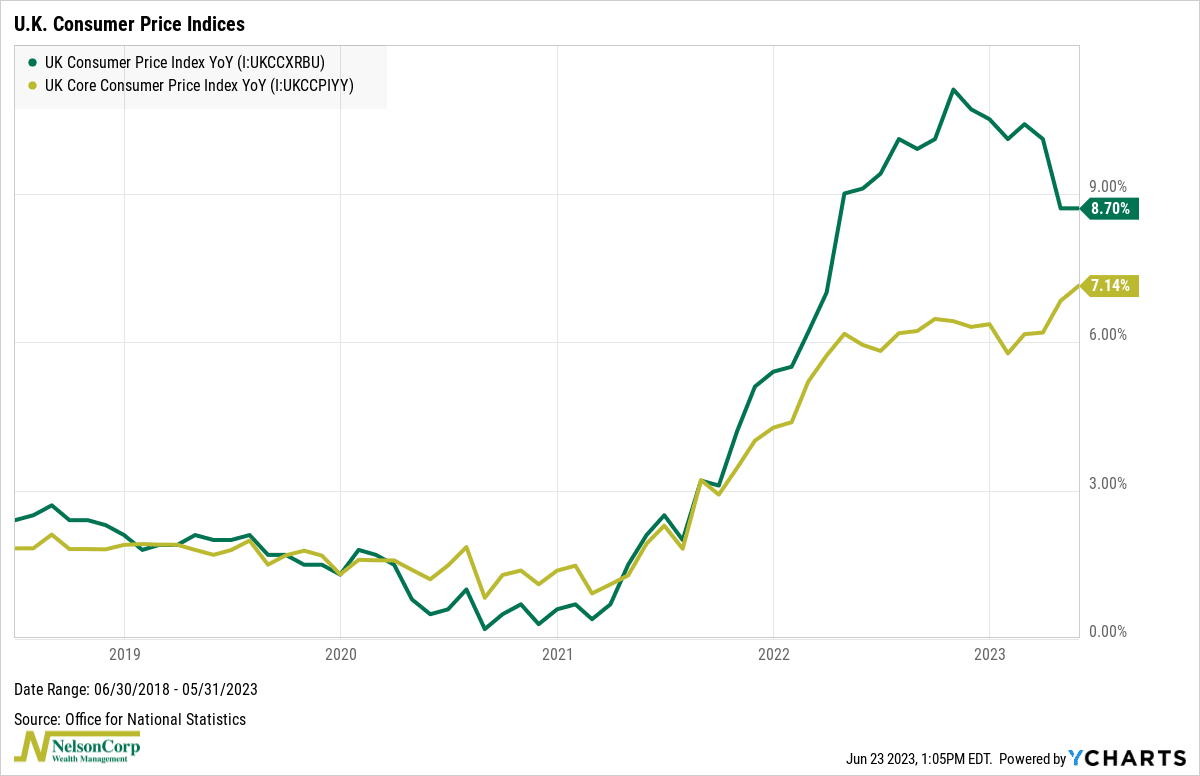

We’ve discussed how inflation seems to be moving in the right direction here in the U.S. But across the pond, things look more worrisome. The U.K. has the worst inflation problem of any major developed county, and last month, it got worse.

As our featured chart above shows, the U.K.’s Consumer Price Index rose 8.7% last month compared to a year ago, which was unchanged from the prior month. Even worse, the core measure, which strips out energy, food, alcohol, and tobacco costs, increased by 7.14%, up from 6.8% in April. That is the worst in 30 years! And in response, the Bank of England delivered a half-point rate hike this Thursday, double what was expected.

On the one hand, U.S. investors can take heart in the fact that our inflation problem is not that bad. But on the other hand, it stands as a cautionary tale that we shouldn’t let ourselves get complacent. Both the U.S. and the U.K. have seen the drivers of inflation shift to wages and the services sector—which tend to be “stickier.” Once the effects of last year’s higher energy prices drop out of inflation rates, the U.S. inflation rate could suddenly stop falling—and that could happen well above the Fed’s target. If that happens, more (or larger) rate hikes could be in store, and that would likely put pressure on stock prices.

The bottom line? It’s important to know what you own in your portfolio, be flexible, and not get complacent, as risks like inflation can always come back to bite you.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.