In the world of finance, two key interest rates reign supreme: the 10-year Treasury yield and the Fed Funds rate.

The Fed Funds rate is set by the Federal Reserve, and changes to this rate are designed to influence the 10-year Treasury yield—a market-based measure of investor expectations for rates over the next decade.

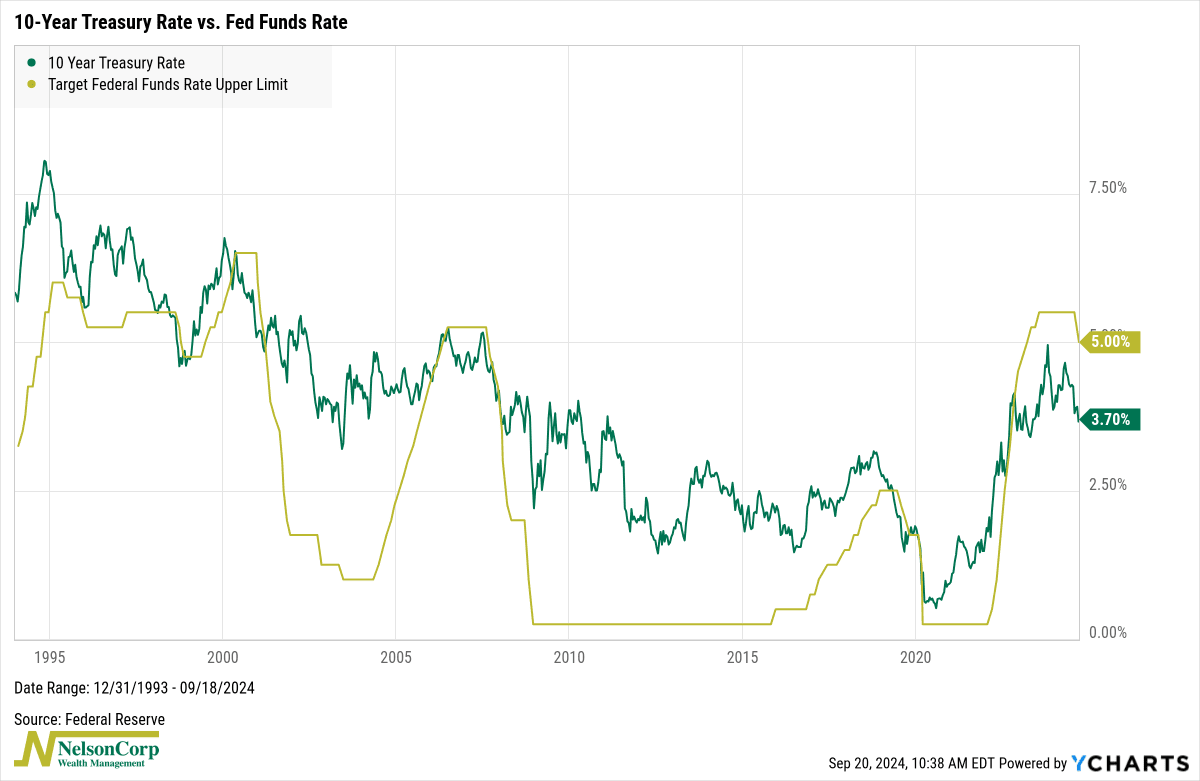

As shown in our featured chart above, these two rates often move in sync, almost like they’re dancing the tango. The Fed Funds rate plays a big role in where the 10-year yield heads, but the 10-year yield is also shaped by other factors like economic growth, inflation expectations, and global demand. This means the two don’t always match up perfectly.

We’ve seen this divergence in recent years. While the Fed pushed the Fed Funds rate (gold line) as high as 5.5%, the 10-year Treasury rate (green line) never quite reached 5%.

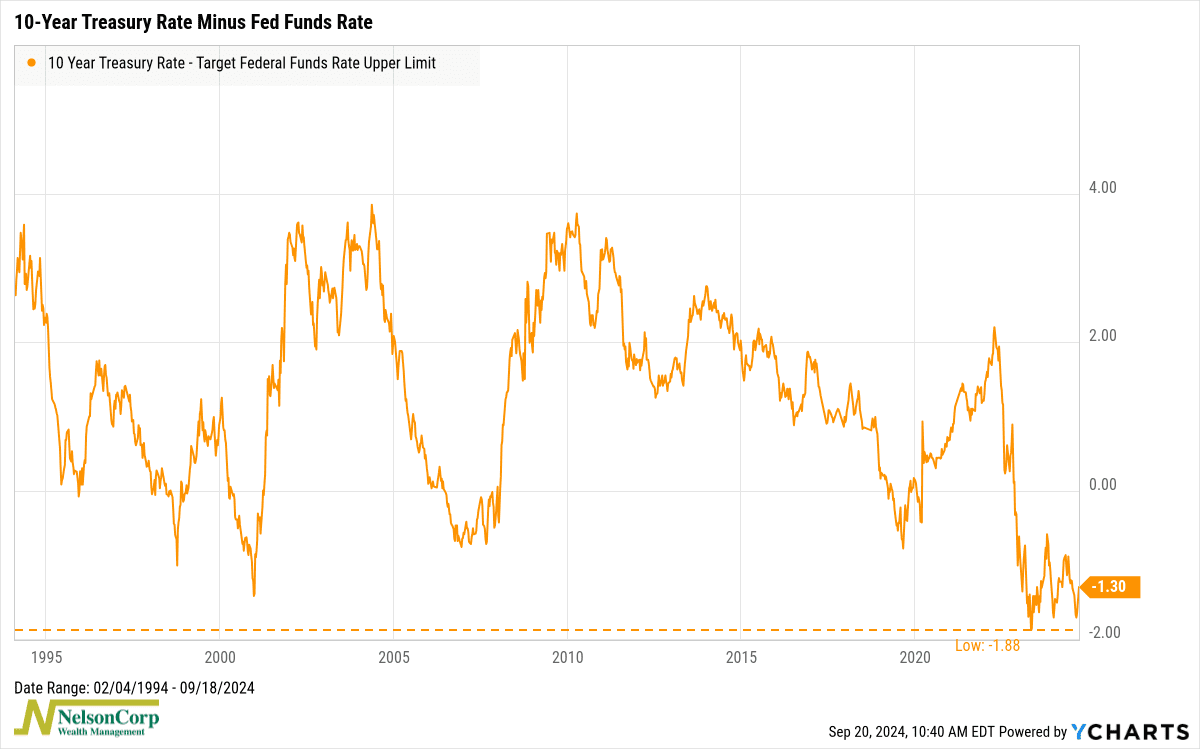

In fact, the gap between the two rates, shown on this next chart, hit a record low of -1.88 percentage points.

In other words, the market has been betting that the Fed’s high rates were only temporary. The Fed needed to raise rates to fight inflation, but everyone expected future rate cuts to follow.

Sure enough, this week, the Fed finally made its move, lowering the Fed Funds rate by 50 basis points (0.5 percentage points). This brought the two rates closer together, after being out of sync for roughly two years.

Does this mean the Fed was behind the curve, so to speak, and needed to catch up with market expectations? Maybe.

But the bottom line is that while the Fed can set the stage for interest rates, the market has its own rhythm, and the two don’t always dance in perfect harmony. With this latest rate cut, it seems the Fed is starting to get back in step with market expectations.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.