by NelsonCorp | May 1, 2025 | Indicator Insights

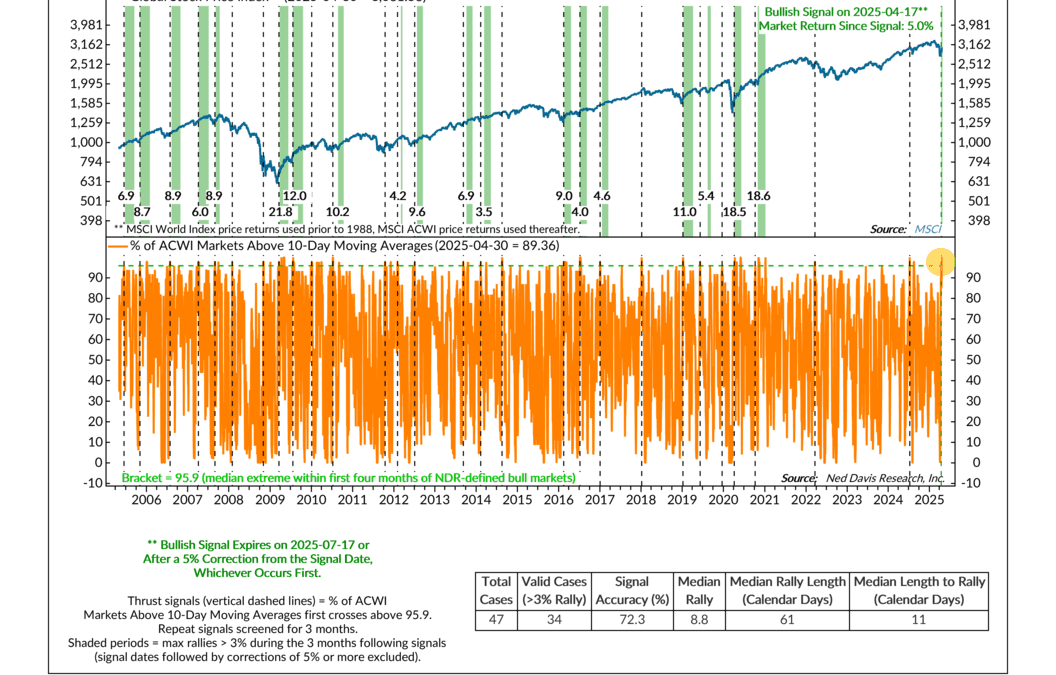

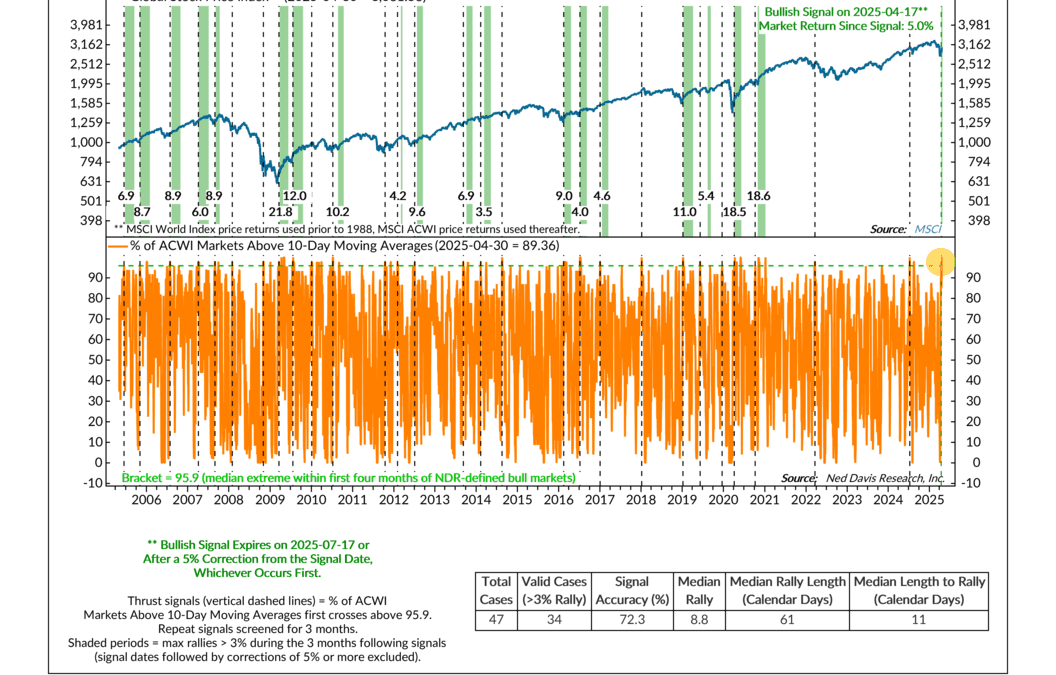

After a rocky few months to start the year, we finally got some good news a few weeks ago: a global breadth thrust. What’s that? Simply put, it’s when a big chunk of global stocks all start moving higher at the same time—and in a relatively short period. In the...

