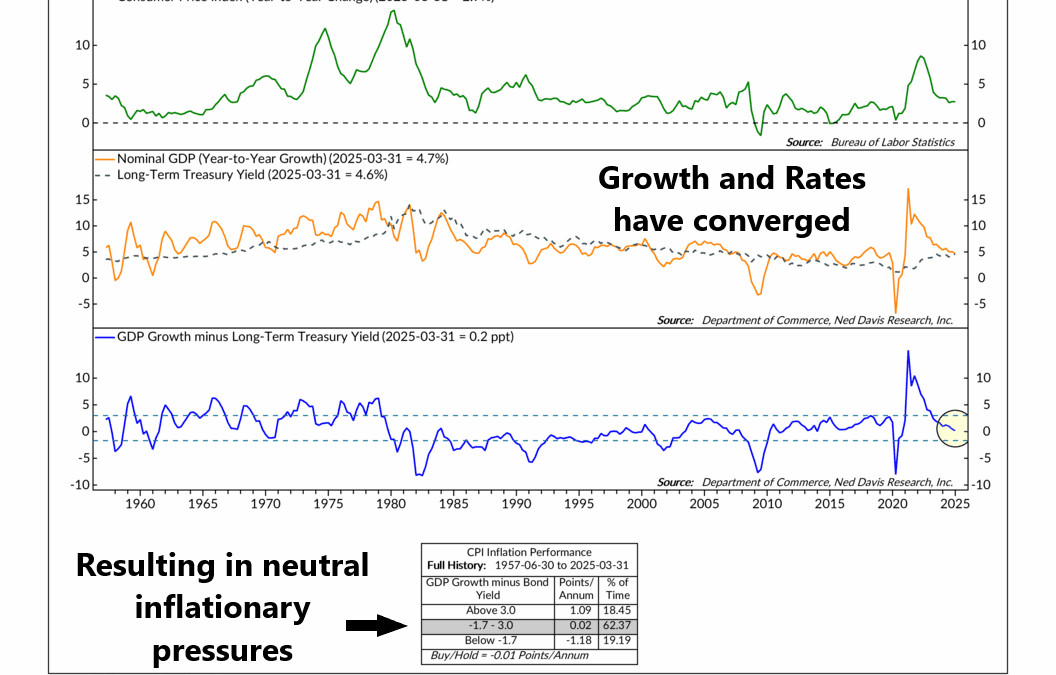

Check out this week’s indicator, which tracks the tug-of-war between economic growth and interest rates and acts like a pressure gauge for inflation. Which side is winning can reveal a lot about where prices might be headed next.

Check out this week’s indicator, which tracks the tug-of-war between economic growth and interest rates and acts like a pressure gauge for inflation. Which side is winning can reveal a lot about where prices might be headed next.

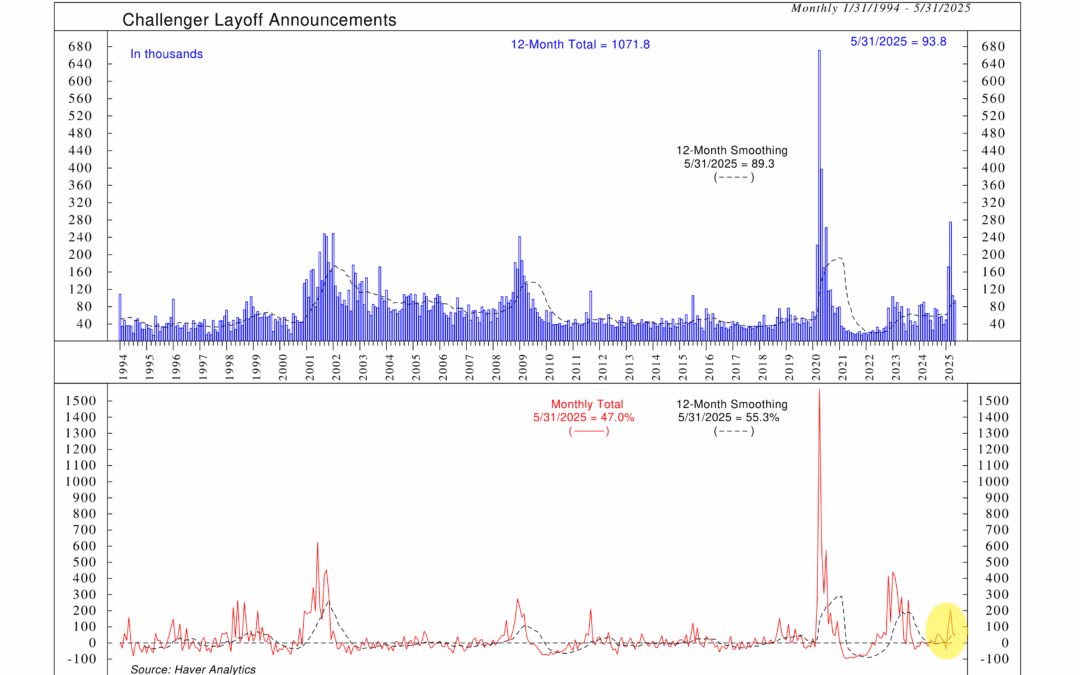

Layoffs are on the rise, and one of our favorite early-warning indicators is flashing yellow. While the broader economy still looks healthy, the recent surge in announced job cuts could be the first crack in the labor market’s foundation.

