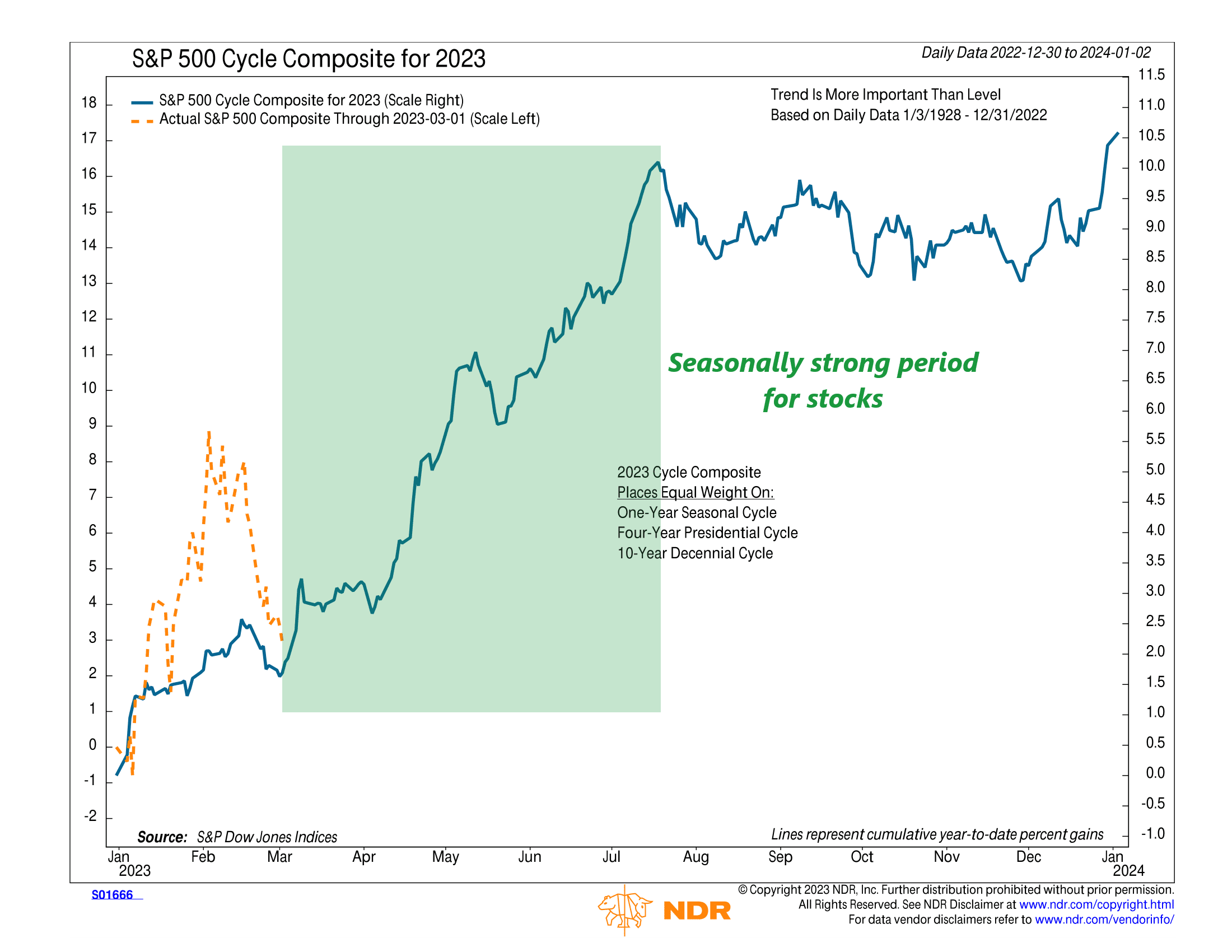

This week’s featured chart shows that the S&P 500 stock market index is about to enter a seasonally strong period for the year.

How so? For any given year in the stock market, the period from March to July tends to be strong. But if we take this concept one step further and add the 4-year Presidential Cycle and the 10-year Decennial Cycle, we get the Cycle Composite for 2023, shown as the blue line on the chart above. (The current S&P 500’s performance for the year is the orange dashed line).

Even after combining these three different cycles, the message remains the same: the next five months should be a strong period for stocks.

But that’s if the market abides by its historical tendencies. This sort of analysis is based on historical seasonality only; it doesn’t consider anything that might be specific to this cycle.

Therefore, consider this as the year’s base-case scenario. Things can play out differently than the Cycle Composite says. But the direction of the current appears to be flowing in a way that favors a rally in the first half of the year, perhaps followed by some turbulence later.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.