by NelsonCorp Wealth Management | Apr 24, 2025 | Indicator Insights

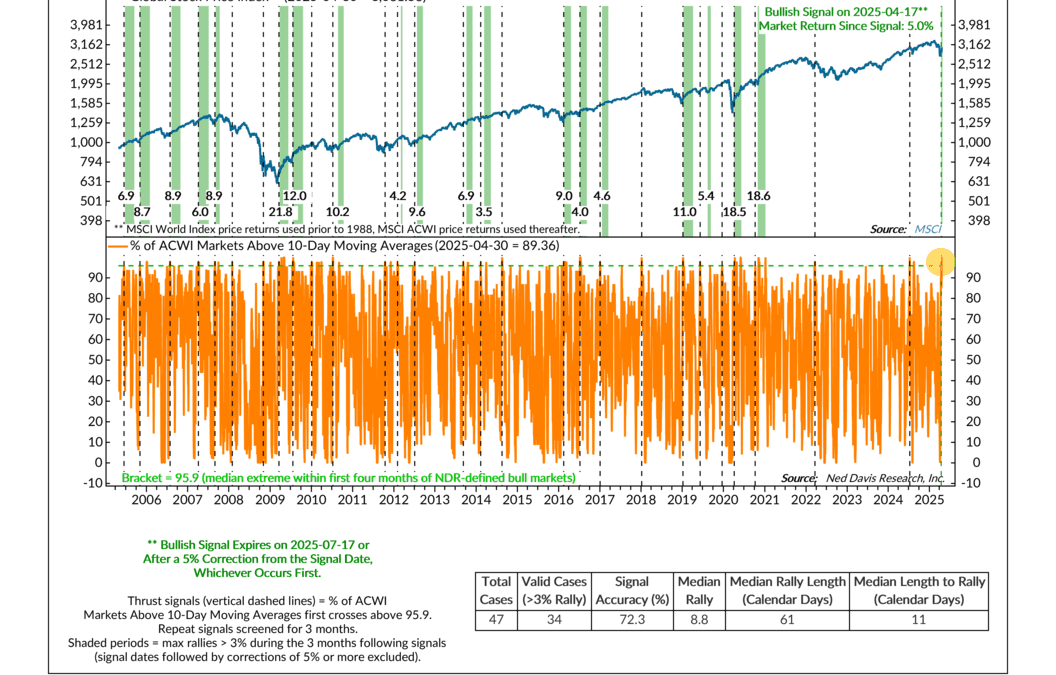

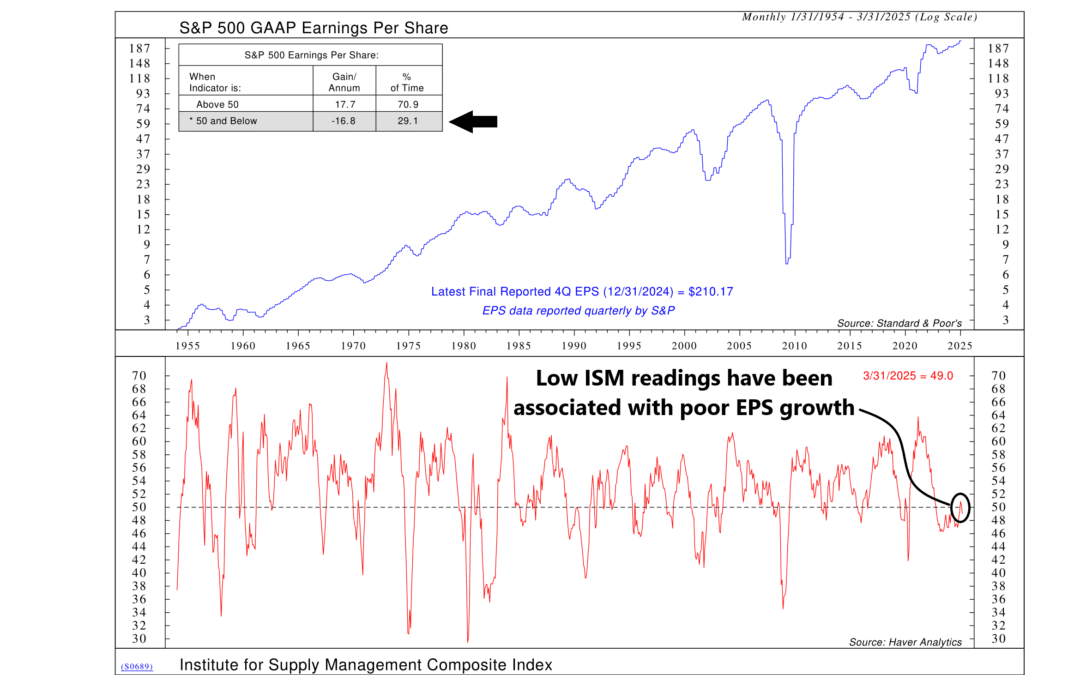

Over the past few weeks, we’ve spent some time diving into the state of corporate earnings—how they’re holding up, what expectations look like, and whether they’re realistic. This week, we’re taking it a step further by linking those earnings to the broader...

