This week’s indicator is actually three different indicators that, when combined, are flashing some good news for the stock market.

The indicators (or models, to be exact) focus on three key areas: stocks, interest rates, and inflation. The idea is simple—when stocks are trending higher while interest rates and inflation are trending lower, it’s usually a positive sign for the stock market.

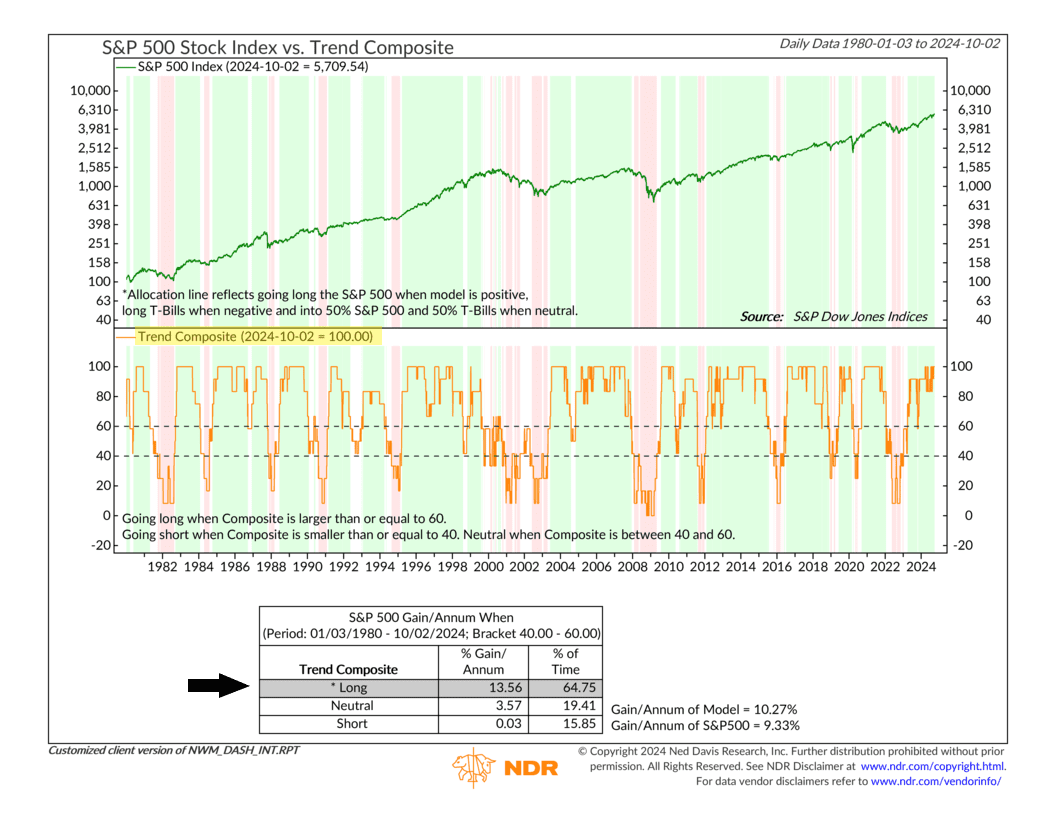

First up, we have the Trend model (shown below), which tracks the overall movement in stock prices. When all six indicators in this model are positive, it’s a strong bullish signal for the market. Right now, it’s fully bullish, sitting at 100%.

