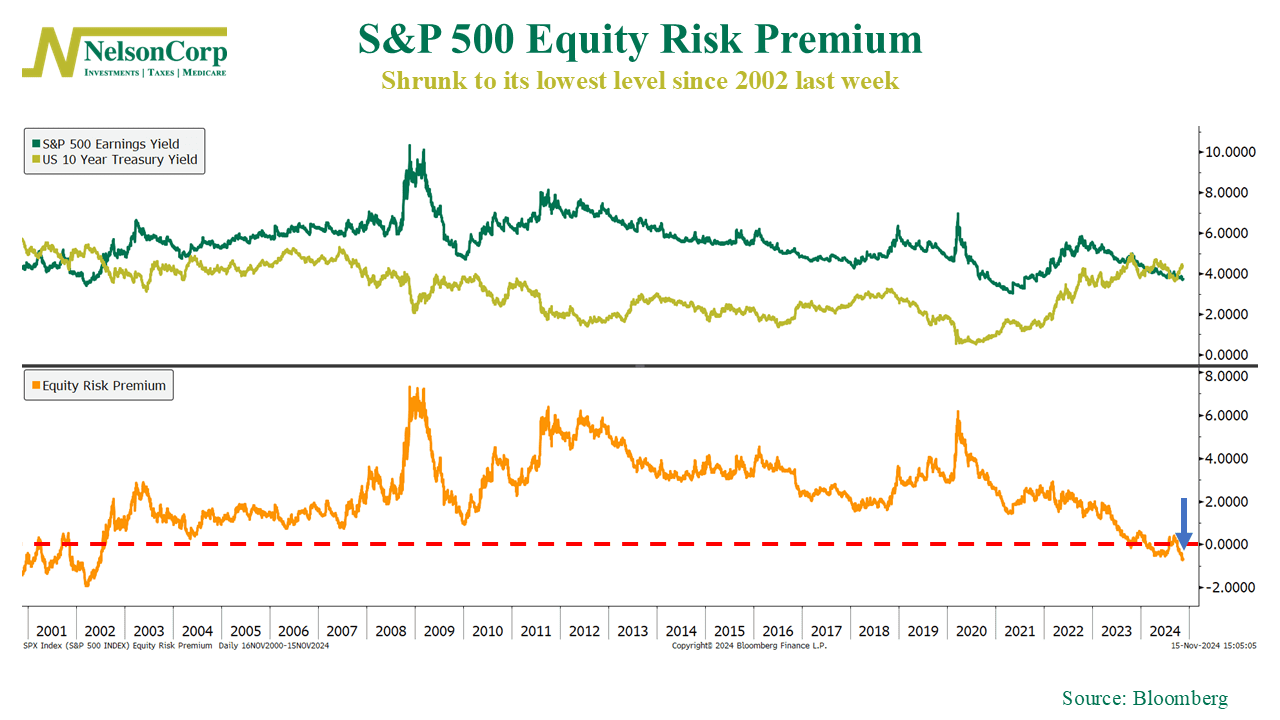

Is the stock market still worth the risk? This week’s chart paints a surprising picture.

It measures something called the equity risk premium—the extra return investors expect from stocks compared to the safer 10-year U.S. Treasury bond. It’s shown as the orange line on the bottom half of the chart. It’s calculated by subtracting the 10-year Treasury yield (gold line) from the S&P 500’s earnings yield (green line).

In simple terms, it compares how much stocks pay versus bonds. And as you can see on the chart, it recently fell below zero—its lowest level since 2002.

What’s going on? Well, Treasury yields have surged to 4.45% as investors demand more return to account for inflation and rising government debt. Meanwhile, the S&P 500’s earnings yield has fallen, with stock prices climbing faster than earnings. This has squeezed the premium investors earn for taking on stock market risk.

With Treasuries now offering similar returns to stocks but with far less risk, some investors are questioning if stocks are still worth it. For now, our indicators say yes. The market’s price action remains strong, and the economic backdrop remains firm. So don’t worry. The equity risk premium, which essentially measures valuation, probably won’t drag the market lower until we see one or both of those areas break to the downside.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.