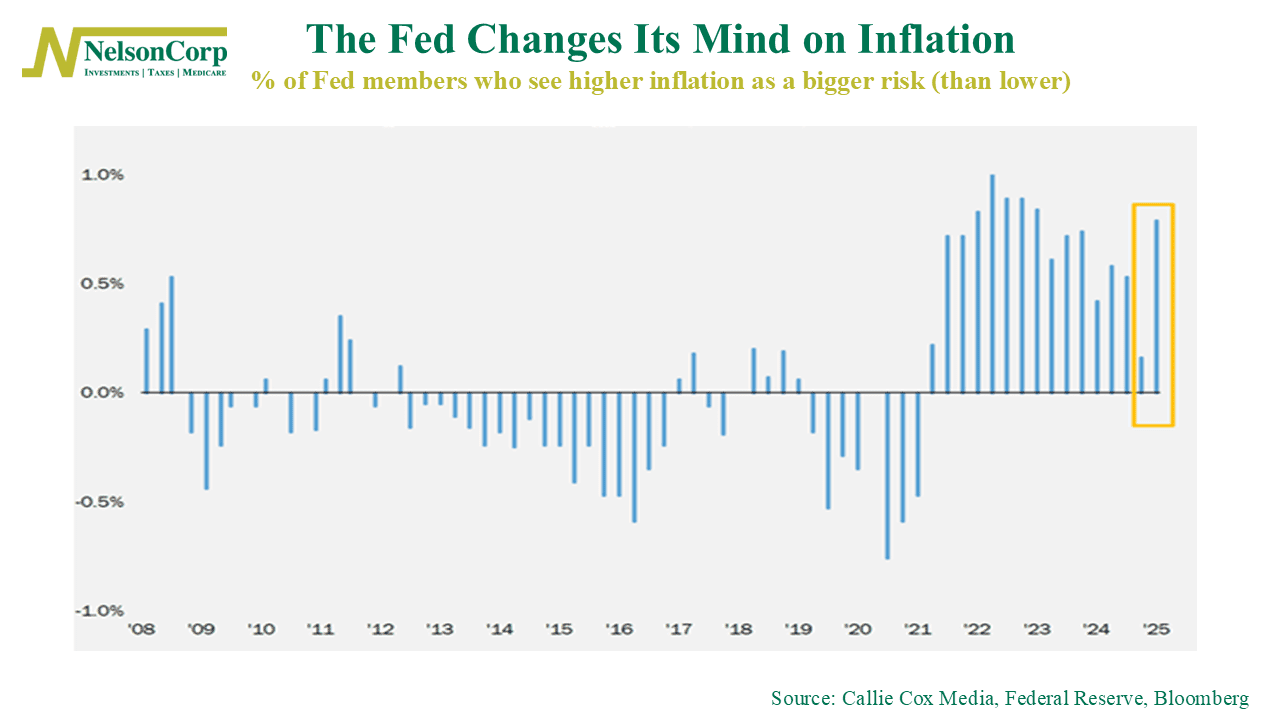

The Federal Reserve prides itself on being data-driven, but this chart shows just how quickly their outlook can shift.

It shows the percentage of Fed members who view rising inflation as a greater risk than falling prices. For most of the past decade, that number lingered below zero, signaling that policymakers were more worried about weak inflation. That changed with the 2021-2022 surge, briefly shifting their focus. By late 2024, those concerns had mostly faded—until now.

As you can see highlighted on the chart, just a few months ago, only a small fraction of Fed officials saw inflation as the dominant risk. Today, 79% do. That’s a massive turnaround, the biggest since 2021 (and before that, 2008). What changed? The data hasn’t moved much—core inflation is running at just under 3%, with producer prices holding steady.

But the Fed isn’t just reacting to numbers; it’s managing expectations. Markets, businesses, and consumers still feel the sting of 2022’s price spikes. Mortgage rates creep up? People worry. Grocery bills rise? Confidence takes a hit. The Fed knows inflation psychology matters, and they’re adjusting accordingly.

This shift has real implications. It could mean fewer rate cuts—or a slower pace of easing—than markets expected. Investors, already hanging on every Fed statement, may need to prepare for more uncertainty.

The takeaway? The Fed isn’t ignoring the data—but it’s also responding to the broader economic narrative. And in today’s market, perception can be just as powerful as reality.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.