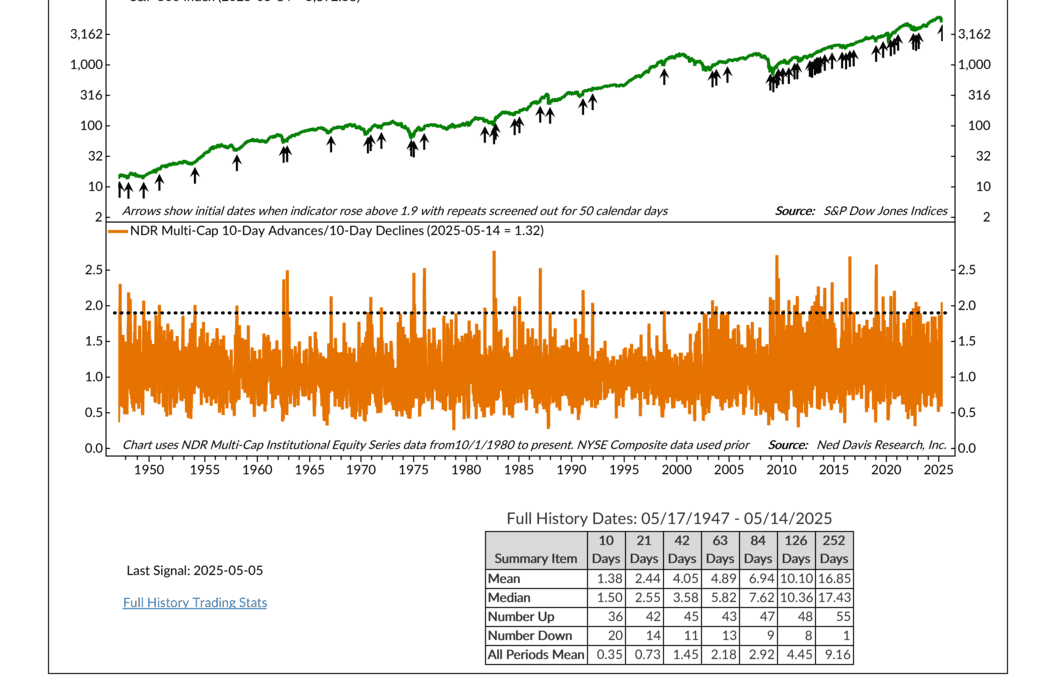

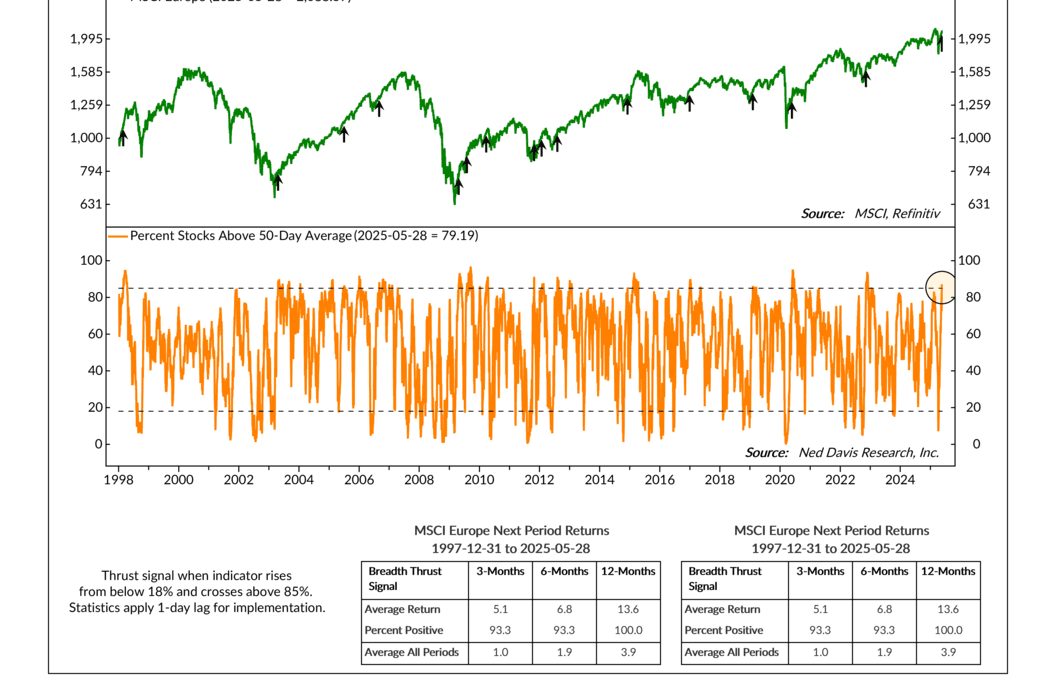

Most investors keep their eyes on the U.S.—but sometimes, the real story is happening elsewhere. This week, a rare and powerful signal just flashed in European markets, and history says it’s one worth watching.

