James Carville has a famous quote about the bond market. It goes, “I used to think that if there was reincarnation, I wanted to come back as the President, or the Pope, or as a .400 baseball hitter. But now, I would want to come back as the bond market. You can intimidate everybody.”

While funny, the quote also rings true.

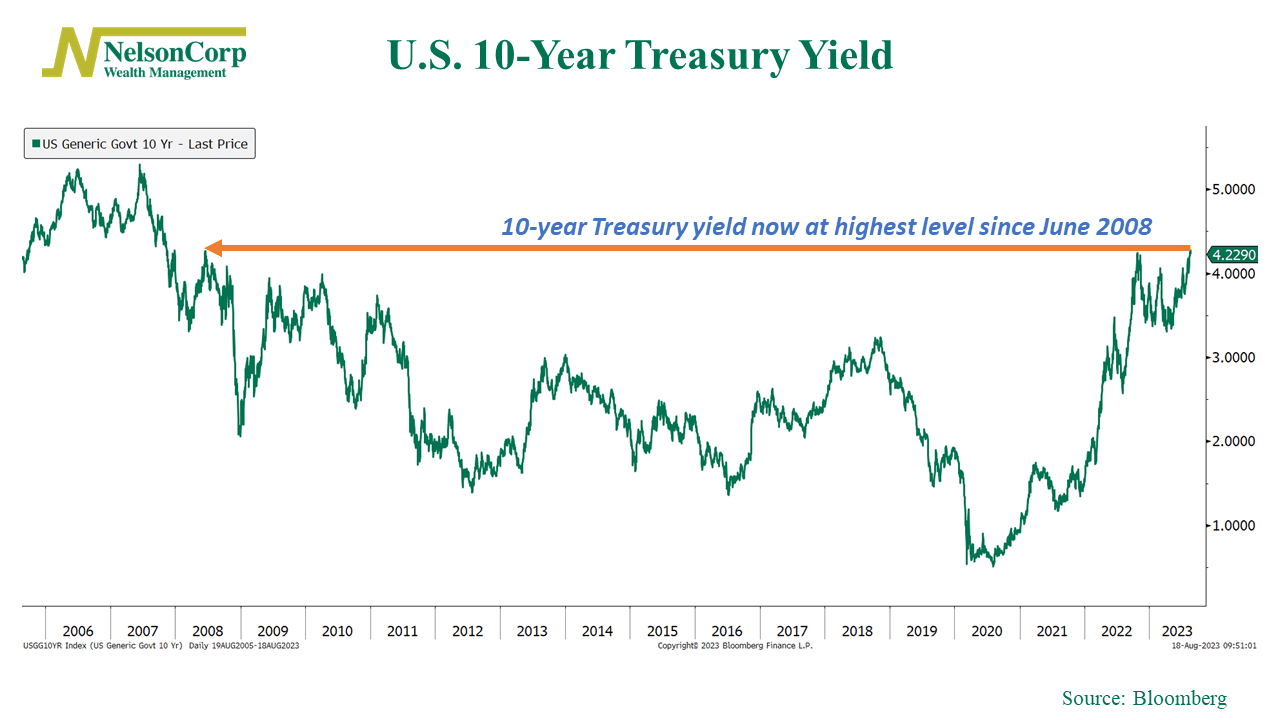

Our chart of the week, shown above, features the yield of the 10-year Treasury government bond, the benchmark rate the U.S. government borrows at for ten years. It peaked last October, around the same time the U.S. stock market bottomed. Falling rates were good for the stock market, as lower yields meant a lower opportunity cost of holding long-duration assets like stocks.

However, the tables have since turned. The 10-year rate has started rising again; it’s now at its highest level since June 2008. The bond market is intimidating the stock market, and stocks have pulled back in response.

We think this will be something to watch as we finish out the rest of the year. Rising rates don’t always hurt stock prices, but as last year showed, they can certainly act like a wrecking ball for stocks when they get out of hand.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.