It’s perhaps no surprise to investors that America’s stock market has dominated the rest of the developed world in recent years. But have you ever wondered why U.S. stocks have outshined?

This week’s chart gives a big clue: economic strength. When the U.S. economy is running stronger than other major economies, U.S. stocks tend to take the lead.

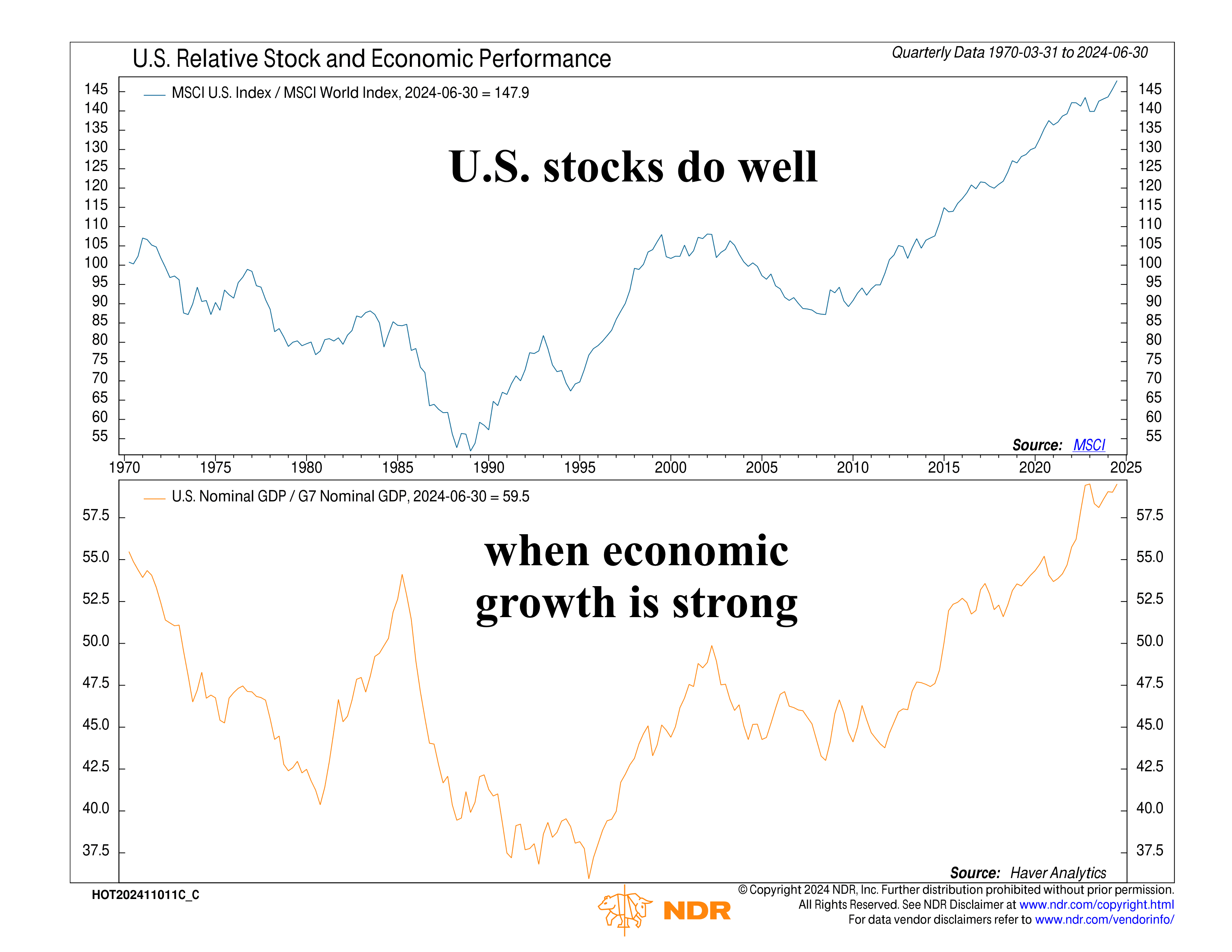

The top line on the chart above shows the performance of U.S. stocks relative to the global market since the 1970s. When it’s rising, it means U.S. stocks are outperforming.

Now look at the bottom half of the chart. Here we have the U.S. economy’s growth (nominal GDP) relative to the G7 countries (the world’s largest and most advanced economies). When it’s consistently going up, it means America’s economy is outperforming—and that coincides with superior equity market performance.

This relationship underscores why economic growth matters so much to investors. In times when the U.S. economy flexes its strength, U.S. equities are often primed to lead, rewarding those who keep an eye on the bigger picture.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI U.S. Index is a stock market index that represents the performance of large- and mid-cap companies in the U.S. market.

The MSCI World Index is a stock market index that measures the equity market performance of developed markets worldwide. It includes large- and mid-cap companies from 23 developed countries, providing broad exposure to international markets.