An important commodity-based inflation indicator that we highlighted a few months back recently fell out of its high negative zone—a sign that inflation has likely peaked and that stock market returns could be stronger going forward.

This specific indicator measures inflationary pressures using the Reuters-CRB Continuous Commodity Index (CCI). The index is comprised of many of the major commodities we are all familiar with—such as corn, wheat, cattle, soybeans, gold, copper, and oil. Since changes in these commodity prices tend to lead changes in inflation, you could say this index is a leading indicator for inflation.

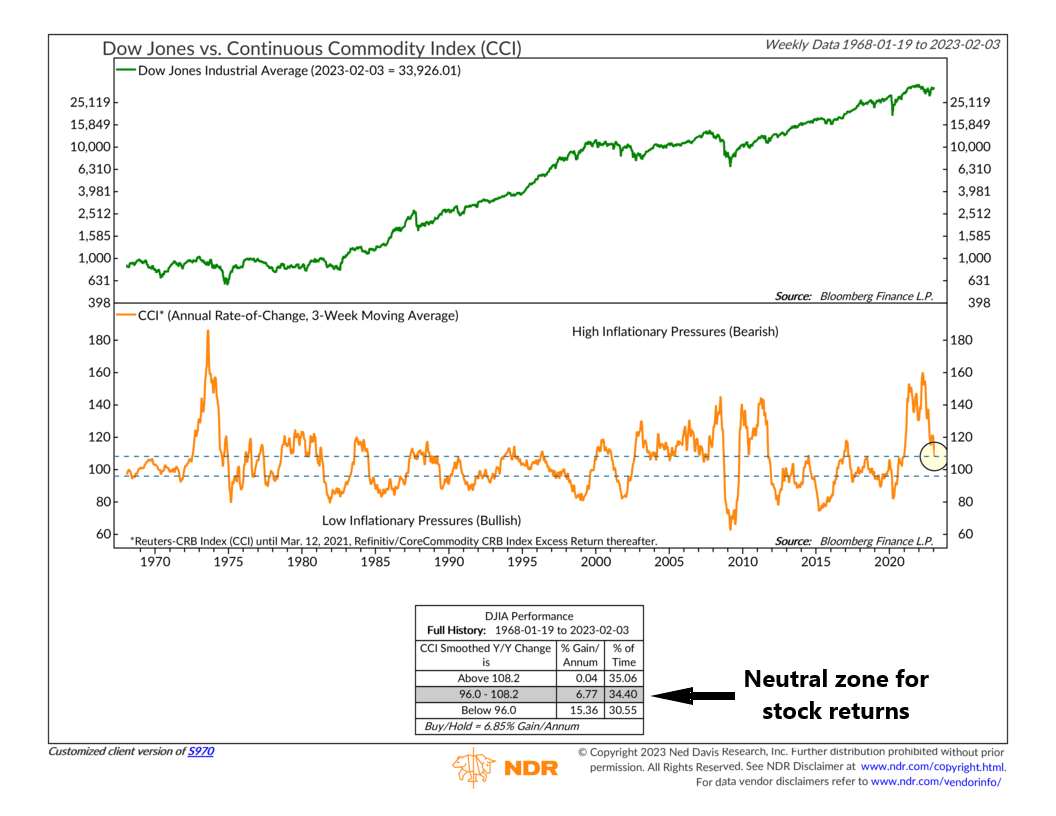

The most effective way to use this indicator is to apply a 3-week moving average to the 52-week rate of change of the CCI. This is the orange line on the bottom clip of the chart.

Historically, the best returns for the Dow Jones Industrial Average (green line, top clip) have come when the smoothed rate of change drops to -4% (96 on the chart) or below. Readings above 8.2% (108.2 on the chart) are bad because it means inflationary pressures are high, and stock market returns are essentially zero. This is where the indicator was last year, and we know how much stocks struggled then.

The good news, however, is that the most recent reading for this indicator saw the smoothed rate of change drop to just 7.9% (107.9 on the chart), which is below that upper danger zone for stock returns. Historically, we can expect the stock market to return roughly 6.8% when this indicator is in the current zone—right in line with the long-run average return for the market.

The bottom line? This is another sign that inflation has likely peaked, and the worst of the price increases are behind us. Historically, the stock market prefers falling inflation versus rising inflation, so the fact that commodity prices are falling is an encouraging sign that we will continue to see consumer price inflation fall and stock prices recover.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.