We all know the story—slow and steady wins the race. The tortoise beats the hare. Well, lately, it turns out bonds have been channeling their inner tortoise.

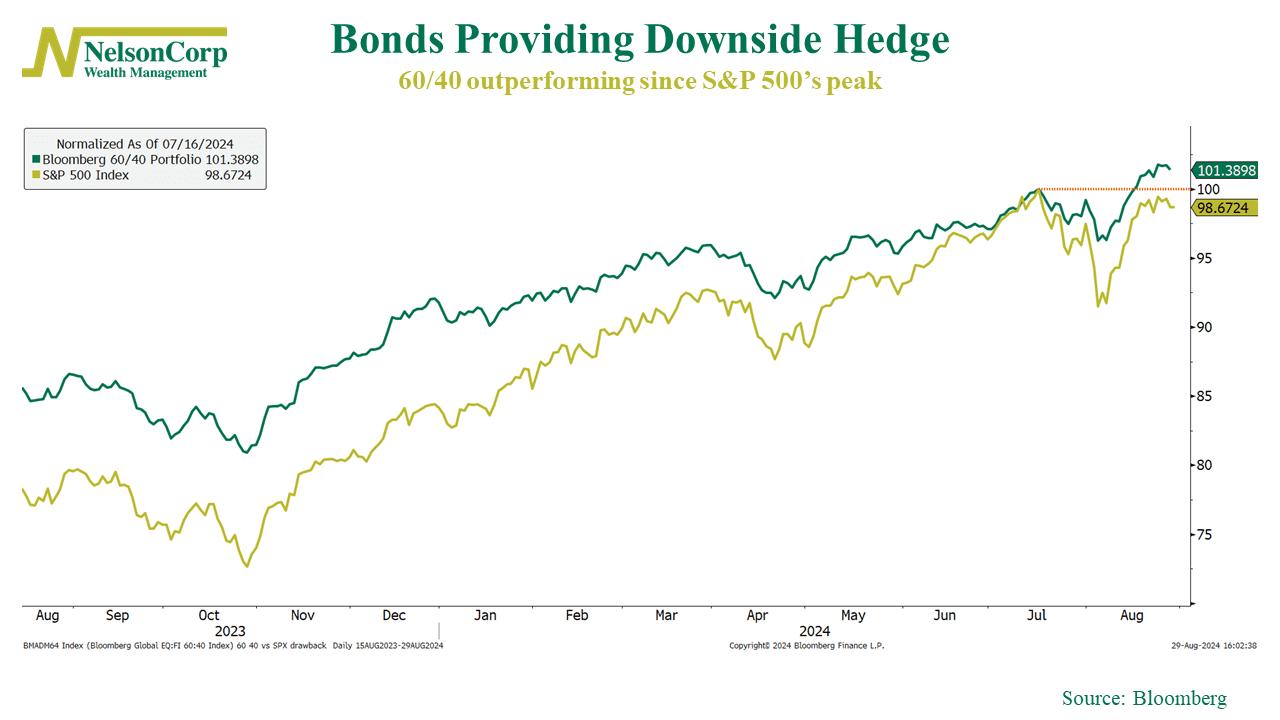

How so? Imagine this: the S&P 500 Index (the stock market) is like the hare—fast, flashy, always in a hurry. But just like in the story, the hare eventually takes a break. That’s what happened this summer when the stock market peaked on July 16th.

Since then, bonds—playing the role of the tortoise—have stepped up. If we look at a traditional 60/40 portfolio, where 60% is in stocks and 40% in bonds, it’s outperformed the stock market since the S&P 500 topped out. In fact, it’s sitting well above its all-time high.

In other words, bonds are acting like a solid downside hedge again. That wasn’t the case in 2022, when stocks dropped about 18% and the core bond market fell roughly 13%. Long-term Treasuries were hit even harder, plunging over 30%!

But this time, when the S&P 500 dipped nearly 9% earlier this month, long-term bonds were up more than 5%. Not bad.

The takeaway? Don’t underestimate bonds. They may not have the flash of stocks, but when used wisely, they can add significant value to a portfolio.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.