by NelsonCorp Wealth Management | Apr 17, 2025 | Indicator Insights

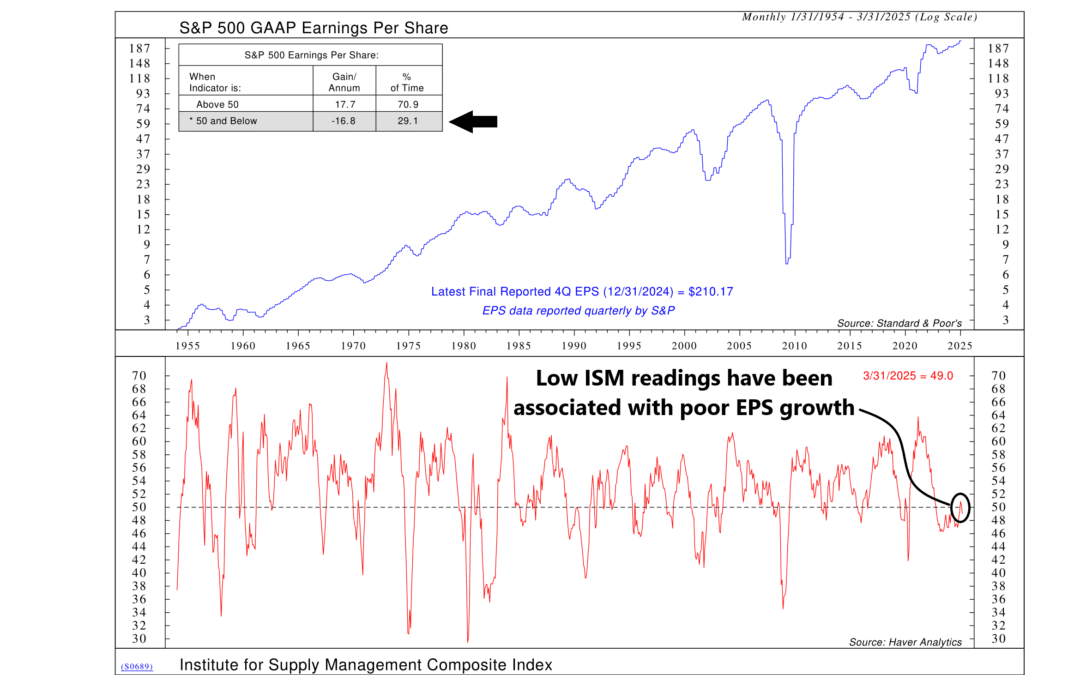

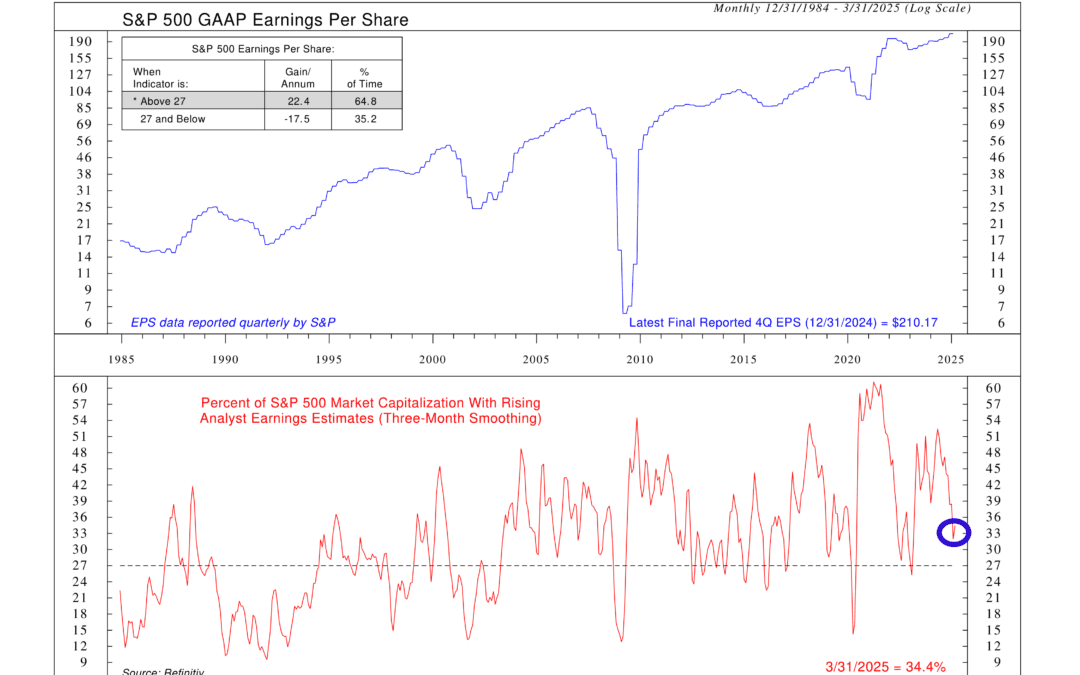

Last week, we looked at how the market has remained fairly upbeat about earnings. This week’s discussion builds on that, digging into just how broad that optimism really is—or isn’t. This week’s indicator tracks the percentage of S&P 500 market...

