Some bull markets sprint. Others grind higher, slow and steady. A few explode out of the gate and never look back. The current one? It’s moving at a measured pace—respectable, but not outpacing history.

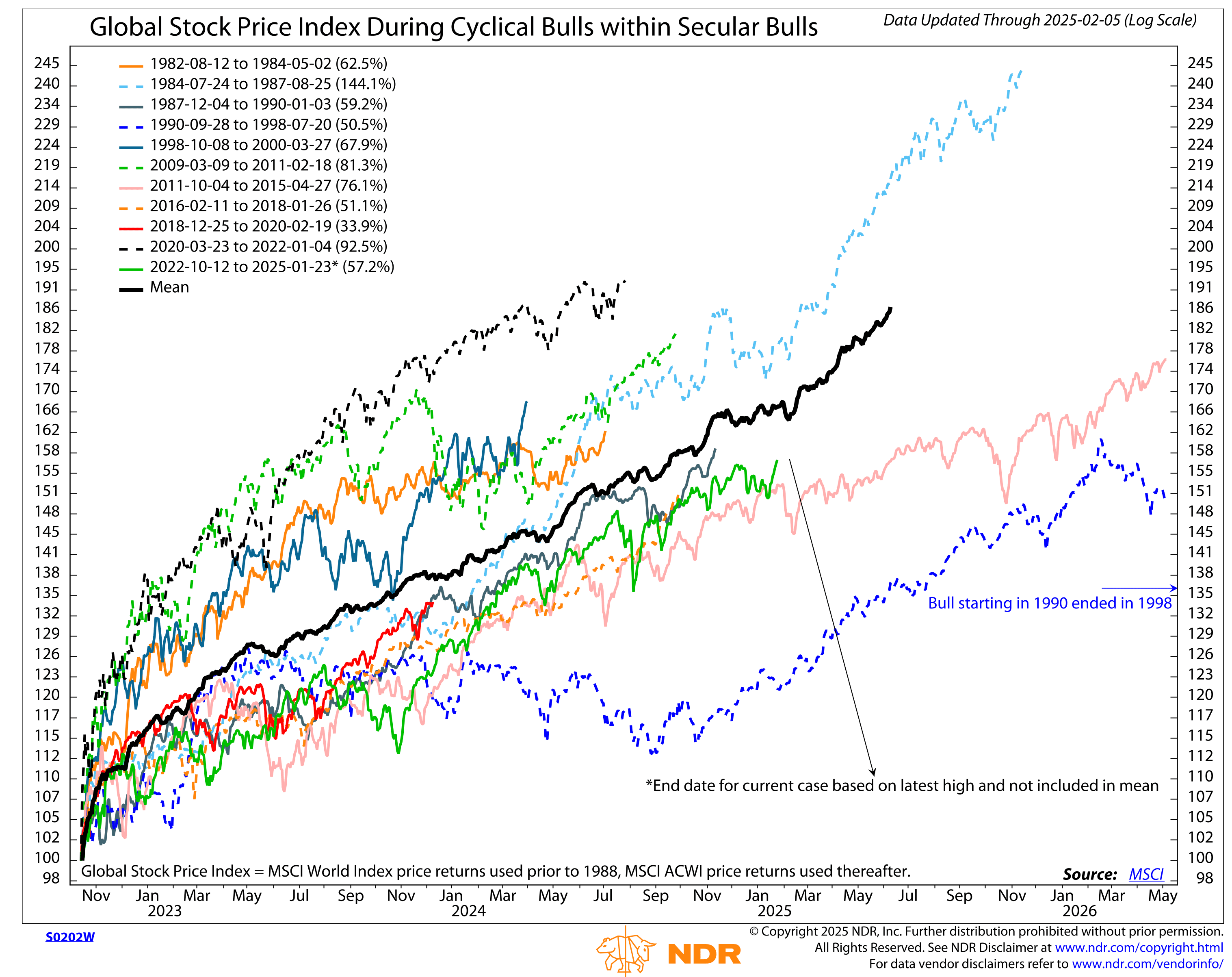

This week’s chart tracks the Global Stock Price Index during past cyclical bull markets within secular bull trends. A cyclical bull market is a shorter-term upswing, often driven by economic cycles, lasting a few years at most. A secular bull market, on the other hand, is a long-term trend—often a decade or more—where stocks generally move higher despite periods of volatility and pullbacks.

Each colored line represents a different cyclical bull market, showing how global stocks performed after a market bottom. The black line is the historical average. The green line represents today’s bull market, which began in October 2022.

So far, this rally is up 57.2%, putting it just below the long-term average and well behind some of the more explosive runs. The 2020-2022 surge, for example, soared 92.5% in under two years. The post-2009 recovery climbed 81.3%, fueled by aggressive stimulus. Even the late ‘90s run reached 67.9% before it peaked.

But most of these bulls follow a pattern. Historically, cyclical rallies inside secular bull markets tend to last 1.5 to 3 years, with gains in the 50-80% range before momentum fades.

That means this one is right in the middle of the historical playbook—past the early stages, still moving, but entering a phase where the road can get rougher.

Does it have more room to run? Maybe. History suggests gains could continue, but the easy part of the rally may already be behind us. The next leg—if there is one—will have to climb a wall of uncertainty, just like every bull market before it.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.