There’s been a lot of chatter this year about the U.S. economy and where it might be headed. The consensus is somewhat mixed, but what does seem clear is that, as of right now, the U.S. is beating the rest of the world as far as economic activity is concerned.

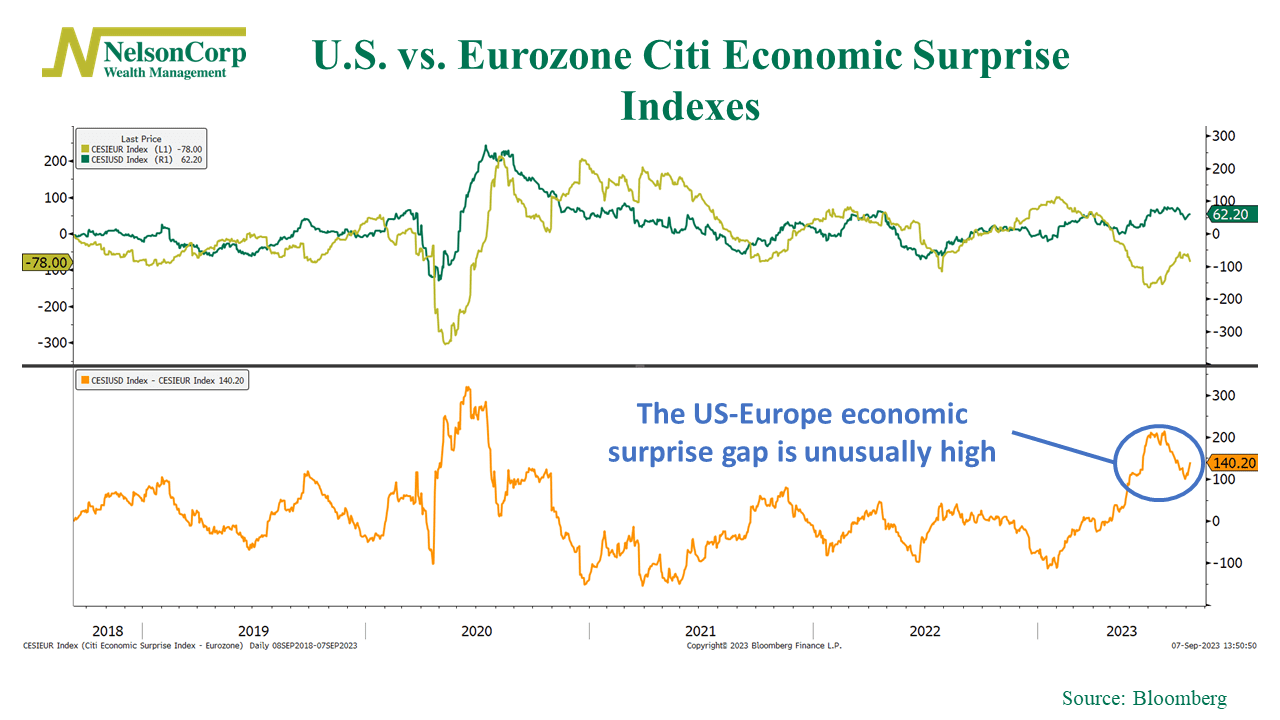

Our chart of the week, shown above, illustrates this nicely. On top, it shows the Citi Economic Surprise Indexes for both the United States and the Eurozone. These indexes show the degree to which the economic data in each area is coming in either better or worse than expected. And on the bottom of the chart, we show the difference between the two indexes, or what I call the US-Euro gap.

As you can see, the gap between the two is unusually wide right now. As that orange line shows, the U.S. economy is outperforming the Eurozone by a degree that is higher than really any point in the last five years.

The implication? It’s somewhat mixed. On the one hand, a stronger U.S. economy could help bolster corporate profits and, in turn, prospective stock returns. But on the other hand, the stronger U.S. economy relative to Europe has led to a stronger U.S. dollar, which has been a headwind to stock prices in recent times. In other words, the US-Euro gap is leaving a mix of opportunities and obstacles in its wake for investors to navigate.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.