by NelsonCorp Wealth Management | Apr 10, 2025 | Indicator Insights

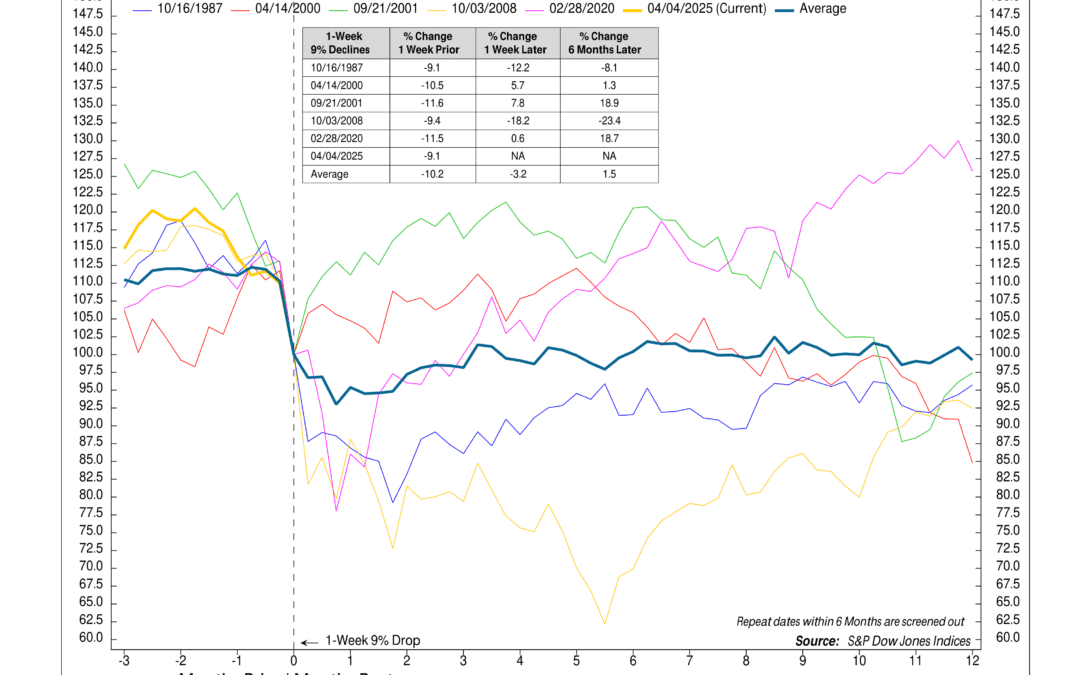

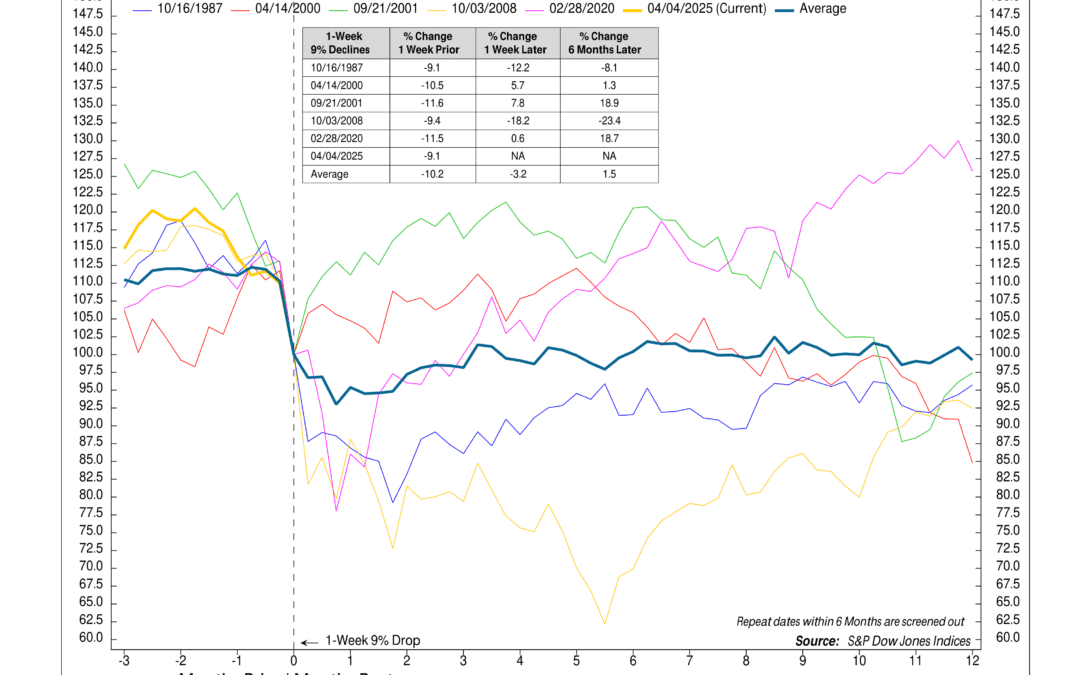

We’re doing something a little different this week. The chart we’re looking at isn’t one of our go-to indicators—it’s more of a historical curiosity. But with the market falling over 9% last week, it’s worth digging into how things have played out after similar...

