“Don’t throw the baby out with the bathwater.” This expression is generally used to describe when something good is eliminated while trying to get rid of something bad. Interestingly enough, this tends to happen from time to time in the stock market.

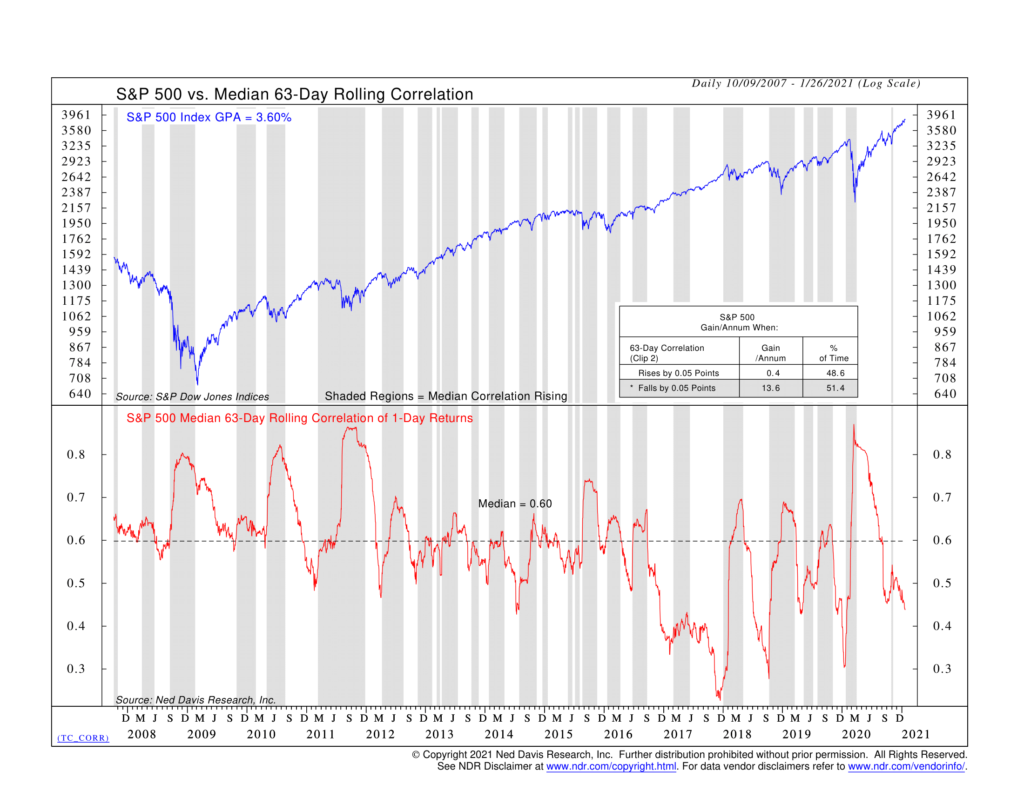

To see what I mean, let’s look at this week’s featured indicator: The S&P 500’s Median 63-Day Rolling Correlation of 1-Day Returns. That’s quite a mouthful, but to put it simply, it tells us how closely the median (or average) stock in the S&P 500 is moving in relation to the market over the past 63 days (or three months). When correlations are low (closer to 0), stocks are moving independently from one another. But when correlations are high (closer to 1), stocks are moving together.

We find that correlations are generally driven by fear. This fear consumes investors during a selling climax, and stocks get sold regardless of their underlying fundamentals or future growth prospects. In other words, the good gets thrown out with the bad!

Because of this dynamic, we look at elevated correlations as a type of sentiment gauge.

Specifically, when correlations have risen by at least 0.05 points, it’s a sign that fear is overtaking the market and volatility is rising. Historically, stocks have struggled significantly when this is the case, returning just 0.4% per year, on average.

On the other hand, when correlations have fallen by at least 0.05 points, it’s back to business as usual; stocks have returned about 13.6% per year, on average, during this time.

During this recent crisis, we can see correlations started spiking just before the major sell-off in March, a warning sign that fear was taking over. However, after the waterfall sell-off, correlations began to fall, and the indicator gave the all-clear sign shortly after the market bottomed.

This recent history shows just how powerful this type of indicator can be when used to gauge investor sentiment and psychology.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.