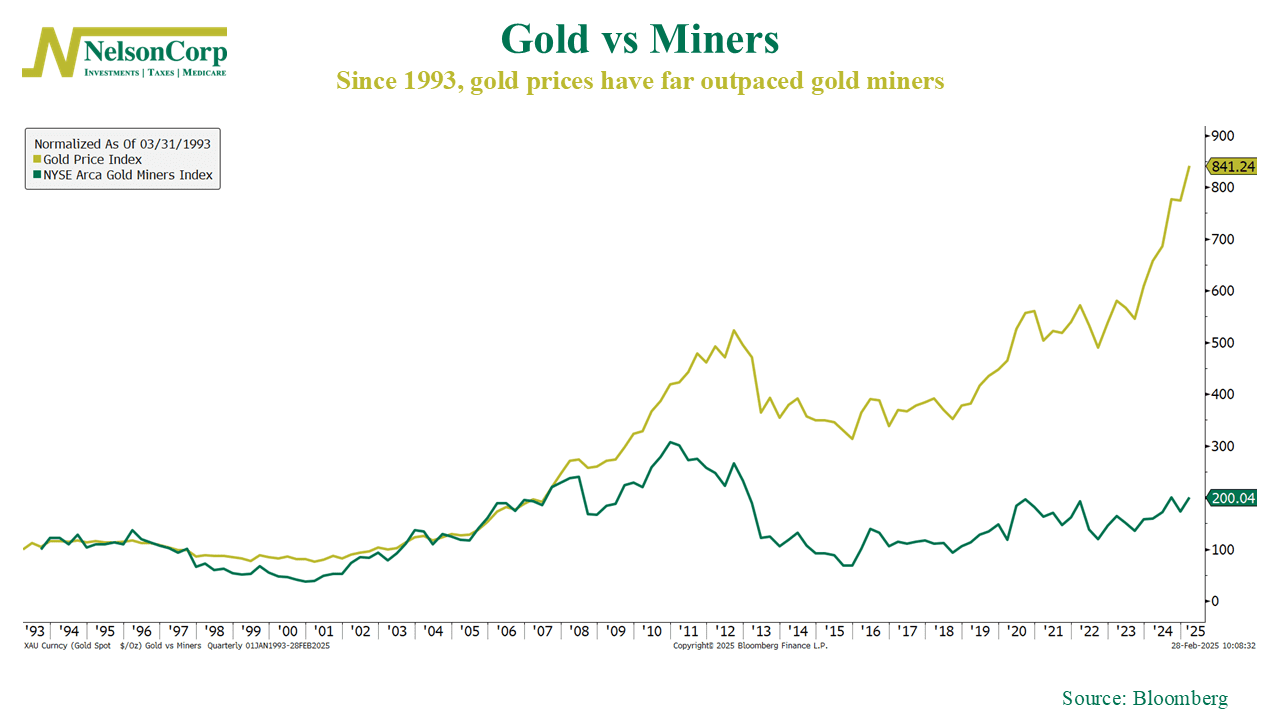

It’s been a golden era for gold—but not so much for gold miners. This week’s chart shows how gold prices have skyrocketed over the past three decades, while mining stocks have lagged far behind. Since 1993, gold has soared more than eightfold, while the index of gold miners has merely doubled—a massive divergence for an industry that literally digs up the metal.

Why have miners underperformed so dramatically? Well, mining is an expensive and risky business. Rising labor, equipment, and regulatory costs eat into profits. Plus, miners don’t just track gold—they’re also exposed to corporate mismanagement, geopolitical risks, and shifting investor sentiment.

But there’s a bigger issue: we’re running out of new gold. Since 2005, global gold discoveries have declined by 50% every five years. The easy-to-mine gold is gone, leaving deeper, lower-quality deposits that require more effort (and money) to extract. That’s a big reason why gold prices have soared while mining stocks have remained stuck in the mud.

This is a classic case of investing not working the way you’d expect. Just because two things seem connected—like gold prices and gold miners—doesn’t mean they’ll move in sync. The market always finds a way to keep investors on their toes.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.