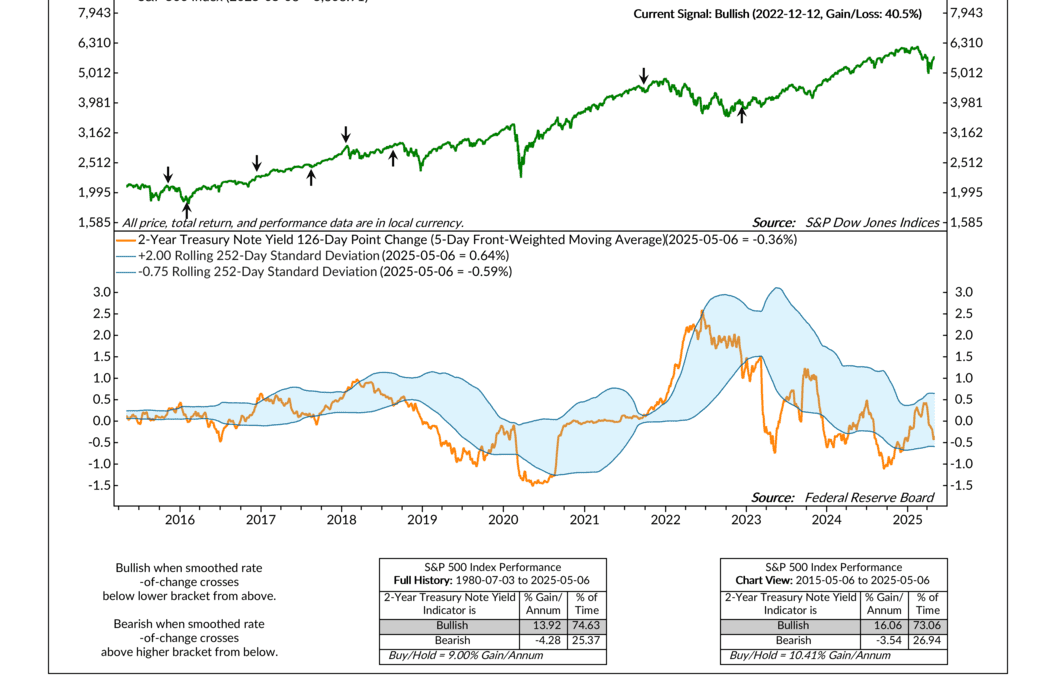

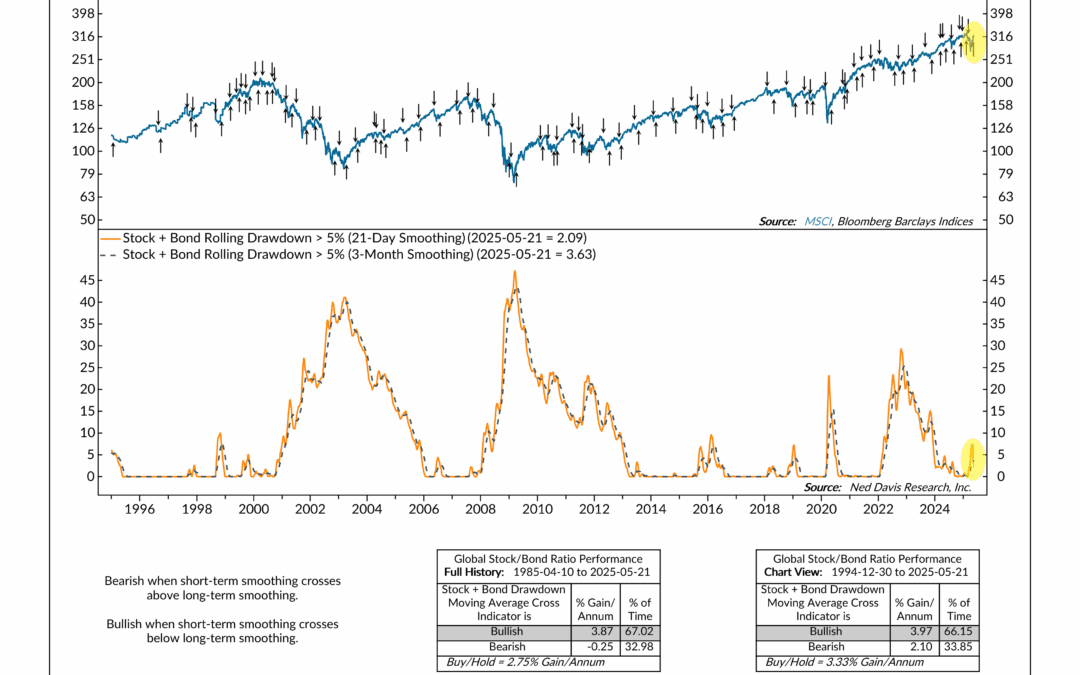

Stocks and bonds came under pressure earlier this year—but this week’s indicator suggests the worst of the pain might be behind us. A new bullish signal just triggered, and history shows it often shows up right as markets begin to recover.