by NelsonCorp Wealth Management | Apr 3, 2025 | Indicator Insights

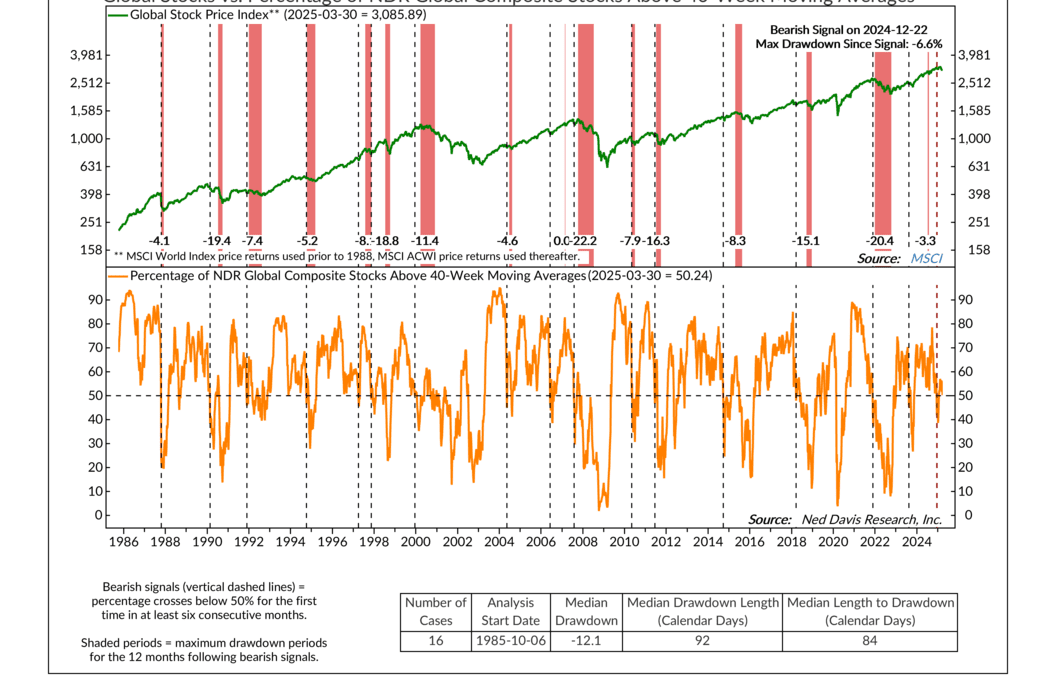

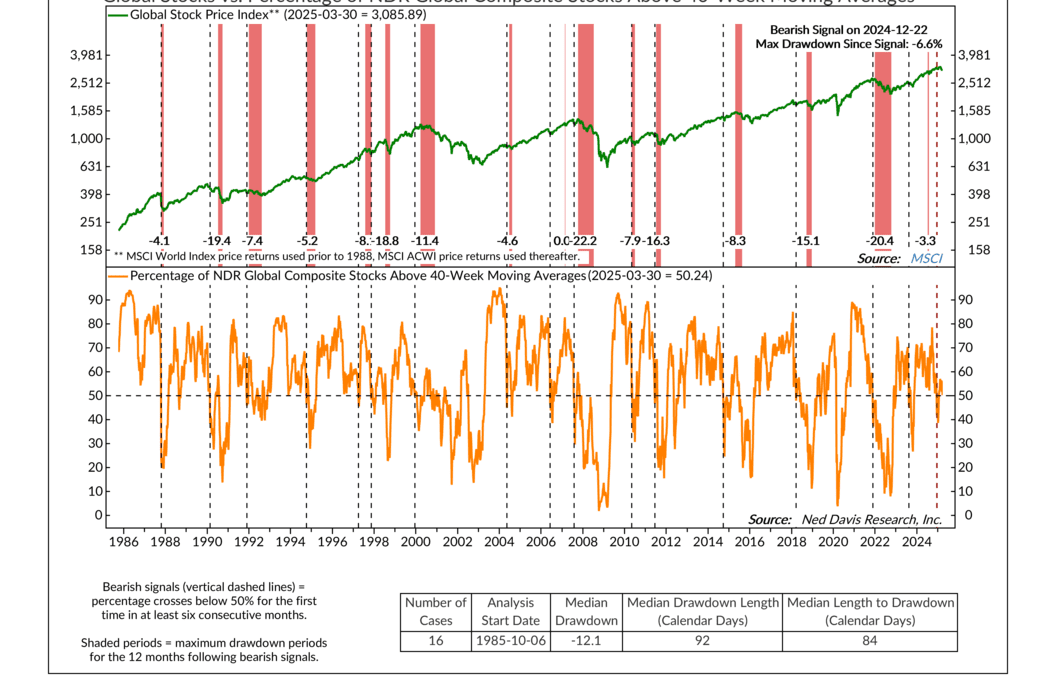

Global stocks are having a rough week. After a strong start to the year, markets have stumbled—hard. The selling pressure has been widespread, and it’s hitting many of the biggest names that have been propping things up. It’s starting to feel like a building...

