The Baltic Dry Index (BDI) is a financial index that measures the average cost to ship various dry bulk materials—such as coal and steel—around the world. Because it reflects the supply and demand for important materials used in manufacturing, the BDI is typically seen as a leading indicator of economic activity. And since stocks tend to go up when the global economy is healthy and growing, the BDI can also be used to estimate the stock market’s performance.

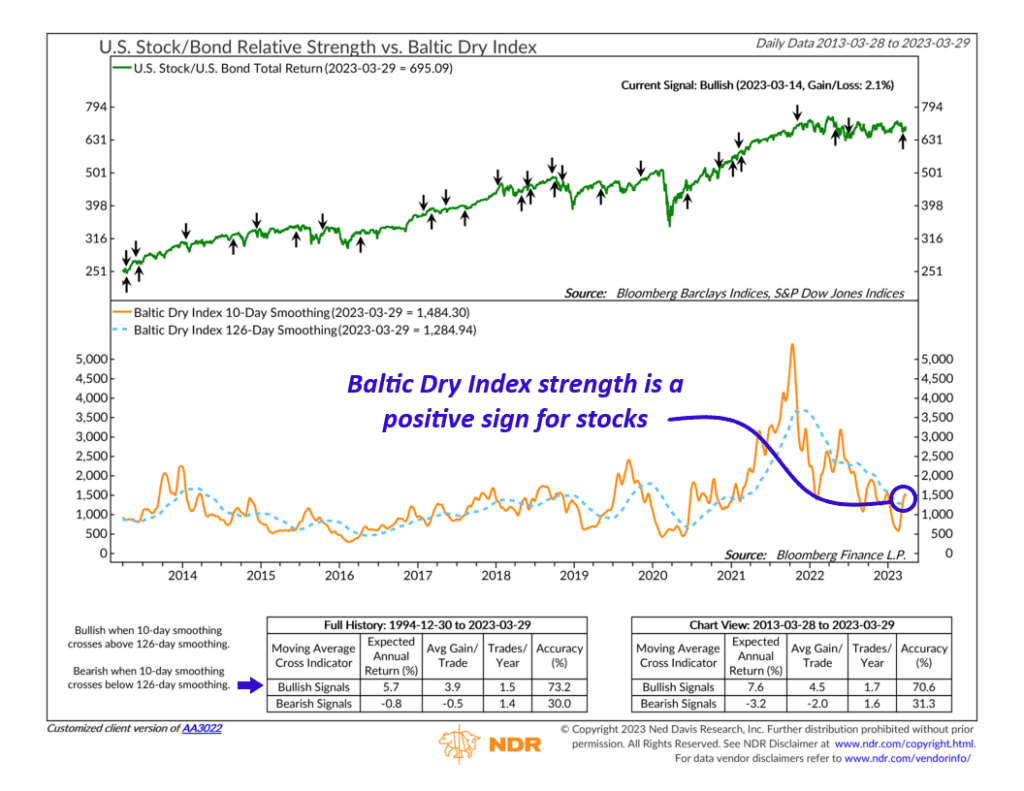

The 10-day smoothing of the BDI is shown as the orange line on the chart above. When it crosses above its 126-day smoothing (blue dashed line), it’s a sign that the cost (and demand) for ships is increasing. The ratio of stocks-to-bonds—shown as the green line on the top half of the chart—tends to increase when this happens. In other words, strength in the BDI correlates with strength in stock prices relative to bonds. And likewise, weakness in the BDI—a sign of slowing economic growth—tends to benefit bond prices compared to stocks.

Historically, the Baltic Dry Index has experienced long bouts of volatility. Mostly this is because the supply of large ships tends to be small—with long lead times and high production costs. But overall, the index is reasonably consistent because it depends on the straightforward factors of supply and demand and is therefore not much affected by things like unemployment and inflation.

The recent history of the indicator shows a peak in the BDI’s momentum near the end of 2021. Stock price performance has been pretty flat ever since. However, we saw a strong surge in the BDI’s 10-day smoothing this month—enough to lift it above its average 126-day level. In other words, according to the BDI, the global economy is firm and even improving based on the costs associated with shipping raw manufacturing goods. This is likely one of the reasons why stocks have performed relatively well lately.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.