In chaos theory, there’s this concept known as the butterfly effect. You might have heard of it or seen the 2004 movie by the same name. The idea is that tiny actions can lead to unpredictable changes over time. The famous example is a butterfly flaps its wings in China and causes a tornado in Texas.

Well, a couple of weeks ago, a butterfly flapped its wings in Japan and caused a tornado on Wall Street. Not literally, of course. I’m talking about the technical unwinding of something called the Japanese Yen carry trade.

What is the Yen carry trade? Picture this: Investors borrow Yen because it’s cheap, thanks to Japan’s super-low interest rates. They then invest that borrowed money in higher-return assets elsewhere. That’s the trade. Easy-peasy. It’s a pretty sweet deal—as long as the Yen stays weak.

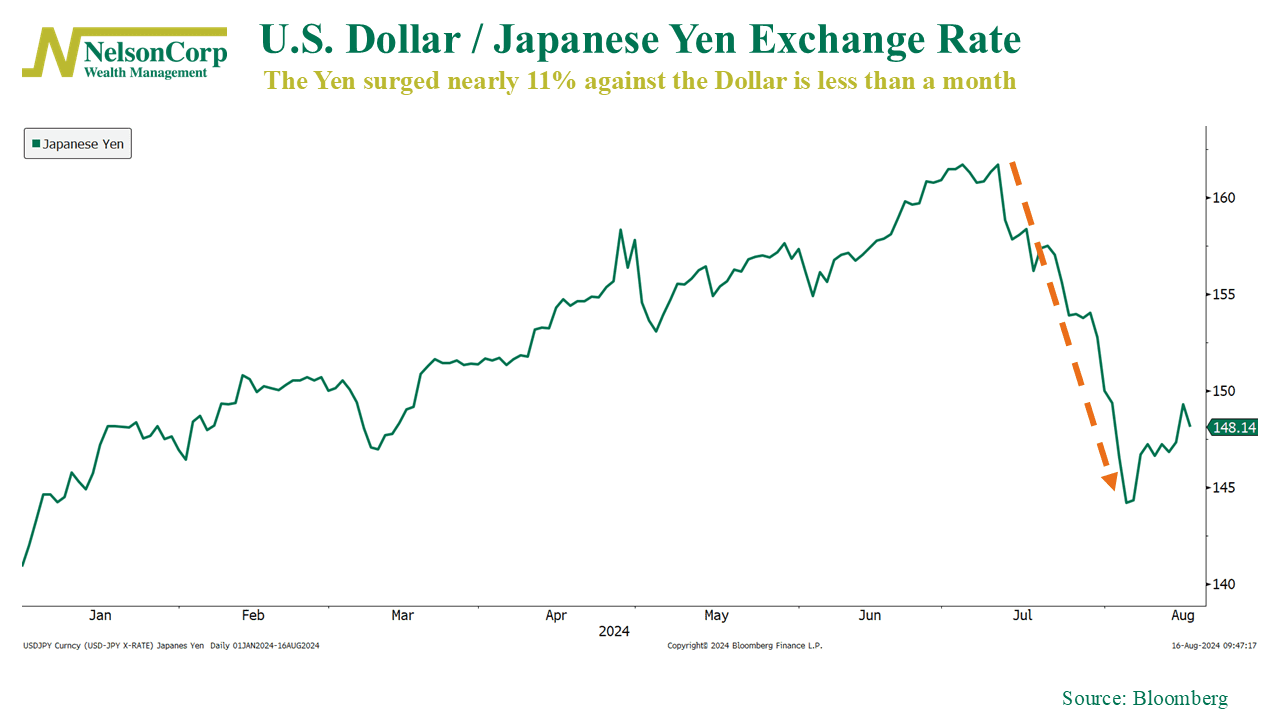

But the Yen didn’t stay cheap. In July, the Bank of Japan raised interest rates, catching everyone off guard. As you can see on our featured chart above, the Japanese Yen got significantly stronger relative to the U.S. dollar in a fairly short period of time (i.e., the line went down quickly).

What happened next? Well, investors were suddenly stuck with more expensive Yen loans. It created a bit of a panic, as everyone had to sell their investments to pay back their loans, leading to a market sell-off. It even hit U.S. markets, particularly U.S. tech stocks.

The good news? The panic seems to have subsided, and markets have calmed down significantly. But this episode is a great reminder that, in global finance, nothing happens in a vacuum. Everything is connected.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.