It was another rollercoaster week in the markets. Volatility was high, and stock prices swung wildly. But beyond the headline-grabbing moves in equities, there was a deeper, more telling story unfolding under the surface—one that many non-market watchers likely missed.

This week’s chart highlights what I like to call the “Vigilantes.” It’s a nod to the idea that certain asset classes—think the bond and currency markets—act as watchdogs, holding governments accountable when policies go too far. And last week, those vigilantes showed up in full force.

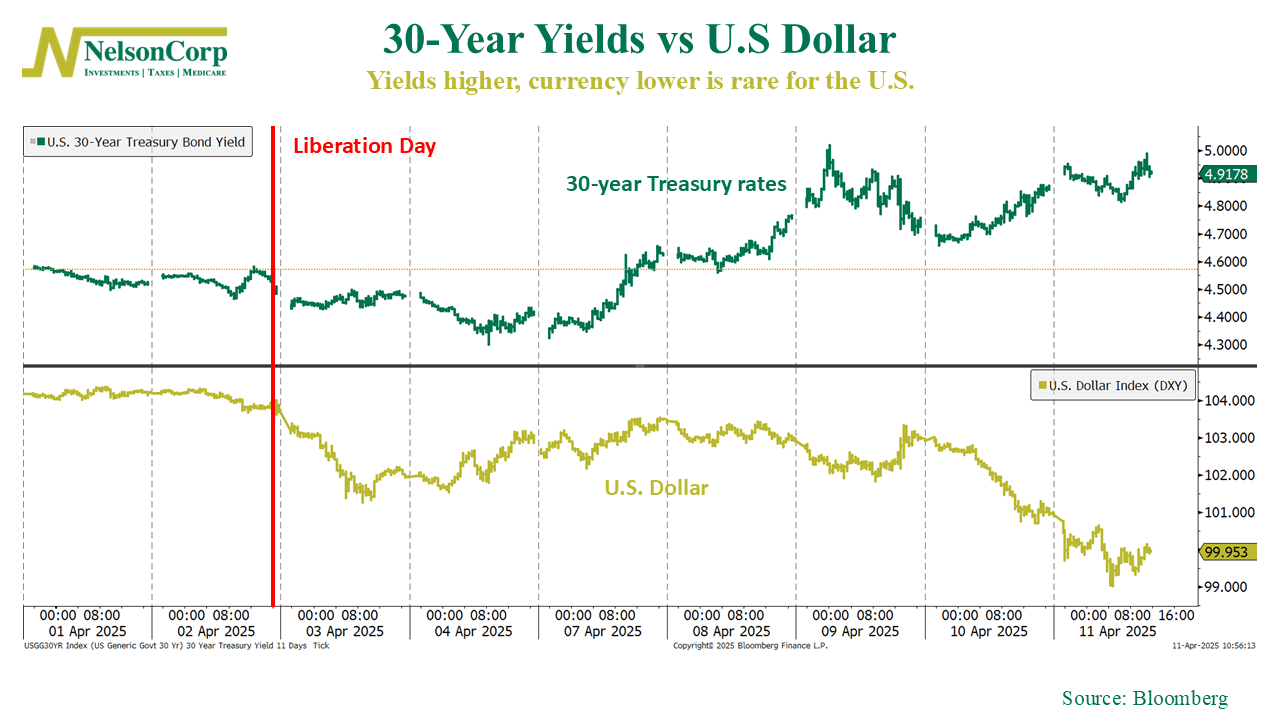

After President Trump’s “Liberation Day” tariff announcement on April 2nd, stocks plunged. But the more concerning shock came from what happened next: instead of money flowing into traditional safe havens, it flowed out. The 30-year Treasury yield (green line) surged more than 40 basis points, while the U.S. dollar (gold line) dropped over 3%, slipping below the 100 mark.

Let’s not undersell it. These were some massive moves for these markets. And that kind of move—higher yields and a falling dollar—is typical of emerging markets facing a credibility crisis. In the U.S., it’s rare. In fact, over the past 30 years, there have only been four other instances where the dollar fell more than 1.5% while long-term yields rose by at least 10 basis points.

Apparently, the message was received. Within days, the White House began softening its tone on tariffs.

Was that enough? It’s too early to say. But markets have a way of pushing back when policies go too far. And last week, the bond and currency vigilantes sent a loud warning shot across the bow.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.