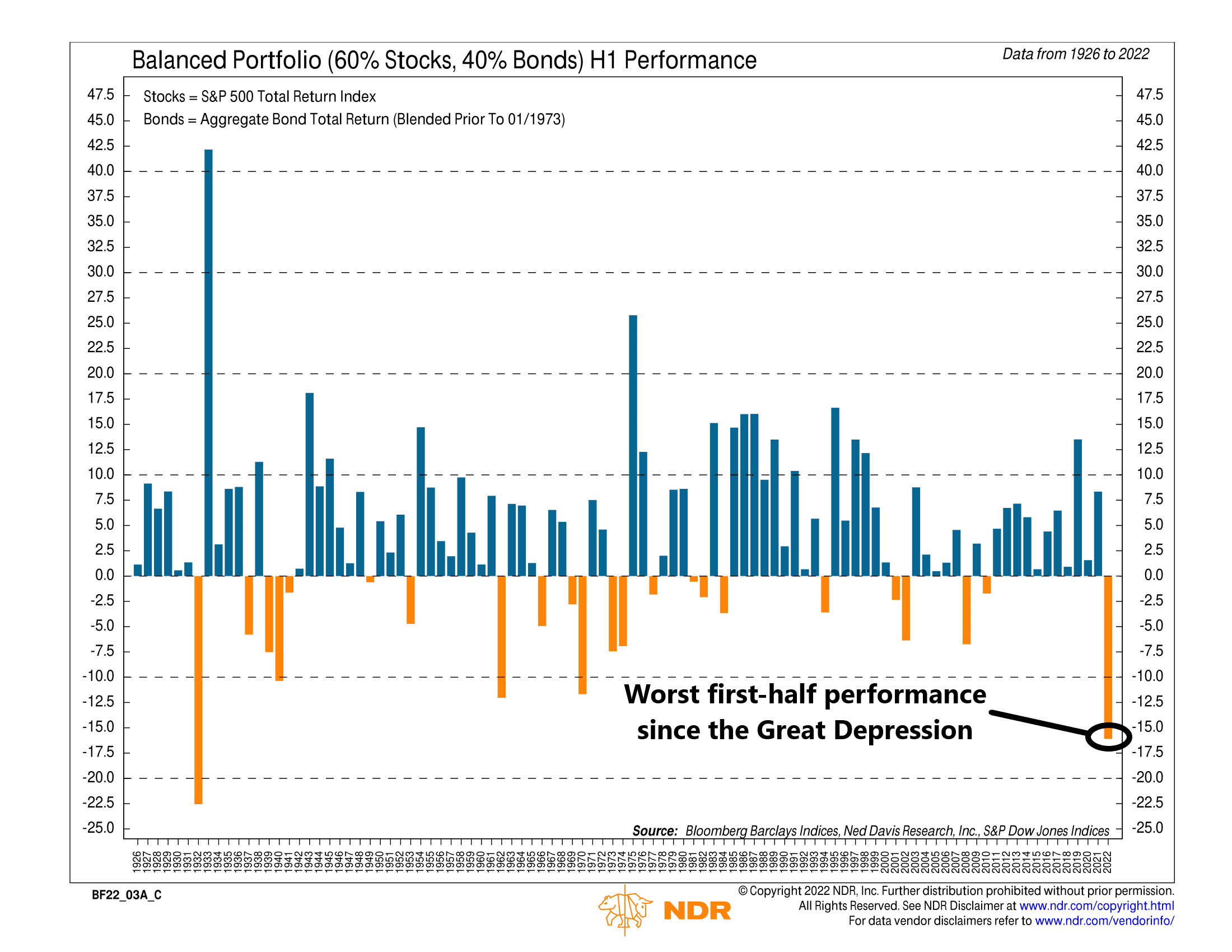

The 60/40 portfolio had a rough first half of the year. As our chart of the week above shows, it just registered its worst first-half performance since the worst one occurred during the Great Depression in 1932.

So, what happened?

The 60/40 balanced portfolio is a natural starting point for many investors. You put 60% of your money into stocks and the other 40% into bonds with the idea that when stocks zig, bonds zag. In other words, it’s a way to diversify your assets so that when one asset class is doing poorly, the other holds up better. It’s balanced. This increases the overall risk-adjusted return of your portfolio (i.e., better returns with lower volatility).

However, the problem is that bonds have fallen right alongside stocks this year. The diversification benefits from holding longer-duration bonds just haven’t held so far this year. That’s because markets are grappling with sky-high inflation and surging interest rates, the kind of stuff we haven’t seen in roughly four decades. This pulls both stocks and bonds down together.

The good news is that, as an investor, you don’t have to just buy and hold a portfolio like the 60/40 and watch it go down. Tactical decisions can help. By staying nimble, you can alter your portfolio mix when the time is right to include short-duration assets like cash and short-term government bonds that hold up much better in this type of environment than longer-duration assets like stocks and long-dated bonds. Even some real asset exposure, like commodities, do well in high inflation environments.

These tactical decisions will help if we see multiple years of negative performance for the 60/40 portfolio, which, as you can see from the chart, has happened from time to time throughout history. Even so, the other bright spot is that some of the best returns for the 60/40 portfolio have come in the years right after a big down year. That’s at least some comfort to investors that things will likely turn around and improve from here.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.