We saw a lot of good news on the inflation front this week. The May Consumer Price Index (CPI) showed a broad cooling in prices, and then we found out that the Producer Price Index (PPI) unexpectedly declined by the most in seven months last month.

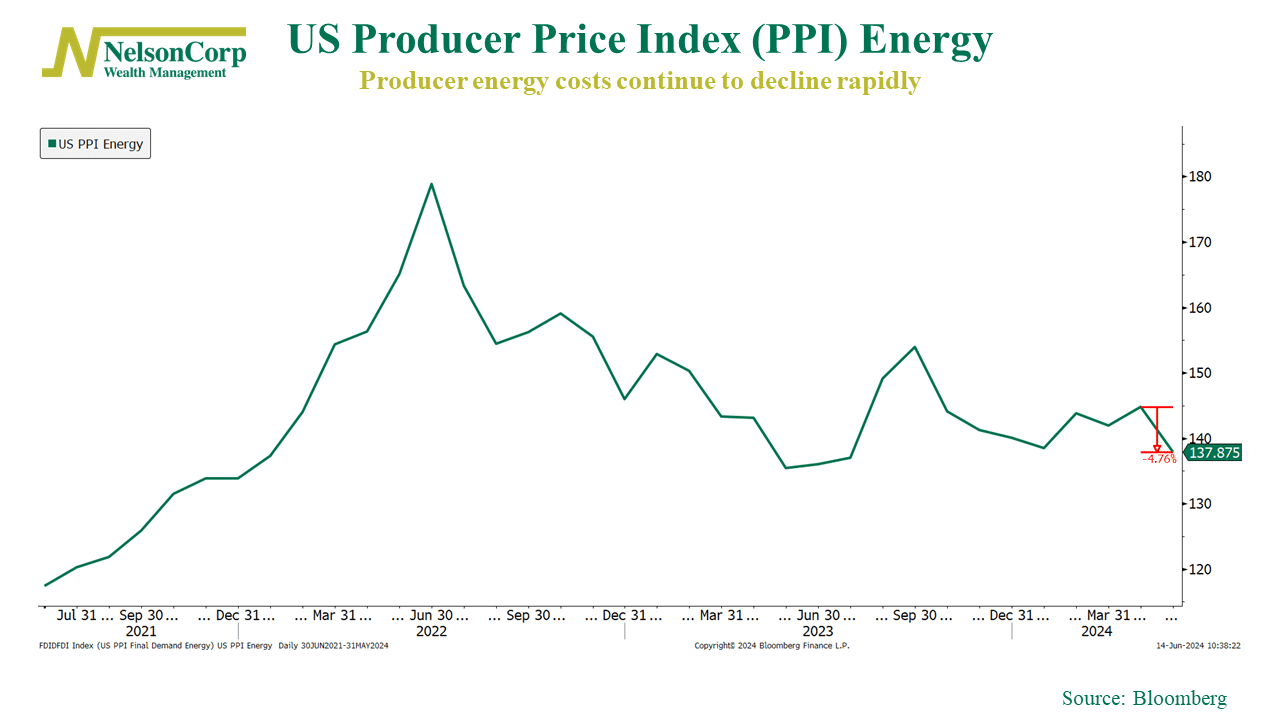

The big reason for the decline in producer prices? Energy costs. Gasoline prices alone dropped more than 7%. And as our chart above shows, the overall energy component of the PPI fell 4.76% in May. That one move resets producers’ energy costs almost all the way to the post-pandemic lows of mid-2023.

This is an important data point because some of the underlying details in the PPI report are used to calculate the Federal Reserve’s go-to measure of inflation, the Personal Consumption Expenditures Price Index, released later this month.

The bottom line? After a couple of hiccups to start the year, it appears the “disinflation trend” is finally back on track.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.