Last year, the Federal Reserve geared up in its battle against inflation by swiftly increasing interest rates. They threw a powerful right hook at inflation, delivered in the form of 8% mortgage rates. The impact? A direct hit on the housing market, leaving it a bit wobbly.

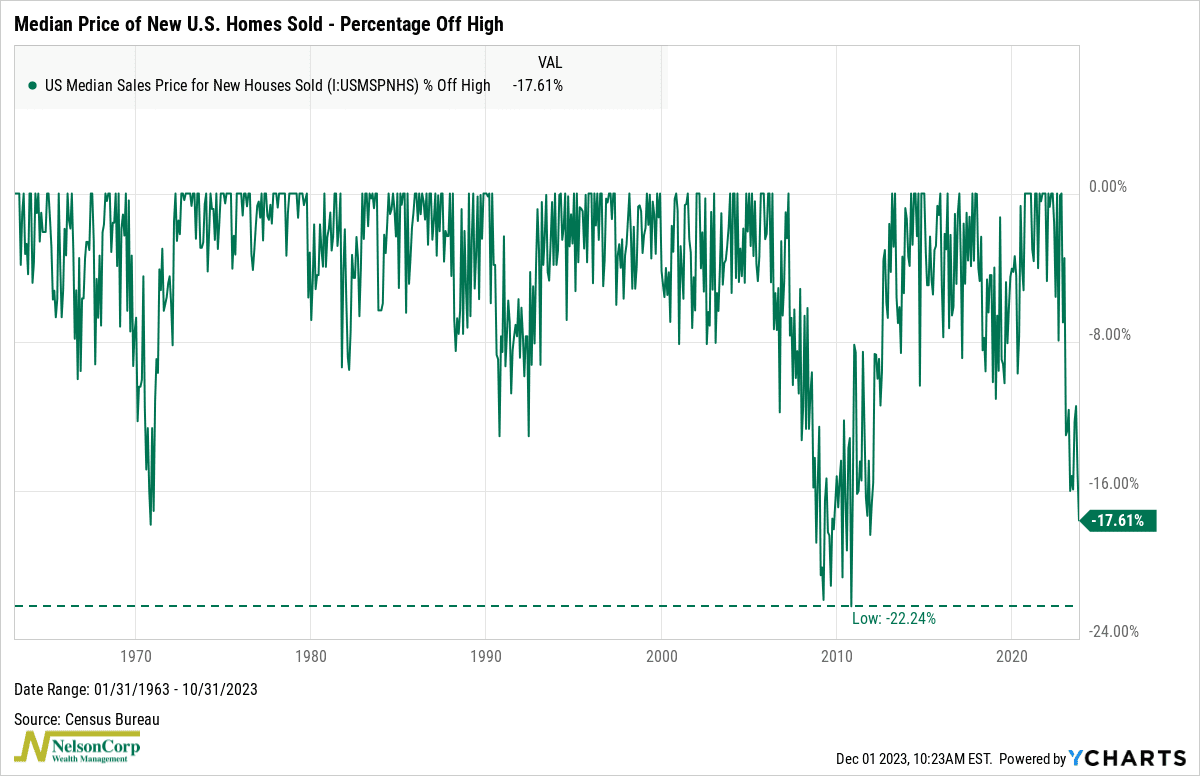

For example, our featured chart above shows that the median price of a new home sold in the U.S. is now down nearly 18% from its peak in October 2022. For those of you who vividly remember the housing bubble in the 2000s, this might trigger a sense of déjà vu. Back then, the median price of a new home fell 22% nationally.

But here’s the silver lining: Unlike that downturn—which was coupled with a harsh recession—this time around, our economy has held up remarkably well. As long as this trend continues, with new home prices and inflation cooling down, we think this will likely set the stage for a much more favorable investing environment.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.