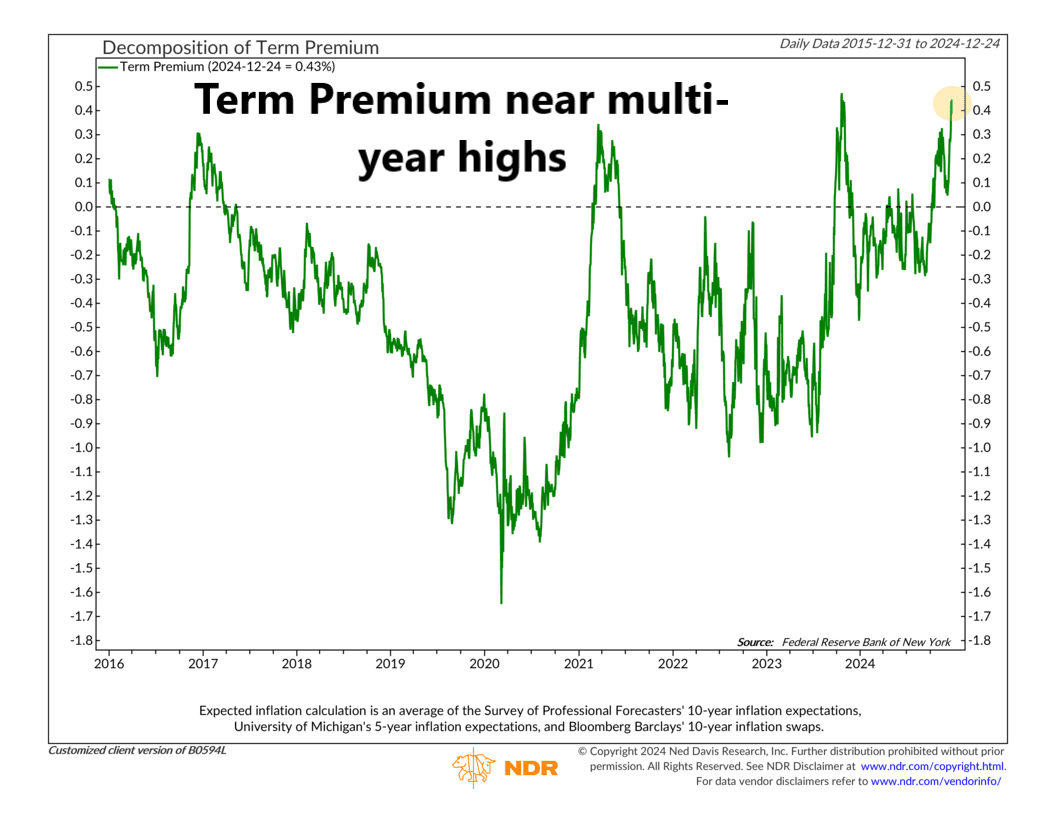

This week’s chart highlights the surge in the term premium on U.S. Treasuries—the extra return investors demand for holding long-term bonds instead of short-term ones. Think of it like asking for a bigger reward to lock your money away for longer because the future feels uncertain. The term premium helps cover risks like unexpected inflation or changes in the economy.

Right now, the term premium is at its highest since October 2023. What’s behind the jump? Mostly sticky inflation and concerns about rising federal deficits. But’s what’s really interesting is that while 30-year Treasury yields have climbed to 4.78%, near yearly highs, the term premium is rising even faster.

This signals growing investor caution, with risks extending beyond inflation to broader economic and debt concerns. So basically, the bond market is waving a caution flag, signaling that 2024 could bring more twists and turns than investors bargained for.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.