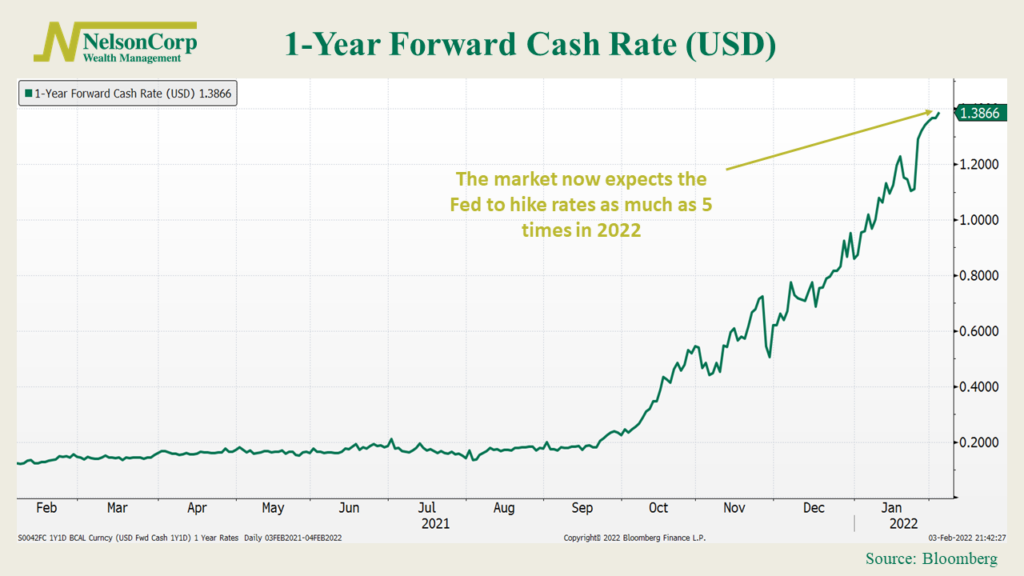

This week, we’ll take a look at a chart from the interest rate markets: the 1-year forward cash rate. The cash rate (or fed funds rate) is the interest rate that banks charge to lend to each other on an overnight basis. This is the rate that the Federal Reserve targets when it wants to influence interest rates and the money supply in the economy. In other words, it’s a big deal!

The chart above is specifically looking at what the market thinks the cash rate will be one year from now. Currently, the rate is set to zero. The Fed lowered it to zero back in 2020 to fight the pandemic-induced recession.

However, inflation ran hotter than expected in 2021, so starting around mid-September, the 1-year forward cash rate started rising sharply. This was in anticipation that the Fed would start hiking rates in 2022 to combat inflation.

To start the year, the 1-year forward cash rate was about 1%, which meant the market expected the Fed to hike rates four times in 2022 (0.25% increments each time). Fast forward one month later to today, however, and the forward rate has jumped to over 1.25%, meaning the market now expects at least five rate hikes this year.

This sudden rise in expectations for higher interest rates one year from now is the source of a lot of the volatility we’ve seen in the equity markets to start the year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.