by NelsonCorp Wealth Management | Mar 27, 2025 | Indicator Insights

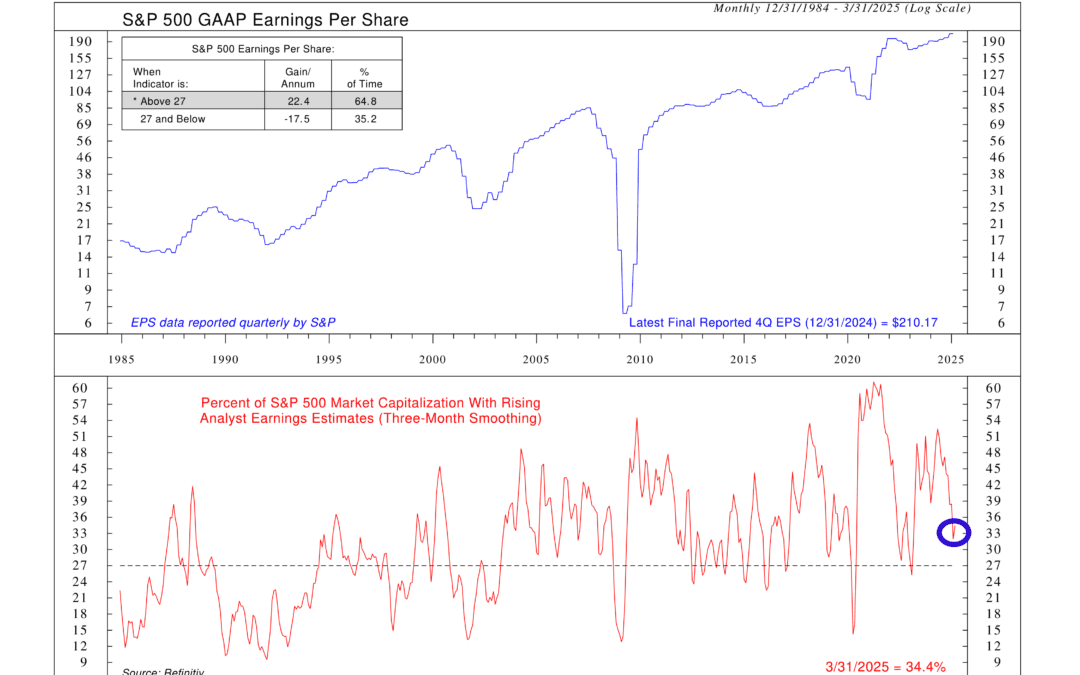

“Downward revision” is one of the most common phrases you’ll hear during earnings season. It’s a polite way of saying: “We got a little too optimistic.” This week’s indicator looks at how much those revisions are happening—and how much...