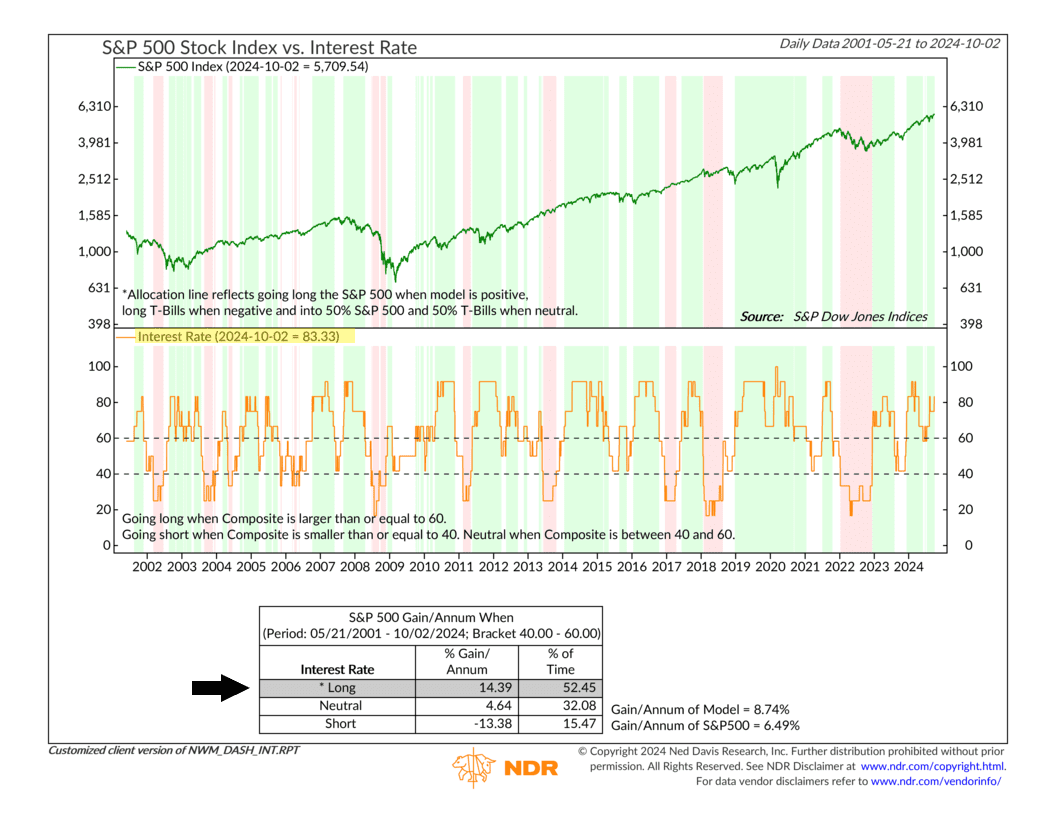

Next is the Interest Rate model, which monitors six different indicators across various interest rate durations. Generally, lower rates are good for stocks, and this model is currently 83% bullish.

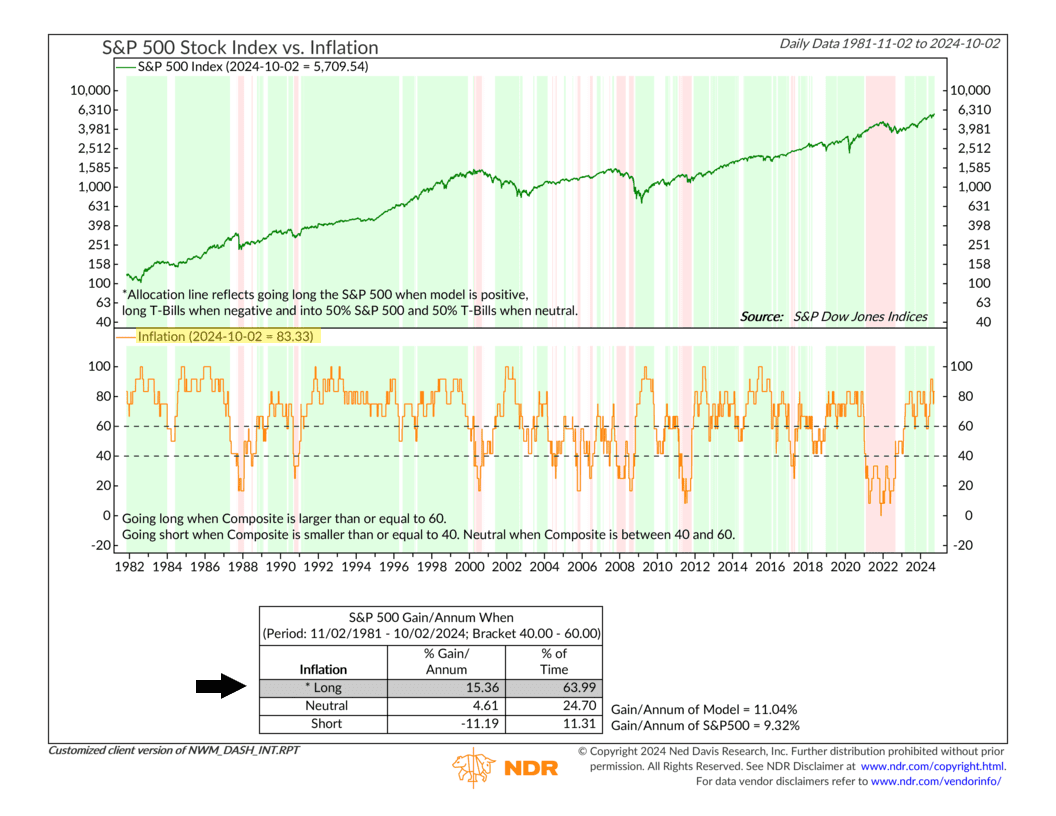

Finally, we have the Inflation model. Like the others, it includes six indicators that track inflation trends using economic data. The lower the inflation, the higher the model score—and lower inflation tends to be positive for stocks. This model is also 83% bullish.

When you combine all three, the market environment is looking quite bullish. Historically, when these models have been in their upper bullish zones, the S&P 500 has delivered above-average returns.

In short, stocks, interest rates, and inflation are all pointing in the right direction—a direction that has historically been favorable for stock market performance. With everything aligning, the outlook for stocks is bright, but we’ll keep a close watch on these models, as they’ve consistently been dependable indicators of market direction.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.