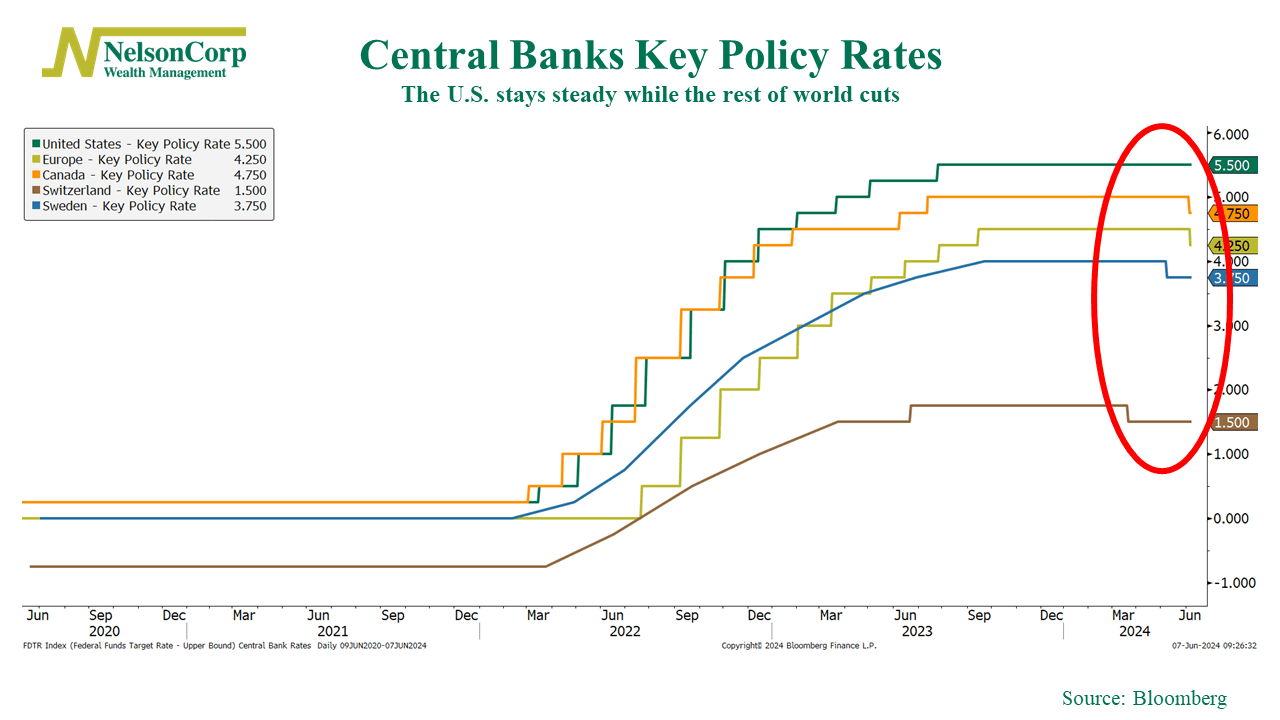

Hikes are out, and cuts are in. That’s the direction the world’s Central Banks have been moving lately.

This week, the European Central Bank and Canada joined Sweden and Switzerland in cutting their key policy interest rates. That makes four major Central Banks now entering a rate-cutting cycle.

Meanwhile, the United States is holding its key policy rate steady at 5.5%, thanks to stronger-than-expected economic growth and inflation.

That could change, however. The market still expects the Fed to cut rates at least once this year. Will the United States join the party before the year is up? American investors certainly hope so.

But as far as the rest of the world is concerned, it does appear that we are shifting away from the era of restrictive monetary policies and moving toward a more relaxed approach. As long as this rate-cutting cycle isn’t accompanied by a global recession, it will likely be a good thing for investors.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.